|

市场调查报告书

商品编码

1430559

农业人工智慧:市场占有率分析、产业趋势与统计、成长预测(2024-2029)AI In Agriculture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

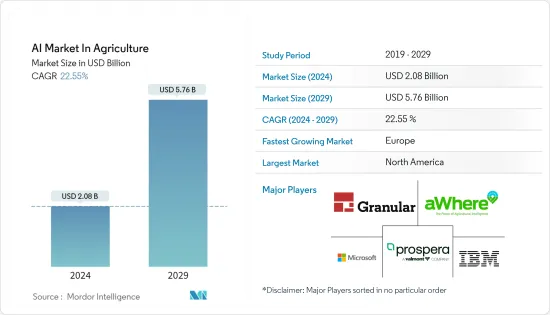

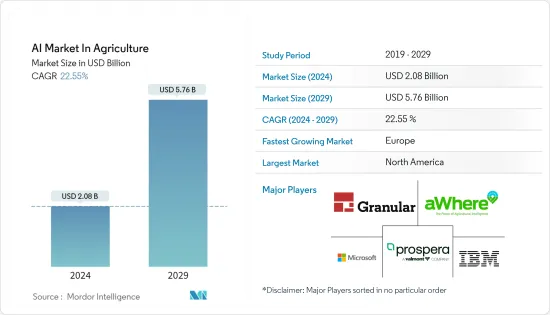

农业人工智慧市场预计将从2024年的20.8亿美元成长到2029年的57.6亿美元,预测期内(2024-2029年)复合年增长率为22.55%。

因为这些拖拉机使用基于 GPS 的技术来自动驾驶、从地面举起工具、识别农场边界,并且可以使用平板电脑进行远端控制。小型自动驾驶拖拉机有潜力为农民增加10%以上的收益,并降低农场人事费用。

主要亮点

- 利用机器学习技术实现作物产量最大化正在推动市场发展。品种选择是一个费力的过程,需要寻找决定水和养分利用效率、适应气候变迁、抗病性、营养成分和更好口味的特定基因。机器学习,特别是深度学习演算法,需要数十年的现场资料来分析各种气候下的作物表现。基于这些资料,可以建立机率模型来预测哪些基因最有可能赋予植物有益的性状。

- 牛脸部辨识技术的日益采用正在推动市场发展。透过应用先进的指标,如牛脸部辨识程序和影像分类,结合身体状况评分和餵食模式,酪农现在可以独立监控牛群的所有行为方面。

- 无人机在农业中的应用可用于使用小型多频谱成像感测器扫描作物、使用机载摄影机创建 GPS 地图、运输重物、使用配备热感成像相机的无人机监控牲畜等。无人机(UAV)的使用在世界范围内不断增加,从而增加了对无人机的需求。

- 然而,对资料收集和资料共用标准化的需求很高,限制了市场的成长。机器学习、人工智慧和先进演算法设计正在迅速发展,但有意义的、标记良好的农业资料的收集却落后了。

- COVID-19对AI农业市场的整体影响是正面的。此次疫情成为产业创新和数位转型的催化剂,刺激采用人工智慧主导的解决方案来提高效率、生产力和永续性。远端监控和管理的需求加速了农业流程的数位化。用于资料分析、预测建模和智慧农业的人工智慧主导工具对于优化生产、减少废弃物和确保粮食安全至关重要。

农业人工智慧 (AI) 市场趋势

无人机分析应用/细分市场预计将占据很大的市场占有率

- 无人机分析和人工智慧在农业中的集成为优化农业运营、降低成本和增强永续性提供了巨大潜力。透过利用人工智慧的力量分析无人机捕获的资料,农民可以做出资料驱动的决策,改善资源配置并实现更高的生产力。因此,无人机分析预计将成为农业市场人工智慧的关键驱动力。

- 无人机配备高解析度摄影机和感测器,可以捕获有关作物、土壤状况和田间特征的大量资料。与人工智慧驱动的分析相结合,这些资料为农民提供了有关作物健康、营养水平、虫害以及其他影响农业生产力的因素的宝贵见解。

- 人工智慧驱动的无人机分析透过提供田地内特定区域的详细资讯来实现精密农业实践。透过使用人工智慧演算法分析无人机资料,农民可以识别作物生长、土壤湿度水平和害虫种群的变化。这使得有针对性的干预成为可能,例如精确施肥、杀虫剂和散布,从而优化资源利用并提高产量。

- 配备人工智慧分析功能的无人机可以监测作物的整个生长阶段。透过分析无人机影像和感测器资料,人工智慧演算法可以检测植物压力、疾病爆发和营养缺乏的早期征兆。然后,农民可以采取积极措施,例如调整灌溉、采用适当的处理方法以及实施预防措施,以降低风险并优化作物健康。

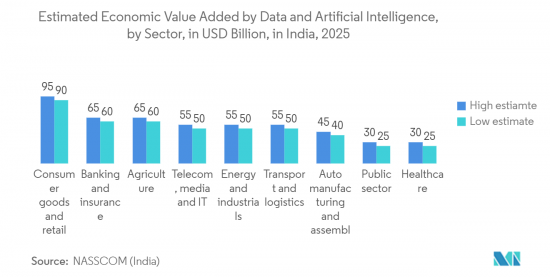

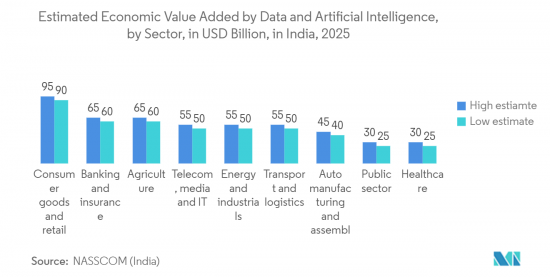

- 人工智慧驱动的无人机分析使农民能够有效地监控大片农田。人工智慧演算法可以自动分析无人机捕获的资料并识别需要注意的区域,而不是耗时的手动检查。这简化了操作,降低了人事费用,并使农民能够根据准确、及时的资讯做出决策。 NASSCOM 预计,到 2025 年,资料和人工智慧技术将为印度农业部门付加约 900 亿美元的收入。总体而言,到 2025 年,人工智慧预计将为印度 GDP 增加约 5,000 亿美元。

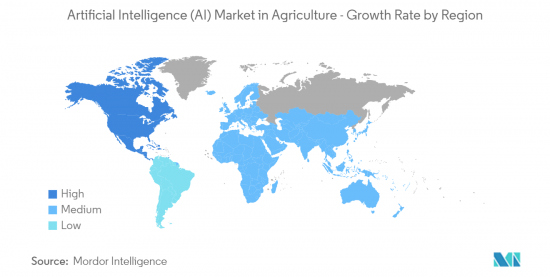

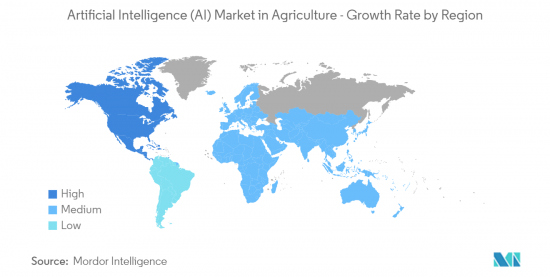

预计北美将占据较大市场占有率

- 北美农业人工智慧市场是更大的农业技术产业的重要组成部分。北美农业人工智慧市场正在经历显着成长。由于农业领域越来越多地采用人工智慧技术,预计未来几年该市场将大幅扩大。提高生产力的需求、对精密农业技术的需求不断增长以及先进基础设施的可用性等因素正在促进市场成长。

- 北美农民和农业企业正在采用人工智慧技术来提高效率、优化资源配置并增强决策流程。该地区农业产业的人工智慧应用包括精密农业、遥感、作物监测、预测分析和自动化农业系统。这些技术帮助农民做出资料驱动的决策,以提高产量、降低成本和风险。

- 技术供应商、相关企业、研究机构和新兴企业之间的合作是北美农业人工智慧市场的特征。这些合作将促进创新并开发适合该地区农业部门独特需求的人工智慧主导解决方案。对人工智慧新兴企业的合作和投资进一步促进了市场成长和技术进步。

- 北美各国政府正在认识到人工智慧在农业中的潜力,并正在实施支持性政策和措施。这包括资助计划、研究津贴、法律规范,以加速人工智慧在农业中的采用和创新。这些倡议为人工智慧市场的成长提供了有利的环境,并促进永续和有弹性的农业实践的发展。

- 2023 年 1 月,美国和欧盟 (EU) 建立合作关係,透过使用人工智慧 (AI) 改善农业、气候预测、紧急应变和电网。这项合作目前正在欧盟委员会和 27 个欧盟 (EU) 执行机构白宫之间进行。

农业人工智慧(AI)产业概况

- 农业人工智慧(AI)市场由微软公司、IBM公司、Granular Inc.、aWhere Inc.和Prospera Technologies Ltd.等主要企业瓜分。市场参与者正在采取联盟、合作和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 4 月,IBM 和 Texas A&M AgriLife 联手为农民提供消费量见解,从而提高农业生产力并降低经济和环境成本。 Texas A&M AgriLife 和 IBM 将部署和发展 Liquid Prep,这是一种技术解决方案,可帮助美国干旱地区的农民确定何时浇水。

- 2022 年 5 月,AGRA 和微软扩大合作,支持农业数位转型。 AGRA 和微软在达沃斯签署了一份关于透过非洲转型办公室未来合作的谅解备忘录。两个组织都将利用 2019 年启动的合作伙伴关係所取得的成功,该合作关係促成了 AgriBot 的开发。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19对农业人工智慧(AI)市场的影响分析

第五章市场动态

- 市场驱动因素

- 利用机器学习技术最大化作物产量

- 牛脸部辨识技术的采用增加

- 农业中无人机 (UAV) 的使用增加

- 市场限制因素

- 资料收集缺乏标准化

第六章市场区隔

- 按用途

- 天气追踪

- 精密农业

- 无人机分析

- 按配置

- 云

- 本地

- 混合

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Microsoft Corporation

- IBM Corporation

- Granular Inc.

- aWhere Inc.

- Prospera Technologies Ltd.

- Gamaya SA

- ec2ce

- PrecisionHawk Inc.

- Cainthus Corp.

- Tule Technologies Inc.

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 64248

The AI Market In Agriculture Industry is expected to grow from USD 2.08 billion in 2024 to USD 5.76 billion by 2029, at a CAGR of 22.55% during the forecast period (2024-2029).

The driverless tractor is trending in the market, as these tractors can steer automatically using GPS-based technology, lift tools from the ground, recognize the boundaries of a farm, and be operated remotely using a tablet. A fleet of smaller automated tractors could raise farmer revenue by more than 10 percent and reduce farm labor costs.

Key Highlights

- Maximizing crop yield using machine learning techniques is driving the market. Species selection is a tedious process of searching for specific genes that determine water and nutrient use effectiveness, adaptation to climate change, disease resistance, nutrient content, or a better taste. Machine learning, in particular deep learning algorithms, takes decades of field data to analyze crop performance in various climates. Based on this data, one can build a probability model to predict which genes will most likely contribute a beneficial trait to a plant.

- An increase in the adoption of cattle face recognition technology is driving the market. By applying advanced metrics, including cattle facial recognition programs and image classification incorporated with body condition scores and feeding patterns, dairy farms can now individually monitor all behavioral aspects of a group of cattle.

- The increased use of unmanned aerial vehicles (UAVs) across agricultural farms is driving the market, as the use of drones in the agriculture industry can be used in crop field scanning with compact multispectral imaging sensors, GPS map creation through onboard cameras, heavy payload transportation, and livestock monitoring with thermal-imaging camera-equipped drones, which increases the demand for UAVs.

- However, the need for standardization is restraining market growth as the need for data collection and data sharing standards is high. Machine learning, artificial intelligence, and advanced algorithm design have moved quickly, but collecting well-tagged, meaningful agricultural data is way behind.

- The overall impact of COVID-19 on the AI agriculture market was positive. The pandemic acted as a catalyst for innovation and digital transformation in the industry, driving the adoption of AI-driven solutions for increased efficiency, productivity, and sustainability. The need for remote monitoring and management accelerated the digitization of agricultural processes. AI-driven tools for data analysis, predictive modeling, and smart farming have become essential for optimizing production, reducing waste, and ensuring food security.

Artificial Intelligence (AI) in Agriculture Market Trends

Drone Analytics Application Segment is Expected to Hold Significant Market Share

- Integrating drone analytics and AI in agriculture offers tremendous potential for optimizing agricultural operations, reducing costs, and enhancing sustainability. By leveraging the power of AI to analyze drone-captured data, farmers can make data-driven decisions, improve resource allocation, and achieve higher productivity. Therefore, drone analytics is expected to be a significant driver of the AI market in agriculture.

- Drones with high-resolution cameras and sensors can capture vast amounts of data about crops, soil conditions, and field characteristics. Combined with AI-powered analytics, this data enables farmers to gain valuable insights into crop health, nutrient levels, pest infestations, and other factors influencing agricultural productivity.

- AI-powered drone analytics enable precision agriculture practices by providing detailed information about specific areas within a field. By using AI algorithms to analyze drone-captured data, farmers can identify variations in crop growth, soil moisture levels, or pest populations. This allows for targeted interventions, such as precise fertilizers, pesticides, or irrigation applications, leading to optimized resource utilization and increased crop yields.

- Drones equipped with AI-enabled analytics can monitor crops throughout their growth stages. By analyzing drone imagery and sensor data, AI algorithms can detect early signs of plant stress, disease outbreaks, or nutrient deficiencies. Farmers can then take proactive measures, such as adjusting irrigation, applying appropriate treatments, or implementing preventive measures, to mitigate risks and optimize crop health.

- Drone analytics powered by AI enable farmers to efficiently monitor large agricultural areas. Instead of conducting time-consuming manual inspections, AI algorithms can automatically analyze drone-captured data and identify areas requiring attention. This streamlines operations saves labor costs, and allows farmers to make informed decisions based on accurate and timely information. According to NASSCOM, by 2025, approximately USD 90 billion of value will be added to the agriculture sector through data and AI technologies in India. With all the sectors combined, artificial intelligence is projected to add approximately USD 500 billion to India's GDP by 2025.

North America is Expected to Hold Significant Market Share

- The North American artificial intelligence (AI) market in agriculture is a significant segment within the larger agricultural technology industry. The North American AI market in agriculture has been experiencing substantial growth. With the increasing adoption of AI technologies in the agricultural sector, the market is expected to expand significantly in the coming years. Factors such as the need for increased productivity, rising demand for precision farming techniques, and the availability of advanced infrastructure contribute to market growth.

- North American farmers and agricultural businesses embrace AI technologies to improve efficiency, optimize resource allocation, and enhance decision-making processes. AI applications in the region's agriculture industry include precision agriculture, remote sensing, crop monitoring, predictive analytics, and automated farming systems. These technologies help farmers make data-driven decisions, increase yields, reduce costs, and mitigate risks.

- Collaborations between technology providers, agriculture companies, research institutions, and startups characterize the North American AI market in agriculture. These collaborations foster innovation and the development of AI-driven solutions tailored to the specific needs of the region's agricultural sector. Partnerships and investments in AI startups further contribute to market growth and technological advancements.

- Governments in North America recognize the potential of AI in agriculture and are implementing supportive policies and initiatives. These include funding programs, research grants, and regulatory frameworks to foster AI adoption and innovation in the agricultural sector. Such initiatives provide a conducive environment for AI market growth and facilitate the development of sustainable and resilient agricultural practices.

- In January 2023, the United States and the European Union established a collaboration to improve agriculture, climate forecasting, emergency response, and the electric grid through the use of artificial intelligence (AI). The cooperation is now between the European Commission and the White House, the executive arm of the 27-member European Union.

Artificial Intelligence (AI) in Agriculture Industry Overview

- The artificial intelligence (AI) market in the agriculture market is fragmented with major players like Microsoft Corporation, IBM Corporation, Granular Inc., aWhere Inc., and Prospera Technologies Ltd. Players in the market are adopting strategies such as partnerships, collaborations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In April 2023, IBM and Texas A&M AgriLife collaborated to provide farmers with water consumption insights, which can boost agricultural productivity while lowering economic and environmental expenses. Texas A&M AgriLife and IBM will deploy and grow Liquid Prep, a technology solution that helps farmers decide "when to water" in dry parts of the United States.

- In May 2022, AGRA and Microsoft expanded their collaboration to help with the digital agricultural transformation. AGRA and Microsoft signed an MoU in Davos for future collaboration through its Africa Transformation Office. The organizations will leverage their success from a previous partnership started in 2019, which led to the development of the AgriBot.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis on the impact of COVID-19 on the Artificial Intelligence (AI) Market in Agriculture

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Maximize Crop Yield Using Machine Learning technique

- 5.1.2 Increase in the Adoption of Cattle Face Recognition Technology

- 5.1.3 Increase Use of Unmanned Aerial Vehicles (UAVs) Across Agricultural Farms

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Data Collection

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Weather Tracking

- 6.1.2 Precision Farming

- 6.1.3 Drone Analytics

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.2.3 Hybrid

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Granular Inc.

- 7.1.4 aWhere Inc.

- 7.1.5 Prospera Technologies Ltd.

- 7.1.6 Gamaya SA

- 7.1.7 ec2ce

- 7.1.8 PrecisionHawk Inc.

- 7.1.9 Cainthus Corp.

- 7.1.10 Tule Technologies Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219