|

市场调查报告书

商品编码

1430560

资料角力:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Data Wrangling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

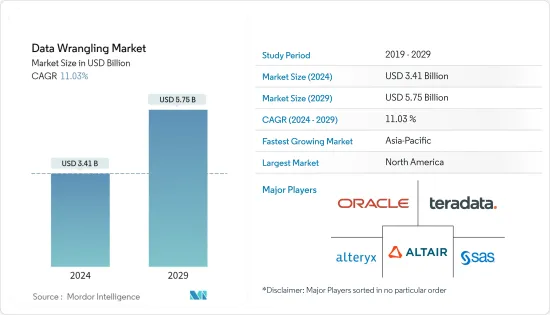

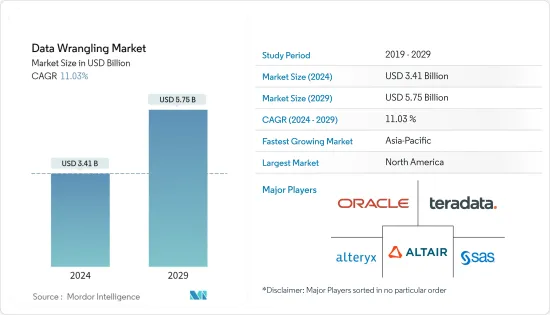

根据预测,资料角力市场规模到 2024 年将达到 34.1 亿美元,到 2029 年将达到 57.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 11.03%。

随着各种自动化技术的出现,资料缩减程序已经得到增强和改进。该行业可能会创建更复杂的人工智慧解决方案,以帮助预测期内的资料细化和资料分析过程。

主要亮点

- 由于许多工业部门收集的资料数量和可靠性的快速发展,采用复杂的分析演算法来选择可能彻底改变营业单位的见解。巨量资料使用的激增也产生了大量的非结构化资料。迭代和互动式资料分析的应用程式可以识别分布和不一致,并提案流程改进建议。

- 资料操作可以透过提高资讯一致性来提供对元资料的统计洞察。更一致的元资料允许自动化技术更快、更准确地询问资料,通常会带来这样的发现。资料缩减可以清理资讯以确保模型运作良好,尤其是在开发有关预期市场表现的模型时。

- 企业越来越多地使用资料角力来即时预测和监控可能影响业务绩效的众多事件。资料角力市场正在不断成长,因为它有可能透过针对不可预见的事件(例如网路攻击和其他紧急情况)做出复杂的决策来降低风险。此外,随着网路攻击的增加,对资料角力的需求也在增加,因为它使得发现和恢復资料变得更加容易。

- 对资讯遗失或窃盗的担忧日益加剧、BYOD(自带设备)趋势不断增长以及业务敏捷性只是显着加速资料角力市场成长的部分因素。这只是一个部门。预计资料角力行业将从边缘运算的进步中受益匪浅。

- 然而,资料品质问题限制了市场的扩张。资料角力产业预计将面临挑战,因为它尚未准备好从传统 ETL 工具转向尖端自动化技术。此外,这一市场扩张的主要障碍之一是中小型企业缺乏对资料角力工具的了解。

- COVID-19 的爆发导致大量资料涌入。科技公司和资料聚合商利用来自手机讯号塔和行动应用程式的本地资料,使用仪表板来监控和追踪联络人,以实施社会隔离并减少差异。该应用程式使用蓝牙、建模工作和定位服务来预测医院需求和传染病负担。由于透过此程式创建的资料存在缺陷,预计数百万人将受到不利影响。资料角力用于清理、格式化和丰富原始资料,以帮助使用者更快、更准确地做出决策。因此,COVID-19 的资料角力要求提供了市场扩张的潜力。

资料角力市场趋势

分析显示,大公司占较大市场占有率

- 预计大公司将在资料角力市场中占据重要的市场占有率,这主要是由于人工智慧和机器学习的采用不断增加,以及由于先进技术的大量采用而导致资料量的增加。此外,大公司日益增加的监管压力预计将为未来的市场扩张提供重大成长机会。

- 此外,资料管理解决方案能够透过快速分析资讯并采取行动来实现更好更快的决策并提供竞争优势,这进一步推动了大型企业的需求。此外,大型企业正在采用资料角力来即时监控和预测可能影响大型组织绩效的各种事件。

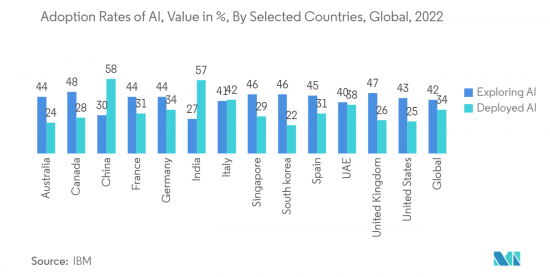

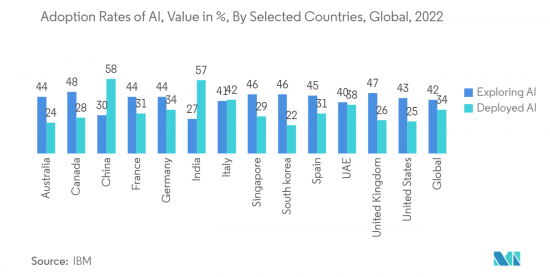

- 此外,根据 IBM 的说法,人工智慧的采用因公司、国家和行业而异。大公司积极使用人工智慧作为营运一部分的可能性是大公司的两倍,但小公司这样做的可能性较小。公司更有可能调查人工智慧而不是积极追求它。到 2022 年,中国和印度超过一半的 IT 员工认为他们的公司已经积极参与人工智慧领域,而韩国 (22%)、美国(24%)、英国市场 ( 26%)。我相信公司正在根据这项政策采取。

- 此外,随着巨量资料的进步,大公司不断发现新类型的资料。然而,随着科技创造出越来越多的资料来源,资料管理持续成为企业面临的更重要的挑战。这类公司已经认识到资料管理在大型企业中的重要性,并正在推动市场的成长。

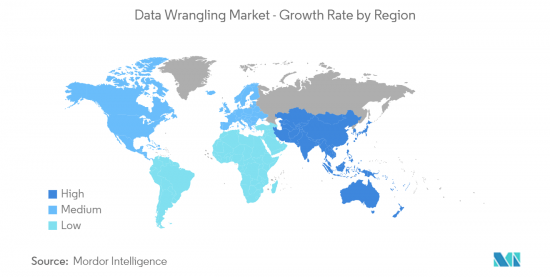

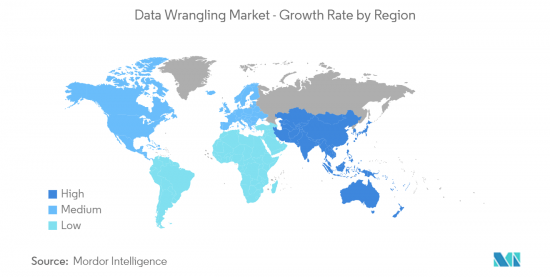

北美预计将占据很大份额

- 预计北美将在预测期内主导资料角力市场,因为它是对资料角力工具和服务的采用贡献最大的地区之一。此外,还分析了主要供应商的存在以及最终用户行业不断增长的采用率,以促进预测期内该地区的市场成长。

- 随着工业4.0服务的出现和巨量资料的应用,该地区预计将出现大规模增长。此外,巨量资料在美国是一个巨大的现象,各行各业的公司都透过从多个来源收集、分析和操作大量资料来获利。

- 持有大量股份的公司主要位于北美地区,并透过在该地区的大量投资和开拓而拥有重要的市场领导地位。 Trifacta、Altair Engineering, Inc、TIBCO Software Inc、Oracle Corporation 和 SAS Institute Inc 等公司均位于美国,并活跃于该地区的资料管理业务。

- 该地区日益增长的技术趋势,例如各种技术的投资、采用和集成,预计将为资料角力技术创造重要的商机,从而帮助公司有效地处理大量资料。此外,疫情后不断增长的云端采用趋势正在推动该地区的市场成长。

资料角力产业概述

资料角力市场因 Alteryx, Inc.、Oracle Corporation 和 Teradata Corporation 等几家主要参与者的存在而得到巩固。 Alteryx、Oracle、Teradata 等几家主要企业正在透过持续的技术创新来获得竞争优势。透过研发、策略伙伴关係和併购,这些参与者正在市场上留下更强大的足迹。

2023 年 3 月,Simplebim 发布了 BIM资料管理软体第 10 版,供建设公司、BIM 经理、建筑师以及结构和设计工程师使用。该公司表示,其最新版本开闢了利用 IFC 文件中的资料来增强生产计画和调度、采购、竞标、成本估算、监控、安装操作和其他下游 BIM资料使用的新方法。我将使之成为可能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 资料量增加

- 人工智慧和巨量资料技术的进步

- 人们对资料可靠性的担忧日益加深

- 市场限制因素

- 企业缺乏资料管理工具意识

- 显式资料权限

第六章市场区隔

- 按成分

- 工具

- 按服务

- 按发展

- 云端基础

- 本地

- 按公司类型

- 小到中尺寸

- 规模大

- 按最终用户产业

- 资讯科技/通讯

- 零售

- 政府机关

- BFSI

- 卫生保健

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 新加坡

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Alteryx, Inc.

- TIBCO Software Inc.(Cloud Software Group, Inc.)

- Altair Engineering Inc.

- Teradata Corporation

- Oracle Corporation

- SAS Institute Inc.

- Datameer, Inc.

- DataRobot, Inc.

- Cloudera, Inc.

- Cambridge Semantics, Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Data Wrangling Market size is estimated at USD 3.41 billion in 2024, and is expected to reach USD 5.75 billion by 2029, growing at a CAGR of 11.03% during the forecast period (2024-2029).

The creation of various automated technologies has already enhanced and improved the data-wrangling procedure. The industry would create more complex AI solutions during the forecast period to assist the processes of data wrangling and data analysis.

Key Highlights

- The adoption of sophisticated analytics algorithms to choose insights that might revolutionize a business entity results from the rapid development in the quantity and reliability of data collected throughout many industrial verticals. Massive amounts of unstructured data have also been produced due to the surge in Big Data usage. Applications for iterative and interactive data wrangling may identify distributions and inconsistencies and suggest process improvement.

- Data manipulation can offer statistical insights into the metadata by making the information more consistent. Increased metadata consistency makes it possible for automated technologies to examine the data more quickly and precisely, frequently leading to these findings. Data wrangling would clean the information to enable a model to operate without problems, mainly in developing a model about expected market performance.

- Businesses are increasingly using data wrangling for real-time forecasting and monitoring of numerous events that may impact their performance. The market for data wrangling is expanding due to the potential to mitigate risks by executing complicated judgments concerning unplanned occurrences, such as cyberattacks and other emergencies. Also, as more cyberattacks occur, there is a growing demand for data wrangling since it makes data simpler to find and recover.

- Growing concerns about information loss and theft, expanding Bring Your Own Device (BYOD) trends, and business mobility are just a few factors that are significantly accelerating the growth of the data wrangling market.The industry of data wrangling is predicted to benefit significantly from advances in edge computing.

- However, issues with data quality are limiting the market's ability to expand.The data-wrangling industry is anticipated to face challenges due to a lack of readiness to switch from conventional ETL tools to cutting-edge automated technologies. Further, one of the key obstacles to this market's expansion is the lack of knowledge about data-wrangling tools among small and medium-sized businesses.

- The COVID-19 epidemic brought on a considerable data influx. Technological firms and data aggregators exploited local data from cell towers and mobile applications to impose social segregation and close the gaps using dashboards that monitored and tracked contacts. Applications predicted hospital requirements and epidemic burden using Bluetooth, modeling efforts, and geolocation services. As a result of the flawed data produced throughout this procedure, millions of people were expected to be negatively impacted. Data wrangling is used to clean, arrange, and enhance raw data into the appropriate format for users to make better decisions more quickly and accurately. As a result, COVID-19's requirement for data wrangling provided market potential for expansion.

Data Wrangling Market Trends

Large Enterprises are Analyzed to Hold Significant Market Share

- Large enterprises are expected to hold significant market share in the data wrangling market primarly due to increasing adoption of AI and ML, growing volume of data owing to the substantial adoption of advanced technologies. Furthermore, increasing regulatory pressure among the large enterprises is expected to present major growth opportunities for the expansion of the market in future.

- Additionally, the ability of data-wrangling solutions to deliver better and faster decision-making and to offer a competitive advantage by analyzing and acting upon information promptly further boosts the demand among large enterprises. Furthermore, large enterprises are adopting data wrangling for real-time monitoring and forecasting of various occasions that may affect the performance of large organizations.

- Moreover, according to IBM, the adoption of AI varies amongst businesses, countries, and sectors. While larger firms are twice as likely to have actively used AI as part of their company operations, smaller businesses are less likely. Companies are more likely to investigate AI than actively pursue it. As of 2022, a majority of IT workers in China and India, compared to markets like South Korea (22%), Australia (24%), the United States (25%), and the United Kingdom (26%), believe their organization is already actively employing AI.

- Further, large businesses are constantly discovering new data kinds as big data continues to progress. Data management, however, keeps becoming a more significant challenge for firms as technology produces more and more data sources. Such companies significantly recognize the importance of data wrangling in the large businesses, thereby driving market growth.

North America is Expected to Hold the Significant Share

- North America is expected to dominate data wrangling during the forecast period, as the region remains one of the most significant contributors to the adoption of data wrangling tools and services. Further, the presence of major market vendors coupled witg growing adoption among end-user industries is analyzed to boost the market growth in the region over the forecast period.

- The region is expected to witness massive growth along with the application of big data due to the emergence of Industry 4.0 services. Moreover, big data is an enormous phenomenon in the United States, and companies from various industries benefit from collecting, analyzing, and manipulating vast amounts of data from multiple sources.

- The significant shareholding firms are considerably based in the North America region, which significantly drives the market with considerable investments and developments in the region. Companies such as Trifacta, Altair Engineering, Inc., TIBCO Software Inc., Oracle Corporation, SAS Institute Inc., etc., are based in the United States and are actively engaged in the operation of data wrangling in the region.

- The rising technological trends in terms of investments, adoption, and integration of various technologies in the region would significantly create opportunities for data wrangling technology in assisting firms to work effectively in handling huge amounts of data. Further, the increased trends of cloud adoption in the region post-pandemic boosted market growth in the region.

Data Wrangling Industry Overview

The data wrangling market is consolidated owing to the presence of a few key players, such as Alteryx, Inc., Oracle Corporation, and Teradata Corporation, amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over others. Through research and development, strategic partnerships, and mergers and acquisitions, these players have gained a stronger footprint in the market.

In March 2023, Simplebim released version 10 of its BIM data wrangling software used by construction firms, BIM managers, architects, and structural and design engineers. According to the company, the latest release by the company opens up new ways to use data in IFC files to enable enhanced production planning and scheduling, procurement, tendering, cost estimation, monitoring, installation work, and other downstream BIM data usage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Volumes of Data

- 5.1.2 Advancement in AI And Big Data Technologies

- 5.1.3 Growing Concern about Data Veracity

- 5.2 Market Restraints

- 5.2.1 Lack Of Awareness Of Data Wrangling Tools Among Enterprises

- 5.2.2 Explicit Data Access Permission

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Tools

- 6.1.2 Service

- 6.2 By Deployment

- 6.2.1 Cloud-Based

- 6.2.2 On-premises

- 6.3 By Enterprise Type

- 6.3.1 Small and Medium Sized

- 6.3.2 Large

- 6.4 By End-user Industry

- 6.4.1 IT and Telecommunication

- 6.4.2 Retail

- 6.4.3 Government

- 6.4.4 BFSI

- 6.4.5 Healthcare

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 Singapore

- 6.5.3.4 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Mexico

- 6.5.4.2 Brazil

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 Rest of Middle-East & Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alteryx, Inc.

- 7.1.2 TIBCO Software Inc. (Cloud Software Group, Inc.)

- 7.1.3 Altair Engineering Inc.

- 7.1.4 Teradata Corporation

- 7.1.5 Oracle Corporation

- 7.1.6 SAS Institute Inc.

- 7.1.7 Datameer, Inc.

- 7.1.8 DataRobot, Inc.

- 7.1.9 Cloudera, Inc.

- 7.1.10 Cambridge Semantics, Inc.