|

市场调查报告书

商品编码

1430576

液态氮:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Liquid Nitrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

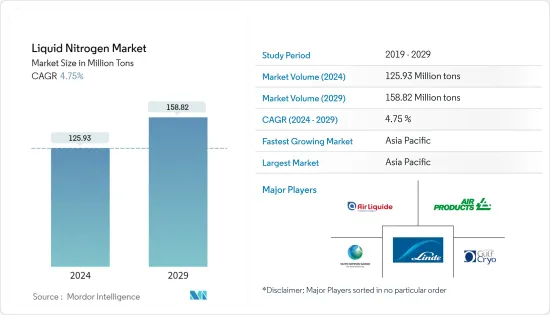

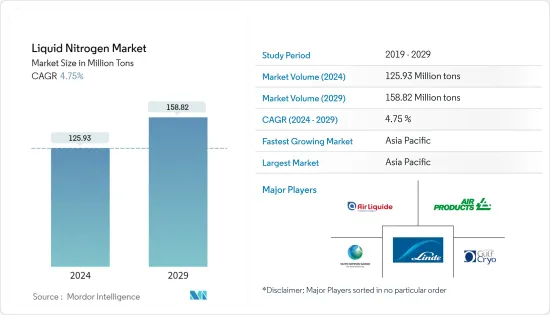

液态氮市场规模预估2024年为1,2,593万吨,预估2029年将达1,5,882万吨,在预测期内(2024-2029年)复合年增长率为4.75%,预计会成长。

COVID-19 阻碍了市场成长。由于全球限制,运输业遭受了疫情的影响。然而,由于大流行,由于健康问题的增加,医疗保健行业出现了显着增长。随着医疗设备需求大幅增加,液态氮市场需求也随之增加。目前,市场已经从疫情中恢復过来,并正在经历显着成长。

主要亮点

- 从中期来看,化学和製药行业需求的增加以及医疗保健行业应用的扩大正在推动市场成长。

- 然而,维护液态氮工厂存在监管限制,预计将阻碍市场成长。

- 也就是说,新製造技术的开拓可能会在未来几年为市场创造机会。

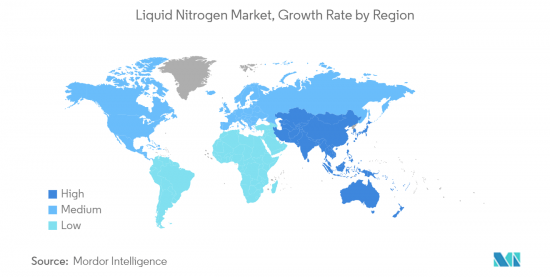

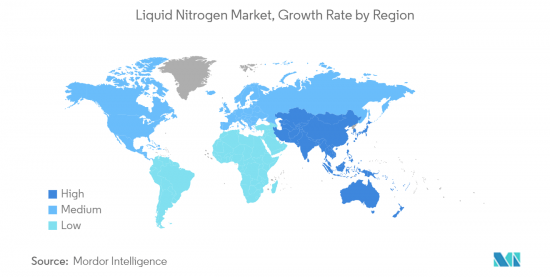

- 亚太地区主导全球市场,消费量最高的国家为中国、印度和日本。

液态氮市场趋势

化学和製药业的需求不断增加

- 液态氮是元素氮的液化形式,透过液态空气分馏在商业性生产。用于许多冷却和低温应用。

- 它惰性、无味、无色、化学惰性、易燃,广泛应用于化学和製药工业。

- 氮气的沸点为摄氏-195度。因此,其在化学和製药行业中作为冷却剂和冷媒的用途正在迅速扩大。

- 中国的製药业是世界上最大的製药业之一。该国生产学名药、治疗药物、原料药和草药。

- 根据中国国家统计局统计,2022年6月,中国原料药月产量突破30万吨。这一数字在过去三年中逐渐增长,反映了中国化学品业务的发展。活性药物成分是在疾病治疗中发挥作用的药物化学物质。

- 此外,根据药品管理局的数据,印度是世界上最大的学名药供应商,截至 2022 年 2 月,其药品供应量超过 220 亿美元。从数量来看,印度药品占全球学名药出口量的20%,其中北美占大部分。预计到2030年将达到1,000亿美元左右,未来几年该市场的潜力将持续增加。

- 其最大的优点之一是氮气是一种干燥的惰性气体。这意味着它不与其他物质相互作用。结果,氧气和其他有毒或不必要的气体,特别是氧气,可以用氮气代替。

- 在製造药品时,氮气经常用于将反应混合物从一个容器转移到另一个容器。运输液体或粉末药品时,使用安全的惰性气体极为重要。某些药物化学物质在暴露于氧气或水蒸气时可能有害或爆炸。

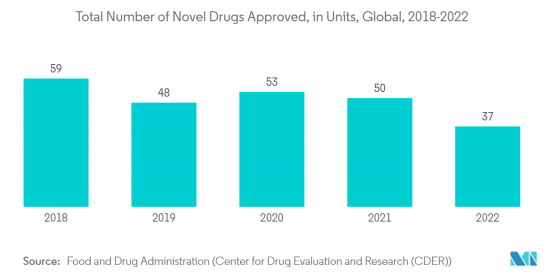

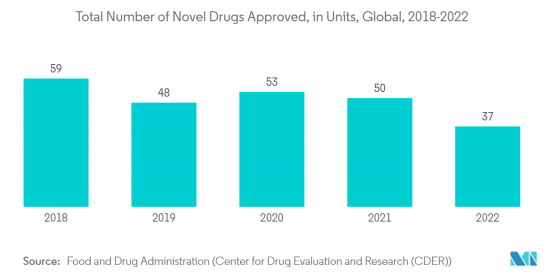

- 根据食品药物管理局(药品审查与研究中心(CDER))统计,2022 年批准了 37 个新药。每年上市的新药数量波动很大。 2021年,50个独特药物获得核准。

- 由于上述所有因素,预计化学和製药业对液态氮的需求在预测期内将会成长。

亚太地区主导市场

- 预计亚太地区将在预测期内主导液态氮市场。中国、印度和日本等国家化学和製药行业的成长正在推动该地区液态氮市场的需求。

- 根据《中国医药健康报告》,2023年,中国医药和生物製药的研发投入合计预计将以每年平均23%的速度成长。如果达到 490 亿美元,占全球药物开发和测试支出的 23%,这是可能的。

- 该国拥有庞大且多元化的国内製药业,由大约 5,000 家製造商组成,其中许多是中小企业。预计将支持製药行业液态氮使用的成长。

- 国家药品监督管理局联合公布《医药工业「十四五」发展规划》。 「十四五」规划明确了未来五年我国医药工业发展的目标与方向。

- 「十四五」规划是依照《国家经济和社会发展「十四五」规划和2035年中长期目标纲要》提出的思路和标准制定的。

- 印度化学工业预计将强劲成长。政府预测,到 2025 年,化学工业将达到 3,040 亿美元,这提供了机会,因为未来五年需求预计将以每年 9% 左右的速度成长。

- 根据综合冷链和加值基础设施计划,到2022年,印度已核准约356个食品加工行业低温运输计划,这将增加对液态氮的需求。

- 亚太地区的主要液态氮製造商包括 Linde PLC、Southern Industrial Gas Sdn Bhd、MVS Engineering Pvt. Ltd 和 Taiyo Nippon Sanso Corporation。

- 因此,预计上述因素将在预测期内推动该地区液态氮市场的需求。

液态氮产业概况

液态氮市场碎片化。该市场的主要企业包括液化空气公司、空气化工产品公司、Gulf Cryo、Linde PLC 和 Taiyo Nippon Sanso。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 化学和製药业的需求增加

- 扩大在医疗保健产业的应用

- 其他司机

- 抑制因素

- 维护液态氮工厂的监管限制

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模,基于数量)

- 储存类型

- 圆柱

- 包装气体

- 功能

- 冷却剂

- 冷媒

- 最终用户产业

- 化学/製药

- 卫生保健

- 运输

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- Air Liquide

- Air Products and Chemicals, Inc.

- Cryomech Inc.

- Gulf Cryo

- Linde plc

- MVS Engineering Pvt. Ltd

- Southern Industrial Gas Sdn Bhd

- Praxair Technology, Inc.

- Messer Group

- TAIYO NIPPON SANSO CORPORATION

第七章 市场机会及未来趋势

- 新製造技术开发

- 其他机会

The Liquid Nitrogen Market size is estimated at 125.93 Million tons in 2024, and is expected to reach 158.82 Million tons by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

COVID-19 hampered the market growth. The transportation industry suffered from the pandemic due to restrictions worldwide. However, due to the pandemic, the healthcare industry witnessed huge growth because of increased health concerns. It increased the demand for the liquid nitrogen market, as the demand for medical devices increased tremendously. Currently, the market recovered from the pandemic and is growing at a significant rate.

Key Highlights

- Over the medium term, the increasing demand from the chemical and pharmaceutical industry and the growing application in the healthcare industry are driving market growth.

- However, the regulatory restrictions in maintaining liquid nitrogen plants are expected to hinder the market's growth.

- Nevertheless, developing new manufacturing techniques will likely create opportunities for the market in the coming years.

- The Asia-Pacific region dominated the global market with the largest consumption from countries such as China, India, and Japan.

Liquid Nitrogen Market Trends

Growing Demand from the Chemical and Pharmaceutical Industry

- Liquid nitrogen is the liquefied form of the element nitrogen produced commercially by the fractional distillation of liquid air. It is used in many cooling and cryogenic applications.

- Owing to its non-toxic, odorless, colorless, chemically inert, and inflammable properties, its application is highly used in the chemical and pharmaceutical industry.

- The boiling point of nitrogen is -195 degrees Celsius. Because of this, its application as a coolant and refrigerant in the chemical and pharmaceutical industry is rapidly increasing.

- The pharmaceutical industry in China is one of the largest in the world. The country produces generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine.

- According to the National Bureau of Statistics of China, in June 2022, China's monthly output volume of chemical active pharmaceutical ingredients (API) topped 300,000 metric tonnes. The figure gradually climbed over the previous three years, indicating a development in China's chemical medication business. Active pharmaceutical ingredients are medicinal chemicals responsible for a condition's therapy.

- Moreover, according to the Department of Pharmaceuticals, India is the world's largest supplier of generic medications, and as of February 2022, the country supplied pharmaceuticals worth more than USD 22 billion. Regarding volume, Indian pharmaceuticals accounted for 20% of worldwide generic drug exports, with North America accounting for the lion's share. It is expected to value about USD 100 billion by 2030, increasing the scope for this market during the coming years.

- The fact that nitrogen is a dry, inert gas is one of its greatest advantages. It implies that it won't interact with other substances. As a result, oxygen and other toxic or unwanted gases, particularly oxygen, can be replaced by N2.

- Nitrogen is frequently used to manufacture pharmaceuticals to transfer the reaction mixture from one container to another. When delivering liquid or powdered medications, it is crucial to employ safe, inert gas since doing so might be hazardous. Several pharmaceutical chemicals may be harmed or even explode if exposed to oxygen or water vapor.

- According to the Food and Drug Administration (Center for Drug Evaluation and Research (CDER)), it authorized 37 new medications in 2022. The amount of new pharmaceutical products hitting the market each year fluctuates greatly. In 2021, there were 50 approvals for unique medications.

- Owing to all the factors mentioned above, the demand for liquid nitrogen is expected to grow from the chemical and pharmaceutical industries during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for liquid nitrogen during the forecast period. The growing chemical and pharmaceutical industries in countries such as China, India, and Japan are boosting the demand for the liquid nitrogen market in the region.

- According to China's Healthcare Report, China's pharmaceutical and biopharmaceutical combined R&D investment is projected to expand at a compound annual rate of 23% through 2023. It will be possible when it reaches USD 49 billion, accounting for 23% of global drug development and testing spending.

- The country includes a large and diverse domestic drug industry, comprising around 5,000 manufacturers, of which many are small- or medium-sized companies. It is expected to boost the growth of liquid nitrogen usage in the pharmaceutical industry.

- The National Medical Products Administration and the National Administration of Traditional Chinese Medicine collaborated to release the "14th Five-Year Plan for Pharmaceutical Industry Growth." The 14th Five-Year Plan specifies the aims and directions for China's pharmaceutical industry's development during the following five years.

- The 14th Five-Year Plan was developed in compliance with the ideas and standards outlined in the Framework of the 14th Five-Year Plan for National Economic and Social Development and Long-Term Goals for 2035.

- India is expected to witness robust growth in its chemical industry. The government predicts the chemical industry to reach USD 304 billion by 2025, with opportunities offered by the anticipated increase in demand by about 9% per annum over the next five years.

- According to the Scheme of Integrated Cold Chain and Value Addition Infrastructure, about 356 Cold Chain Projects in the food processing industry were approved in India in 2022, creating an increasing demand for liquid nitrogen.

- Some leading producers of liquid nitrogen in the Asia-Pacific region include Linde PLC, Southern Industrial Gas Sdn Bhd, MVS Engineering Pvt. Ltd, and TAIYO NIPPON SANSO CORPORATION.

- Therefore, the factors above are expected to boost the demand for the liquid nitrogen market in the region during the forecast period.

Liquid Nitrogen Industry Overview

The liquid nitrogen market is fragmented in nature. Some of the major players in the market include Air Liquide, Air Products and Chemicals, Inc., Gulf Cryo, Linde plc, and TAIYO NIPPON SANSO CORPORATION, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Chemical and Pharmaceutical Industry

- 4.1.2 Growing Application in the Healthcare Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Regulatory Restrictions in Maintaining Liquid Nitrogen Plant

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Storage Type

- 5.1.1 Cylinder

- 5.1.2 Packaged Gas

- 5.2 Function

- 5.2.1 Coolant

- 5.2.2 Refrigerant

- 5.3 End-user Industry

- 5.3.1 Chemical and Pharmaceutical

- 5.3.2 Healthcare

- 5.3.3 Transportation

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals, Inc.

- 6.4.3 Cryomech Inc.

- 6.4.4 Gulf Cryo

- 6.4.5 Linde plc

- 6.4.6 MVS Engineering Pvt. Ltd

- 6.4.7 Southern Industrial Gas Sdn Bhd

- 6.4.8 Praxair Technology, Inc.

- 6.4.9 Messer Group

- 6.4.10 TAIYO NIPPON SANSO CORPORATION

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Manufacturing Techniques

- 7.2 Other Opportunities