|

市场调查报告书

商品编码

1430584

成形充填密封(FFS) 包装机:市场占有率分析、产业趋势、成长预测(2024-2029 年)Form-Fill-Seal (FFS) Packaging Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

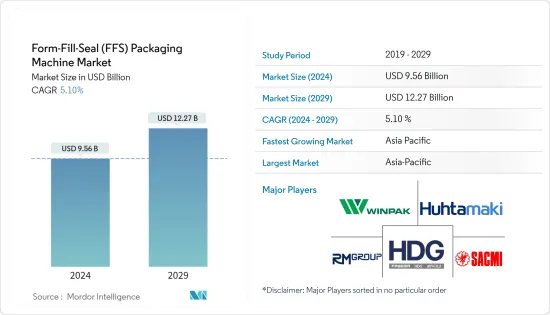

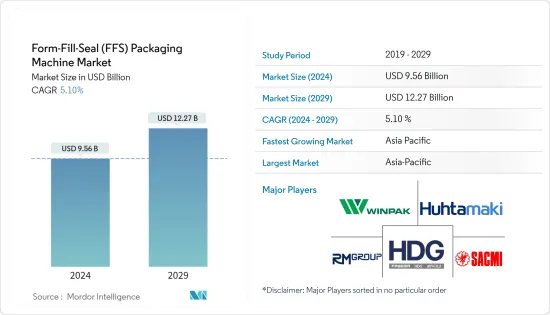

预计2024年成形充填密封包装机市场规模为95.6亿美元,预计2029年将达122.7亿美元,预测期内(2024-2029年)复合年增长率为5.10%,预计将会成长。

主要亮点

- 成形充填密封(FFS) 机器使用电脑控制的自动化来生产软质包装,从而降低整个製造过程中的污染风险。连续自动成形充填密封(FFS)包装机是目前包装行业中最常用的包装机之一。它的优点是比单一机器更快、更有效率地成型、填充和密封产品。

- 成形充填密封薄膜是最通用、最具成本效益且环保的包装选择之一。这些薄膜具有优异的防潮、防氧和防紫外线性能,使其适用于消费品和食品的自动包装。成形充填密封-密封袋、小袋和袋子易于使用、重量轻、耐用,并且可以不间断地分发。它们适合大规模生产,通常与水平式或垂直成形充填密封机相容。将 FSS 薄膜融入您的包装中,您可以提高工作效率,同时降低包装成本。

- 随着消费品製造商努力留住员工,对机器的需求不断增长,不仅可以排除故障,还可以协助转换。 FFS 小袋包装机现在配备了运动控制和人机介面 (HMI),以促进流程的执行。

- FFS 袋包装机已被证明是一种多功能解决方案,快速、准确、经济高效,并自动提高效率和盈利。然而,以中速包装麵粉、爽身粉、乳清粉等低密度产品是不经济的,而且成本太高。 FFS 包装有这样的障碍。

- 随着世界继续受到 COVID-19 的影响,包装卫生和安全成为消费者和企业关注的问题。这场流行病的传播表明,它是多么容易透过人际接触和交叉污染传播。许多政府制定了严格的法规,以确保食品以安全的方式生产、包装和分销。

成形充填密封包装机市场趋势

水平成形充填密封设备预计市场将出现高速成长

- 水平成形充填密封(HFFS) 机也称为 FFS 机,是一种用于包装、密封和出货食品的大批量製造设施的包装系统。使用水平成形充填密封机来包装食品,这些机器可以比其他传统包装(例如手工包装和其他手动包装方法)在更短的时间内有效地包装产品,并进行真空包装和真空密封在耐用的袋子中,这些袋子可以容纳2.2 磅的产品,可以节省时间和金钱,因为它们是为速度和效率而设计的。

- 一些 HFFS 机器有两个成型站和两个密封站,因此从一种包装尺寸更改为另一种包装尺寸也可以自动完成,无需停机。这对于频繁更换的工厂非常有用。 HFFS 机器有通用的设定程序来生产高品质、形状良好的包装。

- 对包装食品的需求不断增长以及软包装解决方案的成本效益预计将推动对包装袋的需求。根据软包装特许的哈里斯民意调查数据,83% 的品牌所有者现在使用某种形式的软包装。这支持了小袋包装市场的成长,并有效增加了对 HFFS 机器的需求。借助新的整合技术,这些 HFFS 机器变得更加先进,因为它们允许调整外部因素。例如,Loesch Verpackungstechnik 提供高性能卧式成形充填密封机,用于巧克力棒、格兰诺拉麦片棒和蛋白棒的初级包装。

- 采用智慧控制,具有自调节控制架构,可根据运作过程中的变化因素(温度、湿度、产品特性)自动调节参数,从合理的产品进料到产品的排放。非常适合谷物棒和蛋白棒等黏性包装产品。

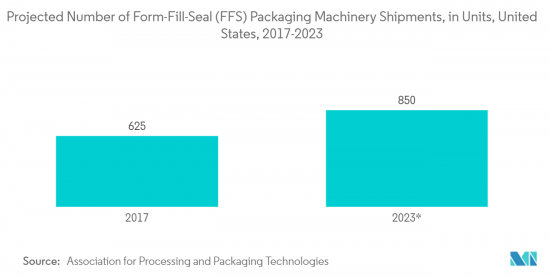

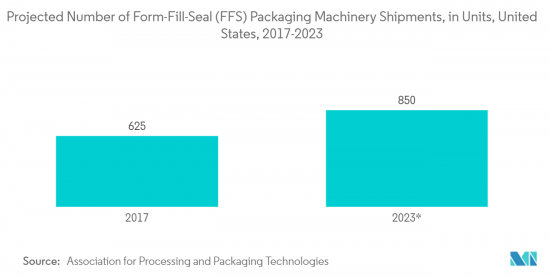

- 据包装加工协会称,在预测期内,美国对水平成形充填密封机的需求预计将增加。考虑到永续性和生态友善环境等因素,预计在预测期内 HFFS 机械将出现各种新技术进步。

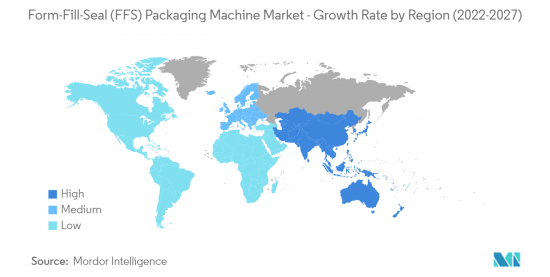

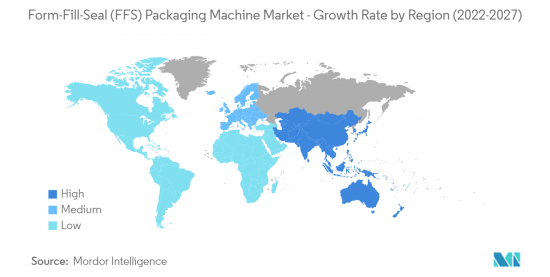

亚太地区市场实现高速成长

- 中国人口成长、可支配收入增加以及食品和饮料行业的扩张正在推动市场成长。该地区生活方式和跨国食品的开拓也促进了袋子市场的成长,导致成形充填密封机的使用增加。

- 此外,对优质水的需求不断增长以及注重健康的饮用习惯预计将增加瓶装水的消费量,这可能对该地区的包装行业产生直接影响。

- 日本是亚洲主要的製造地,拥有高品质的产品和最佳製造实践。日本在製造业方面处于世界领先地位。除了无可挑剔的电子产品和庞大的汽车产业外,日本还是世界化妆品生产国之一和包装器材最大的消费国之一。

- 印度是世界上人口最多的国家之一,仅次于中国。根据国际货币基金组织的数据,2021年目前人口约13.9199亿,预计2026年将达到14.5582亿。这么大的一个国家,也是各类产品的消费大国。由此可见,印度呈现出庞大的FFS包装器材市场。

- 除了亚太地区研究中已经讨论的国家外,韩国、澳大利亚、台湾、泰国、印尼、马来西亚等其他国家也在研究市场中占据了很大的份额。 。

成形充填密封包装机产业概述

成形充填密封(FFS) 包装机市场较为分散,市场上的主要製造商面临来自较小企业的激烈竞争。市场上的公司在价格、分销网络、技术创新和品牌声誉方面竞争。此外,併购、合作和创新是这些公司为确保长期成长所采取的主要策略。主要参与者包括 Winpak Ltd. 和 HDG Verpackungsmaschinen GmbH。近期市场开拓如下。

- 2022 年 2 月 - RM 集团推出了一个令人印象深刻的新网站,以展示其知识、创新和自动化专业知识。该公司为食品和饮料和饮料、园艺、骨料、化学品和农业等广泛的基本客群设计、製造和供应各种手动和自动包装包装器材、包装系统和机器人自动化。

- 2021 年 8 月 - Furutamaki 与 RiverRecycle 和 VTT 合作开发技术,解决印度孟买 Mithi 河的漂浮废弃物问题。这种废弃物收集技术是 RiverRecycle 解决世界海洋废弃物问题的解决方案的重要组成部分。在 Futamaki 的支援下,原型机在芬兰製造和测试,然后组装到孟买进行组装。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 木槌概述

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 无菌包装产业需求不断成长

- 宠物食品包装需求增加

- 市场限制因素

- 低密度产品不经济

第六章市场区隔

- 依设备类型

- 直立式成形充填密封装置

- 食品和饮料

- 药品

- 个人护理

- 其他最终用户

- 水平成形充填密封装置

- 食品与饮品

- 药品

- 个人护理

- 其他最终用户

- 直立式成形充填密封装置

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Winpak Ltd

- HDG Verpackungsmaschinen GmbH

- Huhtamaki Oyj

- REES MACHINERY GROUP LIMITED

- SACMI Imola SC

- HAVER Continental Ltd

- Mega Plast GmbH

- Duravant LLC

- MDC Engineering Inc.

- Busch Machinery

- Rovema GmbH

- Fres-co System USA Inc.

- ProMach Inc.(Matrix Packaging Machinery LLC)

- PFM Group

- Viking Masek Global Packaging Technologies

- Nichrome Packaging Solutions

- Triangle Package Machinery Company

- Scholle IPN

- Bosch Rexroth AG

第八章投资分析

第九章 市场未来展望

The Form-Fill-Seal Packaging Machine Market size is estimated at USD 9.56 billion in 2024, and is expected to reach USD 12.27 billion by 2029, growing at a CAGR of 5.10% during the forecast period (2024-2029).

Key Highlights

- Form-fill-seal (FFS) machines use automated computer-controlled technology to create flexible to rigid packages while reducing the risk of contamination throughout the manufacturing process. The continuous automatic form-fill-seal (FFS) packaging machine is currently one of the most popular packaging machine types being used in the packaging industry. It has the advantage of high speed and efficiency when compared to individual machines for forming, filling, and sealing products.

- Form-fill-seal films are one of the most versatile, cost-effective, and environmentally friendly packaging options available. These films are apt for automatic packaging of consumer goods and food products because they offer superior moisture, oxygen, and UV protection. form-fill-seal pouches, sachets, and bags are simple to use, lightweight, durable, and allow for mess-free distribution. These are suitable for mass manufacturing and are usually compatible with horizontal and vertical form-fill-seal machines. Incorporating FSS films into packaging increases job productivity while lowering package costs.

- Since consumer-packaged goods companies struggle with employee retention, the need for machinery that helps with changeovers, as well as troubleshooting problems, is on the rise. FFS packaging machines now come with motion control and human-machine interfaces (HMIs), which makes it easier to execute the process.

- FFS pouch packing machines have been demonstrated to be quick, accurate, cost-effective, and versatile solutions that enhance efficiency and profitability automatically. However, packing low-density items such as wheat flour, talcum powder, and whey powder at medium speeds is uneconomical and costs far too much. FFS packaging has a hurdle with this form of packaging.

- Packaging hygiene and safety are a concern for consumers and businesses as the world continues to suffer due to COVID-19. The pandemic's spread has demonstrated how easily it may be disseminated through human contact and cross-contamination. Many governments have enacted strict regulations to ensure that food is produced, packed, and distributed in a safe manner.

Form Fill Seal Packaging Machine Market Trends

Horizontal Form Fill Seal Equipment Expected to Gain High Market Growth

- Horizontal form fill seal (HFFS) machines, also known as FFS machines, are packaging systems for high production manufacturing facilities that pack, seal, and ship food goods. Using horizontal form fill seal machines to package the food products will save time and money as these machines are designed for speed and efficiency, effectively packing and vacuum sealing products in a shorter amount of time than other traditional packagings, such as hand packaging or other manual packaging methods, can be packaged and vacuum-sealed in durable bags that can hold up to 2.2 pounds of product.

- Some HFFS machines are equipped with two molding stations and two sealing stations, so changes from one pack size to another can be done automatically with no downtime. This is useful in factories where switching is frequent. There are general setup steps to ensure that the HFFS machine produces high-quality and well-shaped packs.

- The growing demand for packaged food and the cost-effectiveness of flexible packaging solutions is expected to drive the demand for pouches. According to numbers generated by a Harris Poll chartered by Flexible Packaging, 83% of all brand owners currently use flexible packaging of some type. This supports the growth of the pouch packaging market, which effectively grows the demand for HFFS machines. With new integrated technology, these HFFS machines are getting more advanced in enabling the adjustment of external factors. For instance, Loesch Verpackungstechnik provides a high-performance horizontal form fill seal machine for primary packaging of chocolate bars, granola bars, and protein bars.

- It has intelligent control, a self-regulating control architecture enabling automatic parameter adjustments for fluctuating factors during operation (temperature, humidity, product characteristics), from rational product feeding to product discharge. It is ideally suited for sticky packaging products such as cereal bars and protein bars.

- According to the Association for Packaging and Processing, Horizontal form fill seal machinery is projected to attribute high demand during the forecast period in the United States. With factors considered, such as sustainability and an eco-friendly environment, various new technological advancements in HFFS machinery are expected during the forecast period.

Asia Pacific to Witness High Market Growth

- The growing population, rising disposable income, and the expansion of the food and beverage industry in China contribute to market growth. Changing lifestyles and the development of multi-national food shops in the region also contribute to the growth of the bag market, leading to the increased use of form-fill-seal machines.

- Further, the increasing need for quality water and health-conscious drinking habits are expected to increase the consumption of bottled water, which is likely to influence the packaging industry in the region directly.

- Japan is a major manufacturing hub in Asia, with high-quality products and best manufacturing practices. Japan is a leader in the world when it comes to manufacturing. Apart from its impeccable electronics and huge automobile sector, Japan also is a global producer of cosmetics and one of the biggest consumers of packaging machinery.

- India is one of the most populous countries globally and ranks 2nd after China. According to the IMF, the country's current population was approximately 1391.99 million in 2021 and is expected to reach 1455.82 million by 2026. This large mass of the country also makes it a heavy consumer of all sorts of products. Therefore, India presents a massive FFS packaging machinery market.

- Apart from the countries already discussed as a part of the study under the Asia Pacific region, other countries like South Korea, Australia, Taiwan, Thailand, Indonesia, Malaysia, etc., also have high potential scope for gaining a considerable share in the market studied.

Form Fill Seal Packaging Machine Industry Overview

The Form-Fill-Seal (FFS) Packaging Machine Market is fragmented as the major manufacturers in the market face stiff competition from smaller players. The companies present in the market are competing on price, distribution network, innovation, and brand reputation. Also, mergers and acquisitions, partnerships, and technological innovations are some of the primary strategies adopted by these companies to ensure long-term growth. Key players are Winpak Ltd., HDG Verpackungsmaschinen GmbH, etc. Recent developments in the market are -

- February 2022 - RM Group has launched an impressive new website, showcasing its knowledge, innovation, and automation expertise. The company designs, manufactures, and supplies a wide range of manual and automatic packaging machinery, packaging systems, and robotic automation to an expansive customer base spanning food and beverage, horticultural, aggregates, chemicals, and agricultural industries.

- August 2021 - Huhtamaki partnered with RiverRecycle and VTT to develop technology to solve the floating waste issue on the Mithi River in Mumbai, India. The waste collector technology is an integral part of RiverRecycle's solution to tackling marine waste, one of the biggest global challenges of time. With Huhtamaki's support, a prototype was built and tested in Finland and then transported to and assembled in Mumbai.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Maret Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand of Aseptic Packaging Industry

- 5.1.2 Rise in Demand of Pet Food Packaging

- 5.2 Market Restraints

- 5.2.1 Uneconomical for the Low Density Products

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Vertical Form Fill Seal Equipment

- 6.1.1.1 Food and Beverage

- 6.1.1.2 Pharmaceuticals

- 6.1.1.3 Personal and Household Care

- 6.1.1.4 Other End-Users

- 6.1.2 Horizontal Form Fill Seal Equipment

- 6.1.2.1 Food and Beverage

- 6.1.2.2 Pharmaceuticals

- 6.1.2.3 Personal and Household Care

- 6.1.2.4 Other End-Users

- 6.1.1 Vertical Form Fill Seal Equipment

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Winpak Ltd

- 7.1.2 HDG Verpackungsmaschinen GmbH

- 7.1.3 Huhtamaki Oyj

- 7.1.4 REES MACHINERY GROUP LIMITED

- 7.1.5 SACMI Imola SC

- 7.1.6 HAVER Continental Ltd

- 7.1.7 Mega Plast GmbH

- 7.1.8 Duravant LLC

- 7.1.9 MDC Engineering Inc.

- 7.1.10 Busch Machinery

- 7.1.11 Rovema GmbH

- 7.1.12 Fres-co System USA Inc.

- 7.1.13 ProMach Inc. (Matrix Packaging Machinery LLC)

- 7.1.14 PFM Group

- 7.1.15 Viking Masek Global Packaging Technologies

- 7.1.16 Nichrome Packaging Solutions

- 7.1.17 Triangle Package Machinery Company

- 7.1.18 Scholle IPN

- 7.1.19 Bosch Rexroth AG