|

市场调查报告书

商品编码

1430952

全球商用车润滑油市场:市场占有率分析、产业趋势与统计、成长预测(2021-2026)Global Commercial Vehicles Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

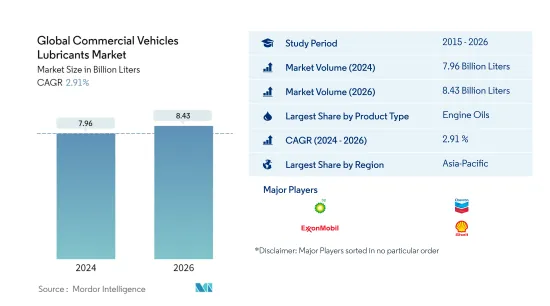

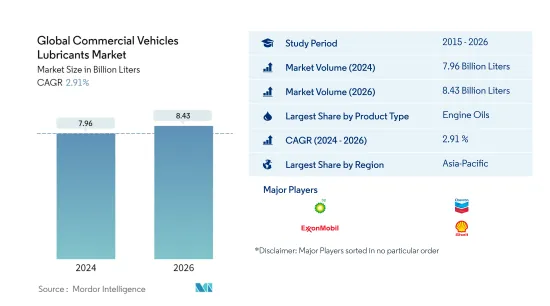

预计2024年全球商用车润滑油市场规模为79.6亿公升,预计2026年将达到84.3亿公升,在预测期间(2024-2026年)复合年增长率为2.91%,预计将会成长。

主要亮点

- 按产品类型划分最大的细分市场 - 机油:引擎油是CV领域最受欢迎的产品类型,因为它在高温高压下使用,需求量大,换油週期短。

- 按产品类型划分最快的细分市场 - 变速箱和齿轮油:预计变速箱油消费量将成为全球商用车领域所有产品类型中最高的,轻型商用车和卡车的使用量预计将增加。

- 最大的区域市场 - 亚太地区:亚太地区拥有庞大的持有,如中国、印度和日本。因此,该行业的润滑油消费量是亚太地区最高的。

- 成长最快的区域市场 - 亚太地区:合成润滑油的普及较低以及印度等国家卡车车队的预期高成长率预计将推动亚太地区的润滑油消费。

商用车润滑油市场趋势

按产品类型划分最大的细分市场:引擎油

- 2015年至2019年,全球商用车领域润滑油消费量复合年增率为2%。机油在该领域的润滑油产品类型中占据主导地位,2020年占73%的份额,其次是变速箱油,占11.5%的份额。

- 2020 年 COVID-19 爆发期间,由于应对大流行的封锁,货物运输大幅减少。因此,该产业的润滑油消费量较2019年下降了7.8%。

- 物流需求的预期繁荣和新商用车销售的復苏可能会推动该行业的润滑油消费。因此,预计2021-2026年商用车润滑油消费量将以3.2%的复合年增长率成长。

最大地区:亚太地区

- 按地区划分,亚太地区商用车(CV)润滑油消费量份额最大,约占全球商用车润滑油消费量的41.5%,其次是欧洲(占 17.7%)和北美(占 17.7%)。12.6 %,我是。

- COVID-19 爆发后对商业和运输活动实施的限制全部区域2020 年商用车润滑油消费量产生了负面影响。北美受影响最严重,2019-2020年消费量量下降12.1%,其次是欧洲,下降11.8%。

- 亚太地区可能是成长最快的CV润滑油市场,预计2021-2026年消费量复合年增长率为4.38%,其次是非洲,复合年增长率为3.09%,南美洲预计复合年增长率为3.0%。

商用车润滑油产业概况

全球商用车润滑油市场较分散,前五大企业占39.20%。该市场的主要企业包括 BP PLC(嘉实多)、雪佛龙公司、埃克森美孚公司、荷兰皇家壳牌公司、TotalEnergies(按字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第三章 产业主要趋势

- 汽车产业趋势

- 法律规范

- 价值炼和通路分析

第四章市场区隔

- 依产品类型

- 机油

- 润滑脂

- 油压

- 变速箱和齿轮油

- 按地区

- 非洲

- 埃及

- 摩洛哥

- 奈及利亚

- 南非

- 其他非洲

- 亚太地区

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 保加利亚

- 法国

- 德国

- 义大利

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东

- 伊朗

- 卡达

- 沙乌地阿拉伯

- 土耳其

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 其他北美地区

- 南美洲

- 阿根廷

- 巴西

- 哥伦比亚

- 南美洲其他地区

- 非洲

第五章竞争形势

- 重大策略倡议

- 市场占有率分析

- 公司简介

- BP PLC(Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- Idemitsu Kosan Co. Ltd

- Royal Dutch Shell PLC

- TotalEnergies

- Valvoline Inc.

第六章 附录

- 附录1 参考文献

- 附录-2 图表清单

第七章 CEO 面临的关键策略问题

简介目录

Product Code: 90300

The Global Commercial Vehicles Lubricants Market size is estimated at 7.96 Billion Liters in 2024, and is expected to reach 8.43 Billion Liters by 2026, growing at a CAGR of 2.91% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Product Type - Engine Oils : Since it has high-temperature and high-pressure uses, engine oil is the most popular product type in the CV sector, with large volume needs and shorter drain intervals.

- Fastest Segment by Product Type - Transmission & Gear Oils : Transmission oil consumption is predicted to be the highest among all product categories in the global CV sector, with the use of LCVs and trucks expected to rise.

- Largest Regional Market - Asia-Pacific : Asia-Pacific is home to countries with large vehicle fleets like China, India, and Japan. As a result, the lubricant consumption by this sector was highest in Asia-Pacific.

- Fastest Growing Regional Market - Asia-Pacific : The low penetration of synthetic lubricants and expected high growth rates of the truck fleet in countries like India are likely to drive lubricant consumption in APAC.

Commercial Vehicles Lubricants Market Trends

Largest Segment By Product Type : Engine Oils

- During 2015-2019, lubricant consumption in the global commercial vehicle sector increased at a CAGR of 2%. Engine oil was the dominating lubricant product type in this sector, accounting for a share of 73% in 2020, followed by transmission oils, which accounted for a share of 11.5%.

- During the COVID-19 outbreak in 2020, freight transportation significantly dropped due to the lockdowns in response to the pandemic. Hence, lubricant consumption in this sector declined by 7.8% compared to 2019.

- The projected boom in logistic requirements and recovery in sales of new commercial vehicles are likely to drive lubricant consumption in this sector. Hence, commercial vehicle lubricant consumption is expected to increase at a CAGR of 3.2% during 2021-2026.

Largest Region : Asia-Pacific

- By geography, lubricant consumption of commercial vehicles (CV) was the highest in Asia-Pacific, at around 41.5% of the total CV lubricant consumption globally, followed by Europe and North America, which accounted for a share of 17.7% and 12.6%, respectively.

- The restrictions imposed on business and transportation activities after the COVID-19 outbreak negatively affected CV lubricant consumption across the region in 2020. North America was the most affected, as it recorded a 12.1% drop in consumption during 2019-2020, followed by Europe, which recorded an 11.8% drop.

- During 2021-2026, Asia-Pacific is likely to be the fastest-growing CV lubricant market as the consumption is likely to increase at a CAGR of 4.38%, followed by Africa and South America, with an expected CAGR of 3.09% and 3.0%, respectively.

Commercial Vehicles Lubricants Industry Overview

The Global Commercial Vehicles Lubricants Market is fragmented, with the top five companies occupying 39.20%. The major players in this market are BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell PLC and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Product Type

- 4.1.1 Engine Oils

- 4.1.2 Greases

- 4.1.3 Hydraulic Fluids

- 4.1.4 Transmission & Gear Oils

- 4.2 By Region

- 4.2.1 Africa

- 4.2.1.1 Egypt

- 4.2.1.2 Morocco

- 4.2.1.3 Nigeria

- 4.2.1.4 South Africa

- 4.2.1.5 Rest of Africa

- 4.2.2 Asia-Pacific

- 4.2.2.1 China

- 4.2.2.2 India

- 4.2.2.3 Indonesia

- 4.2.2.4 Japan

- 4.2.2.5 Malaysia

- 4.2.2.6 Philippines

- 4.2.2.7 Singapore

- 4.2.2.8 South Korea

- 4.2.2.9 Thailand

- 4.2.2.10 Vietnam

- 4.2.2.11 Rest of Asia-Pacific

- 4.2.3 Europe

- 4.2.3.1 Bulgaria

- 4.2.3.2 France

- 4.2.3.3 Germany

- 4.2.3.4 Italy

- 4.2.3.5 Norway

- 4.2.3.6 Poland

- 4.2.3.7 Russia

- 4.2.3.8 Spain

- 4.2.3.9 United Kingdom

- 4.2.3.10 Rest of Europe

- 4.2.4 Middle East

- 4.2.4.1 Iran

- 4.2.4.2 Qatar

- 4.2.4.3 Saudi Arabia

- 4.2.4.4 Turkey

- 4.2.4.5 UAE

- 4.2.4.6 Rest of Middle East

- 4.2.5 North America

- 4.2.5.1 Canada

- 4.2.5.2 Mexico

- 4.2.5.3 United States

- 4.2.5.4 Rest of North America

- 4.2.6 South America

- 4.2.6.1 Argentina

- 4.2.6.2 Brazil

- 4.2.6.3 Colombia

- 4.2.6.4 Rest of South America

- 4.2.1 Africa

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 BP PLC (Castrol)

- 5.3.2 Chevron Corporation

- 5.3.3 China National Petroleum Corporation

- 5.3.4 China Petroleum & Chemical Corporation

- 5.3.5 ENEOS Corporation

- 5.3.6 ExxonMobil Corporation

- 5.3.7 Idemitsu Kosan Co. Ltd

- 5.3.8 Royal Dutch Shell PLC

- 5.3.9 TotalEnergies

- 5.3.10 Valvoline Inc.

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

02-2729-4219

+886-2-2729-4219