|

市场调查报告书

商品编码

1430994

世界纺织机械:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Textile Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

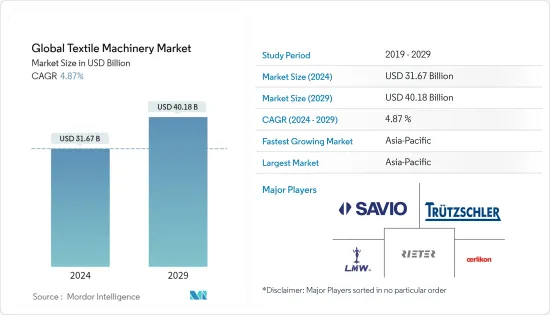

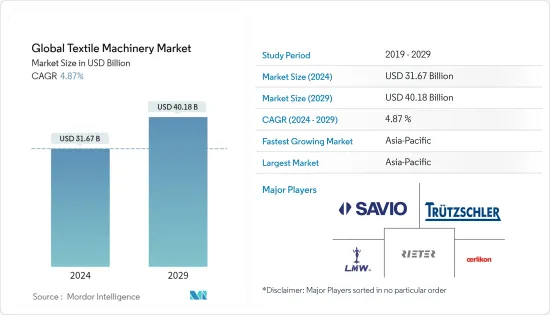

2024年全球纺织机械市场规模预计为316.7亿美元,预计2029年将达到401.8亿美元,预测期内(2024-2029年)复合年增长率为4,预计将以87%的速度增长。

主要亮点

- 纺织品生产中印花技术的进步以及生产高品质面料对精密设备的需求不断增加正在推动市场扩张。自动化和机器人在纺织製造中的日益使用也推动了纺织机械产业的发展。

- 机械製造商现在不仅提供纺织机械,还以更低的价格提供生产能力更高、速度更快的复杂机器。小型市场参与企业也为机械行业的竞争力做出了贡献,跨国公司进入全球市场加剧了竞争,迫使企业创新并提高生产力。由于不断的技术进步,纺织机械行业尤其充满活力,从传统的解决方案转向更复杂的解决方案。

- 儘管COVID-19情况带来了原材料短缺、价格上涨、供应链中断等挑战,但这段时期的强劲需求导致订单增加,并在2021年实现復苏。疫情为日常生活带来的重要而深刻的变化,也让永续性、循环生产、数位化等概念成为相关人员投资和决策的焦点。全球领先的纺织机械和技术製造商预测,2022年开始的成长动能和永续生产导向发展将在2023年继续,随着许多国际展览的举办,该产业将迎来復苏。

纺织机械市场趋势

纺织机械板块是成长最快的机械板块

纺织机械板块预计将成为未来五年成长最快的纺织机械板块。该领域的成长很大程度上归功于棉纺机的扩张。棉纺机械市场可能受到新兴国家对纺织产品和环保纤维不断增长的需求的推动。欧洲是纺织机械的重要生产国。

亚太地区靠近大多数服饰和纺织品生产国家。为了降低营运成本,自动化在生产成本高、劳动力昂贵的国家受到高度追捧。在预测期内,自动化和需求增加等因素预计将为製造商提供巨大潜力,以满足技术升级的棉纺机的需求。

在印度纺织服装市场蓬勃发展的推动下,印度纺织机械产业正经历显着成长。由于消费者需求不断增长,到 2030 年,印度的棉花产量预计将达到 720 万吨(相当于 170 公斤棉包的 4,300 万包)。目前,纺织机械产业在印度纺织服装业从集中生产转变为更先进、工业化生产的过程中发挥着越来越重要的作用。随着国内外市场对纺织机械的需求不断增加,印度纺织机械产业预计在不久的将来会有更大的发展。

快速成长的亚太地区

亚太地区预计将主导全球纺织机械产业。外国公司越来越多地参与服装和纺织业是推动该地区市场扩张的关键因素。亚太地区主要纺织机械市场包括印度、越南、中国、日本、韩国和印尼。重要的纺织业的存在和服饰不断增长的需求正在推动该地区的成长。此外,全球公司对印度纺织业投资的增加正在推动该地区的成长。

2016年4月至2021年3月,印度纺织业(包括染色和印花纺织品)的最大外国直接投资提供者是日本、毛里求斯、义大利和比利时。印度在2021-2022财年实现了有史以来最高的纺织品服装(T&A)和手工艺品出口总额444亿美元,在2020-21财年和2019-20财年分别增长了41%和26%。 2017年至2022年,纺织领域外商直接投资15.2223亿美元。

PM MITRA Park,纺织产品生产挂钩奖励(PLI) 计划,为国家技术纺织品使命 (NTTM) 向印度纺织工业拨款 148 亿卢比(1.8084 亿美元),用于 FDI 等计划,未来可能会增加。

纺织机械产业概况

全球纺织机械产业企业市场占有率不多,市场竞争激烈且分散。由于公司希望扩大其地理覆盖范围和独特知识,目前正在进行许多併购。例如,2021年10月,数位印刷机领域的早期领导者康丽收购了开发新型纺织增材製造技术的Voxel8。 Voxel8 开发的技术透过使用与喷墨技术相连的高性能合成橡胶以及对材料特性的区域控制,可以实现功能特征的数位化製造。

全球纺织机械市场的一些主要参与者包括 OC Oerlikon、Trutzschler Group Benninger AG (Jakob Muller AG)、Savio Macchine Tessili SpA、Camozzi Group SpA.、Itema SpA. 和 Lakshmi Machine Works Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 市场限制因素

- 市场机会

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 政府法规和倡议

- 科技趋势

- COVID-19 对市场的影响

第五章市场区隔

- 按原料分

- 棉布

- 羊毛

- 尼龙

- 聚酯纤维

- 丙烯酸纤维

- 丝绸

- 其他原料

- 按机器类型

- 纺纱机

- 织布机

- 针织机

- 织布机

- 其他机器

- 按通路

- 直接地

- 间接

- 按用途

- 服饰/服饰

- 家用纺织产品

- 产业用纺织品(医用、防护、运动等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 孟加拉

- 土耳其

- 韩国

- 澳洲

- 印尼

- 其他亚太地区

- 中东/非洲

- 埃及

- 南非

- 沙乌地阿拉伯

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 市场集中度概览

- 公司简介

- OC Oerlikon

- Trutzschler Group

- Savio Macchine Tessili SpA

- Rieter Holding AG

- Lakshmi Machine Works Ltd

- Murata Machinery Ltd.

- Santoni SpA

- Saurer Intelligent Technlogy AG

- TMT Machinery Inc.

- Mayer & Cie. GmbH & Co. KG

- 其他公司(概述/关键资讯)

第七章 市场机会及未来趋势

第8章附录

The Global Textile Machinery Market size is estimated at USD 31.67 billion in 2024, and is expected to reach USD 40.18 billion by 2029, growing at a CAGR of 4.87% during the forecast period (2024-2029).

Key Highlights

- The increased need for sophisticated equipment that generates high-quality fabric as well as advancements in printing technology in textile production are driving market expansion. The increased use of automation and robots in textile manufacturing is also boosting the textile machinery industry.

- Machine makers now provide complex machines with increased production capacity and speed, as well as textile machinery, at cheap costs. Several small-scale market participants also help to make the machinery sector more competitive, and multinational firms have entered the global market, raising competition and forcing enterprises to improve their innovation and productivity. Because of constant technical improvements, the textile machinery industry is particularly dynamic, shifting from traditional to more complex solutions.

- While the COVID-19 situation brought problems such as shortages of raw materials, price increases, and disruptions in the supply chain, the pent-up demand during this period resulted in an increase and recovery in orders in 2021. The important and major changes created by the pandemic in daily life have also brought concepts such as sustainability, circular production, and digitalization into the focus of stakeholders investments and decisions. The world's leading textile machinery and technology manufacturers anticipate that the increasing momentum and sustainable production-oriented developments that began in 2022 will continue in 2023 and that the sector will revive with the organization of numerous international exhibitions.

Textile Machinery Market Trends

Spinning Machine Segment is the Fastest Growing Machinery Segment

The spinning machinery segment is expected to be the fastest-growing textile machinery segment over the next five years. Much of this segment's growth can be attributed to the expansion of the cotton spinning machinery. The cotton spinning machine market is likely to be driven by rising demand for textile goods and environmentally friendly fibers in emerging countries. Europe is a significant producer of textile machines.

Asia-Pacific is close to most of the countries that make clothes and textiles. This gives producers a huge chance to meet demand in the region.In order to lower operating costs, automation is in great demand in countries where production costs are high and labor is expensive. During the projected period, factors such as automation and rising demand are expected to provide a substantial potential for manufacturers to meet the need for technologically upgraded cotton spinning machines.

The Indian textile machinery industry is experiencing tremendous growth, facilitated by the country's booming textile and apparel markets. Cotton production in India is expected to reach 7.2 million metric tons (43 million bales of 170 kg each) by 2030, owing to rising consumer demand. Currently, the textile machinery industry plays an increasingly vital role in shifting India's textile and apparel industry from labor-intensive production to a more advanced and industrialized sector. With the growing demand for textile machinery in both domestic and international markets, the Indian textile machinery industry is expected to see greater development in the near future.

Asia-Pacific region is the Fastest Growing Region

The Asia-Pacific region is expected to dominate the global textile machinery industry. The rising involvement of foreign firms in the garment and textile sectors is an important element driving regional market expansion. Asia Pacific's major textile machine markets include India, Vietnam, China, Japan, South Korea, and Indonesia. The presence of a significant textile sector and rising garment demand are driving regional growth. Furthermore, growing investments by global firms in the textile sector in India are fueling regional growth.

From April 2016 to March 2021, Japan, Mauritius, Italy, and Belgium were the top FDI providers to India's textile sector (including dyed and printed textiles).. India achieved its highest-ever Textiles and Apparel (T&A) and Handicrafts export total of USD 44.4 billion in FY 2021-22, representing a 41% and 26% rise over equivalent amounts in FY 2020-21 and FY 2019-20, respectively. From 2017 to 2022, FDI invested USD 1522.23 million in the textile sector.

Because of schemes like the Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks, the Production Linked Incentive (PLI) Scheme for Textiles, and the allocation of Rs. 1480 crore (USD 180.84 million) for the National Technical Textiles Mission (NTTM), FDI may increase in the Indian textile industry in the future.

Textile Machinery Industry Overview

The companies in the global textile machinery industry don't have a lot of market share because the market is very competitive and divided.There are a lot of mergers and acquisitions going on right now because companies want to grow their geographic reach and their own knowledge. For example, in October 2021, Kornit, a company that was an early leader in digital printing machines, bought Voxel8, a company that made new textile additive manufacturing technology. The technique developed by Voxel8 enables the digital manufacture of functional features with zonal control of material characteristics as well as the use of high-performance elastomers adhering to inkjet technology.

Some of the leading players in the textile machinery market around the world are OC Oerlikon, Trutzschler Group Benninger AG (Jakob Muller AG), Savio Macchine Tessili S.p.A., Camozzi Group SpA., Itema SpA., and Lakshmi Machine Works Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Raw Material

- 5.1.1 Cotton

- 5.1.2 Wool

- 5.1.3 Nylon

- 5.1.4 Polyester

- 5.1.5 Acrylic

- 5.1.6 Silk

- 5.1.7 Other Raw Materials

- 5.2 By Machine Type

- 5.2.1 Spinning Machines

- 5.2.2 Weaving Machines

- 5.2.3 Knitting Machines

- 5.2.4 Texturing Machines

- 5.2.5 Other Machine Types

- 5.3 By Distribution Channel

- 5.3.1 Direct

- 5.3.2 Indirect

- 5.4 By Application

- 5.4.1 Garments & Apparels

- 5.4.2 Household and Home Textiles

- 5.4.3 Technical Textiles (Medical, Protective, Sports, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Bangladesh

- 5.5.3.5 Turkey

- 5.5.3.6 South Korea

- 5.5.3.7 Australia

- 5.5.3.8 Indonesia

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 Egypt

- 5.5.4.2 South Africa

- 5.5.4.3 Saudi Arabia

- 5.5.4.4 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 OC Oerlikon

- 6.2.2 Trutzschler Group

- 6.2.3 Savio Macchine Tessili S.p.A

- 6.2.4 Rieter Holding AG

- 6.2.5 Lakshmi Machine Works Ltd

- 6.2.6 Murata Machinery Ltd.

- 6.2.7 Santoni S.p.A.

- 6.2.8 Saurer Intelligent Technlogy AG

- 6.2.9 TMT Machinery Inc.

- 6.2.10 Mayer & Cie. GmbH & Co. KG*

- 6.3 Other Companies (Overview/Key Information)