|

市场调查报告书

商品编码

1431008

玄武岩纤维:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Basalt Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

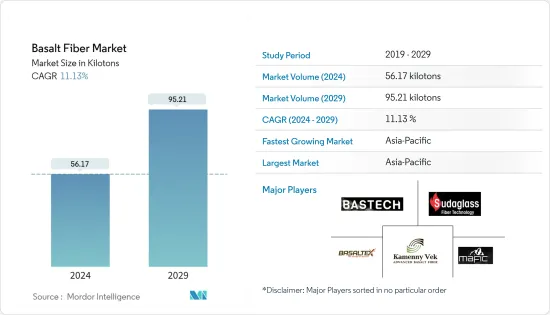

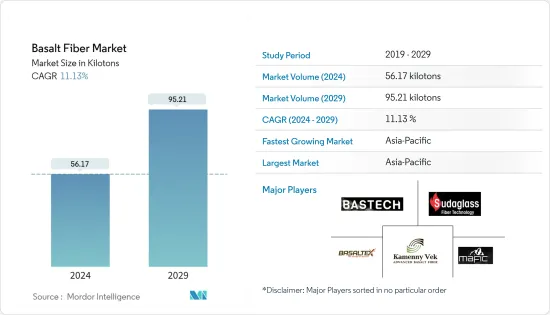

玄武岩纤维市场规模预计到2024年为56.17千吨,预计2029年将达到95.21千吨,在预测期内(2024-2029年)复合年增长率为11.13%。

COVID-19 的爆发对玄武岩纺织业造成了沉重打击。全球封锁和严格的政府监管迫使大多数生产基地关闭,造成毁灭性的挫折。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

主要亮点

- 从短期来看,汽车行业需求的增加以及住宅装修和维修活动的支出是推动所研究市场成长的因素。

- 另一方面,现有替代产品的可用性和原材料价格的波动预计将抑制市场成长。

- 然而,越来越多地采用环保材料可能会在未来几年为市场提供机会。

- 预计亚太地区将主导市场,并且在预测期内也可能呈现最高的复合年增长率。

玄武岩纤维市场趋势

增加在汽车产业的使用

- 玄武岩纤维环保,具有优异的机械强度、耐高温、耐用性和耐化学性。由于这些特性,玄武岩纤维被用于汽车产业。

- 在汽车工业中,玄武岩纤维用于车顶内衬、CNG气瓶、燃料箱、煞车皮、离合器片、排气系统、消音器填料、面板、萤幕、轮胎罩、基于织物的内部和外部部件、热塑性复合部件、用于组件等各种零件。

- 人口成长、生活水准提高和消费能力增强预计将推动全球汽车需求。例如,根据国际汽车工业协会(OICA)的数据,2022年全球整体小客车产量为6,159万辆,较2021年成长8%。因此,小客车产量的增加预计将在预测期内增加玄武岩纺织品市场的需求。

- 此外,德国的供应链问题已经缓解,汽车产量正在上升。例如,根据 OICA 的数据,2022 年德国将生产约 3,677,820 辆汽车,比 2021 年成长 11%。因此,国内汽车产量的增加预计将为玄武岩纺织品市场带来需求上行。

- 此外,美国也是全球第二大汽车销售和生产市场。例如,根据国际汽车工业协会(OICA)的数据,2022年美国汽车产量为10,060,339辆,较2021年成长10%。因此,汽车产量的增加预计将对玄武岩纤维产生大量需求。

- 玄武岩纤维作为汽车消音器的填充材具有许多优点,表现出优异的隔音性能和良好的耐热循环性。例如,丰田(世界领先的汽车公司之一)使用玄武岩纤维作为消音器的辅助材料。

- 由于这些因素,预测期内全球对玄武岩纤维的需求可能会成长。

亚太地区主导市场

- 由于中国、日本和印度等国家的汽车生产以及建设活动的增加,亚太地区主导了全球市场占有率。

- 随着消费者对电池驱动电动车的偏好增加,中国汽车产业正经历转变。中国汽车产业的扩张预计将使安定器纤维市场受益。根据国际汽车工业协会(OICA)的数据,中国是世界上最大的汽车生产国,占全球产量的近34%。 2022年汽车产量为27,020,615辆,比2021年的26,121,712辆增加24%。因此,汽车产量的增加预计将创造对玄武岩纤维的需求。

- 在印度,汽车废气法规的收紧、车辆安全的进步、ADAS(高级驾驶辅助系统)的引入以及零售和电子商务领域物流的快速增长正在催生新型先进的轻商业车辆(轻型商用车)。这极大地推动了对汽车的需求。例如,根据国际汽车工业协会(OICA)的数据,2022年印度轻型商用车产量达到617,398辆,较2021年成长27%。

- 此外,印度汽车工业的投资增加和进步预计将增加安定器纺织品的消费。例如,2022年4月,塔塔汽车宣布计画未来5年向小客车业务投资30.8亿美元。这一扩张预计将对该国的玄武岩纤维市场产生积极影响。

- 此外,中国在亚太地区建筑市场中占有最大份额。由于该国投资和建设活动的增加,预计玄武岩纤维的需求在预测期内将会增加。例如,根据国家统计局(NBS)的数据,2022年中国建筑业产值将达到27.63兆元人民币(41,085.81亿美元),比2021年增加6.6%。

- 随着2025年大阪世博会的举办,日本建设产业预计将蓬勃发展。此外,ESR Cayman、OS Cosmosquare资料中心和大阪项目是日本最大的建设计划,总成本达20亿美元,将于2022年第四季开工。 ESR 开曼、OS Cosmosquare 资料中心、大阪计画将于 2021 年第二季在大阪(市)宣布,预计第一季完工。第二名计划是国土交通省设乐大坝开发(爱知县),于2022年第四季开始开发,计划价值5.7亿美元。日本国土交通省的设乐大坝开发计划位于日本,于 2022 年第三季宣布,预计竣工日期为 2034 年第四季。

- 由于这些因素,预计该地区的玄武岩纤维市场在预测期内将稳定成长。

玄武岩纺织业概况

玄武岩纺织品市场本质上是部分一体化的。市场的主要企业(排名不分先后)包括 Kamenny Vek、Basaltex、Sudaglass Fiber Technology、MAFIC、BASTECH 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车产业的需求不断增加

- 住宅装修/维修支出增加

- 其他司机

- 抑制因素

- 轻鬆取得替代产品

- 原物料价格波动

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 类型

- 连续式

- 离散的

- 最终用户产业

- 建筑/施工

- 车

- 建造

- 海洋

- 能源工业

- 其他(体育、化工、工业)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析(%)/排名分析

- 主要企业策略

- 公司简介

- ARMBAS

- Basalt Engineering, LLC

- Basaltex

- BASTECH

- Deutsche Basalt Faser GmbH

- Fiberbas construction and building technologies

- FINAL ADVANCED MATERIALS

- Galen Ltd

- INCOTELOGY GmbH

- JiLin Tongxin Basalt Technology Co.,Ltd

- Kamenny Vek

- MAFIC

- Sudaglass Fiber Technology

- Technobasalt Invest

第七章 市场机会及未来趋势

- 增加环保材质的使用

- 其他机会

The Basalt Fiber Market size is estimated at 56.17 kilotons in 2024, and is expected to reach 95.21 kilotons by 2029, growing at a CAGR of 11.13% during the forecast period (2024-2029).

The COVID-19 epidemic harmed the basalt fiber sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the businesses were recovering since 2021 and are expected to rise significantly in the coming years.

Key Highlights

- Over the short term, increasing demand from the automotive industry and spending on home remodeling and retrofitting activities are factors driving the studied market's growth.

- On the flip side, the easy availability of existing substitute products and fluctuations in raw material prices are expected to hinder the studied market's growth.

- However, increasing adoption of environmentally friendly materials will likely create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Basalt Fiber Market Trends

Increasing Usage in the Automotive Industry

- Basalt fiber is environmentally friendly and includes good mechanical strength, resistance to high temperatures, durability, and chemical resistance. Due to all these properties and characteristics, basalt fiber is used in the automotive industry.

- In the automotive industry, basalt fiber is used for different parts such as headliners, CNG cylinders, fuel tanks, brake pads, clutch plates, exhausting systems, Muffler's filler, panels, screens, tire covers, interior and exterior parts based on fabrics, thermoplastic compound parts, and components.

- The rising population, improved living standards, and increased spending power will likely boost the demand for automobiles globally. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021. Therefore, an increase in the production of passenger cars is expected to create an upside demand for the basalt fiber market during the forecast period.

- Moreover, with the ease of supply chain issues in Germany, automobile production in the country observed an upside trend. For instance, according to OICA, in 2022, around 36,77,820 units of automobiles were produced in Germany, which shows an increase of 11% compared to 2021. Therefore, an increase in the production of automobiles in the country is expected to create an upside demand for the basalt fiber market.

- Furthermore, the United States is the second-largest vehicle sales and production market globally. For instance, according to The International Organization of Motor Vehicle Manufacturers (OICA), in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create a significant demand for basalt fiber.

- Basalt fibers provide many benefits as filler for car mufflers showing great silencing properties and good resistance to thermal cycling. For instance, Toyota (one of the world's leading automotive companies) uses basalt fiber as sub- Muffler stuffing for their cars.

- Owing to all these factors, the demand for basalt fiber will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share owing to the increasing automotive production and building and construction activities in the countries like China, Japan, and India.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit the ballast fiber market. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing the production of automobiles is expected to create demand for basalt fiber.

- In India, increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist system introduction, and rapidly growing logistics in the retail and e-commerce sectors significantly drove the demand for new and advanced Light commercial vehicles (LCVs). For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, light commercial vehicle production in India amounted to 6,17,398 units, showing an increase of 27% compared to 2021.

- Moreover, increased investments and advancements in the automobile industry in India are expected to increase the consumption of ballast fiber products. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This expansion is expected to include a positive impact on the basalt fiber market in the country.

- Furthermore, China holds the largest Asia-Pacific share of the construction market. The demand for basalt fiber is expected to rise throughout the forecast period due to rising investments and construction activity in the country. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 27.63 trillion (USD 4,108.581 billion), an increase of 6.6% compared with 2021.

- The Japanese construction industry is expected to be booming as the country will host the World Expo in 2025 in Osaka, Japan. Furthermore, the ESR Cayman, OS Cosmosquare Data Centre, Osaka project, valued at USD 2,000 million, was Japan's largest building project, on which construction started in Q4 2022. The ESR Cayman, OS Cosmosquare Data Centre, Osaka project was announced in Q2 2021 in Osaka (City), Japan, with a completion date of Q1 2026. The second-largest project, the MLIT Japan, Shitara Dam Development, Aichi, with a project value of USD 570 million, began development in Q4 2022. The MLIT Japan, Shitara Dam Development, Aichi project is located in Japan and was announced in Q3 2022, with a completion date of Q4 2034.

- Due to all such factors, the region's basalt fiber market is expected to grow steadily during the forecast period.

Basalt Fiber Industry Overview

The Basalt Fiber Market is partially consolidated in nature. The major players in this market (not in a particular order) include Kamenny Vek, Basaltex, Sudaglass Fiber Technology, MAFIC, and BASTECH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Automotive Industry

- 4.1.2 Increase in Spending on Home Remodeling and Retrofitting Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Easy Availability of Substitute Products

- 4.2.2 Fluctuations in Raw Material Prices

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Continuous

- 5.1.2 Discrete

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Marine

- 5.2.5 Energy Industry

- 5.2.6 Other (Sports, Chemical Industry, Petroleum Industry)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARMBAS

- 6.4.2 Basalt Engineering, LLC

- 6.4.3 Basaltex

- 6.4.4 BASTECH

- 6.4.5 Deutsche Basalt Faser GmbH

- 6.4.6 Fiberbas construction and building technologies

- 6.4.7 FINAL ADVANCED MATERIALS

- 6.4.8 Galen Ltd

- 6.4.9 INCOTELOGY GmbH

- 6.4.10 JiLin Tongxin Basalt Technology Co.,Ltd

- 6.4.11 Kamenny Vek

- 6.4.12 MAFIC

- 6.4.13 Sudaglass Fiber Technology

- 6.4.14 Technobasalt Invest

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing adoption of environmentally friendly materials

- 7.2 Other Opportunities