|

市场调查报告书

商品编码

1431025

IP电话/UCaaS:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)Global IP Telephony & Ucaas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

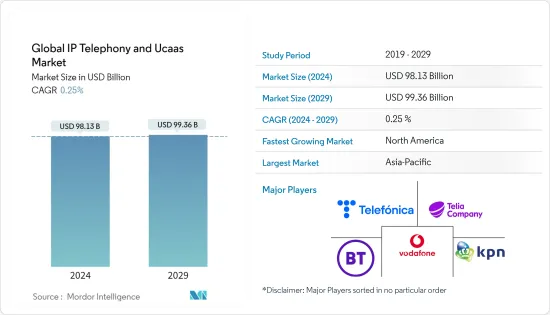

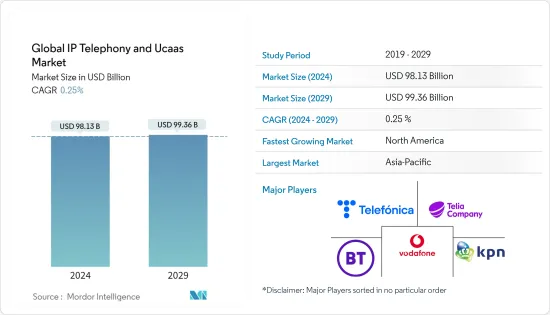

全球IP电话和UCaaS市场规模预计到2024年为981.3亿美元,预计到2029年将达到993.6亿美元,在预测期内(2024-2029年)复合年增长率为0.25%,预计将会增长。

由于2020年是疫情和经济放缓的一年, IP电话市场厂商的累积收入贡献下降。除了 IP 电话销量急剧下降之外,由于前所未有的大流行,市场还受到第一季提供无缝託管 VoIP 服务疲软的负面影响。同时,随着员工越来越多地远距工作并依赖线上媒介进行官方沟通,对云端基础的UCaaS 的需求也在增加。

主要亮点

- 统一通讯即服务 (UCaaS) 是指一种服务模型,提供者通常透过网路提供各种通讯应用程式、软体产品和流程。 IP电话也指使用 Internet 连线传送和接收语音资料的电话系统。

- 近年来,IP技术使用各种通讯协定在公共交换电话网路上交换语音、传真和其他格式。互联网通讯协定已成为所有资料通讯的传输方式。商务电话系统现在可以为企业提供更多服务。 IP技术在单一网路上提供了完整的通讯包。

- 统一通讯提供了更易于管理的成本结构和更低的采购成本。虽然IP电话或硬体电话可能是必要或理想的,但许多企业开始使用可以复製桌面电话功能的软体电话和智慧型手机应用程式。然而,计量收费订阅模式是 UCaaS 和IP电话解决方案的趋势,因为它们为客户提供了最佳的成本结构。

- 随着统一通讯支出的增加,组织内的购买力也会增加。传统上,IT部门上交UC预算,但透过云,业务部门也可以投资UC应用程式。

- 现代职场是数位化且不断变化的。员工期望职场更加开放、加强协作、更好的技术和更大的弹性。随着劳动力变得更加分散,许多员工远距工作,而其他员工则在传统办公室工作,企业需要合适的工具来保持分散的劳动力相互联繫。我需要它。

IP电话/UCaaS市场趋势

BFSI 细分市场预计将推动市场成长

- UCaaS 已成为 BFSI 领域经济高效的解决方案。银行和金融部门主要投资 UCaaS,以更好地了解所有管道的客户通信,从而实现大规模部署所需的可扩展性。

- UCaaS 服务有助于提高可用性和扩充性,同时增强协作。 UCaaS 解决方案使公司能够专注于业务成长而不是维护。公司无需为具有他们永远不会使用的功能的统一通讯软体付费,从而可以节省资金。 UCaaS 服务包括广泛的互动式语音应答 (IVR)、视讯会议、即时聊天、电子邮件、统一通讯、VoIP 服务和其他用户端管理功能。

- 此外,BFSI 公司需要各部门之间的广泛协作。这需要资产和财务经理与分析师交谈,以及客户支援人员跨时区协作。这种有效的协作需要消除摩擦的软体解决方案。

- 例如,UCaaS 允许不同的团队一起工作并无缝协作。然而,由于 UCaaS 在云端中运行,因此团队成员可以从任何设备存取信息,无论其位置如何。客服中心供电督导可以透过智慧型手机即时监控进展。金融研究分析师无需共处一室即可分析资料。 UCaaS 帮助金融服务公司充分利用其人力资本。

- 企业正在寻找减少开支和产生内部收益的潜在方法。能够透过云端存取所需的文件和资料是一种可行的解决方案,并导致了自带设备 (BYOD) 的普及。银行和金融机构也迅速效仿,鑑于业务全球化,远端存取资料已成为该行业的基本能力。

北美地区预计将录得最快成长

- 北美的优势可归因于近期 IT 消费化和 5G 连接普及式增长导致的移动性激增。

- 在美国,零售、银行、医疗保健、资讯科技和通讯领域的最终用户无论身在何处,都要求所有通讯(包括语音、视讯和聊天)获得更直接、无缝的体验。为了满足这些需求,企业正在寻求来自他们可以信赖的单一供应商的统一部署和管理解决方案来满足其 UCC 要求。随着 5G 的出现,将可以将远端连线工具整合到单一 UCaaS 平台中。

- 虽然 5G 将有利于消费者,但它也将为依赖统一通讯的企业带来好处和价值。由于 5G,网路速度将会改变。目前每秒 1GB 的平均速率将增加到每秒约 20GB。随着频宽容量和速度的提高,VoIP 产业也将持续发展。 5G 和 VoIP 的结合将为消费者提供相当于光纤宽频的连线。

- 这使得 VoIP 能够大规模使用。由于通讯成本将会降低,世界各地营运的公司将受益于 VoIP 和 5G 的结合。

- 由于 5G 和边缘网路的兴起,供应商可以预见即时通讯市场将发生令人兴奋的变化。 UCaaS 提供无尽的创造性服务和託管服务工具,透过改进的安全性、简化的配置和一组託管服务工具,可以帮助供应商在不久的将来最大限度地提高收益。为工具集合提供了场所。

- 由于加大了对5G部署的投资,美国是5G市场的主要创新者和投资者之一。该国的通讯业占全球 5G 技术消耗的很大一部分。

IP电话/UCaaS产业概况

IP电话/UCaaS 市场竞争非常激烈。近年来,市场竞争更加激烈。此外,参与者正在采取措施在这个快速成长的市场中获得竞争优势。

- 2022年2月-沃达丰和Ring Central在英国联合推出统一云端通讯平台Ring Central的Vodafone Business UC。最初,沃达丰企业业务和 Ring Central 将于 2021 年向英国客户和沃达丰企业业务在欧洲的跨国客户推出这项新服务。预计会有更多国家跟进,包括西班牙、德国和义大利,该平台将根据每个地区的产品进行客製化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业相关人员分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 计量收费的出现推动了对 Lagacy UC 解决方案的需求

- 不断变化的劳动力动态导致新的企业合作的出现

- 市场挑战

- 过渡到现代统一通讯的准备工作出现延误

- IP电话系统语音品质差

第六章市场区隔

- 按公司规模

- 中小企业(员工人数500人以下)

- 大型企业(员工500人以上)

- 按用途

- BFSI

- 零售

- 卫生保健

- 政府/公共机构

- 资讯科技和电讯

- 其他最终用户(按行业)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Vodafone

- Telia Company

- Telefonica

- KPN

- BT

- Orange Business Solutions

- Verizon Communications Inc.

- 8X8 Inc.

- Mitel Networks Corporation

- Gamma Telecom

- Nextiva

- Soluno

- Cisco Systems

- VADS Berhad

- Singapore Telecommunications Limited

- PLDT Enterprise

- NTT Communication Corporation

- Telstra Corporation Limited

- PCCW Global

- Maxis Communications

第八章投资分析

第9章 未来趋势

The Global IP Telephony & Ucaas Market size is estimated at USD 98.13 billion in 2024, and is expected to reach USD 99.36 billion by 2029, growing at a CAGR of 0.25% during the forecast period (2024-2029).

As 2020 marked the whole year of pandemic and economic slowdown, the IP telephony market cumulative revenue contribution by vendors declined. The sharp decline in sales volume for IP phones coupled with a hiccup in initial quarters to provide seamless hosted VoIP service due to unprecedented pandemic affected the market negatively. While cloud-based UCaaS demand increased as employees resorted to remote work and used online mediums for official interactions.

Key Highlights

- Unified communications-as-a-service (UCaaS) refers to a service model where the provider delivers different telecom or communications applications, software products, and processes generally over the web. Moreover, IP telephony refers to any phone system that uses an internet connection to send and receive voice data.

- Recently, IP technology has used a variety of protocols to exchange voice, fax, and other forms over the public switched telephone network. The internet protocol became the transport for all data communication. The business telephone system is now able to deliver much more to enterprises. The IP technology has provided a complete communication package over a single network.

- Unified communications provide a more manageable cost structure and a lower acquisition cost. While IP telephony and hardware phones may be required or desired, many businesses get started using a softphone or smartphone app that can replicate the functions of a desktop telephone. However, the pay-as-you-go subscription model is in trend across UCaaS and IP telephony solutions as it provides the best cost structure to customers.

- As UC spending increases, the buying power within the organization rises. Traditionally, IT departments were handing the UC budgets, but the cloud has enabled lines of business to also invest in UC apps.

- The modern workplace is digitizing and shifting. Employees expect more openness, improved collaboration, better technology, and higher flexibility in a workplace. As the workforce continues to become more distributed, with many employees going remote and others working from traditional offices, organizations need the right tools to keep their dispersed workforce always connected.

IP Telephony & Ucaas Market Trends

The BFSI Segment is Expected to Drive the Market Growth

- Unified Communications as a Service (UCaaS) emerged as a cost-effective solution for the BFSI sector. Banks and financial sectors primarily invest in UCaaS to better understand customer communications across all channels to attain the scalability required for large-scale implementation.

- UCaaS services help increase availability and scalability while enhancing collaboration. UCaaS solutions allow enterprises to focus on the growth of their business rather than their maintenance. Businesses need not pay for UC software with features that they will never use, thereby saving money. UCaaS services broadly incorporate interactive voice response (IVR), video conferencing, live chat, e-mails, unified messaging, VoIP services, and other client management capabilities.

- Moreover, BFSI companies require extensive collaboration across a range of departments. For this, wealth and finance managers need to speak to analysts while customer support staff collaborate across time zones. This effective collaboration requires software solutions that eliminate friction.

- For instance, UCaaS allows diverse teams to coordinate and collaborate seamlessly. However, UCaaS operates in the cloud, and team members can access information on any device at any location. Call center supervisors can monitor progress on a smartphone in real-time. Financial research analysts can analyze data without ever being in the same room. UCaaS helps financial services companies get the most out of their human capital.

- Enterprises are searching for ways that cut down on expenses and have the potential to generate internal revenues. Making essential files and data accessible through the cloud was a feasible solution, which led to the proliferation of the BYOD (Bring Your Own Device) trend. Banks and financial institutions are quickly following suit, and given the globalized nature of their business, remote access to data becomes an essential feature for this industry.

North America is Expected to Register the Fastest Growth

- The country's supremacy may be ascribed to the recent surge in mobility and explosion of 5G connection due to the consumerization of IT, which has aided enterprises in adopting IP telephony and UCaaS to allow remote employees to simulate in-office work experiences.

- In the US, end-users such as retail, banking and finance, healthcare, information technology, and telecommunications seek a more direct and seamless experience for all oftheir communications-audio, video, and chat-no matter where they are. To fulfill this need, enterprises are looking for a unified deployment and management solution from a single vendor they can rely on to handle their UCC requirements. They'll be able to integrate remote connectivity tools on a single UCaaS platform with the advent of 5G.

- 5G will be advantageous to consumers, but it will also be beneficial and precious to enterprises that rely on Unified Communications. The internet's speed will alter as a result of 5G. The current average pace of 1GB per second will be increased to approximately 20GB per second. The VoIP industry will develop as bandwidth capacity and speed rise. The combination of 5G and VoIP will provide consumers with the equivalent of a fiber-optic broadband connection.

- This will ensure that VoIP can be used on a massive scale. Companies with worldwide operations will benefit from VoIP combined with 5G since communication costs would be reduced.

- As a result of the rise of 5G and edge networking, vendors could expect exciting changes in the real-time communication market. UCaaS provides a place for endless creative services and a collection of managed services tools that may help suppliers maximize revenue generation in the near years due to improved security, simpler provisioning, and a set of managed services tools.

- The United States is one of the foremost innovators and investors in the 5G market due to increasing investment for 5G deployment. The telecom industry in the country accounts for a significant portion of the global consumption of 5G technology.

IP Telephony & Ucaas Industry Overview

The IP Telephony & Ucaas market is highly competitive. The market has gained a competitive edge in recent years. Additionally, the players are being taken to gain a competitive edge in this fast-growing market.

- February 2022- Vodafone and Ring Central jointly launch Vodafone Business UC with Ring Central, a unified cloud communications platform, in the UK. In Initial, Vodafone Business and Ring Central has introduced new services to customers in the United Kingdom and Vodafone Business' multinational customers in Europe in 2021. More countries will follow, including Spain, Germany, and Italy, with the platform tailored to local delivery in each.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholders Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of pay-as-you-go model Driving Demand Over Lagacy UC Solution

- 5.1.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of enterprise Collaboration

- 5.2 Market Challenges

- 5.2.1 Low Readiness to Move to Modern Unified Communication

- 5.2.2 Poor Voice Quality in IP Telephony Systems

6 MARKET SEGMENTATION

- 6.1 By Size of Enterprise

- 6.1.1 Small and Medium Enterprises (Up to 500 Employees)

- 6.1.2 Large Enterprises (More than 500 Employees)

- 6.2 By Application

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Healthcare

- 6.2.4 Government and Public Sector

- 6.2.5 IT and Telecom

- 6.2.6 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vodafone

- 7.1.2 Telia Company

- 7.1.3 Telefonica

- 7.1.4 KPN

- 7.1.5 BT

- 7.1.6 Orange Business Solutions

- 7.1.7 Verizon Communications Inc.

- 7.1.8 8X8 Inc.

- 7.1.9 Mitel Networks Corporation

- 7.1.10 Gamma Telecom

- 7.1.11 Nextiva

- 7.1.12 Soluno

- 7.1.13 Cisco Systems

- 7.1.14 VADS Berhad

- 7.1.15 Singapore Telecommunications Limited

- 7.1.16 PLDT Enterprise

- 7.1.17 NTT Communication Corporation

- 7.1.18 Telstra Corporation Limited

- 7.1.19 PCCW Global

- 7.1.20 Maxis Communications