|

市场调查报告书

商品编码

1431091

全球电动货运自行车市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)E-cargo Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

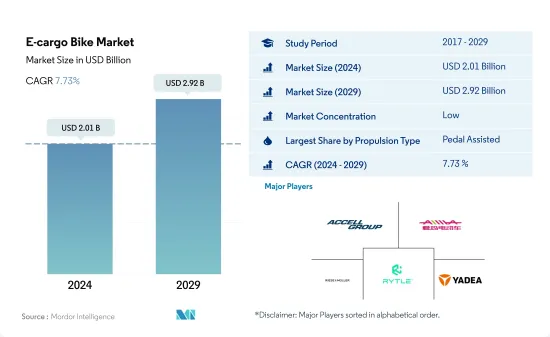

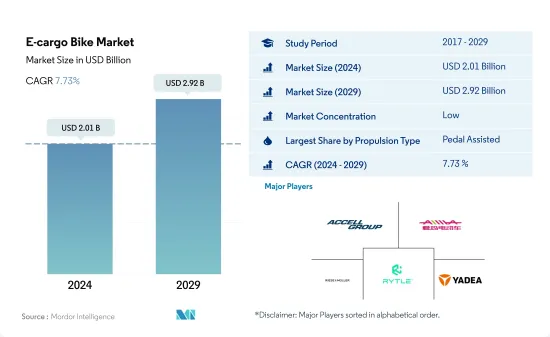

全球电动货运自行车市场规模预计到 2024 年为 20.1 亿美元,2029 年达到 29.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.75%。

- 截至年终,电动货运自行车销量占全球货运自行车市场的66.2%。 2017年至2022年,电动货运自行车销量复合年增长率为6.7%,其中德国、英国、法国和美国等新兴市场占据了全球市场的很大一部分。随着城市与交通拥堵造成的噪音和空气污染作斗争,电动货运自行车和物流领域的自行车正在提供一种便捷且永续来进行第一英里和最后一英里的交付,提供一般物流服务,并为城市居民提供运输服务。家庭。它正在成为一种全面的、无交通堵塞的替代方案。到 2022 年,电子货运/公用事业市场规模将达到 18 亿美元。

- 北美是全球成长最快的电子商务市场,由于其脆弱的地理位置和广阔的城市景观,与其他地区相比面临特殊的物流挑战。预计2022年墨西哥电子商务市场规模将达379.9亿美元。然而,墨西哥运输和物流公司 Estafeta 等公司在 2017 年底实施了“绿色配送”,在某些城市部署电动自行车进行最后一英里配送。由于这些措施,电动货运自行车的使用预计近年来将会增加。

- 线上订单的增加正在推动最后一哩配送业务的成长。各国政府应欢迎创新和变革,以减少未来的依赖并提高永续。由于中国、印度、日本等亚洲国家人口密度非常高,电动货运自行车可望成为未来最实用、最环保的选择。

- 2022 年,全球电动自行车市场产值为 144.048 亿美元,预计到 2029 年将达到 259.56 亿美元。预计该市场在预测期内将以 10.3% 的复合年增长率增长,这主要是由于电动自行车作为全球日常交通方式的日益普及。由于电动自行车具有健康益处、经济的交通选择和骑乘便利等有益特性,其市场销售量正在迅速成长。

- 2022年亚太地区电动自行车市场销量约1,620万辆。过去一段时间,中国、日本和印尼在总销量中占有很大份额。 2022年,中国将占全球电动自行车市场90%以上的销售份额。然而,此后成长停滞,市场几乎饱和状态。

- 在欧洲,电动自行车的销售近年来迅速成长,其中德国、比利时和荷兰等国家占据了主要销售量。这是因为人们越来越偏好使用电动自行车进行交通、运动和休閒。此外,瑞典、比利时和法国针对电动自行车制定了补贴和税收激励计划,预计将进一步支持欧洲电动自行车市场在预测期内的显着成长。

- 在北美,近年来人们对低速两轮车的偏好增加,电动自行车市场也随之兴起。随着各种自行车共享营运商越来越多地引入电动自行车作为其车队扩张的一部分,预计电动自行车销量在不久的将来将会增加。

全球电动货运自行车市场趋势

对无碳汽车的认识

- 近年来,许多国家对电动自行车的需求不断增加。汽油价格上涨、尖峰时段交通拥堵以及运动对健康的好处正在推动电动自行车在包括英国和美国在内的多个国家的使用。欧洲是电动机车销售的主要市场,与其他地区相比,2019年的普及较高。与 2018 年相比,电动自行车需求的增加加快了 2019 年的采用率。

- COVID-19 在全球的快速传播对自行车产业产生了积极影响。与其他交通途径相比,电动自行车是日常通勤和前往当地其他地点最实用、最实惠的解决方案之一,彻底改变了消费者的通勤方式。这鼓励了人们投资电动自行车,2020 年全球普及率比 2019 年更快。

- 随着商业营运的恢復以及停工等贸易限制的解除,电动自行车在世界各国的普及速度也加快。进出口活动的改善是全球贸易壁垒取消的结果。据估计和预测,在预测期内,电动自行车因其骑行锻炼、低燃油成本、清洁骑行舒适等特点和优势将获得越来越多的消费者兴趣,并将在世界许多地区使用. 预计以下国家的普及将会提高。

自行车的优势以及扩大其在最后一英里物流的使用

- 电动自行车在世界各地越来越受欢迎。由于网路购物的增加,过去五年来污染和交通拥堵显着增加。针对这种情况,线上零售商正在选择更快、更环保的电动自行车配送。全球整体,亚太地区的数量最多,其次是北美。与 2018 年相比,这些因素导致 2019 年全球本地配送中电动自行车的使用增加。

- 着眼于扩大电动自行车市场,政府以回扣和补贴形式采取的措施也支持了全球电动自行车市场。例如,在北美,政府提供价值 1,000 美元的激励措施,鼓励人们选择电动自行车。这些因素正在推动电动自行车的需求,2021年北美国家的电动自行车出货较2020年成长19.70%。类似因素导致 2021 年全球电动自行车交付量较 2020 年增加。

- 由于电动机车自行车业务在全球范围内爆炸性增长。由于电动自行车具有时间效率、燃油效率、环境友善性和降低维护成本等优点,各公司正在投资用于本地送货的电动自行车。由于上述因素,预计在预测期内,电动自行车在最后一哩本地配送的使用量将会增加。

电动货运自行车产业概况

电动货运自行车市场较为分散,前五大企业占37.86%。该市场的主要企业包括 Accell Group NV、Aima Technology Group、Riese &Muller、RYTLE GmbH 和 Yadea Group Holdings Ltd。 (按字母顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章执行摘要和主要发现

第二章 报告规定

第三章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 产业主要趋势

- 自行车销量

- 人均国内生产毛额

- 通货膨胀率

- 电动自行车普及

- 每天出游 5 至 15 公里的人口/通勤者百分比

- 自行车租赁

- 电动自行车电池价格

- 以电池化学成分列出的价格表

- 超本地配送

- 专用道

- 电池充电容量

- 交通拥堵指数

- 法律规范

- 价值炼和通路分析

第五章市场区隔(包括市场规模、2029年预测、成长前景分析)

- 推进类型

- 踏板辅助

- 高速智慧电动车

- 油门辅助

- 电池类型

- 铅蓄电池

- 锂离子电池

- 其他的

- 地区

- 非洲

- 按国家/地区

- 南非

- 其他非洲

- 亚太地区

- 按国家/地区

- 澳洲

- 中国

- 印度

- 日本

- 纽西兰

- 韩国

- 其他亚太地区

- 欧洲

- 按国家/地区

- 奥地利

- 比利时

- 丹麦

- 法国

- 德国

- 义大利

- 卢森堡

- 荷兰

- 挪威

- 波兰

- 西班牙

- 瑞典

- 瑞士

- 英国

- 其他欧洲国家

- 中东

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 按国家/地区

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 按国家/地区

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章 竞争形势

- 主要策略趋势

- 市场占有率分析

- 公司形势

- 公司简介

- Accell Group NV

- Aima Technology Group Co. Ltd

- Bakfiets.nl

- DOUZE Factory SAS

- Jiangsu Xinri E-Vehicle Co. Ltd

- Jinhua Jobo Technology Co.

- Pedego Electric Bikes

- Rad Power Bikes

- Riese & Muller

- RYTLE GmbH

- Smart Urban Mobility BV

- Tern Bicycles

- The Cargo Bike Company

- Xtracycle Inc.

- XYZ CARGO

- Yadea Group Holdings Ltd

- YUBA BICYCLES LLC

第七章 CEO 面临的关键策略问题

第8章附录

简介目录

Product Code: 93673

The E-cargo Bike Market size is estimated at USD 2.01 billion in 2024, and is expected to reach USD 2.92 billion by 2029, growing at a CAGR of 7.75% during the forecast period (2024-2029).

- By the end of 2021, electric cargo bike sales were 66.2% of the worldwide cargo bike market. Electric cargo bike sales recorded a CAGR of 6.7% between 2017 and 2022, with developed nations like Germany, the United Kingdom, France, and the United States accounting for a sizable percentage of the worldwide market. As cities struggle with traffic congestion that causes noise and air pollution, the electric cargo bike and bicycle logistic sectors are emerging as a useful, sustainable, non-congested, and inclusive alternative for first- and last-mile deliveries, general logistical service provision, and family vehicles. The e-cargo/utility market reached a value of USD 1.8 billion in 2022.

- North America is the fastest-growing e-commerce market in the world and presents special logistics challenges compared to other regions due to its fraught geography and sprawling urban landscapes. The Mexican e-commerce market is expected to reach USD 37.99 billion by 2022. However, companies like Mexican transportation and logistics Estafeta implemented its "green deliveries" in late 2017, featuring e-bikes for last-mile deliveries in certain cities. Such steps are expected to increase the usage of the e-cargo bike in recent years.

- An increase in online orders is driving the growth of the last-mile delivery business. Governments should welcome technological innovation and change to reduce reliance and become more sustainable in the future. Because of the tremendously dense population in Asian countries such as China, India, and Japan, e-cargo bikes are expected to be the most practical and eco-friendly option in the future.

- The global e-bike market generated USD 14,404.8 million in 2022, and it is expected to reach USD 25,956.0 million by 2029. The market is projected to witness a CAGR of 10.3% during the forecast period, mainly due to the increasing adoption of e-bikes as a daily mode of transportation globally. The market has witnessed an upsurge in the unit sales of e-bikes due to their beneficial characteristics, such as health benefits, economic mobility options, and convenience in riding.

- The unit sale in the APAC e-bike market was around 16.2 million in 2022. China, Japan, and Indonesia accounted for a major share of the overall unit sales during the historical period. China held over 90% volume share in the global e-bike market in 2022. However, it has witnessed stagnant growth since, and the market is almost at a saturation point.

- In Europe, e-bike sales skyrocketed in recent years, with countries including Germany, Belgium, and the Netherlands selling major units of e-bikes. This is due to the growing preference for using e-bikes for transportation, sports, and leisure activities. Additionally, the subsidies and tax incentives programs on e-bikes in Sweden, Belgium, and France are anticipated to further support the significant growth of the European e-bike market during the forecast period.

- In North America, the e-bike market is emerging as the preference for using low-speed two-wheelers has grown in recent years. The increased inclusion of more e-bikes by various bike-sharing operators as part of their fleet expansion is expected to support the sales growth of these bikes in the near future.

Global E-cargo Bike Market Trends

Awareness Regarding Carbon Free Vehicles

- There has been an increase in demand for electric bicycles in many countries over the past several years. Increased gasoline costs, traffic congestion during rush hours, and the health advantages of exercise are driving the usage of e-bikes in several countries, including the United Kingdom and the United States. With a greater adoption rate in 2019 compared to other regions, Europe is the primary market for the selling of electric bikes. The increasing demand for e-bikes accelerated the adoption rate in 2019 compared to 2018.

- The bicycle industry was favorably impacted by the rapid global expansion of the covid cases and wave. E-bikes are one of the most practical and affordable solutions for everyday commutes to work and other local locations compared to other means of transportation, which has revolutionized how consumers commute. This has encouraged people to invest in e-bikes, which accelerated the adoption rate in 2020 over 2019 in various countries across the globe.

- The return of commercial operations and the lifting of trade restrictions like lockout have accelerated the adoption of e-bikes in numerous countries throughout the world. The improvement of import and export activity has been a result of the removal of trade obstacles globally. According to estimates, during the forecast period, the adoption rate of e-bikes will increase in a number of countries around the world due to consumers' growing interest in them as a result of their features and advantages, such as the ability to exercise while riding, the lack of a fuel cost, and cleaner rides.

Advantages of Bicycles and their Increasing Usage in Last Mile Logistics

- E-bikes are becoming increasingly popular in several countries across the world. Due to the increased online shopping, pollution and traffic congestion have increased significantly over the past five years. Due to these circumstances, online merchants are choosing the quicker and greener option of e-bike deliveries. Globally, APAC recorded the highest number of e-bike deliveries, followed by North America. These factors account for the global increase in the use of e-bikes for local deliveries in 2019 over 2018.

- Focusing on e-bike market expansion, the government's efforts in the form of rebates and subsidies are also supporting the global e-bike market. For instance, in North America, the government provides incentives worth USD 1000, encouraging people to choose e-bikes. These factors are driving the demand for e-bikes, which has led to a 19.70% growth in e-bike deliveries in North American countries in 2021 over 2020. Similar factors drove global growth in e-bike delivery units in 2021 over 2020.

- The e-bike business is exploding in many nations across the world due to the cost advantages of electric bikes over other fuel-powered vehicles. Businesses are investing in e-bikes for local deliveries because of advantages like time efficiency, fuel efficiency, environmental friendliness, and lower maintenance costs. The use of e-bikes for last-mile local deliveries is anticipated to rise during the forecast period due to the aforementioned factors.

E-cargo Bike Industry Overview

The E-cargo Bike Market is fragmented, with the top five companies occupying 37.86%. The major players in this market are Accell Group NV, Aima Technology Group Co. Ltd, Riese & Muller, RYTLE GmbH and Yadea Group Holdings Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-Bikes

- 4.5 Percent Population/Commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-Bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-Local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Battery Charging Capacity

- 4.12 Traffic Congestion Index

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Battery Type

- 5.2.1 Lead Acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Others

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest-of-Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Japan

- 5.3.2.1.5 New Zealand

- 5.3.2.1.6 South Korea

- 5.3.2.1.7 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 Austria

- 5.3.3.1.2 Belgium

- 5.3.3.1.3 Denmark

- 5.3.3.1.4 France

- 5.3.3.1.5 Germany

- 5.3.3.1.6 Italy

- 5.3.3.1.7 Luxembourg

- 5.3.3.1.8 Netherlands

- 5.3.3.1.9 Norway

- 5.3.3.1.10 Poland

- 5.3.3.1.11 Spain

- 5.3.3.1.12 Sweden

- 5.3.3.1.13 Switzerland

- 5.3.3.1.14 UK

- 5.3.3.1.15 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Saudi Arabia

- 5.3.4.1.2 United Arab Emirates

- 5.3.4.1.3 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 US

- 5.3.5.1.4 Rest-of-North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accell Group NV

- 6.4.2 Aima Technology Group Co. Ltd

- 6.4.3 Bakfiets.nl

- 6.4.4 DOUZE Factory SAS

- 6.4.5 Jiangsu Xinri E-Vehicle Co. Ltd

- 6.4.6 Jinhua Jobo Technology Co.

- 6.4.7 Pedego Electric Bikes

- 6.4.8 Rad Power Bikes

- 6.4.9 Riese & Muller

- 6.4.10 RYTLE GmbH

- 6.4.11 Smart Urban Mobility B.V

- 6.4.12 Tern Bicycles

- 6.4.13 The Cargo Bike Company

- 6.4.14 Xtracycle Inc.

- 6.4.15 XYZ CARGO

- 6.4.16 Yadea Group Holdings Ltd

- 6.4.17 YUBA BICYCLES LLC

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219