|

市场调查报告书

商品编码

1431243

建筑幕墙垫片:市场占有率分析、产业趋势、成长预测(2024-2029)Facade Gasket - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

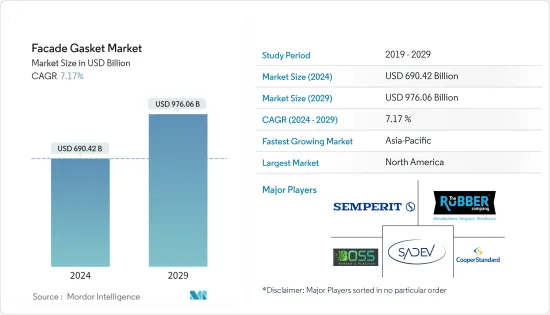

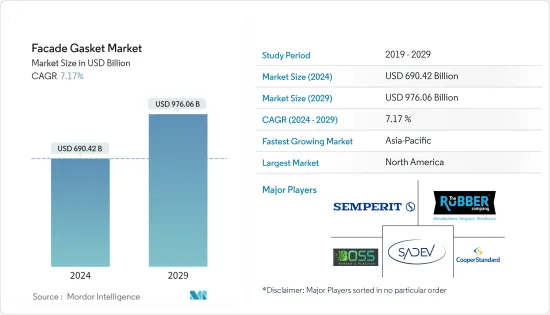

建筑幕墙垫片市场规模预计到2024年为6,904.2亿美元,预计到2029年将达到9,760.6亿美元,在预测期内(2024-2029年)复合年增长率为7.17%。

主要亮点

- COVID-19 对建设产业产生了重大影响,限制措施导致计划延误,建筑工作因劳动力短缺而停止。随后,监管放鬆后,该行业復苏,主要是由于住宅和商业领域计划的增加。这种成长进一步推动了建筑幕墙垫片製造的需求。

- 此外,为了实现永续性目标,大多数开发商都选择太阳能建筑幕墙作为其建筑外墙。例如,2022年8月,澳洲Kenon公司在墨尔本规划了一个名为「550 Spencer」的新计划。这座八层办公大楼采用由 1,182 块太阳能板组成的最先进的太阳能建筑幕墙,可产生超出其需求的电力。因此,随着计划数量的增加,需要大量的垫片产品来保持建筑幕墙指定并稳定,以承受高压和极端气候。

- 此外,建筑幕墙垫片不仅广泛应用于现代建筑中,而且还广泛应用于旧建筑的修復。此外,大多数国家的结构老化,建筑幕墙密封件和垫圈也过时。这些旧的密封件和垫片可以替换为由更高效的材料製成的新产品,这些新产品可以承受当今高层建筑的恶劣天气条件。三元乙丙橡胶、硅胶、橡胶和热可塑性橡胶是世界各地用于垫片製造的主要材料。

建筑幕墙垫片市场趋势

亚太地区成长显着

亚太地区住宅和商业领域的建筑计划正在显着成长。这种成长进一步鼓励了该地区建筑幕墙的安装,建筑幕墙墙主要用于解决能源效率、美观和温度控制因素。因此,建筑幕墙安装的增加进一步增强了对建筑幕墙垫圈和密封件的需求,以支持建筑幕墙承受各种因素和气候的能力。

此外,由于住宅和商业领域的开发活动不断增加,建筑幕墙装置在该地区的新兴国家中越来越受欢迎。例如,2022年9月,丹麦工作室Schmidt Hammer Lassen Architects设计了一个具有玻璃建筑幕墙的上海图书馆东馆。图书馆占地115,000平方公尺,共有七层。此外,2022 年 2 月,Innovators 建筑幕墙 Systems订单了在印度设计、供应、製造和建造建筑幕墙的订单。

同时,亚太地区的办公空间建设呈现良好成长动能。儘管存在在家工作的文化,但办公室计划仍在不断增加,且没有中断。印度、韩国、日本、澳洲等办公大楼计划数量不少。例如,在韩国,西面办公大楼开发计划于2022年第二季启动,计划投资超过7.1亿美元。同样在澳大利亚,滑铁卢地铁区开发案和 360 Queen Street 办公大楼计划也已启动。此外,到2022年,海得拉巴、班加罗尔、深圳和上海等城市预计将引领该地区的甲级办公室供应。因此,该地区建设活动的扩展为建筑幕墙垫片製造商提供了机会。

商业部门的成长推动市场

大多数国家都致力于发展节能商业建筑和办公空间。此外,建筑商也致力于让建筑物看起来更好、包裹外墙并消耗更少的能源。这些因素推动了建筑幕墙垫片的使用。此外,维修老化办公大楼的支出增加将推动世界各地对建筑幕墙安装的需求。

此外,北美的商业计划正在显着增加,其中最着名的办公大楼开发项目,从高层建筑到广阔的校园,预计将于 2022 年竣工。此外,据行业专家称,超过 20 个最大的办公计划正计划进行重建。同时,2022年第二季度,多个大型办公室计划在美国和加拿大启动。例如,八办公大楼计划将于 2022 年第二季破土动工,总预算为 4.7 亿美元,将包括劳伦斯街 1900 号办公大楼、北港综合用途开发专案、埃尔塞贡多总部大楼和培训设施。其他人也紧跟在后。

同时,欧洲也涌现大量商业计划。根据业内专家预测,2022年将有超过570万平方公尺的办公室计划竣工,另外510万平方公尺的办公项目计划在2023年开发。此外,美国驻义大利米兰总领事馆综合计划于2022年第二季开工,总预算达3.5亿美元。然而,2022年第一季,跨国房地产交易有所增加。欧洲、中东和非洲地区(包括欧洲、中东和非洲)的跨国交易额最高,达 364 亿美元。因此,全球不断成长的商业部门可能为建筑幕墙垫片製造商提供巨大的机会。

建筑幕墙垫片产业概况

本报告重点介绍了在建筑幕墙垫片市场运营的主要企业。该市场竞争激烈且分散,没有一家公司占据较大份额。为了保持竞争力,我们不断努力增强我们的产品供应。市场上的主要企业包括 Sadev、The Rubber Company、Boss Polymer P/L、Semperit AG Holding 和 Cooper Standard。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 当前市场概况

- 市场动态

- 市场驱动因素

- 市场限制因素

- 市场机会

- 建筑幕墙垫片产业供应链/价值链分析见解

- 洞察政府对市场的监管

- 市场技术进步的见解

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场区隔

- 按用途

- 住宅

- 商业的

- 其他用途

- 按类型

- E垫片

- 楔形垫片

- 气泡垫片

- 其他类型

- 按材质

- 硅胶

- 橡皮

- 其他材料

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 北美洲

第六章 竞争形势

- 公司简介

- SADEV

- THE RUBBER COMPANY

- Boss Polymer P/L.

- Semperit AG Holding

- Conta Flexible Products

- Silicone Engineering Ltd.

- Cooper Standard

- Vip Rubber and Plastic Company

- LOPO International Limited

- Polecex SL*

第七章 市场展望

第8章附录

The Facade Gasket Market size is estimated at USD 690.42 billion in 2024, and is expected to reach USD 976.06 billion by 2029, growing at a CAGR of 7.17% during the forecast period (2024-2029).

Key Highlights

- COVID-19 created a huge impact on the construction industry, and the restrictions resulted in project delays and construction work being halted due to a scarcity of labor. Later, after easing restrictions, the industry recovered, largely driven by increasing projects in the residential and commercial sectors. This growth further fuels the demand for facade gasket manufacturing.

- Also, facade installations are becoming more popular around the world because of how nice they look and how well they save energy.In addition, to meet the sustainability goals, most of the developers are choosing solar facades on the building's outer envelope. For instance, in August 2022, Australian firm Kennon planned a new project in Melbourne called 550 Spencer, the eight-story office building will produce more electricity than it requires using a cutting-edge solar facade made up of 1,182 solar panels. Thus, the increasing number of projects requires a huge amount of gasket products to install facades in place and make them stable to withstand high pressures and extreme climates.

- Furthermore, facade gaskets are heavily used in modern construction as well as the restoration of old buildings. In addition, most of the countries have aging structures that were fitted with older-style facade seals and gaskets. These older seals and gaskets can be replaced by new products made of more efficient materials that can withstand today's extreme weather conditions in high-rise buildings. Ethylene propylene diene monomer, silicone, rubber, thermoplastic elastomer, etc. are some of the major materials utilized in gasket manufacturing across the globe.

Facade Gasket Market Trends

Asia Pacific is Witnessing Significant Growth

Asia Pacific is witnessing significant growth in construction projects across residential and commercial sectors. This growth further fuels the facade installations in the region, and facade envelopes are primarily adopted to cater to growing energy efficiency, external beautification, and temperature control factors. Thus, the growing facade installations further bolster the demand for facade gaskets and seals, which support the facades ability to withstand various elements and climates.

Moreover, facade installations are gaining traction across developing countries in the region due to increasing development activities across the residential and commercial sectors. For instance, in September 2022, Danish studio Schmidt Hammer Lassen Architects designed Shanghai Library East with glass facades. The library is spread across 115,000 square meters and is 7 stories high. In addition, in February 2022, Innovators Facade Systems was awarded a contract to design, supply, fabricate, and install facade work in India.

Meanwhile, office space construction is experiencing lucrative growth in Asia Pacific. Despite the work-from-home culture, office projects are increasing without disruption. India, Korea, Japan, Australia, etc. are witnessing a significant number of office projects. For instance, in Q2 2022, the Seomyeon Office Building Development project commenced in South Korea, and more than USD 710 million was invested in this project. Also in Australia, the Waterloo Metro Quarter Development and 360 Queen Street Office Tower projects have commenced. Moreover, in 2022, Hyderabad, Bengaluru, Shenzhen, Shanghai, etc., will be leading in Grade A office supply in the region. Thus, the growing construction activities in the region are creating opportunities for facade gasket manufacturers.

Growing Commercial Sector is Driving the Market

Most countries are focusing on developing commercial buildings and office spaces that are energy efficient. In addition, builders are focusing on making buildings look better, wrapping the outside walls, and making them use less energy. These factors are driving the utilization of facade gaskets. Also, the increased spending on the renovation of aging office buildings would increase demand for facade installations across the globe.

Moreover, North America is experiencing a significant number of commercial projects, and from supertall skyscrapers to sprawling campuses, the most prominent office developments will be completed in 2022. In addition, as per industry experts, more than 20 of the largest office projects are planned for redevelopment. Meanwhile, in Q2 2022, some of the major office projects commenced across the United States and Canada. For example, The Eight Office Tower project construction began in Q2 2022 with a total budget of USD 470 million.Followed by the 1900 Lawrence Street Office Tower, the North Harbour Mixed-Use Development, El Segundo Headquarters, the Training Facility, etc.

On the other hand, Europe also experienced a huge number of commercial projects. In 2022, as per industry experts, more than 5.7 million square meters of office projects were completed, and a further 5.1 million square meters of development is planned for 2023. In addition, in Q2 2022, construction on the Milan US Consulate General Complex project was started in Italy, with an overall budget of USD 350 million. However, in Q1 2022, cross-border real estate transactions increased. In addition, the EMEA region, consisting of Europe, the Middle East, and Africa, received the largest volume of cross-border transactions, amounting to USD 36.4 billion. Thus, the growing commercial sector across the globe will create a huge opportunity for facade gasket manufacturers.

Facade Gasket Industry Overview

The report covers prominent players operating in the facade gasket market. The market is highly competitive and fragmented, with no players occupying a significant share. To remain competitive, the major players are constantly working to enhance their product offerings to meet the changing needs of the facade gasket market. Some of the major players in the market include Sadev, The Rubber Company, Boss Polymer P/L, Semperit AG Holding, Cooper Standard, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.2.3 Market Opportunities

- 4.3 Insights into Supply Chain/Value Chain Analysis of the Facade Gasket Industry

- 4.4 Insights on Government Regulations in the Market

- 4.5 Insights on Technological Advancements in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Other Applications

- 5.2 By Type

- 5.2.1 E Gaskets

- 5.2.2 Wedge Gaskets

- 5.2.3 Bubble Gaskets

- 5.2.4 Other Types

- 5.3 By Material

- 5.3.1 Silicone

- 5.3.2 Rubber

- 5.3.3 Other Materials

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 United Arab Emirates

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of Middle East & Africa

- 5.4.5 Latin America

- 5.4.5.1 Mexico

- 5.4.5.2 Brazil

- 5.4.5.3 Argentina

- 5.4.5.4 Rest of Latin America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 SADEV

- 6.2.2 THE RUBBER COMPANY

- 6.2.3 Boss Polymer P/L.

- 6.2.4 Semperit AG Holding

- 6.2.5 Conta Flexible Products

- 6.2.6 Silicone Engineering Ltd.

- 6.2.7 Cooper Standard

- 6.2.8 Vip Rubber and Plastic Company

- 6.2.9 LOPO International Limited

- 6.2.10 Polecex S.L.*