|

市场调查报告书

商品编码

1431258

有机肥料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Organic Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

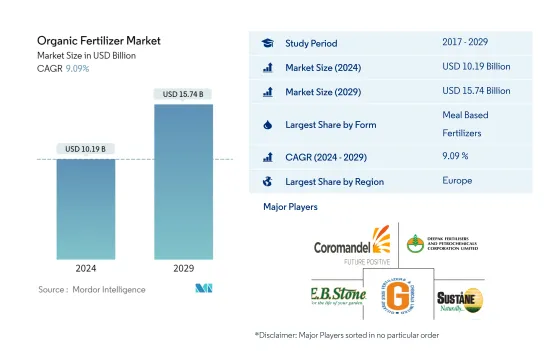

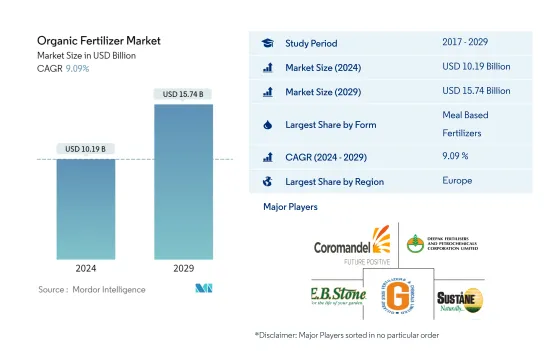

预计2024年有机肥料市场规模为101.9亿美元,预计2029年将达到157.4亿美元,预测期内(2024-2029年)复合年增长率为9.09%,预计还会成长。

主要亮点

- 粉基肥料是最大的型态:骨粉主要用于满足作物种植对磷的需求,而血粉主要用于补充作物的氮素。

- 堆肥是一种快速成长的型态:到2022年,堆肥占有机肥料份额的42.5%。堆肥的养分含量有限,需要大量施用才能满足作物的养分需求。

- 田间作物是最大的作物类型:连作作物在世界各地和各个地区都有很大的种植面积。连续作物最常用的有机肥料是粉基肥料。

- 欧洲是最大的地区:欧洲作物作物种植面积逐年增加,成长33.4%,到2022年将达到592,100公顷。

有机肥料市场趋势

餐基肥是最大的型态

- 近年来,由于人们越来越担心传统化肥对环境的影响,有机肥料受到农民和生产者的欢迎。 2022年,餐肥占有机肥领域的比重为43.2%。肥料是第二受欢迎的有机肥料,占42.5%。

- 骨粉主要用于补充作物所需的磷,血粉主要用于补充氮。肥料广泛用于所有类型的作物,包括常规作物和有机作物,以改善土壤的理化性质并支持作物在各个阶段的生长。

- 另一方面,由于矿化速度慢、营养成分高,油饼的使用受到限制,如果过量施用,可能会损害植物。但油饼的作用比化肥慢,需要时间释放养分,所以建议施用于园艺作物。

- 其他有机肥料子区隔包括鱼粪、蝙蝠粪、鱼乳、蚯蚓粪、糖蜜和其他堆肥,到2022年占有机肥细分市场的13.5%。儘管这些肥料不太常用,但利用其效益的采用和研究正在增加,而且政府推广有机农业的努力可能会推动未来几年的需求。很可能会。

- 随着农民和生产者寻求永续和环境友善的作物生产解决方案,有机肥料的使用正在增长。在预测期内,粉基肥料和堆肥的普及以及其他有机肥料子区隔的潜力可能会推动有机肥料细分市场的发展。

欧洲是最大的地区

- 随着农民努力减少对化学肥料的依赖,有机肥料在全世界的传统农业和有机农业中越来越受欢迎。欧洲和亚太地区是有机肥料的主要消费者,预计从2017年到2022年,欧洲的市场占有率以金额为准将显着增加,而亚太地区预计在预测期内有机肥料市场将显着增长。一直是。

- 欧洲有机肥料工业联盟(ECOFI)致力于在欧洲推广有机肥料的使用。该地区的农民正在转向有机替代品,促进了有机肥料市场的成长。在亚太地区,中国和印度已成为有机作物生产的领导者,而有机农业仅占农业总面积的一小部分。然而,该地区的有机农业面积正在扩大,这一趋势预计将推动有机肥市场的成长。

- 在北美,美国在有机肥料市场上占据主导地位,2022年金额份额将达到40.7%。美国农业部(USDA)实施的有机转型倡议在促进该国有机农业扩张方面发挥重要作用。预计2022年,有机种植面积将占作物种植总面积的39.6%。

- 全球有机作物种植面积的增加以及政府为促进有机农业和永续农业实践而采取的各种措施正在推动全球对有机农产品的需求。消费者对化学肥料有害影响的认识也促进了全球对有机肥料的需求不断增长。

有机肥料产业概况

有机肥市场较为分散,前五名企业占比为3.97%。市场的主要企业是(按字母顺序排列):Coromandel International Ltd.、Deepak Fertilizers & Petrochemicals Corp. Ltd.、EB Stone &Sons Inc.、Gujarat State Fertilizers & Chemicals Ltd.、Sustane Natural Fertilizer Inc.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 检举要约

第三章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 产业主要趋势

- 有机种植面积

- 人均有机产品支出

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 型态

- 肥料

- 餐基肥

- 油饼

- 其他有机肥料

- 作物类型

- 经济作物

- 园艺作物

- 田间作物

- 地区

- 非洲

- 按国家/地区

- 埃及

- 奈及利亚

- 南非

- 其他非洲

- 亚太地区

- 按国家/地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 按国家/地区

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 土耳其

- 英国

- 其他欧洲国家

- 中东

- 按国家/地区

- 伊朗

- 沙乌地阿拉伯

- 其他中东地区

- 北美洲

- 按国家/地区

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 按国家/地区

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章 竞争形势

- 主要策略趋势

- 市场占有率分析

- 公司形势

- 公司简介

- Agribios Italiana SRL

- BioFert Manufacturing Inc.

- Biolchim SPA

- California Organic Fertilizers Inc.

- Cascade Agronomics LLC

- Coromandel International Ltd

- Deepak Fertilisers & Petrochemicals Corp. Ltd

- EB Stone & Sons Inc.

- Fertikal NV

- Gujarat State Fertilizers & Chemicals Ltd

- HELLO NATURE ITALIA SRL

- Indogulf BioAg LLC(Biotech Division of Indogulf Company)

- Sustane Natural Fertilizer Inc.

- The Espoma Company

第七章 CEO 面临的关键策略问题

第8章附录

- 世界概况

- 概述

- 五力分析框架

- 世界价值链分析

- 市场动态(DRO)

- 资讯来源和参考文献

- 图表列表

- 重要见解

- 资料包

- 词彙表

The Organic Fertilizer Market size is estimated at USD 10.19 billion in 2024, and is expected to reach USD 15.74 billion by 2029, growing at a CAGR of 9.09% during the forecast period (2024-2029).

Key Highlights

- Meal Based Fertilizers is the Largest Form : Bone meal is predominantly utilized to address the crop cultivation requirement for phosphorous, while blood meal is deployed primarily for supplementing nitrogen in crops.

- Manure is the Fastest-growing Form : Manures accounted for a 42.5% share of organic fertilizers in 2022. Manures have limited nutrient content and require a substantial application to meet crop nutrient needs.

- Row Crops is the Largest Crop Type : Row crops have large areas under cultivation in the world and across different regions. Meal-based fertilizers are the most applied organic fertilizers in the row crops.

- Europe is the Largest Region : In Europe, the area under cultivation of organic crops is increasing year on year, which has increased by 33.4% and reached 592.1 thousand hectares of land in 2022.

Organic Fertilizer Market Trends

Meal Based Fertilizers is the largest Form

- In recent years, organic fertilizers have gained popularity among farmers and growers due to growing concerns about the environmental impact of traditional chemical fertilizers. In 2022, the organic fertilizer segment was dominated by meal-based fertilizers, which accounted for a 43.2% share. Manures were the second most popular organic fertilizer, accounting for 42.5% in the same year.

- Bone meal is primarily used to address the phosphorus requirements of crops, while blood meal is used to supplement nitrogen. Manures are widely used in all types of crops, both in conventional and organic farming, to improve the physio-chemical properties of the soil and support crop growth at various stages.

- On the other hand, oil cakes have limited usage due to their slower rate of mineralization and elevated nutrient levels, which can damage plants if applied excessively. However, oil cake application is still recommended for horticultural crops, as it is slow in action and needs more time for nutrient release compared to chemical fertilizers.

- The other organic fertilizers sub-segment, which includes fish guano, bat guano, fish emulsion, vermicompost, molasses, and other composted fertilizers, accounted for 13.5% of the organic fertilizer segment in 2022. Although these fertilizers are less commonly used, increasing adoption and research to exploit their benefits and government initiatives to promote organic farming may drive their demand in the coming years.

- The adoption of organic fertilizers is growing as farmers and growers seek more sustainable and eco-friendly solutions for crop production. The popularity of meal-based fertilizers and manures and the potential for the other organic fertilizers sub-segment may drive the organic fertilizer segment during the forecast period.

Europe is the largest Region

- Organic fertilizers are becoming increasingly popular in both conventional and organic farming worldwide as farmers strive to reduce their dependence on chemical fertilizers. Europe and Asia-Pacific are the leading consumers of organic fertilizers, with Europe seeing a significant increase in its market share by value from 2017 to 2022, while the Asia-Pacific region is projected to experience substantial growth in the organic fertilizer market during the forecast period.

- The European Consortium of the Organic-based Fertilizer Industry (ECOFI) promotes the use of organic fertilizers in Europe. The region's farmers are shifting toward organic alternatives, contributing to the growth of the organic fertilizer market. In the Asia-Pacific region, China and India are emerging as leaders in organic crop production, with organic farming accounting for a small portion of their total agricultural area. However, the organic farming area in the region is growing, and this trend is expected to drive growth in the organic fertilizer market.

- In North America, the United States dominates the organic fertilizer market, accounting for a 40.7% share by value in 2022. The Organic Transition Initiative implemented by the United States Department of Agriculture (USDA) is playing a significant role in promoting the expansion of organic farming in the country. As a result, the organic cultivation area accounted for 39.6% of the total crop cultivation area in 2022.

- The increasing global organic crop area and various government initiatives to promote organic agriculture and sustainable agricultural practices are driving the demand for organic commodities worldwide. Consumer awareness about the harmful effects of chemical fertilizers also contributes to the growing demand for organic fertilizers globally.

Organic Fertilizer Industry Overview

The Organic Fertilizer Market is fragmented, with the top five companies occupying 3.97%. The major players in this market are Coromandel International Ltd, Deepak Fertilisers & Petrochemicals Corp. Ltd, E B Stone & Sons Inc., Gujarat State Fertilizers & Chemicals Ltd and Sustane Natural Fertilizer Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Manure

- 5.1.2 Meal Based Fertilizers

- 5.1.3 Oilcakes

- 5.1.4 Other Organic Fertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Nigeria

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest Of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 Thailand

- 5.3.2.1.8 Vietnam

- 5.3.2.1.9 Rest Of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest Of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest Of Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest Of North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest Of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Agribios Italiana SRL

- 6.4.2 BioFert Manufacturing Inc.

- 6.4.3 Biolchim SPA

- 6.4.4 California Organic Fertilizers Inc.

- 6.4.5 Cascade Agronomics LLC

- 6.4.6 Coromandel International Ltd

- 6.4.7 Deepak Fertilisers & Petrochemicals Corp. Ltd

- 6.4.8 E B Stone & Sons Inc.

- 6.4.9 Fertikal NV

- 6.4.10 Gujarat State Fertilizers & Chemicals Ltd

- 6.4.11 HELLO NATURE ITALIA SRL

- 6.4.12 Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- 6.4.13 Sustane Natural Fertilizer Inc.

- 6.4.14 The Espoma Company

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms