|

市场调查报告书

商品编码

1431449

塑胶薄膜电容器的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Plastic Film Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

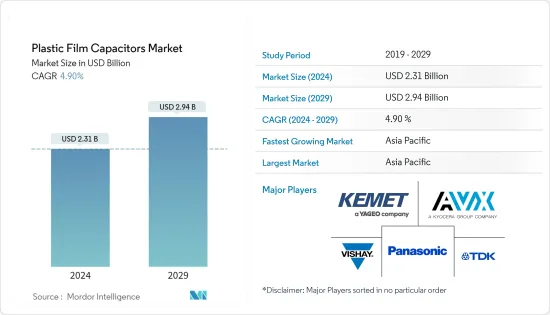

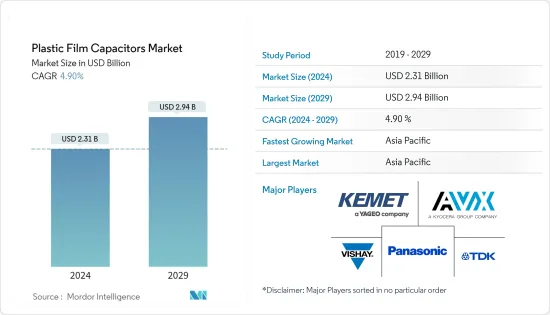

全球塑胶薄膜电容器市场规模预计到2024年为23.1亿美元,到2029年达到29.4亿美元,在预测期内(2024-2029年)复合年增长率为4.90%,预计将会成长。

塑胶薄膜电容器包括多个主要使用不同塑胶作为介电材料的电容器系列。它们在音讯和无线电电路以及低至中压电路等应用中很大程度上取代了纸质电容器。电容器中常用的塑胶包括聚碳酸酯、聚丙烯(PP)、聚酯(PET)、聚苯乙烯、聚砜、 聚亚酰胺膜聚酰亚胺、铁氟隆(PTFE含氟聚合物)和金属化聚酯(金属化塑胶)。

主要亮点

- 使用塑胶薄膜电容器的一大优点是失真度低且频率响应出色。此外,这些电容器使用的塑胶薄膜种类繁多,使其用途广泛。这些电容器不会很快磨损,因此适用于高电压、高频应用,例如耦合和去耦电路以及音讯电路中的 ADC。

- 随着各行业日益关注永续发电解决方案,对太阳能和风能逆变器的需求不断增加。为了解决这个问题,供应商正在推出新的塑胶薄膜电容器。例如,2021 年 5 月,New Yorker Electronics 宣布推出 CDE-Illinois 电容器(33 至 220 uF,高达 1,440 WVDC,-40 至 +85 C)。该产品专为直流母线、电暖器、马达驱动器、感应加热器、UPS 系统以及太阳能和风能逆变器等应用而设计。

- 此外,过去几年,穿戴式装置在医疗保健领域的采用越来越受到关注,使其成为影响研究市场的关键因素之一。穿戴式连接装置的主要趋势包括对疼痛管理穿戴式装置的需求增加以及穿戴式装置在心血管疾病管理的使用增加。

- 此外,2022 年 4 月,Electronicinx 宣布其全套专有金属有机分解 (MOD) 导电金属墨水解决方案现已投入生产规模。除了将独立的墨水产品推向市场外,Electronicinx 还提供墨水产品,包括独特的紧凑型桌面原型增材製造解决方案,用于按需印刷电路基板(PCB) 列印和维修,称为CircuitJet。我们透过以下方式为客户提供整体解决方案:我们的产品阵容。这些新兴市场的开拓也预计将推动研究市场。

- COVID-19 大流行对全球各行业的供应链造成了严重破坏。为了对抗病毒的传播,全球许多公司已暂停或减少业务。然而,在疫情后的情况下,电子元件市场导致整个供应链在原材料和元件生产层面的营运水准提高。这增加了各个地区和国家的销售额。

- 此外,电子元件是资源密集型的。大规模生产表面黏着技术电子元件所消耗的材料(通常以工程粉末或糊剂的形式提供)构成了与电容器等被动元件的生产相关的最大「可变成本」。

塑膜电容器市场趋势

家电预计将占据较大市场占有率

- 家电需求的激增正在提振市场。智慧型手机和平板电脑等设备需要能够提供高效能的小型天线。这些天线系统需要具有特定性能特征的电容器。电容器是天线系统中的重要元件。电容器在天线系统中最常见的用途包括频率调谐、电阻和滤波。这些应用中使用的电容器需要优异的性能特性,例如低漏电流、高品质因数和高线性度。

- 电容器技术取得了许多进步,生产的电容器能够满足智慧型手机天线系统严格的效能要求。例如,电容器製造商正在使用电子机械系统 (MEMS) 技术为智慧型手机天线系统製造超小型、薄型电容器。

- 根据消费者科技协会的数据,2012 年至 2021 年美国消费性电子市场的零售额持续成长。根据2023年零售额预测,美国消费性电子零售额预计将达4,850亿美元。

- 此外,电容器通常内建于相机的闪光灯模组中。相机闪光灯电容器采用低电阻和极低电感构造,可尽快将能量传输至闪光灯管,从而实现电流脉衝的快速上升时间。此外,内部连接更加坚固,以避免因高电流而产生局部热量。如果没有闪光灯电容器,数位相机中的电池将很快耗尽。

- 此外,智慧型手錶、头戴式显示器、佩戴式摄影机、耳挂型设备和健身追踪器等穿戴式电子产品的进步正在推动塑胶薄膜电容器的创新和采用。例如,电容器因其耐磨性而被广泛应用于穿戴式家用电器中,在10,000次充放电循环后,其能源性能会下降几个百分点。

亚太地区预计将占据主要市场占有率

- 亚太地区是电容器最重要的市场之一。中国汽车工业正在崛起,在全球汽车市场中发挥越来越重要的作用。政府认为汽车工业,包括汽车零件产业,是国家的支柱产业之一。中国政府预计,2020年中国汽车产量将达3,000万辆,到2025年将达到3,500万辆。预计这将推动研究电容器的需求。

- 电动车越来越受欢迎,中国被认为是采用电动车的主要国家之一。中国的「十三五」规划促进了混合动力汽车和电动车等环保交通解决方案的发展,预计将发展该国的交通运输业。

- 中国小客车协会资料显示,2021年11月至12月,新能源汽车销量成长一倍多,总计299万辆,较去年同期成长169%,成为全球销量第一的新能源汽车。销量最大,占主要汽车市场中国新车销量的14.8%。预计这将促进塑胶薄膜电容器在该国的采用。

- 根据 IEA 的数据,中国是可再生能源成长领域标语的领导者,预计到 2022 年将占清洁能源总量的 40% 左右。该国还超额完成了 2020 年太阳能电池板目标。

- 此外,为了加速零排放汽车的普及,澳洲新南威尔斯(NSW)政府于2021年推出了电动车策略,提供总计约5亿澳元的资金。 2021年上半年澳洲销售了8,688辆电动车。该国还在扩大其电动车支援基础设施。澳洲有超过3000个电动车公共充电器。我国电动车市场现有电动车车型31款,预计2022年终电动车车型将达58款。

塑膜电容器产业概况

塑胶薄膜电容器市场较为分散,有几家主要公司。这些拥有大量市场份额的大公司正专注于扩大海外基本客群。 Panasonic Corporation、Vishay Intertechnology Inc.、TDK Corporation、AVX Corporation、KEMET Corporation 等许多公司都参与了这个市场。这些公司正在利用策略合作措施来提高市场占有率和盈利。

- 2023 年 11 月 Electrocube 开发了一种金属化聚丙烯薄膜电容器,专为各种军事、商业、陆地和海洋应用中使用的高功率逆变器量身定制。这些电容器经过精心设计和最佳化,可在具有交流和脉衝讯号的高温、高电流环境中表现良好。此外,它们具有承受高突波电流而不劣化的卓越能力,使其成为电解电容器的绝佳替代品。

- 2023年5月,Sabic旗下的Hercules推出了以聚碳酸酯共聚物为基础的HTV150A薄膜。当暴露在高达 150°C 的温度和高达 100kHz 的频率下时,该薄膜可将耗散损耗降低高达 40%。这种材料已经在薄壁电容器薄膜中展示了其有效性。透过利用具有低耗散损耗的 Elcres HTV150A 介电薄膜,工程师可以受益于提高工作效率、减少内部热量产生以及稳定热点温度,从而提高电容器设计的弹性。该薄膜预计将有助于减少电容器的损耗。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估宏观经济趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 由于电动车的出现,汽车产业的需求增加

- 电子产品的复杂度不断增加

- 市场限制因素

- 金属价格上涨影响零件製造成本

第六章市场区隔

- 类型

- 聚丙烯

- 聚乙烯

- 其他类型(PTFE、PPS等)

- 目的

- 车

- 通讯

- 工业的

- 航太/国防

- 家用电器

- 医疗保健

- 其他用途

- 地区

- 美洲

- 欧洲、中东/非洲

- 亚太地区(不包括日本和韩国)

- 日本、韩国

第七章 竞争形势

- 公司简介

- KEMET Corporation(Yageo company)

- Panasonic Corporation

- Vishay Intertechnology Inc.

- TDK Corporation

- AVX Corporation(Kyocera Corp)

- Murata Manufacturing Co. Ltd.

- Cornell Dubilier Electronics Inc.

- Desai Electronics

- Shanghai Yinyan Electronic

- Rubycon Corporation

- Nantong Jianghai Capacitor Co. Ltd.

- Nichicon Corporation

- Wima GmBH & Co. KG

第八章投资分析

第九章 市场未来展望

The Plastic Film Capacitors Market size is estimated at USD 2.31 billion in 2024, and is expected to reach USD 2.94 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Plastic Film capacitors primarily include multiple families of capacitors that use different plastics as dielectric materials. They significantly replace paper-type capacitors in applications such as audio, radio circuits, and circuits operating at low to moderate voltages. Some of the commonly used plastics in these capacitors include polycarbonate, polypropylene (PP), polyester (PET), polystyrene, polysulfone, Kapton polyimide, Teflon (PTFE fluorocarbon), and metalized polyester (metalized plastic).

Key Highlights

- The significant advantage of using a plastic film capacitor is that it has a low distortion factor and exceptional frequency characteristics. Also, the wide range of plastic films that are used for these capacitors makes them versatile. These capacitors do not wear off quickly and are suited for high-voltage and high-frequency applications such as coupling and decoupling circuits and audio circuit ADCs.

- With a rising focus on sustainable solutions across various industries for power generation, the demand for solar and wind power inverters has increased. To cater to this, vendors are introducing new plastic-film capacitors. For instance, in May 2021, New Yorker Electronics introduced CDE-Illinois capacitors (33 to 220 uF and up to 1,440 WVDC, -40°C to +85°C) that are manufactured with low-profile metalized polypropylene film and offer high capacitance. The product is designed for applications such as DC links, electric heaters, motor drives, induction heaters, UPS systems, and solar and wind power inverters.

- Moreover, the adoption of wearables in the healthcare sector has been gaining traction in recent times, which, in turn, has been one of the significant factors influencing the market studied. The major trends in wearable connected devices include the increasing demand for pain management wearable devices and the increased use of wearables for cardiovascular disease management, among others.

- Further, in April 2022, Electroninks, Inc. announced the production-scale availability of its full suite of proprietary metal-organic decomposition (MOD) conductive metal ink solutions. In addition to bringing standalone ink products to market, Electroninks is also bringing total solutions to the customer with its line of ink products, including its own small desktop prototype additive manufacturing solution for rapid on-demand printed circuit board (PCB) printing and repair, called CircuitJet. These developments will also drive the study market.

- The COVID-19 pandemic led to immense disruptions in supply chains across industries globally. Many businesses globally halted or reduced operations to help combat the spread of the virus. However, in post pandemic scenario, the electronic components market, leading to increased operation levels across the supply chain for raw materials and component production levels. This denoted a rise in sales among a range of regions and countries.

- Moreover, electronic components are resource-intensive. The materials consumed in the mass production of surface-mount electronic components usually come in the form of engineered powders and pastes, making up the largest "variable cost" associated with producing passive components like capacitors.

Plastic Film Capacitors Market Trends

Consumer Electronics is Expected to Hold Significant Market Share

- The rapid surge in demand for consumer electronics products has boosted the market. Devices such as smartphones and tablets need small antennas capable of delivering high performance. These antenna systems demand capacitors with specific performance characteristics. Capacitors are critical components in antenna systems. The most general applications of capacitors in antenna systems include frequency tuning, impedance matching, and filtering. Capacitors for use in these applications must have prominent performance characteristics, including low leakage current, a high quality factor, and high linearity.

- Numerous advancements in capacitor technology have been made to produce capacitors that meet the strict performance requirements of smartphone antenna systems. For instance, capacitor manufacturers use microelectromechanical systems (MEMS) technology to make ultra-small and thin capacitors for smartphone antenna systems.

- According to the Consumer Technology Association, the retail revenue of the consumer electronics market in the United States constantly increased during the period from 2012 to 2021. Based on the projected retail sales for 2023, consumer electronics retail sales in the United States is expected to reach USD 485 billion.

- Moreover, capacitors are commonly incorporated in the flash module of cameras. Camera flash capacitors are constructed to have low resistance and significantly low inductance to deliver their energy to the flash tube as fast as possible, achieving a fast rise time on the pulse of current. The internal connections are also made more robust to avoid localized heating due to the high current. Without the flash capacitor, the batteries located inside the digital cameras would drain quickly.

- Furthermore, developments in wearable electronics, such as smartwatches, head-mounted displays, body-worn cameras, ear-worn devices, and fitness trackers, among others, drive innovations and the adoption of plastic film capacitors. For instance, capacitors are being widely used in wearable consumer electronics due to their wear and tear capability, which exhibits a loss of a few percentage points of energy performance after 10,000 cycles of charging and discharging.

Asia-Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region is one of the most important markets for capacitors. The automotive industry is increasing in China, and the country plays an increasingly important role in the global automotive market. The government views its automotive industry, including the auto parts sector, as one of the country's pillar industries. The government of China estimates that China's automobile output is expected to reach 30 million units by 2020 and 35 million units by 2025. This is expected to drive the studied capacitors' demand.

- The popularity of EVs is growing, and China is regarded as one of the dominant adopters of electric vehicles. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric vehicles, for advancements in the country's transportation sector.

- According to data by the China Passenger Car Association (CPCA), sales of these new energy vehicles (NEVs) more than doubled in November and December of 2021, increasing full-year deliveries by 169% to a record 2.99 million units, or 14.8% of new sales in China, the world's largest vehicle market. This is anticipated to boost the country's adoption of plastic film capacitors.

- According to the IEA, China was the undisputed leader in renewable growth, estimated to account for around 40% of its total clean energy mix by 2022. The country also surpassed its 2020 solar panel target.

- Additionally, to promote the adoption of zero-emission vehicles, the New South Wales (NSW) state government in Australia introduced an Electric Vehicle Strategy in 2021 with funding totaling almost AUD 500 million. 8,688 electric vehicles were sold during the first half of 2021 in Australia. The country is witnessing a growing electric vehicle support infrastructure as well. Australia has more than 3,000 public chargers for electric vehicles. The country's EV market had 31 electric vehicle models, and by the end of 2022, it was estimated that there would be 58 electric vehicle models in the country.

Plastic Film Capacitors Industry Overview

The plastic film capacitors market is fragmented and has several major players. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. The market comprises Panasonic Corporation, Vishay Intertechnology Inc., TDK Corporation, AVX Corporation, KEMET Corporation, and many others. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- November 2023: Electrocube has developed a range of metalized polypropylene film capacitors specifically tailored for high-power inverters used in various military, commercial, land, and sea applications. These capacitors have been carefully designed and optimized to function exceptionally well in high temperature and high current scenarios with AC and pulsing signals. Furthermore, their remarkable capability to withstand high surge currents without deterioration makes them an outstanding alternative to electrolytic capacitors.

- May 2023: Sabic's Elcres introduced its polycarbonate copolymer-based HTV150A films, which can potentially decrease dissipation losses by up to 40% when exposed to temperatures up to 150°C and frequencies up to 100 kHz. This material has already demonstrated its effectiveness in thin-wall capacitor films. By utilizing Elcres HTV150A dielectric films with lower dissipation losses, engineers can benefit from improved operating efficiency, reduced internal heat generation, and more stable hot spot temperatures, resulting in increased flexibility when designing capacitors. It is anticipated that these films will lead to reduced dissipation losses in capacitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitute Products

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Automotive Industry due to the Advent of EVs

- 5.1.2 Increasing Complexity of Electronics

- 5.2 Market Restraints

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Polypropylene

- 6.1.2 Polyethylene

- 6.1.3 Other Types (PTFE, PPS, etc.)

- 6.2 Applications

- 6.2.1 Automotive

- 6.2.2 Telecommunications

- 6.2.3 Industrial

- 6.2.4 Aerospace & Defense

- 6.2.5 Consumer Electronics

- 6.2.6 Medical

- 6.2.7 Other Applications

- 6.3 Geography

- 6.3.1 Americas

- 6.3.2 Europe, Middle East & Africa

- 6.3.3 Asia-Pacific (Excl. Japan and Korea)

- 6.3.4 Japan and Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KEMET Corporation (Yageo company)

- 7.1.2 Panasonic Corporation

- 7.1.3 Vishay Intertechnology Inc.

- 7.1.4 TDK Corporation

- 7.1.5 AVX Corporation (Kyocera Corp)

- 7.1.6 Murata Manufacturing Co. Ltd.

- 7.1.7 Cornell Dubilier Electronics Inc.

- 7.1.8 Desai Electronics

- 7.1.9 Shanghai Yinyan Electronic

- 7.1.10 Rubycon Corporation

- 7.1.11 Nantong Jianghai Capacitor Co. Ltd.

- 7.1.12 Nichicon Corporation

- 7.1.13 Wima GmBH & Co. KG