|

市场调查报告书

商品编码

1693813

钽电容器-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Tantalum Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

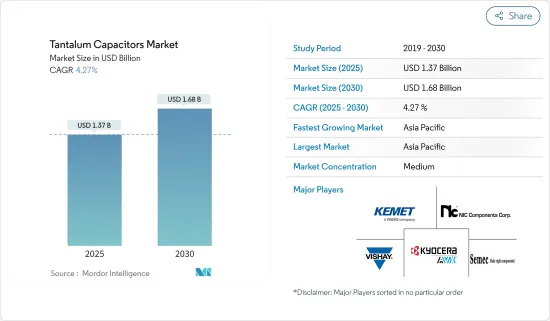

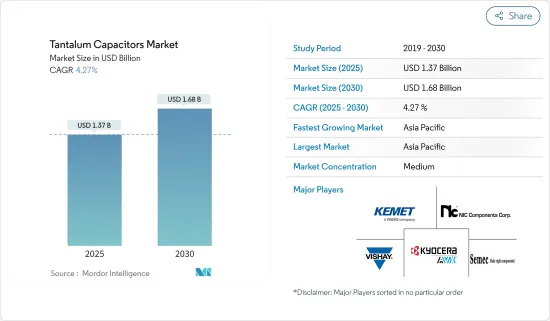

钽电容器市场规模预计在 2025 年为 13.7 亿美元,预计到 2030 年将达到 16.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.27%。

钽电容器是使用钽金属作为阳极的电解电容器。钽电容是有极化电容,具有较高的频率和回弹特性。它比相同电容的电解电容器更小。钽电容器的额定电压范围很广,从 2V 到 500V 以上。

关键亮点

- 钽电容器用于多种终端应用,包括医疗设备、家用电子电器、汽车和工业。钽电容器通常用于各种电子设备应用,包括个人电脑、笔记型电脑、医疗设备、音讯参与企业、汽车电路、智慧型手机、数位相机、可携式媒体播放器和其他表面黏着型元件(SMD)。

- 根据TME Electronic Components 2023年11月报道,钽电容器具有许多优点,可用于各种不同的应用。它们也可用于替代或支援电解电容器和 MLCC。钽电容器的基本特性之一是其在很宽的温度范围内的参数稳定性,电容在-55°C至125°C范围内保持稳定。

- 钽电容器不会老化,因此可以保持其参数多年。钽电容器还具有高体积效率。例如,标准SMD电解电容器的体积效率为11.8μFV/mm3,而钽电容器的效率可达63μFV/mm3以上。

- 钽电容器主要原料钽矿的价格波动可能为市场带来重大挑战。钽电容器价格会根据多种因素而波动,包括地缘政治紧张局势、多个行业的需求变化、供应链中断以及有关原材料采购的某些法律和法规。

- 在家用电子电器产业扩张、电子产品市场进步以及 5G 等先进技术的日益普及的推动下,市场正在不断增长。此外,汽车产业向电动车的转变以及物联网设备的兴起进一步促进了市场的成长。在持续的技术创新和各行业电子整合度不断提高的推动下,随着製造商专注于开发更小、更有效率的电容器,市场有望持续成长。

钽电容器市场趋势

消费性电子部门强劲成长

- 钽电容器通常用于各种家用电子电器,包括智慧型手机。这些电容器通常用作连接到智慧型手机中的 GSM 功率放大器(PA)电源线的电容器。钽电容器体积小,适合用于智慧型手机等小尺寸应用。

- 根据爱立信预测,2022年全球智慧型手机用户数将超过66亿,预计2028年将达到78亿人。行动网路智慧型手机用户数量最多的国家是美国、中国和印度。智慧型手机的大幅成长预计将推动市场发展。

- 钽电容器也用于笔记型电脑和其他电子设备。例如,研究表明,笔记型电脑(尤其是主机板)中的电源滤波器每个含有约 1 克钽。这是因为钽电容器比 MLCC 电容器具有更高的电容值,并且不会产生微音效应,使其成为扁平或紧凑设计设备的理想选择。

- 随着支援 5G 的智慧型手机越来越普及,以及穿戴式装置等装置的功能越来越丰富、体积越来越小,对更小、更密集的电子电路的需求也越来越大。此外,随着5G的快速普及,钽电容器的需求也不断增加。用湿钽电容器取代固体电容器可能会在短期内带来机会。

- 根据 GSMA Intelligence 最近发布的数据,到 2029 年,5G 连线将占所有行动连线的一半以上(51%)。预计到 2020 年,这一比例将进一步上升至 56%,从而牢固确立 5G 作为领先连接技术的地位。预计到 2023 年底,这一数字将达到 16 亿个连接,到 2030 年将达到 55 亿个连接。钽电容器支援网路设备高效运行,提高资料传输速度,增强连接性,最终推动钽电容器市场的成长。

亚太地区成长强劲

- 随着亚太地区转型为清洁能源来源并努力减少碳排放,对电动车的需求正在上升。因此,对钽电容器为这些车辆供电的需求日益增加。在电动车电池中,钽电容器对于提高能源效率、延长电池寿命和提高整体性能至关重要。

- 此外,智慧型手机和其他行动装置等家用电子电器正在推动亚太地区对钽电容器的进一步需求。随着消费者对更小、更轻、更强大的设备的需求,製造商开始转向使用钽电容器来满足这些要求。

- 亚太地区 5G 技术的推出正在推动通讯基础设施对钽电容器的需求。钽电容器透过促进高效的电源管理、滤波和讯号调节,在 5G基地台、天线和其他通讯设备中发挥至关重要的作用。

- 随着下一代通讯网路建设的进展,预计钽电容器在主电路基板和 GaN RF 功率放大器等应用中的使用量将激增。

钽电容器产业概况

钽电容器市场呈半刚性,全球市场上有领先的供应商。主要企业正在采取收购和联盟等各种策略来提高市场占有率并增加市场盈利。市场的主要企业包括 Vishay Intertechnology Inc.、Kemet Corporation(YAGEO Corporation)、NIC Components Corp.、KYOCERA AVX Components Corporation、Semec Technology Company Limited 等。

- 2024年3月,KEMET推出了全新的T581聚合物钽表面黏着技术电容器,符合军用性能规范MIL-PRF-32,700/2的要求。此次发布标誌着聚合物钽表面黏着技术电容器的市场化,也是首批符合新规范的电容器。这进一步巩固了 KEMET 在国防和航太领域高可靠性应用市场的主要企业。

- 2023 年 11 月,Vishay Intertechnology Inc. 宣布已与 Nexperia BV 签署最终协议,以约 1.77 亿美元现金收购 Nexperia 的英国晶圆代工厂及业务,但须进行售后调整。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 价值链分析

- 市场宏观经济趋势评估

第五章市场动态

- 市场驱动因素

- 越来越注重设备小型化

- 汽车电子的兴起

- 市场限制

- 钽矿价格波动

第六章市场区隔

- 按应用

- 医疗设备

- 家用电子电器

- 车

- 工业的

- 其他的

- 按地区

- 美洲

- 欧洲、中东和非洲

- 亚洲

- 澳洲和纽西兰

- 日本

- 韩国

第七章竞争格局

- 公司简介

- Vishay Intertechnology Inc.

- Kemet Corporation(YAGEO Corporation)

- NIC Components Corp.

- KYOCERA AVX Components Corporation(KYOCERA CORPORATION)

- Semec Technology Company Limited

- Samsung Electro-Mechanics

- Exxelia Group

- Abracon LLC

- Panasonic Corporation

- NTE Electronics Inc.

第八章投资分析

第九章:未来市场展望

The Tantalum Capacitors Market size is estimated at USD 1.37 billion in 2025, and is expected to reach USD 1.68 billion by 2030, at a CAGR of 4.27% during the forecast period (2025-2030).

Tantalum capacitors are electrolytic capacitors that use tantalum metal for the anode. They are polarized capacitors with higher frequency and resilience characteristics. They are smaller than aluminum electrolytic capacitors of the same capacitance. The voltage range rating for tantalum capacitors varies from 2 V to more than 500 V.

Key Highlights

- Tantalum capacitors are used across multiple end-user applications such as medical devices, consumer electronics, automotive, and industrial. Tantalum capacitors are commonly used in various electronic applications, including PCs, laptops, medical devices, audio amplifiers, automotive circuitry, smartphones, digital cameras, portable media players, and other surface-mounted devices (SMD).

- According to TME Electronic Components, in November 2023, tantalum capacitors boast a significant number of advantages and thus can be used in many different applications. They can also be used to replace or support aluminum electrolytic capacitors and MLCCs. One of the essential features of tantalum capacitors is their stability of parameters over a wide range of temperatures - capacitance is stable in temperature ranges from -55°C to 125°C.

- Tantalum capacitors do not age, so they retain their parameters for many years. Tantalum capacitors also feature high volumetric efficiency. For instance, standard SMD aluminum electrolytic capacitors have a volumetric efficiency of 11.8 µFV/mm3, whereas tantalum capacitors attain an efficiency of 63 µFV/mm3 and above.

- The market may face a significant challenge due to the fluctuating prices of tantalum ore, the primary raw material used to produce tantalum capacitors. The prices of tantalum capacitors are subject to change based on various factors, including geopolitical tensions, demand changes from multiple industries, disruption in the supply chain, and specific laws and regulations on the sourcing of material.

- The market is experiencing continued growth driven by the expanding consumer electronics sector, the advancing market for electronic gadgets, and the growing prevalence of advanced technologies like 5G. In addition, the automotive industry's transition toward electric vehicles and the rise of IoT devices further contribute to the market's growth. As manufacturers focus on developing smaller, efficient capacitors, the market is poised for sustained growth, pushed by ongoing technological innovations and rising electronic integration across industries.

Tantalum Capacitors Market Trends

Consumer Electronics Segment to Witness Major Growth

- Tantalum capacitors are commonly used in various consumer electronic devices, including smartphones. These capacitors are often used as the capacitors connected to the power line of the Power Amplifier (PA) for GSM on smartphones. Tantalum capacitors are small in size, making them suitable for use in small-footprint applications like smartphones.

- According to Ericsson, the global number of smartphone subscriptions reached over 6.6 billion in 2022. It is expected to hit 7.8 billion by 2028. The countries with the most smartphone mobile network subscriptions are the United States, China, and India. Such a huge rise in smartphones would drive the market.

- Tantalum capacitors are also used in laptops and other electronic devices. For example, researchers demonstrated that about 1 gram of tantalum is used per unit in laptops, specifically in motherboard power supply filters. This is because tantalum capacitors offer higher capacitance values than MLCC capacitors and display no microphonic effect, making them an attractive option for devices with flat or compact designs.

- With smartphones supporting 5G becoming more widespread and devices like wearable devices becoming increasingly multifunctional and compact, the need for smaller, higher-density electronic circuitry is increasing. Moreover, as 5G is rapidly growing, the need for a tantalum capacitor increases. Replacing solid capacitors with wet tantalum capacitors will likely present an opportunity soon.

- According to recent data released by GSMA Intelligence, 5G connections will account for more than half (51%) of all mobile connections by 2029. This percentage is expected to increase further to 56% by the end of the decade, solidifying 5G as the leading technology for connectivity. This number is anticipated to reach 1.6 billion connections by the end of 2023 and 5.5 billion by 2030. The tantalum capacitors support the effective functioning of network equipment, enhancing the speed of data transmission and strengthening connectivity, ultimately propelling the growth of the tantalum capacitors market.

Asia-Pacific to Witness Significant Growth

- As the Asia-Pacific region embraces the transition towards cleaner energy sources and strives to reduce carbon emissions, the demand for electric vehicles has increased. Consequently, there is an increased need for tantalum capacitors to power these vehicles. In electric vehicle batteries, tantalum capacitors are crucial in improving energy efficiency, extending battery life, and enhancing overall performance.

- Additionally, consumer electronics such as smartphones and other mobile devices drive further demand for tantalum capacitors in Asia-Pacific. As consumers demand smaller, lighter, and more powerful devices, manufacturers turn to tantalum capacitors to meet these requirements.

- The deployment of 5G technology in the Asia-Pacific region has fueled the demand for tantalum capacitors in telecommunication infrastructure. Tantalum capacitors play a vital role in 5G base stations, antennas, and other telecommunications equipment by facilitating efficient power management, filtering, and signal conditioning.

- With the ongoing construction of the next generation of telecom networks, there is poised to be a surge in the utilization of tantalum capacitors in this application, spanning both the main circuit boards and the GaN RF power amplifier.

Tantalum Capacitors Industry Overview

The tantalum capacitors market is semi-consolidated due to large vendors in the global market. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market. The key players in the market include Vishay Intertechnology Inc., Kemet Corporation (YAGEO Corporation), NIC Components Corp., KYOCERA AVX Components Corporation (KYOCERA CORPORATION), Semec Technology Company Limited.

- In March 2024, Kemet introduced the brand-new T581 polymer tantalum surface-mount capacitors that satisfy the requirements of Military Performance Specification Sheets MIL-PRF-32700/2. This launch signifies the introduction of polymer tantalum surface-mount capacitors to the market, making them the first to meet the new specifications. This further solidifies KEMET's position as a key firm in the defense and aerospace high-reliability application market.

- In November 2023, Vishay Intertechnology Inc. announced that it entered a definitive agreement with Nexperia BV to purchase Nexperia's wafer fabrication plant and operations in the United Kingdom for approximately USD 177 million in cash (subject to customary post-sale adjustments).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Value Chain Analysis

- 4.4 Assessment of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Focus on Miniaturization of Devices

- 5.1.2 Rising In-vehicle Electronics

- 5.2 Market Restrains

- 5.2.1 Fluctuations in the Price of Tantalum ore

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Medical Devices

- 6.1.2 Consumer Electronics

- 6.1.3 Automotive

- 6.1.4 Industrial

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East and Africa

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Japan

- 6.2.6 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vishay Intertechnology Inc.

- 7.1.2 Kemet Corporation (YAGEO Corporation)

- 7.1.3 NIC Components Corp.

- 7.1.4 KYOCERA AVX Components Corporation (KYOCERA CORPORATION)

- 7.1.5 Semec Technology Company Limited

- 7.1.6 Samsung Electro-Mechanics

- 7.1.7 Exxelia Group

- 7.1.8 Abracon LLC

- 7.1.9 Panasonic Corporation

- 7.1.10 NTE Electronics Inc.