|

市场调查报告书

商品编码

1431571

航太含氟聚合物:市场占有率分析、产业趋势、成长预测(2024-2029)Aerospace Fluoropolymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

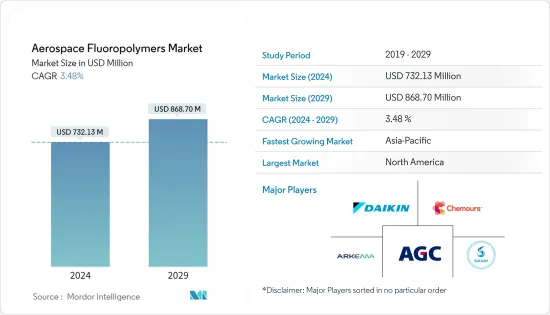

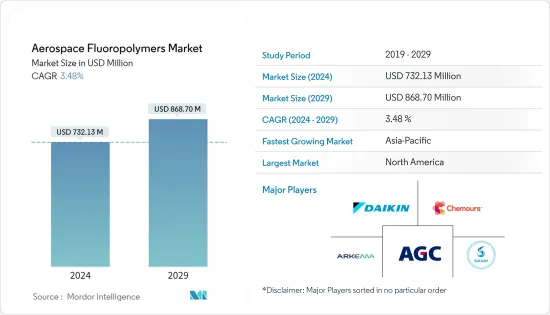

航太含氟聚合物市场规模预计2024年为7.3213亿美元,预计2029年将达到8.687亿美元,预测期内(2024-2029年)复合年增长率为3.48%,预计还会增长。

主要亮点

- 2020 年 COVID-19 大流行期间的供应链中断和飞机订单对航太含氟聚合物市场产生了重大影响。由于最终用户需求减少,主要含氟聚合物製造商 (OEM) 被迫减少产量,减少了收益来源,并给较小的市场参与者带来了永续性问题。然而,在COVID-19之后,由于航空领域的復苏,需求将迅速扩大,并且含氟聚合物在航太应用中的使用预计将增加,因此预计未来将保持强劲。

- 航太对含氟聚合物的需求量很大,因为它们具有独特的性能,可以使飞机等最终用户平台更安全、更节能。高耐用性和有效的耐热、特殊燃料、湿度和引擎振动防护等是含氟聚合物的一些特性,吸引了航太和航太零件製造商的注意。含氟聚合物也比其他材料更轻,这就是为什么它们越来越多地被航太领域采用的原因。然而,一些含氟聚合物成本较高,这可能会阻碍市场成长。

航太氟树脂市场趋势

预计民用航空领域将在预测期内引领市场

- 民航平台预计将在未来几年引领市场。 2020 年,由于 COVID-19 大流行,民航机交付下降。然而,2021 年飞机交付有所改善,空中巴士和波音等主要民航机OEM提高了飞机产量和交付率。随着旅行限制的取消,航空客运量开始改善。

- 随着航空旅客数量的增加,航空公司已开始营运所有主要航线,并增加了新航线。联合航空宣布开通这条新航线,并将其描述为「最大的跨大西洋扩张」。一切都恢復正常,新的航空公司已经开始营运。印度新航空公司阿卡萨航空于 2022 年 8 月开始运营,最初只有一条每週 28 个航班的航线,后来逐渐增加了两条航线。

- 2022 年 10 月,阿拉斯加航空计划订购 52 架波音 B737 MAX 飞机来扩大机队规模。该航空公司宣布计划在年终年底拥有一支全波音干线机队。随着民航机产量的增加,对氟树脂的需求也将增加,市场预计将成长。

亚太地区在预测期间内复合年增长率最高

- 预计亚太地区在氟聚合物市场评估期间将显着成长。亚太地区多年来一直是航空业的重要枢纽。由于航空需求的增加,印度和中国等该地区的新兴经济体在各自的民航市场上正在经历重大突破。中国凭藉强劲的内需引领全球民航市场復苏,为航空公司财务復苏做出了贡献。

- 波音公司表示,由于国内航空客运量增加,中国已成为航空业最大市场,预计到2040年将快速成长4.4%,超过北美地区。亚太地区的军用航空也在成长,由于邻国之间的紧张关係,该地区国家的军事开支增加,外国投资在澳洲等国家设立军事基地基地台。

- 中国正在增强其军用航空能力,并于2022年10月宣布推出新型隐形战斗机J-20,这是世界上第一款两座隐形战斗机。此外,亚太国家人事费用较低,这意味着它们具有成本优势,开发製造能力所需的投资较少。随着亚太地区航太工业的快速发展,航太含氟聚合物市场预计将持续成长。

航太含氟聚合物产业概述

航太含氟聚合物市场本质上是一体化的。大金工业、科慕公司、AGC 集团、阿科玛和索尔维是该市场的领导者。这些领先公司正在采取各种有机和无机成长策略,例如併购、新产品发布、业务扩张、协议、合资企业和合作伙伴关係,以巩固其在该市场的地位。

然而,也有一些规模较小的公司涉足航太含氟聚合物市场。公司正在努力扩大在每个地区的影响力,以扩大基本客群。例如,2021年3月,阿科玛宣布增加投资,将其在中国常熟的氟聚合物产能额外增加35%。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 平台

- 民航

- 通用航空

- 军用机

- 树脂型

- PTFE

- ETFE

- PFA

- FKM

- 其他树脂类型

- 类型

- 粉末

- 颗粒

- 分散液

- 成分类型

- 贴纸

- 线缆

- 软管和管子

- 电影

- 涂层

- 其他部分

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Daikin Industries, Ltd.

- The Chemours Company

- AGC Group

- Arkema SA

- Solvay SA

- Fluorotherm

- Plastics Europe

- Dongyue Group

- The 3M Company

- HaloPolymer, OJSC

- Saint-Gobain Group

第七章 市场机会及未来趋势

The Aerospace Fluoropolymers Market size is estimated at USD 732.13 million in 2024, and is expected to reach USD 868.70 million by 2029, growing at a CAGR of 3.48% during the forecast period (2024-2029).

Key Highlights

- The supply chain disruption and aircraft order backlogs caused during the COVID-19 pandemic in 2020 greatly affected the aerospace fluoropolymers market. Major fluoropolymer original equipment manufacturers (OEMs) had to reduce their production rate due to less demand from the end-users, leading to trickling revenue streams and raising sustainability issues for small market players. However, post-COVID, the demand witnessed rapid growth due to the recovery demonstrated by the aviation sector and was likely to remain robust as the use of fluoropolymers is expected to increase in aerospace applications.

- Fluoropolymers have been witnessing high demand from the aerospace industry due to their unique properties that make end-user platforms such as aircraft safer and more fuel-efficient. High durability and effective protection against heat, specialty fuels, humidity, and engine vibrations, are a few of those characteristics of fluoropolymers that are catching the eyes of aerospace and aerospace component manufacturers. In addition, the lightweight nature of fluoropolymers in comparison to other materials is another reason leading to the greater adoption of fluoropolymers in aerospace. However, the costs of some of the fluoropolymer resins are at the higher end, which can act as a hindrance to market growth.

Aerospace Fluoropolymers Market Trends

Commercial Aviation Segment is Expected to Lead the Market During the Forecast Period

- The commercial aviation platform is expected to lead the market in the years to come. In 2020, there was a decline in commercial aircraft deliveries due to the COVID-19 pandemic. However, aircraft deliveries improved in 2021, and the major commercial aircraft OEMs, like Airbus and Boeing, increased their aircraft production and delivery rates. With the lifting of travel restrictions, air passenger traffic started to improve.

- With the increase in air passenger traffic, airlines have started operating on all major routes and have also added new routes. United Airlines has announced that it has started operating on new routes, describing it as its "largest transatlantic expansion." With everything returning to normal, new airlines have started operations. Akasa Air, a new Indian airline, started its operations in August 2022, starting with one route with 28 flights a week and gradually adding two more routes.

- In October 2022, Alaska Airlines placed an order for 52 Boeing B737 MAX aircraft with a plan to expand its fleet. The airline announced plans to have an all-Boeing mainline fleet by the end of 2023. With the increase in the production of commercial aircraft, the demand for fluoropolymers will also increase, resulting in the growth of the market.

Asia Pacific to Register the Highest CAGR During the Forecast Period

- Asia-Pacific is anticipated to witness tremendous growth over the assessment period in the fluoropolymers market. Asia-Pacific has become a significant hub for the aviation industry over the years. The emerging economies in the region, like India and China, are experiencing a massive surge in their respective commercial aviation markets due to an increased demand for air travel. China is leading the recovery of global commercial aviation due to great domestic demand, helping the airlines witness financial recovery.

- China is the largest market in aviation due to an increase in domestic air passenger traffic, which has surpassed the North American region and is expected to grow rapidly at a rate of 4.4% by 2040, according to Boeing. With the increase in military spending of the countries in the region due to tensions between neighboring countries and with foreign nations investing in arranging military base stations in countries like Australia, military aviation in the Asia-Pacific region is also increasing.

- China is increasing its military airborne capabilities, and a new stealth fighter aircraft, the new version of the J-20, which is the world's first twin-seat stealth fighter aircraft, was unveiled in October 2022. In addition, countries in the Asia-Pacific are cost-friendly due to the low cost of labor and require low investments to set up manufacturing capabilities. Thus, due to the rapidization of the aerospace industry in Asia Pacific, the aerospace fluoropolymers market will continue to experience growth in the region.

Aerospace Fluoropolymers Industry Overview

The aerospace fluoropolymers market is consolidated in nature. Daikin Industries, Ltd., The Chemours Company, AGC Group, Arkema S.A., and Solvay S.A. are the prominent players in the market. These major players have adopted various organic as well as inorganic growth strategies such as mergers & acquisitions, new product launches, expansions, agreements, joint ventures, partnerships, and others to strengthen their position in this market.

However, there are several smaller players that function in the aerospace fluoropolymers market. The companies are trying to increase their presence across all regions to increase their customer base. For example, in March 2021, Arkema announced to increase its investment to further increase its fluoropolymer production capacities in Changshu (China) by 35%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Commercial Aviation

- 5.1.2 General Aviation

- 5.1.3 Military Aviation

- 5.2 Resin Type

- 5.2.1 PTFE

- 5.2.2 ETFE

- 5.2.3 PFA

- 5.2.4 FKM

- 5.2.5 Other Resin Types

- 5.3 Type

- 5.3.1 Powder

- 5.3.2 Pellets

- 5.3.3 Dispersions

- 5.4 Component Type

- 5.4.1 Seals

- 5.4.2 Wires & Cables

- 5.4.3 Hoses & Tubes

- 5.4.4 Films

- 5.4.5 Coatings

- 5.4.6 Other Component Types

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daikin Industries, Ltd.

- 6.1.2 The Chemours Company

- 6.1.3 AGC Group

- 6.1.4 Arkema S.A.

- 6.1.5 Solvay S.A.

- 6.1.6 Fluorotherm

- 6.1.7 Plastics Europe

- 6.1.8 Dongyue Group

- 6.1.9 The 3M Company

- 6.1.10 HaloPolymer, OJSC

- 6.1.11 Saint-Gobain Group