|

市场调查报告书

商品编码

1431615

卫星组件:市场占有率分析、产业趋势、成长预测(2024-2029)Satellite Component - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

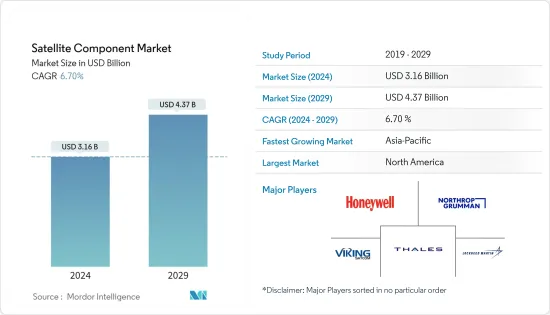

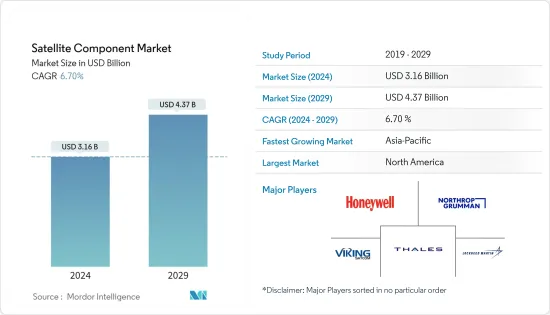

卫星零件市场规模预计到 2024 年为 31.6 亿美元,预计到 2029 年将达到 43.7 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.70%。

主要亮点

- 由于 COVID-19 大流行,全球卫星零件市场面临前所未有的挑战。航太领域面临原料短缺、卫星发射计画延迟、政府严格监管导致供应链中断等挑战。疫情过后,市场呈现强劲復苏态势。航太领域支出的增加和小型卫星发射数量的增加正在推动疫情后的市场成长。

- 卫星部件由通讯系统、电力系统、动力系统等组成。通讯系统包括接收和转发讯号的天线和中继器。推进系统由推进卫星的火箭组成,电力系统由提供电力的太阳能板组成。卫星发射数量的增加和航太领域支出的增加正在推动市场成长。根据联合国外太空事务办公室(UNOOSA)的指标,2022年将有8,261颗卫星绕地球运行,比2021年4月增加11.84%。

卫星组件市场趋势

预计天线部分在预测期内将出现显着成长

- 预计天线部分在预测期内将显着成长。这一增长是由对先进通讯系统的需求增加、卫星发射数量的增加以及航太领域支出的增加所推动的。卫星天线用于将卫星的发射功率集中到地球上的指定地理区域,并避免来自不必要的讯号的干扰,从而劣化整体讯号品质。用于通讯、广播、导航和天气预报等各种最终用途的卫星发射数量的增加正在推动该领域的成长。

- 美国航太局 (UNOOSA) 宣布 2022 年 11 月进行了 155 次轨道和亚轨道发射。此外,2022年6月,卫星产业协会(SIA)发布了第25次卫星产业状况报告(SSIR)。报告显示,2021年部署的商业卫星数量为1,713颗,较2020年大幅增加40%以上。对卫星的需求不断增长将推动对卫星组件的相应需求,并推动预测期内的市场成长。其中一个例子是 2022 年 7 月,MDA Ltd. 与卫星製造商 York Space Systems 签署了一份合同,为卫星建造Ka波段可操纵天线。

在预测期内,北美将主导市场

- 北美在卫星零件市场上占据主导地位,并将在预测期内继续保持这一地位。这是由于美国航太总署(NASA)和SpaceX增加了太空研发支出,以及卫星发射数量的增加。 2022年,美国政府将在太空计画上花费约620亿美元,成为世界上最大的太空支出国。 2022年,全球将成功发射180次火箭,其中76次由美国发射。

- 例如,2021年9月,美国卫星製造公司Terran Orbital宣布将在佛罗里达州太空海岸开设世界上最大的卫星製造和零件工厂,这是一个耗资3亿美元的计画。此外,2021 年 12 月,Redwire Corporation 与卫星製造公司 Terran Orbital 签订了为期三年的供应商协议,提供用于卫星製造和服务的各种先进组件和解决方案。

卫星零件行业概况

卫星零件市场适度整合,少数公司占较大份额。一些着名的市场参与者包括泰雷兹公司、维京卫星通讯公司、洛克希德·马丁公司、诺斯罗普·格鲁曼公司和霍尼韦尔国际公司。由于竞争加剧,主要目标商标产品(OEM) 正在专注于太空应用的先进卫星组件和系统的设计和开发。下一代卫星天线、中继器、推进系统等研发和设计开发支出的增加可能会在未来几年创造更好的机会。

例如,2021年10月,欧洲太空总署(ESA)、法国太空总署CNES和卫星製造商泰雷兹阿莱尼亚航太公司宣布,将共同开发冷却系统,以维持在轨大型卫星的温度。它将是大型商业通讯上使用的第一个机械泵迴路。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 成分

- 天线

- 电源系统

- 推进系统

- 应答器

- 其他组件(感测器、热控制系统等)

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Lockheed Martin Corporation

- Viking Satcom

- Sat-lite Technologies

- Honeywell International Inc.

- THALES

- Northrop Grumman Corporation

- IHI Corporation

- BAE Systems plc

- Challenger Communications

- JONSA TECHNOLOGIES CO., LTD.

- Accion Systems

第七章 市场机会及未来趋势

The Satellite Component Market size is estimated at USD 3.16 billion in 2024, and is expected to reach USD 4.37 billion by 2029, growing at a CAGR of 6.70% during the forecast period (2024-2029).

Key Highlights

- The global satellite component market has faced unprecedented challenges due to the COVID-19 pandemic. The space sector witnessed challenges such as shortages of raw materials, delayed satellite launch programs, and supply chain disruptions due to strict regulations imposed by governments. The market showcased a strong recovery after the pandemic. An increase in expenditure on the space sector and rising small satellite launches drive the market growth post-covid.

- The satellite components consist of the communications system, power systems, power systems, and others. The communication system includes antennas and transponders that receive and retransmit signals. The propulsion system consists of rockets that propel the satellite, and the power system includes solar panels that provide power. An increasing number of satellite launches and growing expenditure on the space sector drive the market growth. According to the United Nations Office for Outer Space Affairs (UNOOSA) index, in 2022, there were 8,261 individual satellites orbiting the Earth, with an increase of 11.84% compared to April 2021.

Satellite Component Market Trends

The Antenna Segment is Expected to Show Remarkable Growth During the Forecast Period

- The antenna segment is projected to show significant growth during the forecast period. The growth is due to increasing demand for advanced communication systems, rising number of satellite launches, and rising spending on the space sector. Satellite antennas are used to concentrate the satellite's transmitting power to the designated geographical region on Earth and avoid interference from undesired signals that will deteriorate the overall quality of the signal. Increasing satellite launches for various end-use applications such as communications, broadcasting, navigation, weather forecasting, and others drive the growth of the segment.

- The United Nations Office for Outer Space Affairs (UNOOSA) stated that 155 orbital and suborbital launches took place in November 2022. Moreover, in June 2022, the Satellite Industry Association (SIA) unveiled the 25th annual State of the Satellite Industry Report (SSIR). The report indicated a remarkable deployment of 1,713 commercial satellites in 2021, reflecting a notable surge of over 40 percent compared to 2020. This escalating demand for satellites is set to trigger a corresponding need for satellite components, thereby propelling market growth in the projected period. As an illustration, a significant development took place in July 2022 when MDA Ltd. entered into a contract with York Space Systems, a satellite manufacturer, to construct Ka-Band steerable antennas for satellites.

North America Held Highest Shares in the Market During the Forecast Period

- North America dominated the satellite components market and continued its domination during the forecast period. An increase in spending on space research and development and a rising number of satellite launches from the National Aeronautics and Space Administration (NASA) and SpaceX. In 2022, the United States government spent approximately USD 62 billion on its space programs and making the country with the highest space expenditure in the world. There were 180 successful rocket launches worldwide in 2022, out of which 76 were launched by the United States.

- For instance, in September 2021, Terran Orbital, a satellite manufacturing company in the United States, announced that it would open the world's largest satellite manufacturing and component facility on Florida's Space Coast at a cost of USD 300 million. Furthermore, in December 2021, Redwire Corporation signed a three-year supplier agreement with Terran Orbital, a satellite manufacturer, to provide a range of advanced components and solutions used in satellite manufacturing and service offerings.

Satellite Component Industry Overview

The satellite component market is moderately consolidated in nature, with a handful of players holding significant shares in the market. Some prominent market players are THALES, Viking Satcom, Lockheed Martin Corporation, Northrop Grumman Corporation, and Honeywell International Inc. With the growing competition, major original equipment manufacturers (OEMs) are focusing on the design and development of advanced satellite components and systems for space applications. Growing expenditure on research and development and design and development of next-generation satellite antennas, transponders, propulsion systems, and others will create better opportunities in the coming years.

For instance, in October 2021, the European Space Agency (ESA), French space agency CNES and Thales Alenia Space, a satellite manufacturer, announced it would jointly develop a cooling system that will maintain the temperature of big satellites in orbit. It will be the first mechanically pumped loop to be used on large commercial telecommunications satellites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Antennas

- 5.1.2 Power Systems

- 5.1.3 Propulsion Systems

- 5.1.4 Transponders

- 5.1.5 Other Components (Sensors, Thermal Control Systems, etc)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lockheed Martin Corporation

- 6.1.2 Viking Satcom

- 6.1.3 Sat- lite Technologies

- 6.1.4 Honeywell International Inc.

- 6.1.5 THALES

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 IHI Corporation

- 6.1.8 BAE Systems plc

- 6.1.9 Challenger Communications

- 6.1.10 JONSA TECHNOLOGIES CO., LTD.

- 6.1.11 Accion Systems