|

市场调查报告书

商品编码

1431631

电池板:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Battery Plate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

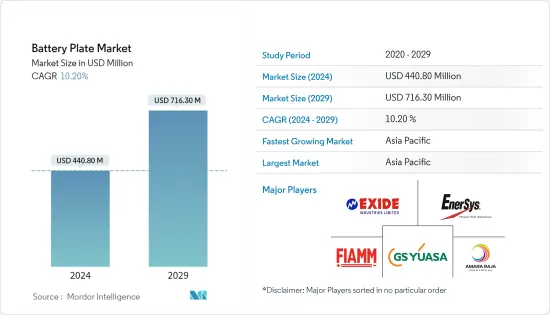

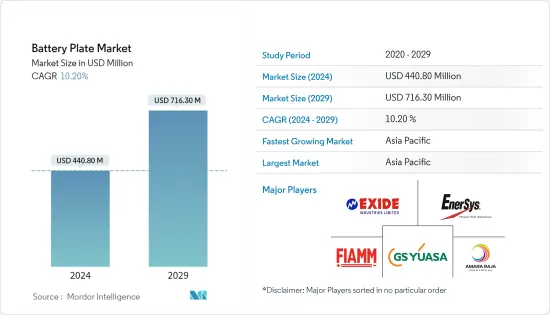

电池板市场规模预计到2024年为4.408亿美元,预计到2029年将达到7.163亿美元,在预测期内(2024-2029年)复合年增长率为10.20%。

主要亮点

- 从中期来看,锂离子电池价格下降和可再生能源普及不断提高推动能源储存系统需求等因素预计将在预测期内推动电池板市场。

- 同时,钴、锂、铜等电池原料的供需失配预计将抑制研究期间电池板的需求。

- 也就是说,新材料(复合材料、合金等)和电池极板配置(袋极板)的技术进步提高了效率和永续性,可能会在预测期内为市场创造有利的成长机会。这是高度性的。

- 由于能源需求的增加,亚太地区是预测期内成长最快的市场。这一增长得益于印度、中国和澳大利亚等该地区国家的投资增加以及政府支持政策。

电池极板市场趋势

汽车产业占市场主导地位

- 在电池产业发展初期,消费性电子产业是电池的主要消费者。然而,近年来,随着电动车(EV)销量的增加,电动车(EV)製造商已成为锂离子电池的最大消费者。

- 电动车不会排放二氧化碳或氮氧化物等温室气体,因此与传统内燃机汽车 (ICE) 相比,它们对环境的影响较小。由于这一优势,许多国家推出了补贴和政府计划来鼓励电动车的使用。

- 多个国家已宣布计划未来禁止销售内燃机汽车。挪威宣布计画在 2025 年禁止销售内燃机汽车,法国到 2040 年,英国到 2050 年。印度也计划在 2030 年逐步淘汰内燃机,中国目前正在研究类似的计画。

- 然而,截至2021年,没有一个国家可以禁止传统燃油汽车。这是因为电动车技术和电动车产业可能还没有准备好应对这项倡议,这可能会对市场造成重大干扰。儘管如此,前瞻性公告正在促使电动车製造商大力投资研发活动。

- 电动车主要使用锂离子电池。由于锂离子电池成本下降,电动车的製造成本正在下降。在预测期内,电动车的价格预计将与汽油车持平。

- 根据国际能源总署(IEA)统计,2022年全球电动车电池年锂需求量将约占77kT。预计此类新兴市场的开拓将在预测期内促进电池板市场的需求。

- 根据IEA统计,2022年,汽车锂离子(Li-ion)电池需求达到550GWh,较2021年的330GWh大幅成长约65%。这一增长主要得益于电动小客车的日益普及,2022年新註册量与前一年同期比较增长55%。

- 因此,在预测期内,汽车产业预计将主导电池板市场,因为电动车产业的需求预计将主导电池销售。

亚太地区主导市场

- 2022 年,亚太地区占据市场主导地位。随着中国和印度等国家电动车的普及,以及都市化和购电平价格上升对电子设备的高需求,预测期内该地区对锂离子电池的需求将大幅增长。预计将推动电池板的需求。

- 据估计,亚太地区很大一部分人口生活在没有电力的情况下。我们依靠煤油和柴油等传统燃料来为我们的灯供电和为行动电话充电。由于其技术优势和锂离子电池价格下降,锂离子电池整合能源储存方案的采用率可能会提高。预计这将在不久的将来成为锂离子电池製造商和电池组件製造商的重大商机。

- 中国是最大的电动车市场之一,该国增加电动车的采用符合清洁能源政策。此外,中国政府也提供财政和非财政奖励来鼓励电动车的采用。根据IEA预测,截至2022年,中国电动车电池需求量为312GWh/年,占全球电动车电池需求量的近56%。

- 2023年4月,特斯拉宣布计划透过建造一座专门生产大型电池的新工厂来扩大在中国的业务。规划中的上海工厂将能够每年生产10,000台特斯拉Megapack能源储存。 Megapack 工厂预计将于今年稍后开始建设,电池生产预计将于 2024 年夏季开始。

- 印度是世界上锂离子电池成长最快的国家之一。该国没有生产锂离子电池所需的原料蕴藏量,电池芯和电池组均从其他国家(中国、越南、泰国)进口。然后在国内市场组装或直接销售。

- 2022年3月,印度政府宣布,根据先进化学电池(ACC)电池储存PLI(生产连结奖励计画)计划,向四家中标者授予50 GWh电池产能,总金额为22亿美元。该生产设施预计将在两年内建成。

- 激励措施将根据印度製造的电池销量进行支付,重点是在国内创造高付加。约55亿美元将直接投资于ACC电池製造计划。该奖励计划旨在鼓励对印度国内供应链的新投资,并促进该国电池製造的本地化。

- 因此,由于上述因素,亚太地区预计将在预测期内主导电池板市场。

电池极板产业概况

电池极板市场处于半分散状态。市场上的主要企业(排名不分先后)包括 Enersys、Exide Industries Ltd、GS Yuasa Corporation、FIAMM Energy Technology 和 Amara Raja Batteries Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 锂离子电池价格下降

- 能源储存系统的普及

- 抑制因素

- 电池原料供需不符

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 依电池类型

- 铅酸蓄电池

- 锂离子电池

- 其他电池类型

- 按最终用户

- 车

- 航太

- 能源储存

- 电子产品

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- Companies Profiles

- Exide Industries Ltd.

- Yokohama Batteries Sdn. Bhd.

- GS Yuasa Corporation

- Amara Raja Batteries Ltd.

- Leoch International Technology Ltd.

- Crown Battery

- Hitachi Chemical Energy Technology

- Enersys

- Toshiba Corporation

- Narada Power Source Co. Ltd.

- Clarios, LLC.

- Fiamm Energy Storage Solutions SpA

第七章 市场潜力及未来趋势

简介目录

Product Code: 50000864

The Battery Plate Market size is estimated at USD 440.80 million in 2024, and is expected to reach USD 716.30 million by 2029, growing at a CAGR of 10.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and increased penetration of renewable energy driving demand for energy storage systems are likely to drive the battery plate market in the forecast period.

- On the other hand, the demand-supply mismatch of battery raw materials like cobalt, lithium, copper, etc., which is expected to restrain the demand for battery plates in the studied period.

- Nevertheless, technological advancements in novel materials (composites, alloys, etc.) and configurations (bag plates) for battery plates to increase efficiency and sustainability will likely create lucrative growth opportunities for the market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Battery Plate Market Trends

Automotive Sector to Dominate the Market

- In the early years of the battery industry, the consumer electronics sector was the major consumer of batteries. But in recent years, electric vehicle (EV) manufacturers have become the biggest consumers of lithium-ion batteries, owing to the growing sales of EVs.

- EVs do not emit CO2, NOX, or any other greenhouse gases and hence, have a lower environmental impact than conventional internal combustion engine (ICE) vehicles. Due to this advantage, many countries are encouraging the use of EVs by introducing subsidies and government programs.

- Several countries have announced plans to ban the sales of ICE vehicles in the future. Norway announced plans to ban the sales of ICE vehicles by 2025, France by 2040, and the United Kingdom by 2050. India also has plans to phase out ICE engines by 2030, while China's similar plan is currently under the relevant research phase.

- However, as of 2021, conventional fuel-fired cars cannot be banned in any country, as the EV technology and the EV industry may not be ready for such a move, which can cause significant disruptions in the market. Nonetheless, announcements for the future have encouraged EV manufacturers to invest heavily in R&D activities.

- The EVs mainly use lithium-ion batteries. The declining lithium-ion battery costs have brought down the cost of EV manufacturing. During the forecast period, EVs are expected to reach price parity with gasoline-fired vehicles.

- As per International Energy Agency (IEA) statistics 2022, the annual lithium demand for EV batteries accounted for about 77 kT worldwide. Such developments are anticipated to aid the demand for battery plate market during the forecast period.

- According to the IEA, in 2022, the demand for automotive lithium-ion (Li-ion) batteries increased significantly by about 65% to reach 550 GWh, up from 330 GWh in 2021. This growth was mainly driven by the rising popularity of electric passenger cars, with new registrations showing a remarkable 55% increase in 2022 compared to the previous year.

- Therefore, as the demand from the EV sector is expected to dominate battery sales, the automobile segment is expected to dominate the battery plate market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the market in 2022. With the increasing deployment of electric vehicles in countries such as China and India and the high demand for electronics with urbanization and increasing power purchase parity, the demand for lithium-ion batteries is expected to witness significant growth in the region, driving demand for battery plates during the forecast period.

- A significant fraction of Asia-Pacific's population is estimated to live without electricity. It depends on conventional fuels, such as kerosene and diesel, for their lighting and mobile phone charging needs. Lithium-ion battery integrated energy storage solutions are likely to witness an increasing adoption rate due to their technical benefits and declining lithium-ion battery prices. This, in turn, is expected to create a significant number of opportunities for li-ion battery and battery component manufacturers in the near future.

- China is one of the largest markets for electric vehicles, and the increasing adoption of electric vehicles in the country has been in line with the clean energy policy. Moreover, the Government of China has been providing financial and non-financial incentives to promote the adoption of electric vehicles. According to IEA, as of 2022, the EV battery demand in China stood at 312 GWh/year, accounting for nearly 56% of global EV battery demand.

- In April 2023, Tesla announced its plans to grow its presence in China by constructing a new factory dedicated to manufacturing large-scale batteries. The upcoming plant, located in Shanghai, will be able to produce 10,000 units of Tesla's "Megapack" energy storage each year. Construction of the Megapack plant is anticipated to commence later this year, with battery production set to begin in the summer of 2024.

- India is one of the fastest-growing countries globally for lithium-ion batteries. The country does not have reserves of the required raw materials for producing lithium-ion batteries, and the cells and batteries are being imported from other countries (China, Vietnam, and Thailand). They are then either assembled or directly sold in the domestic market.

- In March 2022, the Government of India announced that 50 GWh of battery capacity had been granted to four successful bidders under the PLI (Production Linked Incentive) Scheme for Advanced Chemistry Cell (ACC) Battery Storage, totaling USD 2.2 billion. The manufacturing facilities are expected to be established within a two-year timeframe.

- The incentives will be disbursed based on the sale of batteries manufactured in India, focusing on achieving higher domestic value addition. The ACC Battery storage manufacturing projects will involve a direct investment of approximately USD 5.5 billion. The incentive structure aims to encourage the industry to foster new investments in the indigenous supply chain and promote deep localization for battery manufacturing in the country.

- Therefore, owing to the above factors, Asia-Pacific is expected to dominate the battery plate market during the forecast period.

Battery Plate Industry Overview

The battery plate market is semi fragmented. Some of the major players in the market (in no particular order) include Enersys, Exide Industries Ltd, GS Yuasa Corporation, FIAMM Energy Technology, and Amara Raja Batteries Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Prices of Lithium-ion Batteries

- 4.5.1.2 Increased Penetration of Energy Storage Systems

- 4.5.2 Restraints

- 4.5.2.1 Demand-supply Mismatch of Battery Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 By Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Battery Types

- 5.2 By End-user

- 5.2.1 Automotive

- 5.2.2 Aerospace

- 5.2.3 Energy Storage

- 5.2.4 Electronics

- 5.2.5 Other End-Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Rest of Europe

- 5.3.4 Middle-East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Qatar

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Exide Industries Ltd.

- 6.3.2 Yokohama Batteries Sdn. Bhd.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 Amara Raja Batteries Ltd.

- 6.3.5 Leoch International Technology Ltd.

- 6.3.6 Crown Battery

- 6.3.7 Hitachi Chemical Energy Technology

- 6.3.8 Enersys

- 6.3.9 Toshiba Corporation

- 6.3.10 Narada Power Source Co. Ltd.

- 6.3.11 Clarios, LLC.

- 6.3.12 Fiamm Energy Storage Solutions SpA

7 MARKET OPPORTUNITIES and FUTURE TRENDS

- 7.1 Technological Advancements in Novel Materials to Increase Efficiency and Sustainability

02-2729-4219

+886-2-2729-4219