|

市场调查报告书

商品编码

1431633

锂硫电池:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Lithium Sulfur Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

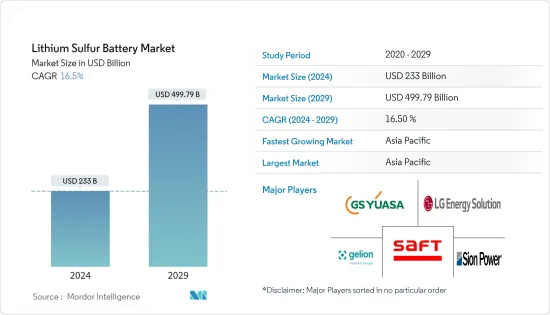

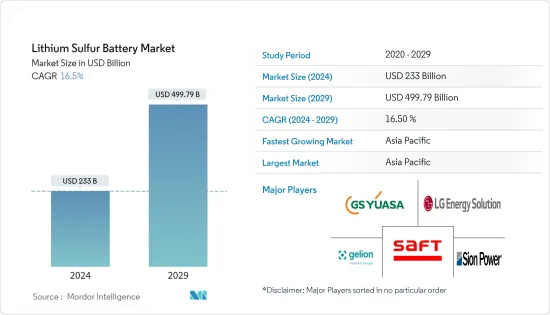

锂硫电池市场规模预计到2024年为2,330亿美元,预计2029年将达到4,997.9亿美元,在预测期内(2024-2029年)复合年增长率为16.5%。

主要亮点

- 从中期来看,由于各国减少排放的支持政策和倡议,对电动车的需求增加,以及由于可再生能源的采用增加对储能设备的需求增加,将推动预测期内的市场成长。

- 同时,锂硫电池的高成本可能会限制预测期内的市场成长。

- 也就是说,电池技术的进步大大增加了整个最终用户产业的需求。政府投资也在增加,以开发用于军事和航空应用的高能量密度电池。因此,在预测期内调查的市场可能会出现巨大的机会。

- 预计亚太地区将成为预测期内最大、成长最快的市场,大部分需求来自中国、日本等国家。

锂硫电池市场趋势

航太领域占市场主导地位

- 在航太领域,电池是关键零件,具有多种应用,包括卫星、高空飞机、太空船和无人机。航太领域使用的电池包括一次电池(一次性)和二次电池(可充电)。用于为飞机上或日常携带的设备供电的电池必须安全、能量密集、重量轻、可靠、需要最少的维护,并且可以在各种环境条件下运行,并且必须能够高效运行。

- 由于需要更高能量密度的电池,锂硫电池越来越多地安装在航太领域。这可以实现更长的寿命和更强的能源储存。航太部门也正朝向低排放源迈进。

- 美国电池新兴企业Leiten 将电动飞机视为其高能量锂硫电池的潜在市场。 2023年6月,该公司宣布已在硅谷运作一条锂硫电池中试线。锂硫电池试验线计画于 2023 年开始向国防、物流、汽车和卫星领域的早期采用者客户提供者交付电池。

- 此外,配备此类电池的无人机的使用正在全球范围内取得进展。无人机製造投资也大幅成长。

- 2023年7月,DroneShield从一家未具名的美国政府机构获得了价值3,300万美元的合约。该合约涵盖了 DroneGun Mk4 等设备的供应,该设备可用于破坏多架无人机的控制和导航能力。

- 航空业的成长主要是由于机票价格下降、经济状况发展和可支配收入增加而导致全球航空乘客数量近期增加。

- 根据国际航空运输协会 (IATA) 的数据,由于冠状病毒大流行,商业航空公司 2022 年收益损失约 7,270 亿美元。然而,到 2023年终,市场收益预计将达到 7,790 亿美元。

- 上述因素可能会推动航太的成长,并在预测期内增加对锂硫电池的需求。

亚太地区主导市场

- 预计亚太地区将主导全球锂硫电池市场。中国、日本、韩国等该地区国家是主要支持国,为市场成长做出了贡献。澳洲、印度和越南等国家也正在推进在预测期内在本国建立锂电池製造设施的计画。

- 该地区因努力提供无处不在的绿能并减少照明和行动电话充电需求对煤油和柴油等传统燃料的依赖而闻名。锂硫电池整合能源储存方案由于其高能量密度和储存容量等技术优势,预计其采用率将会提高。

- 由于能源储存系统和电动车在併网和离网应用中的采用,预计该地区对这些电池的需求将快速增长。此外,可再生能源发电设施的安装不断增加也推动了对这些电池的需求。

- 此外,中国政府正在全国投资建设充电站,以促进电动车的销售。例如,2022年1月,中国政府宣布计画在2025年为2,000万辆电动车建造充电站。

- 充电基础设施的发展正在支持电动车在该国的普及。截至2022年5月,中国电动车充电基础设施促进会(EVCIPA)在全国安装了约142个充电站,其中交流充电站806个,直流充电站61.3万个,直流-交流混合充电站485个,我们已确认拥有10,000个充电站。充电站。

- 日本的目标是製定一项名为「从井到轮零排放」的政策,以与全球零排放努力保持一致,以在2050 年之前改善能源供应和汽车创新。透过专注于用电动车取代所有车辆,我们的目标是减少每辆车的温室气体排放量减少约 80%,其中每辆小客车的温室气体排放量减少约 90%。此类政府措施可能会增加对电动车的需求,进而预计也增加对锂硫电池的需求。

- 同样,2023年4月,韩国政府与三大电池公司(LG能源解决方案有限公司、三星SDI和SK On)合作,到2030年开发包括固态电池的先进电池技术。宣布计划共同投资美国151亿美元。

- 这项措施将使韩国能够领先全球竞争对手开始固态电池的商业化生产。参与的电池公司将在韩国建立试点生产工厂,作为产品开发和製造创新的基地。这些设施将用于测试和製造包括固态电池在内的先进产品,然后在海外生产基地开始大规模生产。作为该计画的一部分,LG Energy Solutions 的目标是到 2027 年实现锂硫电池生产的商业化,首先主要为航太领域生产锂硫电池。

- 因此,由于上述因素,预计亚太地区将在预测期内主导锂硫电池市场。

锂硫电池产业概况

锂硫电池市场较为分散。市场的主要企业包括(排名不分先后)GS Yuasa Corporation、LG Energy Solutions Ltd、Saft Groupe SA、Gelion PLC 和 Sion Power Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车的普及

- 对能源储存系统(ESS)的需求增加

- 抑制因素

- 有限的循环寿命和耐用性

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按最终用户

- 航太

- 电子产品

- 车

- 电力部门

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 合併、收购、合资、合伙和协议

- 主要企业策略

- 公司简介

- GS Yuasa Corporation

- Sion Power Corporation

- LG Energy Solutions Ltd

- Li-S Energy Limited

- Polyplus Battery Co.

- Saft Groupe SA

- Gelion PLC

- LYTEN Batteries Inc.

第七章 市场机会及未来趋势

- 电池技术的进步

简介目录

Product Code: 50000866

The Lithium Sulfur Battery Market size is estimated at USD 233 billion in 2024, and is expected to reach USD 499.79 billion by 2029, growing at a CAGR of 16.5% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing demand for electric vehicles due to the various countries' supportive government policies and initiatives to reduce emissions and the increasing demand for energy storage devices amid increasing renewable energy installation drive growth in the market during the forecast period.

- On the other hand, the high cost of lithium-sulfur batteries is likely to restrain the market growth during the forecast period.

- Nevertheless, advancements in battery technology have dramatically increased the demand across end-user industries. Also, the government's investment is increasing to develop high-energy-density batteries for the military and aviation sectors. This will likely create immense opportunities for the market studied during the forecast period.

- The Asia-Pacific is expected to be the largest and fastest-growing market during the forecast period, with most of the demand coming from countries like China, Japan, and other countries.

Lithium Sulfur Battery Market Trends

Aerospace Segment to Dominate the Market

- In the aerospace sector, batteries are a vital component and have multiple applications in satellites, high-altitude aircraft, outer space vehicles, and unmanned aerial vehicles. Batteries in aerospace can be either primary (single-use) or secondary (rechargeable). Any battery designated for use as a power source in aircraft-installed or regularly carried equipment must be secure, have a high energy density, be lightweight, dependable, require minimal maintenance, and efficiently function in various environmental conditions.

- The installation of lithium-sulfur batteries is increasing across the aerospace sector as this sector requires batteries with higher energy density. Therefore, it can provide longer-lasting and more powerful energy storage. The aerospace sector is also moving toward lower emission sources.

- Lyten, a US-based battery startup company, is looking toward electric aircraft as a potential market for its energy-dense lithium-sulfur batteries. In June 2023, the company announced the commissioning of its lithium-sulfur battery pilot line in Silicon Valley. The lithium-sulfur pilot line is expected to start delivering commercial battery cells in 2023 to early adopting customers within the defense, logistics, automotive, and satellite sectors.

- Furthermore, the utilization of drones for various purposes is increasing worldwide, which can be equipped with such batteries. The investment in manufacturing drones is growing significantly.

- In July 2023, DroneShield was awarded a USD 33 million contract with an unnamed U.S. government agency. The contract covers the supply of equipment such as DroneGun Mk4, which can be used to disrupt the control and navigation capabilities of multiple drones.

- The growth in the aviation sector is mainly driven by the increasing number of air passengers globally because of the cheaper airfare in recent times, developing economic conditions, and rising disposable income.

- Due to the coronavirus pandemic, According to the International Air Transport Association (IATA), commercial airlines generated about USD 727 billion in revenue in 2022. However, the market's revenue was estimated to reach USD 779 billion by the end of 2023.

- The abovementioned factors will likely drive growth in the aerospace sector, boosting the demand for lithium-sulfur batteries during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global lithium-sulfur battery market. Countries in the region, such as China, Japan, and South Korea, are the leading supporters and are contributing to the growth of the market studied. Countries like Australia, India, and Vietnam are also following plans to set up lithium-based battery manufacturing facilities in their countries during the forecast period.

- The region is significantly making efforts to supply clean electricity to every corner and reduce dependency on conventional fuels, such as kerosene and diesel, for their lighting and mobile phone charging needs. Lithium-sulfur battery integrated energy storage solutions will likely witness an increasing adoption rate due to their technical benefits, such as high energy density and storage capacity.

- The demand for these batteries in the region is expected to grow rapidly, owing to the adoption of energy storage systems and electric vehicles for on-grid and off-grid applications. Further, the increasing installation of renewable energy generation facilities also boosts the demand for such batteries.

- Furthermore, the Chinese government is investing in building charging stations nationwide to promote electric vehicle sales. For instance, in January 2022, the Chinese government announced plans to build enough charging stations for 20 million electric vehicles by 2025.

- The development of charging infrastructure is propelling EV adoption in the country. As of May 2022, China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA) confirmed that there were nearly 1.42 million charging stations across the country, including 806 AC charging stations, 613 thousand DC charging stations, and 485 DC-AC combined charging stations.

- Japan aims to establish a policy named 'Well-to-Wheel Zero Emission,' in line with the global efforts to eliminate emissions, focusing on energy supply and vehicle innovation by 2050 and replacing all vehicles with EVs to reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle. Such government initiatives are likely to increase the demand for electronic vehicles, which, in turn, is expected to increase the demand for lithium-sulfur batteries.

- Similarly, in April 2023, the South Korean government, in partnership with the three leading battery companies (LG Energy Solution Ltd, Samsung SDI Co., Ltd and SK on Co., Ltd.), announced plans to jointly invest USD 15.1 billion by 2030 to develop advanced battery technologies, including solid-state batteries.

- The initiative will enable South Korea to begin commercial production of solid-state batteries ahead of global competitors. The participating battery firms will establish pilot production plants in South Korea, serving as centers for product development and manufacturing innovation. These facilities will be used to test and manufacture advanced products, including solid-state batteries, before initiating mass production at overseas production sites. As a part of this effort, LG Energy Solutions set out a target for commercializing the production of lithium-sulfur batteries by 2027, primarily for the aerospace sector to start with.

- Therefore, based on the above factors, the Asia-Pacific is expected to dominate the lithium-sulfur battery market during the forecast period.

Lithium Sulfur Battery Industry Overview

The lithium-sulfur battery market is fragmented. Some of the major players in the market include (in no particular order) GS Yuasa Corporation, LG Energy Solutions Ltd, Saft Groupe SA, Gelion PLC, and Sion Power Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Increasing Demand for Energy Storage Systems (ESS)

- 4.5.2 Restraints

- 4.5.2.1 Limited Cycle Life and Durability

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Aerospace

- 5.1.2 Electronics

- 5.1.3 Automotive

- 5.1.4 Power Sector

- 5.1.5 Other End Users

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Sion Power Corporation

- 6.3.3 LG Energy Solutions Ltd

- 6.3.4 Li-S Energy Limited

- 6.3.5 Polyplus Battery Co.

- 6.3.6 Saft Groupe SA

- 6.3.7 Gelion PLC

- 6.3.8 LYTEN Batteries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219