|

市场调查报告书

商品编码

1431659

卫星零件:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Satellite Parts and Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

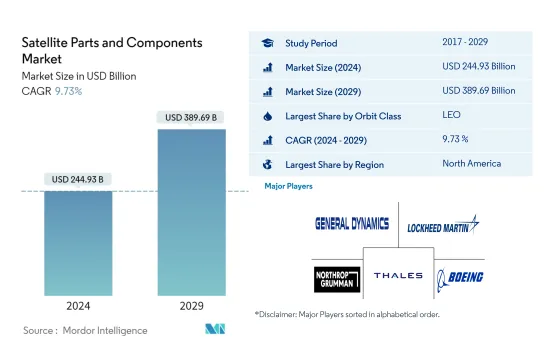

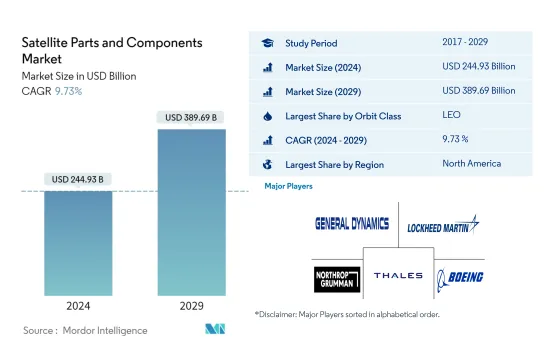

卫星零件市场规模预计2024年为2,449.3亿美元,预计2029年将达到3,896.9亿美元,在预测期内(2024-2029年)复合年增长率为9.73%增长。

新卫星製造技术的采用有望开启新的商机

- 近年来,全球卫星零件产业经历了多种趋势。随着技术的进步,小型卫星的性能和成本效率不断提高,使其成为各种应用的有吸引力的选择。卫星小型化的趋势导致对推进系统、电力系统和天线等小型卫星零件的需求增加。

- 积层製造(3D 列印)由于能够製造复杂零件并降低製造成本,在卫星产业中越来越受欢迎。该技术用于製造卫星零件,如天线、支架和引擎零件。美国太空总署和欧洲太空总署等主要航太机构都在强调这一点。作为全球太空产业的主要企业之一,美国是卫星通讯、遥感和太空探勘先进技术开发的潮流引领者。这些创新包括高性能电子设备、先进感测器、轻质材料、推进系统等。另一个趋势是在卫星设计和开发中越来越多地使用商用现成 (COTS) 现有组件和子系统。 COTS 组件可以显着减少开发时间和成本,同时提高可靠性和效能。

- 2017年至2022年5月,全球製造并发射了4,300多颗卫星。总的来说,这些趋势正在塑造全球卫星零件产业的未来,各公司在推动该领域创新的同时,也应对不断变化的市场需求。预计2023年至2029年全球卫星零件市场将成长40%。

全球卫星零件市场趋势

卫星小型化的重要性日益增加预计将影响卫星质量

- 最近,卫星变得越来越小,小型卫星几乎可以做传统卫星能做的所有事情,而成本只是传统卫星的一小部分,使得建造、发射和运行小型卫星星系变得更加容易,变得更加来越现实。相应地,人们对小型卫星的信心也急剧增加。小型卫星通常具有较短的开发週期、较小的开发团队和较低的发射成本。

- 超过1000公斤的大型卫星大致上依品质分类。在 2017 年至 2022 年间发射的大型卫星中,约 44 颗由北美组织拥有。中型卫星的质量为500至1000公斤。全球整体已发射了320多颗卫星。卫星依质量分类。质量小于500公斤的卫星称为小卫星,全球已发射小卫星3800多颗。

- 由于小型卫星的开发时间短且整体任务成本较低,该地区的小型卫星呈现成长趋势。小卫星的出现使得科技成果的取得时间大大缩短。小型卫星任务的灵活性使其能够轻鬆应对新的技术机会和需求。美国小型卫星产业得到了针对特定应用设计和製造小型卫星的强大框架的支持。由于商业和军事航太领域的需求增加,预计2023年至2029年北美地区对卫星零件的需求将大幅成长。

预计各航太机构支出的增加将对卫星产业产生正面影响。

- 卫星技术越来越多地应用于通讯、导航和地球观测等各种应用,这就产生了对新型创新卫星组件的需求。公司投资研发来开发满足这些应用的特定要求的零件。人工智慧、机器学习、积层製造和先进材料的使用等技术进步正在推动卫星零件产业的研发投资需求。这些进步为创新组件的开发创造了新的机会。

- 2022年11月,欧洲太空总署(ESA)宣布将在未来三年内投资25%的太空资金,旨在维持欧洲在地球观测领域的领先地位,扩大导航服务,并继续与美国保持探勘合作关係。他们美国提案将金额增加 %。欧洲太空总署 (ESA) 要求 22 个国家为 2023-2025 年提供约 185 亿欧元的预算支援。同样,2022 年 9 月,法国宣布预计将增加国家和欧洲太空计画的支出。

- 在北美,全球政府在太空项目上的支出在 2021 年达到约 1,030 亿美元的历史新高。该地区是太空创新和研究的中心,也是世界上最大的航太机构美国太空总署的所在地。 2022年,美国政府将在太空计画上花费约620亿美元,成为全球太空支出最高的国家。在美国,联邦机构每年接受政府资助,其中323.3亿美元用于其子公司。该地区的空间和研究津贴预计将激增,从而提高该行业在全球经济所有领域的重要性。

卫星零件行业概况

卫星零件市场集中度较高,前五家企业占比达90.12%。该市场的主要企业是(按字母顺序排列)通用动力公司、洛克希德马丁公司、诺斯罗普格鲁曼公司、泰雷兹公司和波音公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章执行摘要和主要发现

第二章 检举要约

第三章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 产业主要趋势

- 卫星小型化

- 卫星质量

- 太空探索支出

- 法律规范

- 世界

- 澳洲

- 巴西

- 加拿大

- 中国

- 法国

- 德国

- 印度

- 伊朗

- 日本

- 纽西兰

- 俄罗斯

- 新加坡

- 韩国

- 阿拉伯聯合大公国

- 英国

- 美国

- 价值炼和通路分析

第五章市场区隔

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章 竞争形势

- 主要策略趋势

- 市场占有率分析

- 公司形势

- 公司简介

- AAC Clyde Space

- BAE Systems

- General Dynamics

- Innovative Solutions in Space BV

- Jena-Optronik

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- OHB SE

- SENER Group

- Sitael SpA

- Thales

- The Boeing Company

第七章 CEO 面临的关键策略问题

第8章附录

简介目录

Product Code: 50001258

The Satellite Parts and Components Market size is estimated at USD 244.93 billion in 2024, and is expected to reach USD 389.69 billion by 2029, growing at a CAGR of 9.73% during the forecast period (2024-2029).

The adaptation of new satellite manufacturing techniques is expected to open new scope of opportunities

- The global satellite parts and components industry has been experiencing several trends in recent years. With the advancements in technology, small satellites have become more capable and cost-effective, making them an attractive option for various applications. The trend of satellite miniaturization resulted in an increasing demand for small satellite components, such as propulsion systems, power systems, and antennas.

- Additive manufacturing, or 3D printing, has been gaining popularity in the satellite industry due to its ability to produce complex parts and reduce manufacturing costs. This technology is being used to produce satellite components such as antennas, brackets, and engine parts. The major space agencies such as NASA and the European Space Agency have emphasized that. One of the major players in the global space industry, the United States, is a trendsetter in the development of advanced technologies for satellite communications, remote sensing, and space exploration. These innovative technologies include high-performance electronics, advanced sensors, lightweight materials, and propulsion systems. Another trend is the increasing use of pre-existing components and subsystems commercial-off-the-shelf (COTS) in satellite design and development. COTS components can significantly reduce development time and costs while improving reliability and performance.

- Between 2017 and May 2022, around 4300+ satellites were manufactured and launched globally. Overall, these trends are shaping the future of the global satellite parts and components industry as companies work to meet the demands of an ever-changing market while also driving innovation in the field. The global satellite parts and components market is expected to grow by 40% between 2023 and 2029.

Global Satellite Parts and Components Market Trends

The increased importance of satellite miniaturization is expected to affect the satellite mass

- Satellites are getting smaller nowadays, and a small satellite can do almost everything that a conventional satellite can at a fraction of the cost of the conventional satellite, which has made the building, launching, and operation of small satellite constellations increasingly viable. Correspondingly, reliance on them has been growing exponentially. Small satellites typically have shorter development cycles, smaller development teams, and cost much less for launch.

- The major classification types according to mass are large satellites that are more than 1,000 kg. During 2017-2022, around 44 large satellites launched were owned by North American organizations. A medium-sized satellite has a mass between 500 and 1000 kg. Globally, organizations operated more than 320 satellites launched. Satellites are classified according to mass. Satellites with a mass of less than 500 kg are considered small satellites, and around 3800+ small satellites were launched globally.

- There is a growing trend toward small satellites in the region because of their shorter development time, which can reduce overall mission costs. They have made it possible to significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can, therefore, be more responsive to new technological opportunities or needs. The small satellite industry in the United States is supported by a robust framework for designing and manufacturing small satellites tailored to serve specific application profiles. The demand for satellite parts and components in the North American region is expected to surge during 2023-2029 due to increasing demand in the commercial and military space sector.

The increasing expenditures of different space agencies is expected to positively impact the satellite industry

- The increasing use of satellite technology in various applications, including communication, navigation, and earth observation, has created a need for new and innovative satellite components. Companies are investing in R&D to develop components that meet the specific requirements of these applications. Technological advancements, such as the use of AI and machine learning, additive manufacturing, and advanced materials, are driving the need for R&D investment in the satellite parts and components industry. These advancements are creating new opportunities for the development of innovative components.

- In November 2022, ESA announced that it proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. The European Space Agency (ESA) is asking its 22 nations to back a budget of some EUR 18.5 billion for 2023-2025. Likewise, in September 2022, France announced that it is expecting to increase spending on national and European space programs.

- In North America, global government expenditure for space programs hit a record of approximately 103 billion in 2021. The region is the epicenter of space innovation and research, with the presence of NASA, the world's biggest space agency. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space in the world. In the United States, federal agencies receive aid from the government every year, known as funding, USD 32.33 billion for its subsidiaries. The spending on space and research grants is expected to surge in the region, growing the sector's importance in every domain of the global economy.

Satellite Parts and Components Industry Overview

The Satellite Parts and Components Market is fairly consolidated, with the top five companies occupying 90.12%. The major players in this market are General Dynamics, Lockheed Martin Corporation, Northrop Grumman Corporation, Thales and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Region

- 5.1.1 Asia-Pacific

- 5.1.2 Europe

- 5.1.3 North America

- 5.1.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AAC Clyde Space

- 6.4.2 BAE Systems

- 6.4.3 General Dynamics

- 6.4.4 Innovative Solutions in Space BV

- 6.4.5 Jena-Optronik

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 OHB SE

- 6.4.9 SENER Group

- 6.4.10 Sitael S.p.A.

- 6.4.11 Thales

- 6.4.12 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219