|

市场调查报告书

商品编码

1431725

药品仓储:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

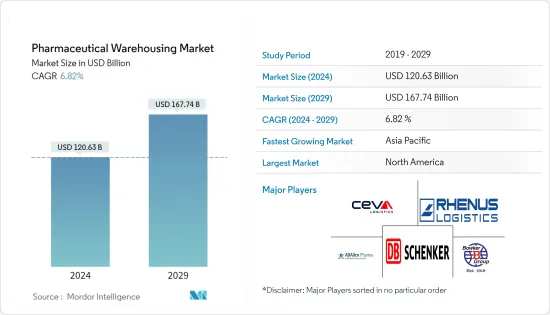

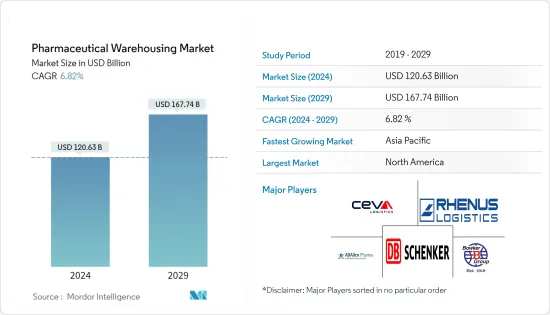

药品仓储市场的市场规模预计到2024年为1206.3亿美元,预计到2029年将达到1677.4亿美元,在预测期内(2024-2029年)复合年增长率为6.82%,预计将会增长。

市场开拓取决于多种因素,包括增加药品仓储服务的外包、製药业对品质和产品敏感度的日益重视,以及提高生产力和准确性的仓库级自动化。随着世界各地的製药商扩大产能和扩大业务,零售商和经销商之间储存原材料和成品的物流需求不断增加。外包医药仓储服务可降低物流成本12%,库存成本降低8%,物流固定资产成本降低20%。

药品供应链管理 (SCM) 面临的挑战包括影响订单准确性、可靠性、库存管理和合规性的即时可见性和技术障碍。由于製药公司的SCM越来越复杂,一些SCM功能被外包给仓储服务提供者。包装后高压加工和非热巴氏杀菌等去除微生物的服务需求量大。

此外,对 VMS(维生素、矿物质和补充品)药物、感冒药、止咳药、胃肠道药物和皮肤科药物等非处方 (OTC) 药物的需求不断增加也推动了市场的成长。医疗保健领域及时援助的重要性日益增加,也推动了药品仓储市场的发展。

医药仓储市场趋势

技术创新驱动市场

- 持续的技术创新促进製药公司之间的无缝沟通,连接製造商、仓库、批发商和其他供应链相关人员。这简化了路线规划,并减少了因天气、延误、风险和法规造成的干扰。使用 RFID(无线射频识别)标籤的远端物流追踪可提高药品安全性并防止假药进入市场。

- 在低温运输产品领域,高性能冷却技术和先进的设计功能(例如垫圈和隔热材料)在维持药品储存期间所需的温度方面发挥关键作用。

- 该监控系统全天候(24/7)运作,允许医院和医护人员追踪内部储存温度、外部环境条件、GPS 定位和设备健康状况。基于网路的介面(B Connected、视听警报、RTMD 等)可实现即时门操作,从而允许医疗专业人员快速回应。

人口成长推动市场

- 根据联合国最新预测,世界人口预计到2050年将达到高峰约103亿,然后到2080年减少约12亿。预计这一人口水准将在 21 世纪剩余时间内保持稳定。

- 由于持续的低出生率以及某些情况下移民的增加,预计未来 30 年将有 61 个国家和地区的人口将减少至少 1%。最近的疫情对人口结构产生了进一步影响,2021年全球平均寿命从前一年的72.9岁降至71岁。疫情可能导致某些地区的怀孕和出生率短期下降。

- 到 2050 年,预计有八个国家将对全球人口成长做出重大贡献:刚果民主共和国、埃及、衣索比亚、印度、奈及利亚、巴基斯坦、菲律宾和坦尚尼亚。联合国刘振民警告说,人口快速增长给消除贫困、减少饥饿和营养不良以及扩大健康和教育覆盖带来了挑战。

- 鑑于全球暖化的日益恶化以及新细菌和病毒扩散的可能性,我们可以预期疫苗的开发将会增加,以应对这些不断变化的威胁。因此,预计药品仓库的增加将适应疫苗生产的扩大。

医药仓储行业概况

市场成长的主要驱动力之一是对药品仓储外包服务的需求不断增长。然而,新兴市场需要更有效的物流支援等因素可能会限制市场成长。主要营运商包括 CEVA Logistics、Rhenus SE and Co 和 DB Schenker AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场考量与动态

- 市场概况(市场和经济的当前市场情景)

- 政府法规和倡议

- 科技趋势

- COVID-19 对市场的影响

- 市场动态

- 市场驱动因素

- 人口成长

- 增加仓储服务

- 市场限制因素/问题

- 缺乏技术纯熟劳工

- 市场机会

- 创新

- 市场驱动因素

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 低温运输仓库

- 非低温运输仓库

- 按用途

- 药厂

- 药局

- 医院

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 西班牙

- 比利时

- 英国

- 俄罗斯

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 越南

- 泰国

- 亚太地区其他国家

- GCC

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 海湾合作委员会休息

- 南美洲

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

- 非洲

- 南非

- 埃及

- 其他非洲

- 世界其他地区

- 北美洲

第六章 竞争形势

第七章市场概况(市场集中度及主要企业)

第八章 公司简介

- Alloga

- Bio Pharma Logistics

- CEVA Logistics

- Rhenus SE and Co.

- ADAllen Pharma

- WH BOWKER LTD

- Pulleyn Transport Ltd

- TIBA

- DB Schenker AG

- DACHSER Group SE*

第九章市场机会与未来性

第10章附录

第十一章 附录 免责声明

The Pharmaceutical Warehousing Market size is estimated at USD 120.63 billion in 2024, and is expected to reach USD 167.74 billion by 2029, growing at a CAGR of 6.82% during the forecast period (2024-2029).

The market's development hinges on several factors, including increased outsourcing of pharma warehousing services, heightened emphasis on quality and product sensitivity in the pharmaceutical sector, and warehouse-level automation for improved productivity and accuracy. Pharmaceutical manufacturers worldwide are expanding their production capacity and operations, leading to a heightened need for logistics between retailers and distributors for storing raw materials and finished goods. Outsourcing pharmaceutical warehousing services can reduce logistics costs by 12%, inventory costs by 8%, and logistics fixed asset costs by 20%.

Challenges faced by pharmaceutical supply chain management (SCM) include real-time visibility and technology barriers that affect order accuracy, dependability, inventory management, and compliance. Due to the growing complexity of SCM for pharmaceutical companies, certain SCM functions are outsourced to warehousing and storage service providers. Services like high-pressure processing after packaging and nonthermal pasteurization for micro-organism elimination are in high demand.

The market growth is also propelled by the rising demand for over-the-counter (OTC) medications such as VMS (vitamin, mineral, and supplement) medicines, common cold and cough medicines, gastrointestinal drugs, and dermatology treatments. The increasing importance of fast-track aid in the healthcare sector is another driving force in the pharmaceutical warehousing market.

Pharmaceutical Warehousing Market Trends

Technological Innovation is driving the market

- Constant technological advancements facilitate seamless communication among pharmaceutical companies, connecting manufacturers, warehouses, wholesalers, and other supply chain stakeholders. This streamlines route planning, mitigating disruptions caused by weather, delays, risks, and regulations. Employing radio-frequency identification (RFID) tags for remote logistics tracking enhances pharmaceutical safety, ensuring counterfeit drugs do not infiltrate the market.

- In the realm of cold chain products, high-performance cooling technologies and advanced design features like gaskets and insulations play a crucial role in maintaining desired temperatures while storing medicines.

- Monitoring systems operate 24x7, allowing hospital and healthcare staff to track internal storage temperatures, external ambient conditions, GPS positioning, and device health. Real-time door operations facilitated by web-based interfaces (such as B Connected, Audio-Visual Alarms, and RTMDs) enable swift responses by healthcare professionals.

Increase in Population is driving the market

- The United Nations' latest projections suggest a peak global population of around 10.3 billion people by 2050, followed by an anticipated decrease of approximately 1.2 billion individuals by 2080. This population level is expected to stabilize throughout the remainder of the 21st century.

- In 61 countries or regions, a projected population decline of at least one percent over the next 30 years is foreseen due to persistently low fertility rates and, in some cases, increased emigration rates. The recent pandemic has further impacted population dynamics, reducing global life expectancy at birth to 71 years in 2021, down from the previous year's 72.9. The pandemic likely led to short-term declines in pregnancy and childbirth in certain regions.

- By 2050, eight countries-namely the DR Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines, and Tanzania-are anticipated to contribute significantly to global population growth. Liu Zhenmin of the United Nations has cautioned that rapid population growth poses challenges to eradicating poverty, reducing hunger and malnutrition, and expanding health and education coverage.

- Considering the escalating effects of global warming and the potential rise in new bacteria and viruses, there's a forecast for increased development of vaccines to combat these evolving threats. Consequently, this development will likely lead to a rise in pharmaceutical warehousing to accommodate the expanded vaccine production.

Pharmaceutical Warehousing Industry Overview

One of the main drivers of the market growth is the increasing demand for pharmaceutical warehousing outsourced services. However, factors such as the need for more effective logistics support in developing countries may limit the growth of the market. Some of the major players operating players are CEVA Logistics, Rhenus SE and Co. and DB Schenker AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Market Scenario of Market and Economy)

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends

- 4.4 Impact of Covid-19 on the market

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Rise In Population

- 4.5.1.2 Increase in Warehousing Services

- 4.5.2 Market Restraints/ Challenges

- 4.5.2.1 Shortage of Skilled Labor

- 4.5.3 Market Opportunities

- 4.5.3.1 Technological Innovations

- 4.5.1 Market Drivers

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Powers of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 BY Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 USA

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 Belgium

- 5.3.2.3 United Kingdom

- 5.3.2.4 Russia

- 5.3.2.5 Germany

- 5.3.2.6 France

- 5.3.2.7 Italy

- 5.3.2.8 Rest-of-Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 Australia

- 5.3.3.2 China

- 5.3.3.3 India

- 5.3.3.4 Indonesia

- 5.3.3.5 Japan

- 5.3.3.6 Malaysia

- 5.3.3.7 Vietnam

- 5.3.3.8 Thailand

- 5.3.3.9 Rest-of-APAC

- 5.3.4 GCC

- 5.3.4.1 UAE

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Qatar

- 5.3.4.4 Rest-of GCC

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Egypt

- 5.3.6.3 Rest of Africa

- 5.3.7 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

7 Overview (Market Concentration and Major Players)

8 Company Profiles

- 8.1 Alloga

- 8.2 Bio Pharma Logistics

- 8.3 CEVA Logistics

- 8.4 Rhenus SE and Co.

- 8.5 ADAllen Pharma

- 8.6 WH BOWKER LTD

- 8.7 Pulleyn Transport Ltd

- 8.8 TIBA

- 8.9 DB Schenker AG

- 8.10 DACHSER Group SE*