|

市场调查报告书

商品编码

1432328

抗菌涂料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Anti-microbial Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

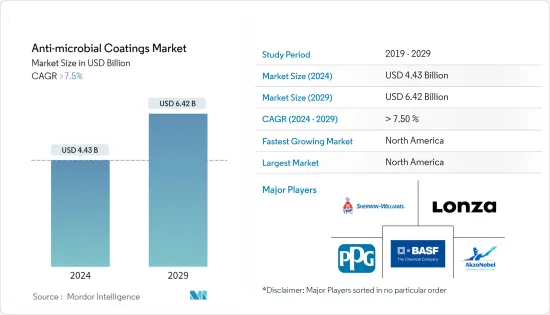

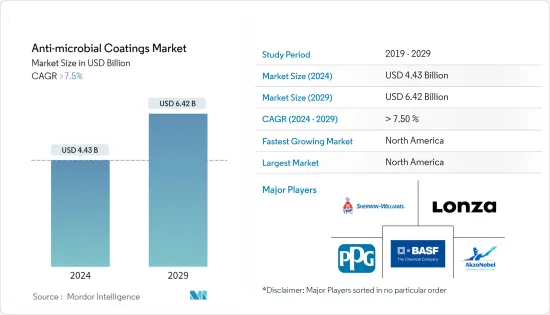

抗菌涂料市场规模预计到2024年为44.3亿美元,预计到2029年将达到64.2亿美元,在预测期内(2024-2029年)复合年增长率预计将超过7.5%。

2020 年市场受到 COVID-19 的正面影响。疫情导致医疗产品和医疗设备中抗菌涂层的使用大幅增加,例如手术口罩、手套、伤口敷料、医院纺织品、手术设备等,导致新冠病例增加19. 被压制了。

主要亮点

- 根据《华尔街日报》报道,2020年1月美国N95口罩总产量约4,500万隻,但到2020年终达到约1.8亿隻,大幅增加约300%。

- 短期内,医疗设备、手套、口罩和其他医疗设备和产品中越来越多地采用抗菌涂层预计将推动市场成长。

- 银涂层在全球市场占据主导地位,由于抗菌涂层的应用不断扩大,尤其是在医疗产业,预计在预测期内将出现成长。

- 另一方面,新兴低度开发国家缺乏对抗菌涂料的技术意识,原材料价格的波动预计将阻碍研究市场的成长。

抗菌涂料市场趋势

医疗保健领域主导市场

- 医疗保健是智慧抗菌涂料使用最多的主要产业之一。这些涂层主要用于手术器械,因为它们有助于减少病菌和细菌在患者、医生和看护者之间的传播。

- 抗菌添加剂被纳入医疗设备和医疗保健家具中,为预防和控制医疗环境中的感染提供解决方案。

- 在医疗保健产业,抗菌涂层也用于手术口罩、手套、绷带、伤口敷料和医院纺织品(机织和不织布)。

- 医疗保健应用抗菌涂料的最大市场需求位于北美和欧洲。这些地区进行了大量的研发投资,并持续致力于开发先进的医疗设备和设备。

- 美国在全球医疗保健市场中占有最大份额,医疗产业发展迅速。根据联邦基金预测,2021年美国将把GDP的17.8%用于医疗保健。到2028年,美国医疗保健支出将达到6.2兆美元。

- 德国政府正在製定立法,预计将促进医疗技术的发展。该法重点在于智慧健康和中年问题、医学研究中的诊断、治疗和预防医学、基于研究的医疗技术、医疗技术与系统的整合和供应解决方案,以及维持和改善生活品质。

- 根据联邦统计局 (Destatis) 的数据,在 COVID-19 爆发的第二年(即 2021 年),德国的医疗保健支出增至 4,741 亿欧元(5,608.6 亿美元)。

- 中国是全球第二大医疗保健市场。然而,该国从已开发国家进口技术高端的植入。

- 此外,中国是全球最大的医疗设备製造中心,目前70%以上的医疗设备依赖进口。中国政府推出政策支持并鼓励国内医疗设备创新,为市场提供了机会。

- 中国正在投资公立医院,旨在在不久的将来改善医疗保健产业。据中华人民共和国财政部称,2022年中国用于健康和卫生的公共支出总额将达到约2.25兆元(3,487.5亿美元)。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

北美市场占据主导地位

- 北美地区在全球市场占有率中占据主导地位。医疗保健产业的持续技术创新、加工食品产量的增加以及建筑业的兴起是促进该地区市场成长的因素。

- 美国拥有世界上最强大的医疗保健系统之一。该国对医疗保健的投资正在迅速增加。根据医疗保险和医疗补助服务中心的数据,2021 年美国医疗保健支出将增加 2.7%,达到 4.3 兆美元,即人均 12,914 美元。

- 美国是全球最大的医疗设备市场,拥有最强大、最先进的医疗研发设施推动市场成长。

- 在美国,随着政府和医院正在实施各种预防医院感染的倡议,人们对医疗设备的兴趣与日俱增。

- 建筑业使用的各种材料都采用了抗菌技术,以减少霉菌的生长,创造更清洁的环境。

- 根据牛津经济研究院预测,2020年至2030年,北美建筑业产值将成长32%,即5,800亿美元,到2030年将达到2.4兆美元。根据加拿大统计局数据,2023年3月加拿大建筑投资下降1.3%至203亿美元。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

抗菌涂料产业概况

抗菌涂料市场是一个分散的市场,众多参与者占据了市场需求的一小部分。这些主要企业包括(排名不分先后)Akzo Nobel NV、 BASF SE、The Sherwin-Williams Company、PPG Industries Inc. 和 Lonza。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 医疗保健行业越来越多地采用抗菌涂层

- 抗菌耐用消费品需求增加

- 抗菌纺织产品需求不断增加

- 抑制因素

- 开发中国家和低度开发国家缺乏技术意识

- 活性成分的排放

- 使用银引起的健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 材料

- 银

- 铜

- 聚合物

- 有机材料

- 其他材料

- 目的

- 建筑/施工

- 食品加工

- 纤维製品

- 家用电器

- 卫生保健

- 海洋

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AK Steel Corporation

- Akzo Nobel NV

- AST Products Inc.

- BASF SE

- BioFence

- Biointeractions Ltd

- Covalon Technologies Ltd

- DSM

- DuPont

- Hydromer

- Lonza

- Microban Products Company

- PPG Industries Inc.

- Sciessent LLC

- Sono-Tek Corporation

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

- Troy Corporation

第七章 市场机会及未来趋势

- 活性化研究和开发

- 多功能涂料的开发

- 对暖通空调应用的需求不断增长

The Anti-microbial Coatings Market size is estimated at USD 4.43 billion in 2024, and is expected to reach USD 6.42 billion by 2029, growing at a CAGR of greater than 7.5% during the forecast period (2024-2029).

The market was positively impacted by COVID-19 in 2020. Owing to the pandemic scenario, the usage of anti-microbial coatings in medical products and devices, including surgical masks, gloves, wound dressings, hospital textiles, and surgical devices, significantly increased to curb the growth of new COVID-19 cases.

Key Highlights

- According to Wall Street Journal, the total production volume of N95 masks in the United States was about 45 million in January 2020 and reached about 180 million by the end of 2020, witnessing an exponential growth of about 300%, which, in turn, has stimulated the demand in the anti-microbial coatings market.

- Over the short term, increasing adoption of anti-microbial coatings in medical devices, gloves, face masks, and other healthcare equipment and products is expected to drive the market's growth.

- Silver coatings dominated the global market and are expected to grow during the forecast period, owing to the growing application of anti-microbial coatings, especially in the medical industry.

- On the flip side, the lack of technological awareness regarding anti-microbial coatings in developing and under-developed nations and volatility in raw material prices are expected to hinder the growth of the studied market.

Anti-Microbial Coatings Market Trends

Healthcare Segment to Dominate the Market

- Healthcare is one of the major industries with the maximum usage of smart anti-microbial coatings. These coatings are used majorly on surgical devices as they help inhibit the spread of germs and bacteria among patients, doctors, and caretakers.

- Anti-microbial additives are incorporated into medical equipment and healthcare furnishings to provide solutions to prevent and control infection in healthcare environments.

- In the healthcare industry, anti-microbial coatings are also used for surgical masks, gloves, bandages, wound dressing, and hospital textiles (woven and non-woven), among others.

- North America and Europe hold the largest market demand for anti-microbial coatings for healthcare applications. These regions incur huge research and development investments and make continuous efforts to develop advanced medical devices and equipment.

- The United States has the largest share of the global healthcare market and the rapid growth of the medical industry. According to the Commonwealth Fund, the United States spent 17.8% of GDP on healthcare in 2021. By 2028, the United States' healthcare spending will reach USD 6.2 trillion.

- The German government has been developing laws that are expected to drive the growth of medical technologies. The laws focus on smart health and mid-aging problems, diagnostic, therapy, and preventive medicine in medical research, research-based medical technologies, integration of medical technologies in systems and supply solutions, and preservation and improvement of life quality.

- According to the Federal Statistical Office (Destatis), the healthcare expenditure in Germany rose to Euros 474.1 billion (USD 560.86 billion) in the second COVID-19 year of 2021.

- China is the second-largest healthcare market in the world. However, the country imports technologically high-end implants from advanced economies.

- In addition, China is the largest medical device manufacturing hub worldwide, where currently, the country is importing over 70% of medical devices. The Chinese government started policies to support and encourage domestic medical device innovation, providing opportunities for the market.

- China is investing in public hospitals and aims to raise the healthcare industry in the near future. According to the Ministry of Finance of the People's Republic of China, China's total public expenditure on healthcare and hygiene amounted to about 2.25 trillion yuan (USD 348.75 billion) in 2022.

- Therefore, the aforementioned factors are expected to show a significant impact on the market in the coming years.

North America Region to Dominate the Market

- The North American region dominated the global market share. Continuous innovation in the healthcare industry, increasing production of processed food, and rise in the construction industry are the factors augmenting the regional market growth.

- The United States has one of the most robust healthcare systems in the world. There has been a surge in healthcare investment in the country. According to the Centers for Medicare & Medicaid Services, healthcare spending in the United States increased by 2.7% in 2021, reaching USD 4.3 trillion, or USD 12,914 per person.

- The United States stands to be the largest medical device market in the world, with the strongest and most advanced research and development medical facilities boosting the growth of the market.

- The preference for anti-microbial coated medical equipment in the United States is increasing due to the various initiatives taken by the government as well as the hospitals in the country to prevent nosocomial infections.

- The built-in anti-microbial technologies are incorporated in various materials used in the building industry, which reduces mold and mildew growth and thus creates cleaner environments.

- According to Oxford Economics, North America's construction output will grow by 32%, or USD 580 billion, from 2020 to 2030, to USD 2.4 trillion in 2030. According to Statistics Canada, the building construction investment in Canada declined by 1.3% to USD 20.3 billion in March 2023.

- Therefore, the aforementioned factors are expected to show a significant impact on the market in the coming years.

Anti-Microbial Coatings Industry Overview

The anti-microbial coatings market is a fragmented market, with numerous players holding a small share of market demand. Some of these major players include (not in any particular order) Akzo Nobel N.V., BASF SE, The Sherwin-Williams Company, PPG Industries Inc., and Lonza, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Antimicrobial Coatings in the Healthcare Industry

- 4.1.2 Increasing Demand for Germ Resistant Durable Goods

- 4.1.3 Increasing Demand for Antimicrobial Textiles

- 4.2 Restraints

- 4.2.1 Lack of Technological Awareness in Developing and Under-developed Nations

- 4.2.2 Emission of Active Ingredients

- 4.2.3 Health Concerns with Silver Usage

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material

- 5.1.1 Silver

- 5.1.2 Copper

- 5.1.3 Polymeric

- 5.1.4 Organic

- 5.1.5 Other Materials

- 5.2 Application

- 5.2.1 Building and Construction

- 5.2.2 Food Processing

- 5.2.3 Textiles

- 5.2.4 Home Appliances

- 5.2.5 Healthcare

- 5.2.6 Marine

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AK Steel Corporation

- 6.4.2 Akzo Nobel NV

- 6.4.3 AST Products Inc.

- 6.4.4 BASF SE

- 6.4.5 BioFence

- 6.4.6 Biointeractions Ltd

- 6.4.7 Covalon Technologies Ltd

- 6.4.8 DSM

- 6.4.9 DuPont

- 6.4.10 Hydromer

- 6.4.11 Lonza

- 6.4.12 Microban Products Company

- 6.4.13 PPG Industries Inc.

- 6.4.14 Sciessent LLC

- 6.4.15 Sono-Tek Corporation

- 6.4.16 Specialty Coating Systems Inc.

- 6.4.17 The Sherwin-Williams Company

- 6.4.18 Troy Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development Activities

- 7.2 Development of Multi-functional Coatings

- 7.3 Growing Demand for HVAC Applications