|

市场调查报告书

商品编码

1432360

应用程式效能管理 (APM):市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)Application Performance Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

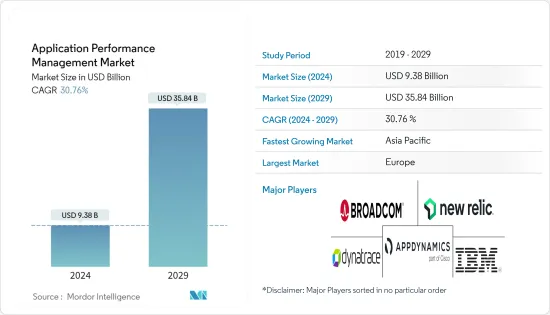

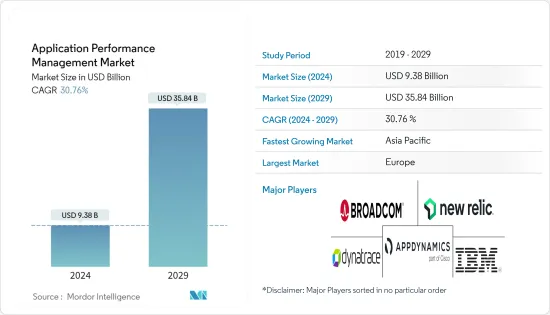

应用效能管理(APM)市场规模预计到 2024 年为 93.8 亿美元,预计到 2029 年将达到 358.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 30.76%。

应用程式效能监控 (APM) 将软体系统分散在不同级别,以提高效率和生产力。它还可以帮助您分析巨量资料并快速解决问题。

主要亮点

- 关键策略之一是关键资料分析,这是由业务全球化、行动和云端运算普及、寻求解决、分析和改进业务流程、应用程式效能监控等的公司之间日益激烈的竞争所推动的。随着消费者对云端和行动运算的需求不断增长,正在加速市场成长。

- APM 有助于应用程式发现和依赖关係映射 (ADDM),识别所有伺服器和应用程序,同时向使用者发出警报并自动执行威胁回应步骤。促进彙报并提供个人化仪表板。此外,应用程式管理软体产品具有高度扩充性且实施成本低。

- 此外,日誌管理的扩展、研发的进步以及先进 APM 分析的开拓将在估计期间支援应用程式效能监控市场的扩展。

- 然而,限制市场成长的主要因素包括最终用户意识的需求、资金筹措成本的上升以及消费者对应用程式效能监控(APM)的意识缺乏。在上述预测期内,由于业务需求的不断增长和变化,应用程式效能监控市场可能会面临挑战。

- 由于住院需求、IT 连接或网路频宽等需求的增加,应用程式效能管理市场预计将因 COVID-19 爆发而大幅增长。随着商店和活动的关闭,许多企业只能透过应用程式和服务来收益。因此,应用效能管理(APM)解决方案在疫情期间发挥了关键作用。

应用程式效能管理 (APM) 市场趋势

大公司的招募推动市场成长

- 能够独立且大规模託管这些系统的组织倾向于直接软体解决方案。推动这项需求的是改进的安全性和资料管理。 APM 系统直接作为软体解决方案交付,还可以根据客户需求进行自订调整,并与他们控制的应用程式无缝整合。对参数的完全存取可让您增强和管理分析,并提供更强大的功能。

- 此外,随着混合云功能的进步,越来越多的大型企业正在整合 APM 系统,从而实现软体解决方案的本地部署以及公有云的扩展。 APM系统软体正在逐渐走向整合模型,允许同时分析效能、业务和使用者体验。

- 各个细分市场之间的相互关联和密切联繫正在改变这一趋势。例如,应用程式效能影响使用者体验,业务分析有助于识别高峰期和退出点。应用效能管理 (APM) 系统的整体方法极大地扩展了其功能,从而对所研究的行业产生了显着的推动作用。

- 许多程式提供应用程式效能管理 (APM),它有几个好处。例如,用于监控组织的 Web 伺服器的解决方案就属于此类。此外,它还有助于应用程式发现和依赖关係映射 (ADDM)、查找所有伺服器和应用程式并对其进行分类、向使用者发出警报并自动执行与威胁相关的活动。它还有助于彙报并提供个人化的仪表板。此外,应用程式管理软体产品具有高度扩充性且实施成本低。

- 如果有效使用,APM 工具可以在技术层面与您的业务互动时提供对客户体验的重要见解,为您的公司提供宝贵的机会,使技术性能更好地与您的目标保持一致。我们可以提供。对改善客户体验的需求不断增长预计将推动市场扩张。

欧洲占主要市场占有率

- 中欧地区的APM服务供应商正在积极参与併购,以支持该产业的扩张。总部位于荷兰的 Azure 专家 MSP Sentia 收购了荷兰-丹麦 MSP Ymir,成为欧洲先进关键任务云端应用程式託管服务的产业领导者。 ExtraHop、AppDynamics 和 Dynatrace 等公司定期与 Ymor 合作,后者被誉为应用程式效能专家。

- 欧洲地区许多政府正在将其IT服务迁移到云端,以提高效率并降低成本。透过以集中的共用服务取代断开连接和过时的旧有系统,政府机构可以将 IT 资源集中在核心业务上,提高资料安全性并优先考虑人力资源。

- Amazon 等公司正在提供 S3 云端储存类,用于资料保存和应用程式託管,以适应日益增长的云端采用。低成本使这些解决方案成为该地区中小型企业的有吸引力的选择。越来越多地使用资料中心和 Web 伺服器来託管应用程序,推动了欧洲市场对应用程式效能管理 (APM) 的需求。

- 企业日益全球化、行动运算的激增以及日益激烈的商业竞争推动了解决、评估和改进该地区业务流程的普及。

- 欧洲 APM 公司开始对将其产品视为 AIOps 工具表现出兴趣。 IT 营运和其他组织已经拥有丰富的资料,随着微服务、云端和物联网 (IoT) 的发展,这种情况预计将变得更加复杂。

应用效能管理 (APM) 产业概述

应用程式效能管理(APM)市场的竞争是温和的。主要参与者包括 New Relic Inc.、Dynatrace LLC 和 IBM Corp.。

2023 年 2 月,New Relic 宣布将与 Microsoft Azure 联盟扩大市场覆盖范围,在 Microsoft Azure Marketplace 中提供 Azure 原生 New Relic 服务,让开发人员和 DevOps 从 Azure 入口网站存取 New Relic。专业人士将受益。

2022 年 11 月,Dynatrace 将进阶可观测性和 AIOps 扩展到 AWS Compute Optimizer。该服务使用客户资源使用资料来提出建议,以提高 Amazon Web Services (AWS) 资源的使用率。透过此支持,Dynatrace 平台可以使用 Dynatrace 的因果 AIOps 和自动化功能,近乎即时地自动撷取和分析客户 AWS 环境中的每个 Amazon Elastic Compute Cloud (Amazon EC2) 执行个体。您现在可以持续优化您的 Amazon EC2 消耗成本、服务可靠性和性能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 日益需要提高最终用户满意度以实现成功的数位业务

- 市场挑战

- 最终用户缺乏意识,在量化不同提供者提供的类似因素方面存在差异

- 评估 COVID-19 对产业的影响

第六章市场区隔

- 按配置

- 本地

- 云

- 按公司规模

- 中小企业

- 大公司

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 供应商市场占有率分析

- 公司简介

- AppDynamics LLC(Cisco Systems Inc.)

- New Relic Inc.

- Dynatrace LLC

- IBM Corp.

- Broadcom Inc.

- Microsoft Corporation

- Mic Focus International PLC

- Datadog Inc.

- SignalFX(part of Splunk Inc.)

- Akamai Technologies Inc.

第八章投资分析

第9章市场的未来

The Application Performance Management Market size is estimated at USD 9.38 billion in 2024, and is expected to reach USD 35.84 billion by 2029, growing at a CAGR of 30.76% during the forecast period (2024-2029).

Application performance monitoring (APM) distributes software systems at different levels to increase efficiency and productivity. Also, it helps analyze big data to solve problems quickly.

Key Highlights

- One of the primary strategies is significant data analytics, which is accelerating market growth along with business globalization, the proliferation of mobile and cloud computing, the increasing level of competition among companies to solve, analyze, and improve business processes, technological development in application performance monitoring, and rising consumer demand for cloud and mobile computing.

- APM aids application discovery and dependency mapping (ADDM), which identifies all servers and apps while alerting users and automating threat response procedures. It facilitates reporting and offers a personalized dashboard. Additionally, application management software products have great scaling potential and are less expensive to deploy.

- Additionally, growing log management, growing R&D, and developing advanced APM analytics will help the application performance monitoring market expand throughout the estimated period.

- However, the main factors limiting market growth include a need for end-user awareness, rising funding costs, and a lack of consumer awareness of application performance monitoring (APM). In the forecast period mentioned above, the application performance monitoring market will face challenges from rising and shifting business demand.

- Due to increased demand, including inpatient needs, IT connectivity, or even network bandwidth, the application performance management market was anticipated to grow significantly in response to the COVID-19 pandemic. Due to the closure of storefronts and events, many businesses can only generate revenue through their applications and services. Therefore, application performance management solutions were crucial during that time of the pandemic.

Application Performance Management Market Trends

Adoption in Large Enterprises to Drive Market Growth

- Organizations capable of hosting these systems independently and on a large scale are drawn to direct software solutions. The demand for this is driven by improved security and data control. APM systems that are directly supplied as software solutions can also be custom tuned to client needs, integrating seamlessly with the application that has to be controlled. Due to total access to parameters, this not only enables analytics enhancement and administration but also offers better capabilities.

- Additionally, as hybrid clouds' capabilities advance, more large businesses are integrating APM systems, which leads to the on-premises deployment of software solutions and their extension to public clouds. The software for APM systems is gradually moving towards unified models, which can analyze performance, business, and user experience simultaneously.

- The interconnectedness and intimate ties between the various segments have caused this trend to change. For instance, application performance impacts user experience, and business analysis can help identify peak hours or exit points. The application performance management systems' holistic approach has dramatically expanded their functionality, consequently significantly boosting the industry under study.

- Numerous programs provide application performance management, which has several benefits. For instance, solutions for monitoring an organization's web server can be found in this category. Additionally, it aids in app discovery and dependency mapping (ADDM), finds and classifies all servers and apps, alerts users, and automates threat-related activities. It facilitates reporting and offers a personalized dashboard. Additionally, application management software products have great scaling potential and are less expensive to deploy.

- When used effectively, APM tools offer significant insight into the customer experience when clients interact with a business on a technical level, providing a rare chance for companies to match their technical performance with their goals better. The growing demand to enhance the customer experience is anticipated to fuel market expansion.

Europe to Hold Significant Market Share

- The Central Europe region's APM service providers aggressively participate in mergers and acquisitions to support the sector's expansion. To become the industry leader in European managed services for sophisticated and mission-critical cloud applications, Sentia, a Netherlands-based Azure Expert MSP, has acquired Dutch-Danish MSP Ymir. While ExtraHop, AppDynamics, and Dynatrace are among the companies that regularly cooperate with Ymor, the latter is known as an expert in application performance.

- To increase efficiency and cut costs, many governments in the European region are migrating their IT services to the cloud. Government organizations can concentrate their IT resources on core business, increase data security, and prioritize human resources by replacing disconnected and outdated legacy systems with centralized shared services.

- Companies like Amazon provide S3 cloud storage classes for data preservation and application hosting to address increased cloud adoption. Lower costs make these solutions an attractive option for the region's SMEs. The expanding use of data centers and web servers to host applications has boosted the European market's demand for application performance management.

- The need to solve, assess, and improve business processes in this region is driven by growing company globalization, the spread of mobile and cloud computing, and rising levels of business competition.

- European APM companies have begun to exhibit interest in having their products considered as AIOps tools. Data is already abundant in IT operations and other organizations, and as microservices, the cloud, and the Internet of Things (IoT) develop, this situation is expected to get more complex.

Application Performance Management Industry Overview

The application performance management market is moderately competitive. Major players include New Relic Inc., Dynatrace LLC, and IBM Corp.

In February 2023, New Relic announced it would expand its market reach with the Microsoft Azure Alliance, where the availability of the Azure Native New Relic Service in the Microsoft Azure Marketplace will benefit developers and DevOps professionals who can access New Relic through the Azure portal.

In November 2022, Dynatrace extended advanced observability and AIOps to AWS Compute Optimizer. This service used customers' resource utilization data to recommend providing Amazon Web Services (AWS) resources for improved utilization. This support enabled the Dynatrace platform to automatically capture and analyze all Amazon Elastic Compute Cloud (Amazon EC2) instances in customers' AWS environments in near-real time and use Dynatrace causal AIOps and automation capabilities to continuously optimize Amazon EC2 consumption for cost, service reliability, and performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing need for End-user satisfaction for successful Digital Business Operations

- 5.2 Market Challenges

- 5.2.1 Lack of End user Awareness and Variability in the Quantification of Similar Factors Provided by Different Providers

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis

- 7.2 Company Profiles

- 7.2.1 AppDynamics LLC (Cisco Systems Inc.)

- 7.2.2 New Relic Inc.

- 7.2.3 Dynatrace LLC

- 7.2.4 IBM Corp.

- 7.2.5 Broadcom Inc.

- 7.2.6 Microsoft Corporation

- 7.2.7 Mic Focus International PLC

- 7.2.8 Datadog Inc.

- 7.2.9 SignalFX (part of Splunk Inc.)

- 7.2.10 Akamai Technologies Inc.