|

市场调查报告书

商品编码

1432380

温度感测器:市场占有率分析、产业趋势、成长预测(2024-2029)Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

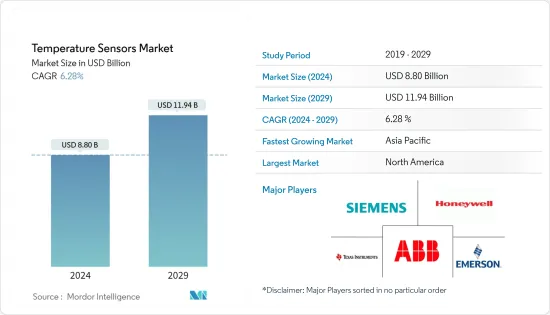

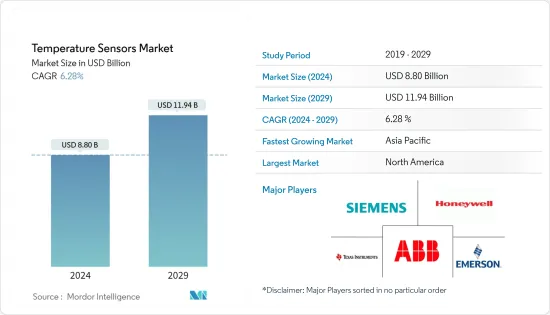

温度感测器市场规模预计到2024年为88亿美元,预计到2029年将达到119.4亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为6.28%。

由于对 COVID-19 测试和筛检的需求不断增加,与物联网连接一起使用的温度感测器预计将加速发展。 Semtech 和 Polysense Technologies 合作开发了基于 Semtech 的 LoRa LPWAN 的人体温度监测设备。 Semtech 的体温感测器为第一线医护人员提供即时资料,并能够快速筛检体温过高的人。

主要亮点

- 汽车产业和工业最终用户应用中越来越多地采用 HVAC 模组是温度感测器市场的关键驱动因素之一。

- 家用电子电器产品需求的增加预计也将进一步推动市场成长。全球对安全和监控的日益关注以及政府针对安全规范的各种倡议预计也将推动温度感测器市场的采用。

- 无线温度感测器在各行业中的日益普及主要是由于非接触式测量功能的应用,使它们能够到达无法物理放置设备的位置。

- 温度感测器的各种应用,如火炬系统、井口罐、化学品罐、管道资料采集和压缩机是温度感测器在石油和天然气行业的多种应用中的一些。温度感测器在石油和天然气行业的应用被认为非常重要。如果工作温度较高,在管道或储槽内安装有线设备效率较低。

- 此外,由于该行业的性质,温度感测器的使用非常重要,因为监控这些生产线的温度变化并保持安全的工作条件至关重要。过热蒸气和水管道延长,这些事件可能导致其他资产的损坏和损失。

- 个人运算产业的趋势,例如更小的系统、更快的处理器以及对更高级应用的支持,使得热监控和控制变得至关重要。这一趋势,加上桌上型电脑和可携式电脑的强劲销售和进步,可能会继续支持温度感测器的成长。

- 荣耀最近发布的智慧型手机之一荣耀 Play 4 Pro 配备了红外线温度感测器。在 COVID-19 大流行期间,这可能是智慧型手机上的有用功能,因为高烧可能是感染 COVID-19 的征兆。据荣耀称,该感测器工作在摄氏-20度到100摄氏度(约-4摄氏度到212华氏度)之间,覆盖超过人体潜在温度范围,并提供10分钟的工作时间。能够感知低至1 度的温度。

温度感测器市场趋势

红外线温度感测器推动市场成长

- 与许多接触式温度感测器不同,红外线温度感测器可用于以 10m/s 或更慢的速度测量移动物体。此类温度感测器的优点使其可用于製造、汽车、食品加工和国防等各领域的多种应用。

- 红外线温度感测器还可以应用于各种国防应用,例如可变发射率测量和光学目标瞄准以帮助活动追踪。由于军费开支的增加,这两种应用的需求和发展都在持续成长。

- 近来,随着全球工业4.0政策的推行,製造领域对红外线温度感测器的需求不断增加。在预测性维护方面,红外线温度感测器正日益获得重要的市场占有率。对运动部件温度监控日益增长的需求很难被红外线温度感测器的效率所取代。

- 对于塑胶成型产业,红外线感测器技术可以优化热塑性塑胶的脱模过程。在汽车产业,红外线温度感测器与喷漆车间结合使用,在智慧演算法的帮助下,它们计算底盘在干燥箱中需要多长时间而不影响喷漆。

- 由于感染COVID-19的人数迅速增加,世界各国正采取措施阻止感染的传播。自从这种致命疾病爆发以来,就出现了每天检查体温的需要。为了每个人的安全和遏制,广泛的发烧检测和筛检可能很快就会成为现实,不仅是针对今天影响我们的 COVID-19,而且是作为一项规定的准备措施。Masu。

- 用于大规模监测和检测的红外线体温监测系统可能会显着提高人们的认识并限制疫情的传播。此类系统提供有效的警报,具有温度范围功能、跟踪多个点并触发警报的能力、永不错过目标的能力、识别人类/动物/有机体目标和其他热物体的能力以及使用视频的能力/用于监控和分析的照片影像,全部都是即时的。

北美占最大市场占有率

- 北美占据了最大的市场占有率,因为该地区的几家现有製造商在开发和改进现有温度感测器方面投入了大量资金。

- 根据美国汽车政策委员会的数据,汽车製造商及其供应商是美国最大的製造业,占美国GDP的3%。此外,仅在过去五年中,FCA美国、福特和通用汽车就扩大了其美国组装厂、发动机厂、变速箱厂、研发实验室、公司总部、行政办公室以及其他连接和支援它们的基础设施。我们已宣布投资约350 亿美元。

- 艾默生电气等该地区的公司提供热电偶温度感测器,其特点是在恶劣的过程环境中具有弹性和耐用性。 Vernier Software & Technology 等其他公司提供可测量 -200°C 至 1400°C 温度范围的热电偶温度感测器。它还可以测量1400℃的火焰温度和-196℃的液态氮温度。

- 此外,据国际能源总署(IEA)称,预计该地区将在未来五年内满足世界不断增长的石油需求。根据 IEA 的数据,随着页岩油生产商找到更便宜、更有利可图的开采方式,美国预计将占 2017 年至 2025 年全球石油供应增量的 80%。因此,在预测期内,该国石油和天然气产业的成长可能会进一步提振所研究市场的需求。

- 美国内政部计划大陆棚进行大陆棚勘探钻探,石油和天然气行业预计将开闢市场新机会。

- 此外,温度感测器广泛应用于医疗保健产业,用于连续心抟出量监测、热稀释导管等。随着该地区各行业的进步以及各类温度感测器的研发被纳入更多产品中,温度感测器市场预计将以健康的速度成长。

温度感测器产业概况

德克萨斯、德州仪器和意法半导体等地区和本地製造商。持续的产品升级和产业融合正在推动市场朝向高度差异化的产品发展。

2022 年 12 月,Omega Engineering 宣布推出最新版本的HANI 夹式温度感测器。 HANI 钳式感测器专为塑胶管道设计,可在几秒钟内准确测量管道内介质的温度,而不会损坏管道。

2022 年 7 月,苹果为 Apple Watch 引进了温度感测器。该公司的目的是在佩戴者因体温高于正常水平而发烧时通知他们。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力——波特五力

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业 4.0 和工厂自动化的快速成长

- 消费性电子产品对穿戴式装置的需求不断增加

- 市场限制因素

- 原物料价格波动

第六章市场区隔

- 类型

- 有线

- 无线的

- 科技

- 红外线的

- 热电偶

- 电阻温度检测器(RTD)

- 热敏电阻器

- 温度变送器

- 光纤

- 其他的

- 最终用户产业

- 化工/石化

- 油和气

- 金属/矿业

- 发电

- 食品和饮料

- 车

- 医疗保健

- 航太/军事

- 家用电器

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporation

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

第八章投资分析

第9章 未来展望

The Temperature Sensors Market size is estimated at USD 8.80 billion in 2024, and is expected to reach USD 11.94 billion by 2029, growing at a CAGR of 6.28% during the forecast period (2024-2029).

Temperature sensors employed using IoT connectivity are expected to speed up owing to the increasing need for COVID-19 testing and screening. Semtech and Polysense Technologies collaborated to develop temperature monitoring devices for a human body based on Semtech's LoRa LPWAN. The company's temperature sensors would offer frontline healthcare workers real-time data for faster screening of individuals with a high temperature.

Key Highlights

- The growing adoption of HVAC modules in the automotive industry and industrial end users applications are some of the major driving factors of the temperature sensor market.

- Growing demand for consumer electronics is also expected to boost market growth further. An increase in the global focus on security and surveillance and various government initiatives toward safety norms is also expected to promote the adoption of the temperature sensor market.

- The growing adoption of wireless temperature sensors in various industries is mainly attributed to the applications of non-contact measurement features, which enable them to reach locations where a device's physical deployment is impossible.

- Various applications of temperature sensors, including flare systems, wellhead tanks, chemical tanks, pipeline data collection, and compressors, are among some of the multiple applications of temperature sensors in the oil and gas industry. The applications of temperature sensors in the oil and gas industry are considered critical. Installing a wired device inside a pipe or a tank would be inefficient if the operating temperature is relatively high.

- Further, the nature of the industry makes the usage of temperature sensors crucial, as it is essential to monitor the temperature changes in these lines and maintain safe working conditions. The super-heated steam and water pipelines are extended, and accidents in these may lead to the damage and loss of other assets, which is one of the driving factors for the demand and regulatory needs.

- Trends in the personal computing industry, such as smaller system sizes, faster processors, and the need to support more advanced applications, make monitoring and controlling heat imperative. This trend, coupled with robust sales and advancements in desktop and portable computers, is likely to continue to support the growth of temperature sensors.

- One of Honor's recently announced smartphones, the Honor Play 4 Pro, is available with an infrared temperature sensor. In the era of a COVID-19 pandemic, when a high temperature could be a sign of being ill with COVID-19, it could be a helpful smartphone feature. According to Honor, the sensor works between temperatures of -20 degrees Celsius and 100 degrees Celsius (approximately -4 to 212 degrees Fahrenheit), which is more than enough to cover the human body's range of potential temperatures, and it can sense temperatures down to the tenth of a degree.

Temperature Sensors Market Trends

Infrared Temperature Sensors to Drive the Market Growth

- IR Temperature sensors, unlike many contact temperature sensors, could be used for taking readings from a moving object at less than 10 m/s. Such advantages of temperature sensors enable them to be used for multiple applications in various fields, including manufacturing, automotive, food processing, and defense.

- The applications of IR temperature sensors are also found in various defense applications, including variable emissivity measurements and optical target sighting, which helps track activities. All these applications have a continuous demand and advance owing to the increasing military spending.

- Recently, the demand for infrared temperature sensors has been increasing in the manufacturing sectors, driven by the global adoption of Industry 4.0 policies. IR temperature sensors, in the case of predictive maintenance, have been increasingly gaining a considerable market share. The increasing requirement for monitoring the temperature of moving parts could rarely be substituted with the efficiency of IR temperature sensors.

- In the case of the plastic molding industry, IR sensor technology can optimize thermoplastic demolding processes. In the automotive sector, IR temperature sensors are used in collaboration with paint workshops, which, with the help of intelligent algorithms, calculate the amount of time a chassis spends in the drying oven without affecting the paint job.

- The rapid surge in COVID-19 cases has caused nations worldwide to take steps to stop the spread. Ever since the deadly disease outbreak, there has been a need to check temperatures routinely. Large-area detection and screening for fever would soon be a reality for the safety of all and containment of not only the current COVID-19 impacting today but also a prescriptive measure of preparedness.

- An infrared body temperature monitoring system for large-area monitoring and detection would significantly improve awareness and control the spread of an outbreak. Such a system would have an effective alarm using a temperature range feature, the ability to track and raise alarms at multiple points, miss no targets, identify between human/animal/organic targets and other high-temperature objects and use video/photographic images for monitoring and analysis - all in real-time.

North America to Hold Maximum Market Share

- North America held the largest market share due to several established manufacturers in the region investing significantly in developing and improving existing temperature sensors.

- According to the American Automotive Policy Council, Automakers and their suppliers are America's largest manufacturing sector, responsible for 3% of America's GDP. Moreover, over the past five years alone, FCA US, Ford, and General Motors have announced nearly USD 35 billion in investments in their U.S. assembly, engine and transmission plants, R & D labs, headquarters, administrative offices, and other infrastructure that connects and supports them.

- Companies in the region, such as Emerson Electric Co., offer thermocouple temperature sensors that feature resilience and durability in harsh process environments. Other companies, such as Vernier Software and Technology, offer thermocouple temperature sensors to measure temperatures between -200oC to 1400oC. It can also measure flame temperatures as high as 1400 °C or liquid nitrogen temperatures at -196 °C.

- Moreover, the region is expected to supply much of the world's growing demand for oil over the next five years, according to the International Energy Agency (IEA). As per the IEA, the United States is expected to account for 80% of the global oil supply increase between 2017 and 2025 as shale producers find more ways to pump oil profitably at lower prices. Thus, the country's growing oil and gas sector is likely to boost further the demand for the market studied over the forecast period.

- With the U.S. Department of the Interior planning to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024, the oil and gas sector in the region is expected to open up new opportunities to the market.

- Additionally, the healthcare industry uses temperature sensors extensively for continuous cardiac output monitoring, thermal dilution catheters, etc. With such advancements across various industries in the region and the R & D of various types of temperature sensors being integrated into more and more products, the market for temperature sensors is set to grow at a healthy rate.

Temperature Sensors Industry Overview

The competitive rivalry is high in this market, owing to the presence of many players operating in the market, such as Honeywell, Texas Instruments, and STMicroelectronics, among other regional and local manufacturers. Continuous product upgradation and industry convergence drive the market towards highly differentiated offerings.

In December 2022, OMEGA Engineering announced the launch of the latest version of its HANI Clamp-On Temperature Sensor: the HANI Clamp Sensor is explicitly designed for plastic pipe applications. The Sensor precisely measures the temperature of media inside a pipe in seconds without ever breaching the pipe.

In July 2022, Apple introduced temperature sensors in its Apple Watch. The company aims to inform the wearer if they have a fever due to a higher-than-normal body temperature.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industry 4.0 & Rapid Factory Automation

- 5.1.2 Increasing Demand for Wearable in Consumer Electronics

- 5.2 Market Restraints

- 5.2.1 Fluctuation in Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 Technology

- 6.2.1 Infrared

- 6.2.2 Thermocouple

- 6.2.3 Resistance Temperature Detectors (RTD)

- 6.2.4 Thermistor

- 6.2.5 Temperature Transmitters

- 6.2.6 Fiber Optic

- 6.2.7 Others

- 6.3 End-User Industry

- 6.3.1 Chemical and Petrochemical

- 6.3.2 Oil and Gas

- 6.3.3 Metal and Mining

- 6.3.4 Power Generation

- 6.3.5 Food and Beverage

- 6.3.6 Automotive

- 6.3.7 Medical

- 6.3.8 Aerospace and Military

- 6.3.9 Consumer Electronics

- 6.3.10 Other End-User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Panasonic Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Honeywell International Inc.

- 7.1.5 ABB Ltd

- 7.1.6 Analog Devices Inc.

- 7.1.7 Fluke Process Instruments

- 7.1.8 Emerson Electric Company

- 7.1.9 STMicroelectronics

- 7.1.10 Microchip Technology Incorporated

- 7.1.11 NXP Semiconductors NV

- 7.1.12 GE Sensing & Inspection Technologies GmbH

- 7.1.13 Robert Bosch GmbH

- 7.1.14 Gunther GmbH Temperaturmesstechnik

- 7.1.15 TE Connectivity Ltd

- 7.1.16 Denso Corporation

- 7.1.17 Omron Corporation

- 7.1.18 FLIR Systems

- 7.1.19 Thermometris

- 7.1.20 Maxim Integrated Products

- 7.1.21 Kongsberg Gruppen