|

市场调查报告书

商品编码

1432382

压敏黏着剂(PSA)的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Pressure Sensitive Adhesives (PSA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

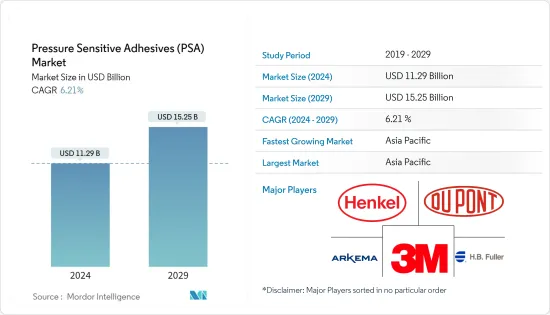

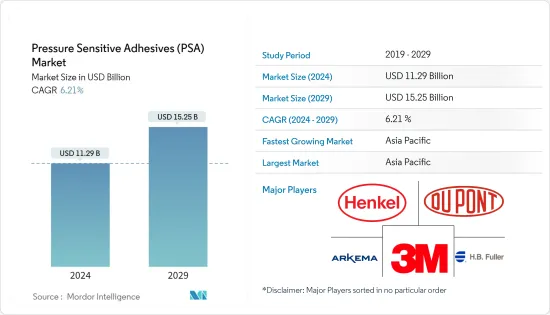

全球压敏黏着剂(PSA)市场规模预计到2024年为112.9亿美元,到2029年达到152.5亿美元,在预测期内(2024-2029年)复合年增长率为6,预计增长率为. 21% 。

2020 年,COVID-19 爆发导致全国封锁、製造活动和供应链中断以及世界各地生产停顿,对市场产生了负面影响。然而,到了2021年,情况开始好转,市场恢復了成长轨迹。

主要亮点

- 推动市场的主要因素是低成本软包装市场的不断开拓以及压敏黏着剂由于其固化时间短而使用量的增加。

- 另一方面,有关挥发性有机化合物排放的严格环境法规以及紫外线固化黏剂等替代品的使用增加预计将阻碍市场成长。

- 磁带市场主导市场,预计在预测期内将成长。这是因为包装、医疗保健和运输等最终用途行业正在成长。

- 未来的机会可能包括采用生物基压敏黏着剂和开发基于奈米技术的功能性黏剂。

- 亚太地区主导全球市场,其中中国和印度等国家的消费量最高。

压敏黏着剂市场趋势

包装产业主导市场

- 黏剂可确保产品包装在到达消费者手中之前保持完整。包装业务需要可靠的黏剂来满足由于多种新产品和产品扩散而日益复杂的包装需求。

- 压敏黏着剂(PSA) 特别为包装产业带来好处:

- 快速返工:返工和重新包装会增加成本。 PSA 提供及时的方法来确保产品符合标准并上架。压敏黏着剂比胶棒更安全,比传统胶带更谨慎。与胶棒不同,压敏黏着剂在涂布中不需要加热。由于没有热量,因此不存在烧烫伤风险,提高了工厂工作人员的安全性。此外,PSA 不会干扰包装图形,并在不损害品牌形象的情况下提供必要的黏合力。压敏黏着剂是谨慎的包装解决方案,可保持并最大限度地提高您的品牌影响力。

- 即时黏合:涂布压敏黏着剂可以节省时间,因为您不必等待它们固化。当涂布压敏黏着剂时,它会在黏合时压缩基材。即时黏合可加快加工速度并提高生产力。

- 维护品牌形象:品牌形像很大程度上取决于包装的外观。 PSA 提供了黏剂,不会损坏包装或留下任何残留物。维护品牌形象可以吸引消费者。

- 此外,近年来,随着製造业和工业部门适应软包装,包装产业正在经历转型。

- 软包装因其重量轻、易于搬运、不占用太多空间、保质期长、易于运输、不易损坏、印刷适性优良等优点而受到普及。

- 随着电子商务、电子零售、线上食品和宅配服务的成长趋势,对包装材料(尤其是软包装)的需求不断增加,并可能在预测期内推动对紫外线固化黏剂的需求。越来越贵了。在德国,2022年纸包装产业与往年相比显着成长。

- 根据印度包装工业协会(PIAI)预测,印度包装产业在预测期内预计将成长 22%。此外,到2025年,印度包装市场预计将达到2,048.1亿美元。

- 软包装用于低收入南美、非洲和亚太国家的食品包装应用。随着经济的持续扩张和食品和饮料行业的加速发展,软包装在新兴国家越来越受欢迎,需求也越来越大。

- 由于各种最终用途产业对非石化燃料包装的需求不断增加,德国纸包装产业在 2022 年经历了显着成长。

- 预计这些因素将在预测期内增加对压敏黏着剂市场的需求。

亚太地区预计将主导市场

- 亚太地区占全球需求量的40%以上,是压敏黏着剂最有前景的市场,并可能在不久的将来占据主导地位。这种垄断是由于该地区对磁带和标籤的需求不断增长。

- 中国、印度、日本、韩国占压敏黏着剂需求的80%以上。

- 中国是胶合剂产品(胶带、标籤等)的主要出口国之一。对于许多客户来说,重要的是产品的品质、供应商提供的产品范围以及黏剂使用量和浪费的减少。因此,中国压敏黏着剂市场目前由国际公司主导。同样的因素也促使当地製造商投资于研发,以占领该国的主要市场占有率。

- 由于人均收入的上升和电商巨头的崛起,中国已成为全球最大的包装消费国。根据印度塑胶工业协会统计,印度包装业位居世界第五,年增率约22-25%。高技能的劳动力和低廉的人事费用使得包装和加工食品的成本比欧洲低 40%。人口的增长和对包装的需求的增加预计将推动市场的发展。

- 此外,由于经济扩张和高购买力中阶的崛起,中国包装产业近年来持续快速成长。食品包装是包装产业的主要企业,约占中国60%的市场占有率。 Interpak预计,在中国食品包装领域,预计2023年包装总量将达到4,470亿件,显示包装产业对压敏黏着剂的需求不断增加。

- 印度压敏黏着剂市场预计将有较高的成长率。其应用范围不断扩大,包括透明标籤和薄膜标籤、快速消费品(FMCG)製造商的收缩包装标籤、柔性标籤和多色环绕标籤。压敏黏着剂市场仍处于早期成长期,未来成长前景较高。

- 巨大的市场规模加上亚太地区的显着成长正在推动压敏黏着剂市场的扩张。

压敏黏着剂产业概况

压敏黏着剂市场正在整合。七大主要企业占近60%。主要企业(排名不分先后)包括 3M、阿科玛、杜邦、HB Fuller、Henkel AG & Co.KGaA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 加大低成本软包装的开发力道

- 增加 PSA 的使用并缩短固化时间

- 其他司机

- 抑制因素

- 关于VOC排放的严格环境法规

- 增加使用紫外线固化黏剂等替代品

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:以金额为准)

- 科技

- 水性的

- 溶剂型

- 热熔胶

- 辐射

- 树脂

- 丙烯酸纤维

- 硅胶

- 合成橡胶

- 其他树脂

- 目的

- 磁带

- 标籤

- 形象的

- 其他用途

- 最终用途产业

- 包装

- 木工/细木工

- 医疗保健

- 商业图形

- 运输

- 电子产品

- 其他最终用途产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟和协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema Group(Bostik SA)

- Ashland Inc.

- Avery Dennison Corp.

- DuPont

- Franklin International

- HB Fuller Co.

- Helmitin Adhesives

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- Jowat AG

- Mapei SPA

- Master Bond

- Pidilite Industries Ltd

- Sika AG

- Tesa SE(A Beiersdorf Company)

- Wacker Chemie AG

第七章 市场机会及未来趋势

- 采用生物基压敏黏着剂

- 基于奈米技术的功能性黏剂的开发

The Pressure Sensitive Adhesives Market size is estimated at USD 11.29 billion in 2024, and is expected to reach USD 15.25 billion by 2029, growing at a CAGR of 6.21% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The major factor driving the market studied is the increasing development of low-cost, flexible packaging and increasing usage of pressure-sensitive adhesives because of lesser curing time.

- On the flip side, stringent environmental regulations regarding VOC emissions and increasing usage of substitutes like UV-cured adhesives are expected to hinder the studied market's growth.

- The tapes segment dominated the market and is expected to grow during the forecast period. It is owing to the growing end-user industries, such as packaging, medical, and transportation.

- Adopting bio-based pressure-sensitive adhesives and developing nanotechnology-based functional pressure-sensitive adhesives is likely an opportunity in the future.

- Asia-Pacific dominated the global market, with the largest consumption from countries such as China and India.

Pressure Sensitive Adhesives Market Trends

Packaging Industry to Dominate the Market

- Adhesives ensure the product packaging remains intact until it reaches the consumer. Packaging operations require a reliable adhesive to meet the increasingly complex packaging demands as there is an increase in several new products and product proliferation.

- Pressure-sensitive adhesives (PSAs) specifically offer several advantages for the packaging industry:

- Quick reworks: Reworking or repackaging increases costs. PSAs offer a timely way to make products compliant and shelf-ready. Pressure-sensitive adhesives are safer than glue sticks and more discrete than traditional tape. Unlike glue sticks, pressure-sensitive adhesives do not require heat during application. The absence of heat eliminates burns and increases safety among plant workers. Additionally, PSAs are less intrusive on packaging graphics, providing the required adhesion without sacrificing the brand image. Pressure-sensitive adhesives are less visible packaging solutions that preserve and maximize the brand's impact.

- Instant bond: Applying pressure-sensitive adhesives is time-saving, as waiting until they cure is unnecessary. When applied, they compress the substrate right when adhesion occurs. Instant bonding increases the processing speed, as well as improves production.

- Maintaining brand image: Brand image relies heavily on the packaging appearance. PSAs provide a bond that removes cleanly without damaging the packaging or leaving behind residue. Preserving brand image adds to your consumer appeal.

- Furthermore, in the last few years, the packaging industry is experiencing a transition where the manufacturing and industrial sector is adapting to flexible packaging.

- The benefits, such as being lightweight, easy to handle, less space-consuming, longer shelf life, easy transit, damage resistance, and better printability, made packaging popular.

- With the growing trend of e-commerce, e-retail, and online food orders and delivery services, the demand for packaging materials, especially flexible packaging, is increasing, likely to drive the demand for UV-curable adhesives during the forecast period. In Germany, the paper packaging industry grew significantly in 2022 compared to previous years.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025.

- Flexible packaging is used in food packaging applications in low-income South America, Africa, and Asia-Pacific countries. The popularity and demand for flexible packaging are rising in emerging economies, and the demand is supported by continued economic expansion and an acceleration in the food and beverage industry.

- The paper packaging industry grew significantly in Germany in 2022 because of the increasing demand for non-fossil-based packaging for different end-user industries.

- Such factors will likely increase the demand for the pressure-sensitive adhesives market over the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- With over 40% of the global demand, Asia-Pacific is the most promising market for pressure-sensitive adhesives, which will likely dominate soon. This domination can be attributed to the region's growing demand for tapes and labels.

- China, India, Japan, and South Korea account for over 80% of the demand for pressure-sensitive adhesives.

- China is one of the major exporters of adhesive products (tapes, labels, etc.). The factors concerning most of its customers are the product quality, the product range offered by the vendor, and reducing the dosage and wastage of adhesives. Therefore, international players currently dominate the Chinese market for pressure-sensitive adhesives. The same factor encourages local producers to invest in R&D to acquire a major national market share.

- China is the world's largest packaging consumer globally, owing to growing per capita income and rising e-commerce giants. India's packaging industry is the fifth-largest globally, growing at about 22-25% per year, according to the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Furthermore, the Chinese packaging industry grew rapidly and consistently in recent years, owing to the expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023, indicating an increased demand for pressure-sensitive adhesives from the packaging industry.

- The pressure-sensitive adhesives market in India is expected to grow at a higher rate. Its usage increased with transparent and film labels, shrink-wrap labels for fast-moving consumer goods (FMCG) manufacturers, flexible labels, and multicolor wrap-around labels. The pressure-sensitive adhesives market is still in its early growth stage, with a higher scope of growth in the future.

- The large market size, coupled with the huge growth of Asia-Pacific, is instrumental in expanding the pressure-sensitive adhesives market.

Pressure Sensitive Adhesives Industry Overview

The pressure-sensitive adhesives market is consolidated. The top seven players account for almost 60%. The major companies (not in any particular order) include 3M, Arkema, DuPont, HB Fuller, and Henkel AG & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Development of Low-cost Flexible Packaging

- 4.1.2 Increasing Usage of PSA Because of Lesser Curing Time

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Increasing Usage of Subsitutes like UV Cured Adhesives

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot Melt

- 5.1.4 Radiation

- 5.2 Resin

- 5.2.1 Acrylics

- 5.2.2 Silicones

- 5.2.3 Elastomers

- 5.2.4 Other Resins

- 5.3 Application

- 5.3.1 Tapes

- 5.3.2 Labels

- 5.3.3 Graphics

- 5.3.4 Other Applications

- 5.4 End-user Industry

- 5.4.1 Packaging

- 5.4.2 Woodworking and Joinery

- 5.4.3 Medical

- 5.4.4 Commercial Graphics

- 5.4.5 Transportation

- 5.4.6 Electronics

- 5.4.7 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group (Bostik SA)

- 6.4.3 Ashland Inc.

- 6.4.4 Avery Dennison Corp.

- 6.4.5 DuPont

- 6.4.6 Franklin International

- 6.4.7 H.B. Fuller Co.

- 6.4.8 Helmitin Adhesives

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Huntsman Corporation

- 6.4.11 Illinois Tool Works Inc.

- 6.4.12 Jowat AG

- 6.4.13 Mapei SPA

- 6.4.14 Master Bond

- 6.4.15 Pidilite Industries Ltd

- 6.4.16 Sika AG

- 6.4.17 Tesa SE (A Beiersdorf Company)

- 6.4.18 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Bio-based Pressure Sensitive Adhesives

- 7.2 Development of Nanotechnology based Functional Pressure Sensitive Adhesives