|

市场调查报告书

商品编码

1432426

温室灌溉系统:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Greenhouse Irrigation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

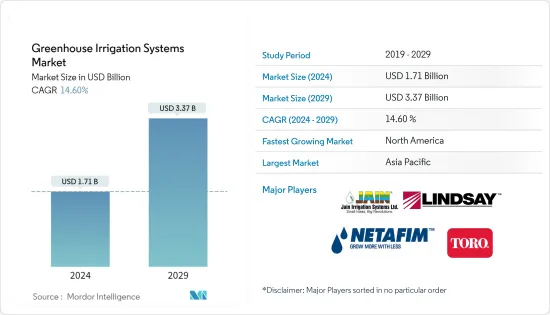

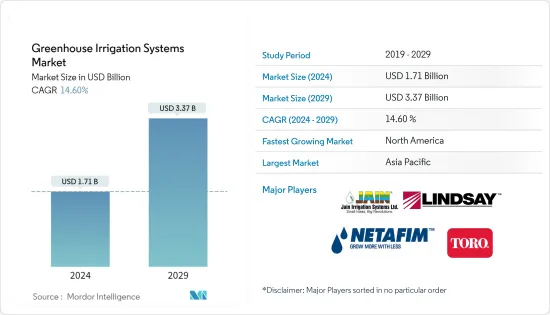

温室灌溉系统市场规模预计到 2024 年为 17.1 亿美元,预计到 2029 年将达到 33.7 亿美元,在预测期内(2024-2029 年)复合年增长率为 14.60%。

主要亮点

- 温室灌溉系统市场主要是由于世界人口的增长和粮食需求的增加而导致保护耕地面积的增加。

- 温室灌溉是在温室内灌溉作物以维持适合生长的条件的系统。温室灌溉技术可以将非农业国家转变为自给自足的农产品的动态中心。

- 在俄罗斯,2017-18 年约有 147.2 公顷土地用于建造温室。随着世界各地温室的增加,温室滴灌系统有着巨大的成长潜力。

温室灌溉系统市场趋势

温室蔬菜产量快速成长

越来越需要集约化农业生产以维持快速成长的世界人口。除了人口成长带来的食品消费增加之外,世界各地的饮食习惯也变得更加多样化,越来越多的消费者将高价值蔬菜纳入他们的饮食中。为了应对这种市场情况,世界各地的农民正在增加其作物组合中的蔬菜产量。为了提高产量并抵消蔬菜种植的季节性,预计未来几年温室的采用将大幅增加,从而导致对温室灌溉系统的高需求。

亚太地区主导全球市场

中国、印度和日本等亚太地区国家预计在预测期内将出现强劲成长。这主要是由于预计经济高速成长以及庞大的人口导致最终产品的大量消费。全部区域政府也意识到需要透过政策措施促进保护性种植。最引人注目的政府措施包括为安装现代和先进的微型灌溉系统提供低利率贷款和补贴。例如,印度政府为促进保护性耕作,对购买的所有保护性耕作设备和安装微灌系统提供至少50%的补助。

温室灌溉系统产业概况

儘管大公司占据最大的市场占有率,但本地供应商也在进入该领域。由于竞争日益激烈,企业正专注于产品开发和技术进步,以征服温室灌溉系统产业。例如,2019年3月,耐特菲姆宣布将在印度100个村庄实施四个大型社区灌溉计划。 2019 年 2 月,拜耳、耐特菲姆和本古里安大学合作整合数位工具来优化滴灌。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按农场规模

- 小农场

- 中型农场

- 大型农场

- 按用途

- 喷雾和喷雾

- 滴

- 潮汐台

- 垫

- 手浇水

- 其他用途

- 按产品零件

- 桨鼻罩和喷雾器

- 微喷灌/发送器

- 稳压器

- 滴灌带和滴灌线

- 软管

- 阀门

- 其他部分

- 透过电源

- 可再生

- 不可可再生

- 按作物

- 蔬菜

- 花朵

- 果树

- 苗木作物

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- The Toro Company

- Netafim Ltd

- Jain Irrigation Systems Ltd

- Nelson Irrigation

- Lindsay Corporation

- Rain Bird Corporation

- Valmont Industries, Inc.

- Rivulis Irrigation

- EPC Industries Limited

- Irritec SpA

第七章 市场机会及未来趋势

The Greenhouse Irrigation Systems Market size is estimated at USD 1.71 billion in 2024, and is expected to reach USD 3.37 billion by 2029, growing at a CAGR of 14.60% during the forecast period (2024-2029).

Key Highlights

- The greenhouse irrigation systems market is largely spurred by the increased area under protected cultivation, as a result of rising population and consequent increased food requirement worldwide.

- Greenhouse Irrigation is a system of irrigating crops in the greenhouse to maintain favourable conditions for growth. It helps in water management along with productive crops grown in the greenhouse.Greenhouse irrigation technology can turn non-agricultural countries into self-reliant and dynamic hubs for agricultural products.Many off season crops can be grown in green houses which enables the farmers to get more returns.

- In Russia, over the course of 2017-18, nearly 147.2 hectares of land is dedicated to greenhouses. With the increase in number of greenhouses across the globe, there lies a huge potential for the growth of drip irrigation system in greenhouses.

Green House Irrigation Systems Market Trends

Rapid Growth in Green house Vegetable Production

There is a significant need to enhance agriculture production, in order to sustain the rapidly increasing global population. In addition to the increased consumption of food, in general by the growing population, diets worldwide are also becoming more and more diverse and consumers are increasingly including more of high-value vegetables in their diets. Farmers across the world are responding to this market scenario by producing more of vegetables in their crop portfolio, which helps them not only gain more gross revenues, but also improves their cash flow situation. To enable increased yields and to offset the seasonal nature of vegetable cultivation, the adoption of greenhouses is expected to increase significantly in the coming years, resulting in higher demand for greenhouse irrigation systems.

Asia Pacific dominating the global market

Countries in the APAC region such as China, India, and Japan among others are expected to register robust growth over the forecast period, primarily due to high economic growth forecasts along with huge population leading to high consumption of end products. Governments across the region are also realizing the need for promoting protected cultivation through policy initiatives. Some of the most noteworthy government initiatives are provision of low-interest loans and subsidies for the implementation of modern and advanced micro-irrigation systems. For instance, the Government of India promotes protected cultivation by providing subsidies to the tune of 50% or more on all equipment purchased for the purpose of protected cultivation and implementation of micro-irrigation systems.

Green House Irrigation Systems Industry Overview

Although the major players are holding biggest market share, there is alot of influx from the local vendors in this segment. The competition is intensifying, hence the companies are more focusing on product development and technological advancements to capitilise upon the Greenhouse Irrigation system industry. For instance, in March 2019, Netafim announced that it is implementing four large community irrigation projects that across 100 villages in India. In February 2019, Bayer, Netafim and Ben-Gurion University collaborated on the integration of digital tools for optimizing drip irrigation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Farm Size

- 5.1.1 Small Farms

- 5.1.2 Medium Farms

- 5.1.3 Large Farms

- 5.2 By Application

- 5.2.1 Misting & Spraying

- 5.2.2 Drip

- 5.2.3 Ebb & Flow Bench

- 5.2.4 Mat

- 5.2.5 Hand Watering

- 5.2.6 Other Applications

- 5.3 By Product Part

- 5.3.1 Spinners & Sprays

- 5.3.2 Micro Sprinklers/Emitters

- 5.3.3 Regulators

- 5.3.4 Drip Tape & Drip Lines

- 5.3.5 Hoses

- 5.3.6 Valves

- 5.3.7 Other Parts

- 5.4 By Power source

- 5.4.1 Renewable

- 5.4.2 Non- Renewable

- 5.5 By Crop Type

- 5.5.1 Vegetables

- 5.5.2 Flowers & Ornamentals

- 5.5.3 Fruit Plants

- 5.5.4 Nursery Crops

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Spain

- 5.6.2.6 Italy

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Rest of the Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East & Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of the Middle East & Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 The Toro Company

- 6.3.2 Netafim Ltd

- 6.3.3 Jain Irrigation Systems Ltd

- 6.3.4 Nelson Irrigation

- 6.3.5 Lindsay Corporation

- 6.3.6 Rain Bird Corporation

- 6.3.7 Valmont Industries, Inc.

- 6.3.8 Rivulis Irrigation

- 6.3.9 EPC Industries Limited

- 6.3.10 Irritec S.p.A