|

市场调查报告书

商品编码

1432427

内容传输网路(CDN):市场占有率分析、产业趋势/统计、成长预测 (2024-2029)Content Delivery Network (CDN) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

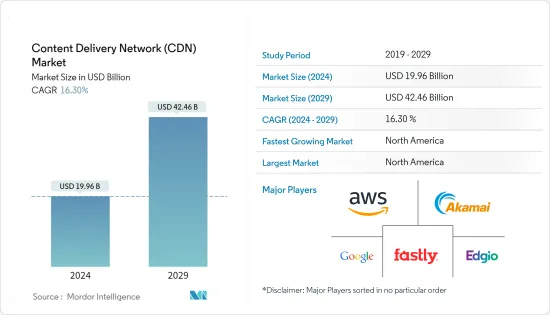

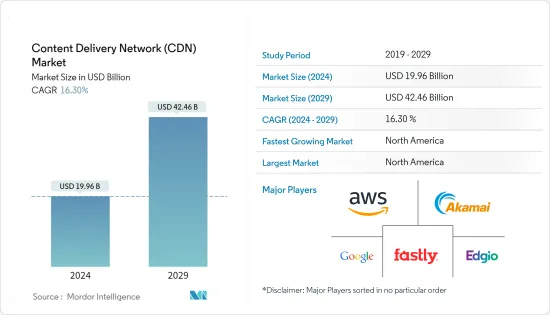

内容传输网路市场规模预计到 2024 年为 199.6 亿美元,到 2029 年将达到 424.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 16.30%。

对丰富视讯内容的需求不断增长、线上用户数量不断增加、最终用户垂直领域组织的数位化趋势以及整体 CDN 市场需求。

主要亮点

- CDN 是一个由互联电脑组成的线上网络,透过将 Web 内容复製或快取到各种伺服器并将其远端传输给消费者,将 Web 内容快速分发给许多使用者。 CDN 可为最终用户内容传送。目前,Web物件(文字、图形、脚本)、可下载物件(媒体檔案、软体、文件)、应用程式(电子商务、入口网站)、即时串流资料、随选串流媒体和社群网路都依赖CDN,我正在使用它。

- Over-the-Top基础设施的持续改进以及 OTT 平台努力製作以合理成本吸引客户的内容,同时提供巨大价值,推动了 OTT 视讯消费的发展,它正在迅速发展。此外,行动装置使用的增加、大萤幕的吸引力以及对原创内容创作的投资也推动了消费。随着OTT和VoD消费者数量的增加,对CDN解决方案的需求也增加。根据思科视觉网路指数,到 2024 年,79% 的线上流量将是 IP 视讯。这表明线上视讯服务呈增长趋势。

- 随着 4K 和超高清等新技术的出现,线上游戏迅速普及,推动了市场的发展。游戏公司正在增加对CDN的投资,以提供高品质的内容,以确保更好的用户体验。 CDN 为游戏公司提供玩家可以快速下载的重要檔案和补丁。此外,还可以避免伺服器崩溃和下载失败。所有这些功能都增强了赛前过程。此外,CDN 还提供可扩展性,其高品质的视觉效果和其他功能使玩家即使在游戏下载大小增加时也可以继续玩游戏。

- 随着网路和智慧型装置的使用不断增加,每天都会产生大量资料,需要进行智慧管理。 Web 效能最佳化解决方案旨在减少延迟。这些解决方案的成功将增加主要零售商以及媒体和娱乐产业的需求。

- 企业面临频宽和网路分配的挑战,尤其是在农村地区。公司必须吸引足够的客户来支付其年度营运成本,例如债务支付、定期资本补充和营运费用。偿还债务是农村地区最难支付的支出之一。然而,近年来我们看到农村地区的显着成长,农村网路覆盖率从60%上升到90%以上。公司瞄准的是发展中和欠发达地区,因为普及因人口统计(收入、年龄、季节性居住者比例)和补贴金额的不同而有很大差异。

- COVID-19 对市场没有直接影响,因为内容传输网路供应商的收益依赖于几个经济因素,包括活跃的金融市场、流动性流动和金融机构的贷款。它影响了我。儘管存在这些障碍,但由于互联网资料交换率不断上升以及高速网路的持续部署,CDN 市场预计将在预测期内稳步扩张。

内容传输网路(CDN) 市场趋势

媒体发行预计将获得显着的市场占有率

- 全球 56.3% 的人口使用互联网,这推动了线上内容的成长。 4K/UHD 电视的出现、支援智慧型装置的高清内容以及连接性的增强提高了观众对高品质内容的期望。

- 许多媒体组织正在转向数位发行模式。这种交付模型透过将媒体檔案的副本放置在离观众更近的位置来避免缓衝和串流崩溃。这种快取功能在直播时也有很大的不同。此外,它还减少了来源伺服器的负载,使您的体验更加可靠。这些转变为 CDN 供应商带来了巨大的市场机会。

- CDN 供应商越来越关注 Web 效能最佳化技术,以满足行动和动态内容要求。例如,Google于2022年4月推出Media CDN,以在网路和API加速内容传送上竞争。

- 《全球网路现象报告》显示,串流影音占网路频宽流量的53.7%,较去年同期成长4.8%。出售内容传输网路(CDN)(为加速网路材料传输而创建的伺服器集合)的存取权的公司获得了巨额利润。随着P2P技术 (p2p)、5G、穿戴式装置、物联网、虚拟实境、扩增实境以及技术创新的进步的出现,CDN 中的资料量不断增加。

- 媒体相关服务的行动流量约占45%,并且预计将持续增加。随着每月资料消耗量预计将从目前的平均 1.5 GB 增加到约 4.5 GB,对行动相容内容的需求预计也会增加。媒体 CDN 使用 AI/ML 构建,让观众能够更好地控制他们查看、体验内容以及与其内容互动的方式。例如,观看比赛的体育迷可以获得即时统计数据和分析,观众可以从虚拟公告板上购买物品。

北美占据内容传输网路市场的最大份额

- 北美网路普及较高,预计将支援内容扩张。北美在区域市场中保持主导地位,由于市场领导的存在以及各个最终用户领域技术的早期采用,预计在整个预测期内将保持其主导地位。

- 增强视讯内容和无延迟线上游戏的需求不断增加、资料成本下降、行动和宽频网路的可近性和可负担性不断提高,以及扩增实境(AR) 和人工智慧(AI) 等先进技术越来越多采用尖端技术,等,都有助于推动北美数位化趋势,并进一步支持CDN的区域扩张。

- 根据 Omdia TV 和线上视讯情报服务的数据,北美地区占 CDN 总收益的 52%。其中大部分将由该地区强劲的经济成长以及 IT 和通讯产业的持续扩张所推动。 CDN 的开发和投资将受到其他因素的推动,例如数位转型、云端采用率的提高和技术发展。

- 美国的付费电视消费也在下降。我们知道,越来越多的消费者喜欢线上媒体内容而不是付费电视。最近, 「停掉有线电视服务呈上升趋势,预计未来几年将有 2,220 万人停掉有线电视服务,凸显了点播娱乐的趋势。

- 市场主要面临网路钓鱼和DDoS攻击。例如,RCDevs 估计,金融业中与诈骗相关的网路攻击平均造成 43% 的事件、34% 的资料外洩和 23% 的中断。作为回应,许多美国银行提案购买 CDN 服务,以减少可疑的网路流量并威慑非法行为者。

- 另外,该地区的一些知名电商公司迅速实施了CDN解决方案,以增加网路流量并减少延迟,这也有助于该地区市场保持显着的份额,我做到了。透过为客户提供所需的内容,这些解决方案的应用在向最终用户分发数位内容方面发挥关键作用。

内容传输网路(CDN) 产业概述

内容传输网路高度分散,因为企业受益于行动内容传送、储存和可访问性的改进。随着新的技术创新,进入 CDN 市场的空间令人兴奋。该市场的主要企业包括 Amazon Web Services Inc.、Akamai Technologies Inc.、Google LLC、Verizon Digital Media Services (Oath Inc.)、Limelight Networks Inc. 和 Tata Communications。这些公司不断创新和升级产品,以满足不断增长的市场需求。

2022 年 9 月,Bharti Airtel 进入内容传输网路(CDN) 市场,推出Edge CDN 作为其边缘云端产品组合的一部分。为了实施 Edge CDN,通讯业者与 CDN 推动者 Qwilt 合作。

2022 年 8 月,亚马逊的云端部门 Amazon Web Services (AWS) 透过在河内和胡志明市开设两个新的边缘站点来提供 Amazon Cloud Front 和 AWS Direct Connect 服务,从而扩大其在越南的业务。

2022 年 3 月,Akamai Technologies 完成了对 Linode 的收购,为企业提供了一个大规模的分散式平台,方便开发人员用来建置、运行和保护应用程式。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的竞争关係

- 市场驱动因素

- 线上用户数量、人均线上消费以及对高品质影片内容的需求不断增长推动成长

- 线上游戏产业不断增长的需求有助于市场成长

- 市场限制因素

- 大企业自建CDN的趋势

- 频宽问题,尤其是在新兴经济体和欠发达经济体

第五章市场区隔

- 按解决方案和服务

- 媒体发行

- 云端安全

- 网路效能

- 按最终用户

- 媒体娱乐

- 广告

- 电子商务

- 卫生保健

- 商业/金融服务

- 研究和教育

- 其他最终用户

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Amazon Web Services Inc.

- Akamai Technologies Inc.

- Google LLC

- Verizon Digital Media Services(Oath Inc.)

- Limelight Networks Inc.

- CDNetworks Co. Ltd.

- Fastly Inc.

- StackPath LLC

- Edgemesh Inc.

- Tata Communications

第七章 投资分析

第八章 市场机会及未来趋势

The Content Delivery Network Market size is estimated at USD 19.96 billion in 2024, and is expected to reach USD 42.46 billion by 2029, growing at a CAGR of 16.30% during the forecast period (2024-2029).

Growing demand for rich video content, increasing online users, and digitization trends in organizations across the end-user verticals boost the overall CDN market demand.

Key Highlights

- A CDN is an online network of connected computers that distributes web content quickly to many users by copying or caching the content on various servers and sending it to consumers remotely. High availability and high-performance content delivery to end users are achieved through the use of CDN. Web objects (text, graphics, and scripts), downloadable objects (media files, software, documents), applications (eCommerce, portals), real-time streaming data, on-demand streaming media, and social networks all make use of CDNs nowadays.

- Over-the-top (OTT) video consumption is quickly evolving due to continual digital infrastructure improvements and initiatives OTT platforms take to produce engaging content for customers at reasonable costs while providing significant value. Additionally, consumption is being boosted by the rising use of mobile devices, the appeal of big screens, and investments in creating original content. Demand for CDN solutions is rising as OTT and VoD consumers grow in number. According to Cisco's visual networking index, IP video is projected to have 79% of the online traffic by 2024. This suggests the growing trend of online video services.

- The popularity of online gaming is skyrocketing as new technologies like 4K and Ultra HD become available, which drives the market. Gaming companies are increasingly investing in CDN to deliver high-quality content to ensure a better user experience. CDN provides gaming firms to provide essential files and patches for players to download quickly. Additionally, server crashes and download failures are also avoided. All of these features enhance the pre-gaming process. Furthermore, CDN offers scalability, allowing players to keep playing even if the game's download size increases due to its high-quality visuals and other capabilities.

- With an increase in usage of the internet and smart devices, an enormous amount of data is being generated daily, which needs to be smartly managed. Web-performance optimization solutions are aimed at reducing latency. The success of these solutions will increase the demand from major retailers and the media and entertainment industry.

- Companies are facing challenges due to bandwidth and network allotment, particularly in rural areas. The company needs to attract enough clients to pay its annual running costs, which include debt payments, replacement capital on a regular basis, and operating expenses. Debt payments rank among the most difficult expenses to cover in rural areas. However, in recent years, significant growth has been observed in rural areas due to rising rural networks from 60% to over 90%. Considering penetration rates that vary widely because of demographics (incomes, ages, and the proportion of seasonal residents) and the amount of grant support companies are targeting developing and underdeveloped regions.

- COVID-19 had a direct impact on the market since the vendors of content delivery networks rely on several economic elements for their revenue, including vibrant financial markets, the movement of liquidity, and financing from financial institutions. Despite these obstacles, the CDN market is anticipated to expand steadily throughout the forecast period due to the rising data exchange rates on the Internet and the ongoing deployment of high-speed networks.

Content Delivery Network (CDN) Market Trends

Media Delivery is Expected to Have a Significant Market Share

- The world population using the internet stands at 56.3%, which is responsible for the growing online content. The advent of 4K/UHD televisions, high-definition content supporting smart gadgets, and improving connectivity raise viewers' expectations for high-quality content.

- Many media organizations are making a transition toward a digital distribution model. This distribution model avoids buffering and stream crashes by putting copies of media files close to viewers. This caching functionality makes a significant difference, even for live broadcasts. Additionally, it reduces the load on the origin server resulting in a more reliable experience. These transitions present a great market opportunity for CDN vendors.

- CDN vendors are increasingly focusing on techniques for web performance optimization to cater to mobile and dynamic content requirements. For instance, in April 2022, Google launched Media CDN to compete in web and API acceleration content delivery.

- According to the Global Internet Phenomena Report, streaming video accounted for 53.7% of internet bandwidth traffic, up by 4.8% from a year ago. Companies that sell access to content delivery networks (CDNs), which are collections of servers made to accelerate the transmission of web material, gained greatly. The data volume of CDN is increasing due to the advent of peer-to-peer technology (p2p), 5G, wearable devices, IoT, virtual reality, augmented reality, and advancing technological innovation.

- Mobile traffic for media-related services accounted for about 45%, which is expected to increase. The need for content to be mobile-compatible is expected to increase, owing to the expected growth of consumed data to about 4.5 GB per month, which is currently at 1.5 GB on average. Media CDN is built with AI/ML, giving viewers more control over how they see, experience, and interact with content. For example, sports fans watching a game can obtain real-time stats and analytics, viewers can purchase items from virtual billboards, etc.

North America Holds the Largest Share in Content Delivery Network Market

- North America has a high internet penetration rate, which is anticipated to support content expansion. North America held the leading regional market position and is expected to maintain its dominance throughout the projection period due to the presence of market leaders and early adoption of technologies across various end-user verticals.

- The growing demand for enhanced video content and latency-free online gaming, falling data costs, increasing accessibility and affordability of mobile and broadband networks, and increasing adoption of cutting-edge technologies like Augmented Reality (AR) and Artificial Intelligence (AI) are all contributing to North America's digitalization trend, further aiding the regional expansion of CDN.

- According to Omdia TV and Online Video Intelligence Service, North America accounted for 52% of the total CDN revenue. Much of this would be fueled by the region's robust economic growth and ongoing IT and telecom industry expansion. The development and investment in CDNs would be driven by additional factors such as the move toward digital transformation, an increase in cloud deployment, and technological developments.

- Pay TV consumption has decreased in the United States as well. More consumers have been found to favor online media content over pay television. Recently, cord-cutting has been growing, and in the upcoming years, 22.2 million cord-cutters are anticipated, emphasizing the trend toward on-demand entertainment.

- Phishing and DDoS attacks are majorly faced in this market. For example, according to RCDevs estimates, fraud-related cyberattacks contribute to an average of 43% of occurrences, 34% of data breaches, and 23% of interruptions in the finance industry. In response, numerous American banks proposed purchasing CDN services to reduce suspicious web traffic and stop illegal actors.

- Additionally, some of the region's well-known e-commerce businesses quickly implemented CDN solutions to increase network traffic and reduce latency which also helped the regional market to maintain its prominent share. By providing the clients with the necessary content, the application of these solutions plays a significant part in distributing digital content to end users.

Content Delivery Network (CDN) Industry Overview

The content delivery network is highly fragmented because companies have benefits, such as improved accessibility to increase mobile content delivery, storage, and accessibility. With new technological innovations, the scope of entering the CDN market is exciting. Some key players in the market are Amazon Web Services Inc., Akamai Technologies Inc., Google LLC, Verizon Digital Media Services (Oath Inc.), Limelight Networks Inc., and Tata Communications. These players constantly innovate and upgrade their product offerings to cater to the increasing market demand.

In September 2022, Bharti Airtel launched Edge CDN as part of its Edge Cloud Portfolio, making its entry into the content delivery network (CDN) market. To implement Edge CDN, the telecom business has teamed up with CDN enabler Qwilt.

In August 2022, Amazon's cloud arm Amazon Web Services (AWS), expanded its presence in Vietnam with two new Edge locations for its Amazon Cloud Front and AWS Direct Connect offerings in Hanoi and Ho Chi Minh City.

In March 2022, Akamai Technologies completed the acquisition of Linode to give companies a massively distributed platform that is friendly to developers for building, running, and securing applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Online Users, Per Capita Online Consumption, and Demand for High -quality Video Content Drives Growth

- 4.4.2 Growing Demand from Online Gaming Industries adding to Market Growth

- 4.5 Market Restraints

- 4.5.1 Larger Organisations Tending to Build their Own CDNs

- 4.5.2 Bandwidth Concerns Particularly in Developing and Undeveloped Economies

5 MARKET SEGMENTATION

- 5.1 By Solution and Service

- 5.1.1 Media Delivery

- 5.1.2 Cloud Security

- 5.1.3 Web Performance

- 5.2 By End-user

- 5.2.1 Media and Entertainment

- 5.2.2 Advertising

- 5.2.3 E-Commerce

- 5.2.4 Healthcare

- 5.2.5 Business and Financial Services

- 5.2.6 Research and Education

- 5.2.7 Other End-users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 Akamai Technologies Inc.

- 6.1.3 Google LLC

- 6.1.4 Verizon Digital Media Services (Oath Inc.)

- 6.1.5 Limelight Networks Inc.

- 6.1.6 CDNetworks Co. Ltd.

- 6.1.7 Fastly Inc.

- 6.1.8 StackPath LLC

- 6.1.9 Edgemesh Inc.

- 6.1.10 Tata Communications