|

市场调查报告书

商品编码

1432431

真空绝热板 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Vacuum Insulation Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

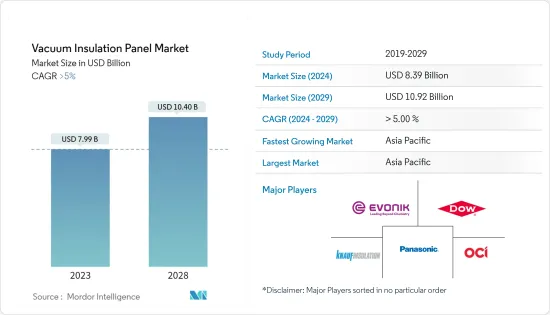

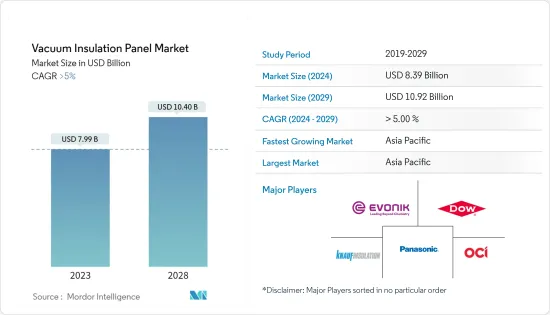

真空绝热板市场规模预计到 2024 年为 83.9 亿美元,预计到 2029 年将达到 109.2 亿美元,在预测期内(2024-2029 年)复合年增长率将超过 5%。

由于封锁和限制导致製造设施和工厂关闭,COVID-19 大流行对市场产生了负面影响。供应链和运输中断进一步阻碍了市场。但2021年,产业復苏,市场需求恢復。

主要亮点

- 从短期来看,建设产业的强劲需求以及全球采用真空隔热板进行自动储存和搜寻是推动所研究市场成长的因素。

- 另一方面,非标准尺寸面板的高成本和重量可能会阻碍市场成长。

- 然而,促进节能材料的日益严格的法规以及引入自动化面板以降低真空隔热板成本的研发倡议为预测期内接受调查的市场提供了机会,而且很有可能会出现这种情况。

真空绝热板市场趋势

建筑板块实现强劲增长

- 真空绝热板(VIP)是目前绝缘能力最高、最有前途的隔热材料之一,在建设产业中广受接受。

- 真空隔热板在建筑领域还有其他优势,例如更薄的建筑构件、增加的室内空间和优化土地利用,以及在使用寿命结束时回收组成材料的可能性。

- 根据美国人口普查局统计,2022年美国商业建筑价值为1,147.9亿美元,与前一年同期比较增加17.63%。

- 此外,亚太、中东和非洲等地区正在吸引大量国内外投资,用于设立工业单位、医院、商场、剧院、旅馆和IT产业,刺激了对真空隔热板的需求,这可能需要一段时间。

- 在沙乌地阿拉伯,不断增长的房地产开拓、不断增长的住宅需求以及政府改善社会经济基础设施的倡议正在推动该国真空隔热板市场的发展。沙乌地阿拉伯住宅部长 Majid Al-Hogail 表示,该国计划在未来五年内建造 30 万套住宅。沙乌地阿拉伯根据 2030 年愿景制定的关键倡议之一是住宅。未来几年,真空隔热板市场可能会受到该国建设产业的需求。

- 根据土木工程师学会 (ICE) 的一项研究,到 2030 年,全球建设产业预计将达到 8 兆美元,主要由中国、印度和美国推动。

- 此外,越来越多的建筑规范和政策要求采用节能结构,也鼓励建筑业更多地使用环保和节能材料。

- 因此,建设产业的上述趋势预计将在预测期内推动真空绝热板市场的成长。

亚太地区主导市场

- 亚太地区在全球市场占有率占据主导地位。印度、中国、菲律宾、越南和印尼对住宅和商业建设活动的投资不断增加,预计未来几年市场将会成长。

- 2011年至2022年中国建筑业产值显示该产业正在成长。例如,根据中国国家统计局的数据,2022年,中国建筑产值将达到峰值,约27.63兆元人民币(4.1兆美元)。

- 由于家庭收入的提高以及人口从农村地区向都市区的迁移,预计中国的住宅建设需求将会增加。公共和私营部门对经济适用住宅的更多关注将刺激住宅建设行业的发展。

- 目前中国有多个机场建设计划正在开发或规划中。例如,新疆维吾尔自治区正在规划兴建8个新机场,形成现代化机场网路体系。新疆机场集团宣布,计画于2023年至2025年在巴彦布拉克、八廓、乌斯、霍博萨尔和奇莫兴建机场。

- 此外,2021年建设产业新签约金额为1,345亿元人民币(195.2亿美元),较去年同期成长2.5%,成长速度为7.1%。 2022年1月,中国宣布了「十四五」(2021-2025)期间建筑业发展计划,为国家经济走上更绿色、更聪明、更安全的道路树立了支柱。因此,建筑合约的增加预计将对真空绝热板市场产生积极影响。

- 此外,印度政府于 2022 年 1 月核准在该国开发 21 个待开发区机场。该国最大的机场将建在北方邦的高塔姆佛陀纳加尔地区。民航部计划未来几年在印度各地增建 21 个机场。

- 此外,印度机场管理局 (AAI) 计划在未来四到五年内建造新机场,并对一些现有机场进行扩建和升级,耗资 3.38 亿美元。这包括现有航站楼的扩建和改造、新航站楼的建设、现有跑道、技术区、停机坪和机场导航服务控制塔的扩建和加固。

- 此外,到 2025 年,德里、班加罗尔和海得拉巴这三个 PPP(官民合作关係)机场将在扩建计画中投资 3,000 亿印度卢比(38.1 亿美元)。因此,真空绝热板市场的需求将会不断上升。

- 在印度,随着政府目标投资1,205亿美元活性化27个产业丛集,该国商业建设预计将回升。

- 因此,亚太国家的所有此类投资和计划计划都正在促进该地区的建设活动,并预计将在预测期内推动对真空隔热板的需求。

真空绝热板产业概况

真空绝热板市场较为分散。该市场的主要企业(排名不分先后)包括赢创工业股份公司、Panasonic Corporation、陶氏化学、可耐福绝缘、OCI有限公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业需求旺盛

- 采用真空绝热板自动搜寻

- 其他司机

- 抑制因素

- 非标准尺寸VIP高成本

- 真空绝热板重量重

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 核心材料

- 二氧化硅

- 玻璃纤维

- 其他核心材料

- 结构类型

- 平坦的

- 特殊形状

- 目的

- 建筑学

- 冷却/冷冻设备

- 后勤

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AVERY DENNISON CORPORATION

- Chuzhou Yinxing Electric Co. Ltd

- Csafe

- Dow

- Etex Group

- Evonik Industries AG

- KCC CORPORATION

- Kevothermal

- Kingspan Group

- Knauf Insulation

- Morgan Advanced Materials

- Panasonic Corporation of North America

- Recticel Insulation

- TURNA doo

- Vaku-Isotherm GmbH

- Va-Q-Tec AG

第七章 市场机会及未来趋势

- 引进自动化面板的研发工作

- 用于永续建筑的真空隔热板

The Vacuum Insulation Panel Market size is estimated at USD 8.39 billion in 2024, and is expected to reach USD 10.92 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market due to the shutdown of manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, robust demand from the construction industry and the adoption of vacuum insulation panels for automated storage and retrieval worldwide are factors driving the studied market's growth.

- On the flip side, the high cost for non-standard sizes and the heavy weight of the panels will likely hinder the studied market's growth.

- However, increasingly stringent regulations promoting energy-efficient materials and R&D initiatives to introduce automated panels to reduce vacuum insulation panel costs will likely provide opportunities for the market studied during the forecast period.

Vacuum Insulation Panel Market Trends

Construction Segment to Witness Strong Growth

- Vacuum insulation panels (VIPs) are one of the most promising insulation materials with the highest thermal insulating capacity and are widely accepted in the construction industry.

- Vacuum insulation panels also offer other advantages in the construction sector, like the reduced thickness of building components, increased indoor space and land use optimization, and recyclability of constitutive materials after their service life.

- According to the US Census Bureau, the value of commercial construction in the United States amounted to USD 114.79 billion in 2022, which showed an increase of 17.63% compared to the previous year.

- Additionally, regions like Asia-Pacific, the Middle East, and Africa are attracting huge domestic and foreign investments for setting up industrial units, hospitals, malls, theaters, hotels, and the IT sector, which may add to the demand for vacuum insulation panels.

- In Saudi Arabia, the growing number of real estate developments, increasing demand for residential property, and governmental initiatives to develop socio-economic infrastructure drive the vacuum insulation panel market in the country. According to Majid Al-Hogail, the Saudi Housing Minister, the Kingdom of Saudi Arabia plans to construct 300,000 extra housing units over the next five years. One of Saudi Arabia's significant initiatives under Vision 2030 is housing. It will likely create demand for the vacuum insulation panel market from the country's construction industry in the upcoming years.

- According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States.

- Furthermore, the rising number of building codes and policies mandating energy-efficient structures is further facilitating an increase in the construction sector's usage of eco-friendly and energy-conserving materials.

- Hence, the trends above in the construction industry are expected to drive the growth of the vacuum insulation panel market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing investments in residential and commercial construction activities in India, China, the Philippines, Vietnam, and Indonesia, the market is expected to grow in the coming years.

- The output value of construction in China from 2011 to 2022 indicates progressive growth in the industry. For instance, according to the National Bureau of Statistics of China, in 2022, the construction output value in China peaked at around CNY 27.63 trillion (USD 4.10 trillion).

- Rising household income rates and population migration from rural to urban areas are expected to increase demand for residential construction in China. Increased emphasis on both public and private sector affordable housing would fuel development in the residential construction sector.

- There are currently several airport construction projects in China, either in the development or planning stage. For instance, the Xinjiang Uygur autonomous region plans to construct eight new airports to form a modern airport network system. Xinjiang Airport Group announced its plan to build airports in Bayanbulak, Barkol, Wusu, Hoboksar, and Qiemo from 2023 to 2025.

- Moreover, in 2021, the value of newly signed contracts in the construction industry was CNY 134.5 billion (USD 19.52 billion), an increase of 2.5% year-on-year, and the growth rate narrowed by 7.1% compared with the same period last year. In January 2022, China unveiled plans to develop its construction industry during the 14th Five-Year Plan (2021-2025), paving a pillar of the country's economy on a greener, smarter, and safer path. Therefore, increasing contracts from construction is expected to include an upside for the vacuum insulation panel market.

- Moreover, in India, the government approved the development of 21 greenfield airports in the country in January 2022. The country's largest airport will be built in Uttar Pradesh's Gautam Buddha Nagar area. The Ministry of Civil Aviation intends to build 21 additional airports across India in the next few years.

- Furthermore, in the next four to five years, the Airports Authority of India (AAI) plans to create new airports and expand and upgrade many existing airports for USD 338 million. It comprises the expansion and alteration of existing terminals, the construction of new terminals, and the expansion or strengthening of existing runways, technical blocks, aprons, and the control towers of the Airport Navigation Services.

- In addition, by 2025, three PPP (Public-Private Partnership) airports in Delhi, Bengaluru, and Hyderabad will invest INR 30,000 crore (USD 3810 million) in expansion plans. Therefore, creating an upside demand for the vacuum insulation panel market.

- In India, the government's target for investing USD 120.5 billion in developing 27 industrial clusters is expected to boost commercial construction in the country.

- Hence, all such investments and planned projects in the Asia-Pacific countries are boosting construction activities in the region, which are anticipated to drive the demand for vacuum insulation panels during the forecast period.

Vacuum Insulation Panel Industry Overview

The vacuum insulation panel market is fragmented in nature. The major players in this market (not in any particular order) include Evonik Industries AG, Panasonic Corporation, Dow, Knauf Insulation, and OCI Company Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Demand from Construction Industry

- 4.1.2 Adoption of Vacuum Insulation Panel for Automated Storage and Retrieval

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of VIPs for Non-standard Sizes

- 4.2.2 Heavy Weight of Vacuum Insulation Panels

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Core Material

- 5.1.1 Silica

- 5.1.2 Fiberglass

- 5.1.3 Other Core Materials

- 5.2 Structure Type

- 5.2.1 Flat

- 5.2.2 Special Shape

- 5.3 Application

- 5.3.1 Construction

- 5.3.2 Cooling and Freezing Devices

- 5.3.3 Logistics

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AVERY DENNISON CORPORATION

- 6.4.2 Chuzhou Yinxing Electric Co. Ltd

- 6.4.3 Csafe

- 6.4.4 Dow

- 6.4.5 Etex Group

- 6.4.6 Evonik Industries AG

- 6.4.7 KCC CORPORATION

- 6.4.8 Kevothermal

- 6.4.9 Kingspan Group

- 6.4.10 Knauf Insulation

- 6.4.11 Morgan Advanced Materials

- 6.4.12 Panasonic Corporation of North America

- 6.4.13 Recticel Insulation

- 6.4.14 TURNA d.o.o

- 6.4.15 Vaku -Isotherm GmbH

- 6.4.16 Va-Q-Tec AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 R&D Initiatives to Introduce Automated Panels

- 7.2 Vacuum Insulated Panels for Sustainable Buildings