|

市场调查报告书

商品编码

1432440

OLED面板:市场占有率分析、产业趋势与统计、成长预测(2024-2029)OLED Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

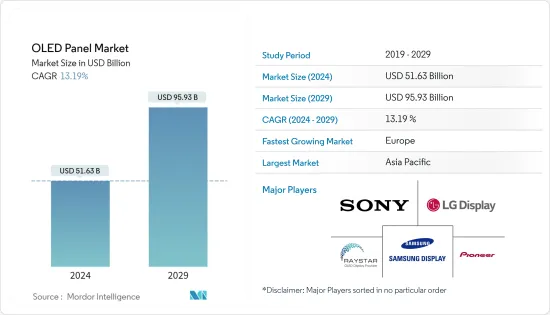

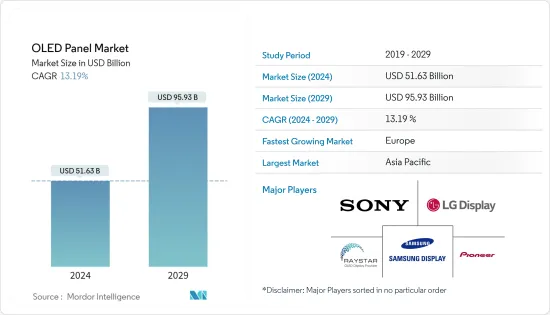

OLED面板市场规模预计到2024年为516.3亿美元,预计到2029年将达到959.3亿美元,在预测期内(2024-2029年)复合年增长率为13.19%。

OLED 是一种重要的显示技术趋势,具有更大的萤幕大小、改进的 8K(7680 x 4320 像素)解析度以及相对较新的外形尺寸。相当长一段时间以来,三星和 LG 等公司一直在尝试柔性 OLED 显示器。尤其是三星,现在在其所有旗舰设备中都使用了曲面柔性 OLED 面板。

主要亮点

- OLED 可实现发射显示器,其中每个像素都被独立控制以产生光(与 LCD 不同,LCD 从背光模组获取光)。 OLED 显示器提供卓越的视觉质量,包括鲜艳的色彩、快速的移动,以及最重要的是高对比度。最值得注意的是“真正的”黑色(液晶显示器由于照明而无法产生这种黑色)。此外,简单的 OLED架构使得製造柔性透明面板变得非常容易。

- 由于视角和黑色水平方面的多种优势,OLED 电视在多个地区的需求激增。根据 ICDM 的说法,在确定电视解析度时,对比度调整比纯粹的像素数更重要,而 OLED 电视显示器满足这一要求。

- 根据市场普及模型,柔性OLED预计在可预见的时期内将表现出较高的市场渗透率。随着智慧型手机在中国等许多重要市场的成熟,智慧型手机製造商正在开发采用柔性 OLED 的新型折迭式行动电话,未来几年成长潜力更大。

- 大规模生产使企业能够享受规模经济,从而降低设备的整体价格,使设备製造商受益。目前只有少数电视製造商使用 OLED,因为该技术对于中阶市场来说太昂贵。许多健身手环和简单的智慧型手錶设备都使用 PMOLED 显示器。

- 例如,Fitbit 的 Charge 手环使用小型单色(白色)PMOLED 显示器。 OLED 的厚度、弹性和外观使其成为可穿戴应用中相对于 LCD 更有前景的技术。此外,根据简单的确定性外推,基于量子点的 OLED显示面板的需求预计将在预测期内呈指数级增长。

OLED面板市场趋势

智慧型手机中的 AMOLED 显示器预计将出现高成长

- AMOLED是一种应用于平板电脑、智慧型手錶、游戏机、数位相机、可携式音乐播放器和音乐製作设备的OLED显示技术。使用薄膜电晶体(TFT)和储存电容器来储存线像素的状态。 AMOLED 面板比被动矩阵有机发光二极体(PMOLED) 快得多,并且可以轻鬆安装在任何尺寸的显示器中。此外,它比以前的显示技术更节能,提供更清晰的影像品质、更宽的视角,并且对运动的反应更快。

- 在全球范围内,快速的都市化、不断提高的收入水平以及不断增长的休閒娱乐需求正在对消费性电器产品销售产生积极影响。这是推动AMOLED显示领域扩大的最重要因素之一。由于苏丹、叙利亚和辛巴威等多个地区的通货膨胀,製造营运成本预计将会上升。然而,与其他显示技术相比,AMOLED 显示器具有许多优势,包括改进的影像品质和改进的显示品质。高解析度显示器的普及正在推动市场扩张。

- 柔性 AMOLED 显示器通常用于製造行动电话、显示器和穿戴式技术,因为它们比其他显示器消耗更少的能量且更便宜。由于包括苏丹、叙利亚、印度和其他国家在内的许多地区的通货膨胀,製造营运成本预计将会增加。

- 技术进步和智慧型手机中 OLED 显示器的使用不断增加带来了巨大的成长机会。此外,LG、飞利浦、SONY等知名电子公司加大对OLED开发的投资,将推动产业在成长期的演变。例如,2022年6月,LG Display与韩国麵包店Paris Baguette合作安装了38块透明OLED显示屏,用作数位萤幕。

- 此外,OLED 面板不需要额外的背光并且具有发射性,因此会在传统上用于智慧型手机的平板显示器上投射阴影。此外,由于AMOLED面板具有轻薄、输出明亮等优越特性,行动电话製造商越来越多地在其产品中采用AMOLED面板,预计这将推动市场成长。

- 此外,三星作为 OLED 面板市场的领导者之一,在其大部分智慧型手机中采用了 AMOLED 和 Super AMOLED 显示技术。

- 众多显示器厂持续投资扩大AMOLED产线,可望提升AMOLED的市场普及。此外,智慧型手机的普及不断提高,全球对智慧型手机显示器的需求也随之增加,预计将推动市场对 AMOLED 面板的需求。

亚太地区占最大市场占有率份额

- 亚太地区是 OLED 面板最大的市场,包括 LG 和三星在内的大多数主要企业都在该地区设有生产设施。此外,一些电视和指示牌显示器製造商以及其他供应商的总部也位于亚太地区。

- 由于中美贸易战的影响,中国政府计画预算的很大一部分都渗透到了显示产业。相较之下,作为密集招商引资的行业之一的半导体产业却面临困境。

- 儘管国土面积较小,韩国正在投资 OLED 技术的学术研究与开发。该国正在见证 LG 和三星等主要电子公司的巨额投资。

- 中国预计将控制全球 43% 的 OLED 面板产能,对韩国竞争对手产生重大影响力。京东方科技集团和TCL华星光电科技(TCL华星光电)是中国面板製造商,自2019年左右以来,在国家巨额补贴的帮助下一直在提高产量。

- 根据美国市场研究公司显示供应链顾问公司(DSCC)10月的预测,中国已经超过韩国,到年终韩国的产能份额预计将达到55%。发光二极体的开发和生产方式与液晶显示面板一样多种多样,但它们需要工程师具有更深入的技术知识。

- 中国是世界製造业中心。该公司是全球最大的消费品出口商和成长最快的消费市场之一。该国拥有世界上最大的电视市场之一。例如,LG计划透过与中国零售商和电视製造商合作扩大其OLED面板业务。预计该地区 OLED显示面板的销量将呈指数级增长。

OLED面板产业概况

由于存在许多在国内和国际范围内运营的公司,OLED 面板市场分散且竞争激烈。此外,面板製造商正在为不同的公司投资替代技术,我们看到公司之间的激烈竞争。该市场的主要企业是三星显示器公司、LG显示器公司和索尼公司。

2023 年 5 月,三星显示器将推出 Rollable Flex,旨在彻底改变平板电脑和笔记型电脑的移动性,透过将血压和指纹感应器整合到面板中而无需安装单独的模组,从而增加便利性。这些和其他 OLED 突破表明三星渴望建立并主导新的细分市场。

2023 年 3 月,SONY电子宣布推出 BRAVIA XR 电视系列,以提供最佳的家庭娱乐体验。 BRAVIA XR 系列包括五种新型号:X95L 和 X93L Mini LED、X90L 全阵列 LED、A95L QD-OLED 和 A80L OLED。所有型号均配备多种功能,让客户能够享受身临其境型的影片、串流媒体应用程式、游戏和其他活动。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的竞争关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- OLED 在智慧型手机中的采用率增加

- 各国政府对OLED技术发展的支持

- 市场挑战

- 量子点技术与Micro LED技术的演进

第六章市场区隔

- 按类型

- 灵活的

- 难的

- 透明的

- 按显示地址方式

- PMOLED显示器

- AMOLED显示器

- 按尺寸

- 小型有机发光二极体面板

- 中型OLED面板

- 大型有机发光二极体面板

- 副产品

- 手机和平板电脑

- 电视机

- 汽车

- 穿戴式的

- 其他(照明、医疗、家电)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 供应商市场占有率

第八章 竞争形势

- 公司简介

- Samsung Display Co. Ltd

- LG Display Co., Ltd

- Sony Corporation

- Pioneer Corporation

- Raystar Optronics Inc.

- Ritek Corporation

- OSRAM OLED GmbH

- WiseChip Semiconductor Inc.

- Winstar Display Co. Ltd

- Visionox Co. Ltd

第九章投资分析

第十章投资分析市场的未来

The OLED Panel Market size is estimated at USD 51.63 billion in 2024, and is expected to reach USD 95.93 billion by 2029, growing at a CAGR of 13.19% during the forecast period (2024-2029).

OLED is a significant display technology trend, with larger screen sizes, improved 8K (7680 x 4320 pixels) resolution, and relatively new form factors. For quite some time, companies like Samsung and LG have experimented with flexible OLED displays. Samsung, in particular, uses curved flexible OLED panels for all of its flagship devices now.

Key Highlights

- OLEDs make it possible for emissive displays, where each pixel is independently controlled and generates its light (unlike LCDs, which get their light from a backlighting unit). OLED displays provide excellent visual quality, including vivid colors, quick motion, and, most significantly, a high contrast ratio. Most notably, "real" blacks (LCDs can't produce due to the illumination). Additionally, the straightforward OLED architecture makes it very simple to manufacture flexible and transparent panels.

- Due to multiple advantages with viewing angles and black levels, OLED Televisions are surging in demand in several regions. According to the ICDM, contrast modulation in qualifying a TV resolution is more critical than pure pixel count, and OLED TV displays cater to this demand.

- Based on market diffusion models, flexible OLEDs are anticipated to observe a high market penetration in the foreseen period. With the maturity of smartphones in many significant markets, such as China, smartphone manufacturers are developing new, foldable phone models that incorporate flexible OLEDs and further have a massive potential for growth over the next few years.

- Mass production enables companies to reach economies of scale, thereby benefiting the device manufacturers by reducing the overall price of the device. Only a few TV manufacturers currently use OLEDs, as the technology is considered too expensive for the mid-range market. Many fitness bands and simple smartwatch devices adopt PMOLED displays.

- For instance, Fitbit's Charge band uses a small monochrome (white) PMOLED display. The thickness, flexibility, and appearance of OLEDs show make it a promising technology for wearable applications over LCDs. Further, based on simple deterministic extrapolation, the demand for quantum dots-based OLED display panels is anticipated to surge exponentially in the forecast period.

OLED Panel Market Trends

AMOLED Display in Smartphone is Expected to Witness High Growth

- AMOLED is an OLED display technology used in tablets, smartwatches, game consoles, digital cameras, portable music players, and music-making equipment. The line pixel states are stored using a thin-film transistor (TFT) and a storage capacitor. AMOLED panels are far quicker than their passive matrix organic light-emitting diode (PMOLED) and can easily fit into displays of any size. In addition, they are more energy-efficient than previous display technologies, offer more vivid image quality and a broader viewing angle, and respond to motion more quickly.

- Globally, rapid urbanization, growing income levels, and expanding leisure and entertainment demand favorably impact consumer electronics sales. This is one of the most significant factors promoting the expansion of the AMOLED display sector. The operating expenses of manufacturing are anticipated to rise as a result of inflation in several places, including Sudan, Syria, Zimbabwe, etc. However, there are a number of benefits that AMOLED displays offer over other display technologies, including enhanced picture quality and a high-resolution display, both of which are propelling the market's expansion.

- Flexible AMOLED displays are often used in the creation of mobile phones, monitors, and wearable technology because they consume less energy and are more affordable than other displays. The operating expenses of manufacturing are anticipated to rise as a result of inflation in numerous places, including Sudan, Syria, India, and other countries.

- Technological advancements and the increasing use of OLED displays in smartphones provide lucrative growth opportunities. Furthermore, growing investments in OLED development by prominent electronics companies such as LG, Philips, and Sony will drive industry evolution during the growing period. For instance, in June 2022, LG Display collaborated with the Korean bakery Paris Baguette to install 38 transparent OLED displays for use as digital screens.

- Further, the OLED panel requires no additional backlighting, and it is emissive, due to which overshadows the flat panel displays traditionally used in smartphones. Additionally, owing to the superior properties, such as less thickness and bright output, mobile manufacturers have been increasingly incorporating AMOLED panels in their products, which is likely to drive market growth.

- Additionally, Samsung, one of the leaders in the OLED panels market, incorporates AMOLED and Super AMOLED display technologies in most of its smartphones.

- Continuous investment undertaken by numerous display factories to expand AMOLED production lines will boost the AMOLED penetration rate in the market. Moreover, the increasing demand for smartphone displays across the globe, owing to the increasing smartphone penetration rates, is expected to propel the demand for AMOLED panels in the market.

Asia Pacific Occupies the Largest Market Share

- Asia-Pacific is the biggest market for OLED panels as most key players, including LG and Samsung, have manufacturing facilities in the region. Additionally, several TV and signage display manufacturers and other vendors have headquarters in the APAC region.

- Due to the trade war between the United States and China, a large portion of the budget planned by the Chinese government is percolating into the display industry. In contrast, the semiconductor industry, one of the intensive investment promotion industries, foreshadows difficulties.

- Despite its small size, South Korea invests in academic R&D for OLED technology. The country is witnessing huge investments from electronics giants like LG and Samsung.

- China is on track to control 43% of the capacity for manufacturing OLED panels globally, putting it in striking reach of South Korea's rival. With hefty state subsidies, BOE Technology Group and TCL China Star Optoelectronics Technology (TCL CSOT) are two Chinese panel manufacturers that have increased output since around 2019.

- China is overtaking South Korea, whose capacity share, according to a projection made in October by the American market intelligence firm Display Supply Chain Consultants (DSCC), is supposed to reach 55% at the end of 2022. OLED panels, which employ organic light-emitting diodes, are developed and produced in many ways as liquid crystal display panels but need engineers with more in-depth technical knowledge.

- China is the global hub for manufacturing. It is one of the largest exporters of consumer goods and the fastest-growing consumer market in the world. The country boasts one of the world's largest television markets. For instance, LG plans to collaborate with retailers and TV makers in China to expand its OLED panel business. The sales of OLED display panels are expected to grow exponentially in the region.

OLED Panel Industry Overview

The OLED Panel Market is fragmented and competitive because of the presence of many players conducting business on a national and an international scale. Also, panel manufacturers are investing in alternative technologies for various players, which showcases an intense rivalry among the players. The major players in the market are Samsung Display Co. Ltd., LG Display Co. Ltd., and Sony Corporation.

In May 2023, Samsung Display is introducing Rollable Flex, which intends to revolutionize the mobility of tablet computers or laptops, and Sensor OLED display, which offers additional usefulness by incorporating blood pressure and fingerprint sensors in panels without attaching separate modules. With these and other OLED breakthroughs, Samsung is showcasing its desire to establish and dominate new market sectors.

In March 2023, to provide the best possible home entertainment experience, Sony Electronics Inc. introduced its BRAVIA XR TV lineup. The BRAVIA XR lineup has five new models: the X95L and X93L Mini LED, X90L Full Array LED, A95L QD-OLED, and A80L OLED. All models come with features that let customers enjoy immersive video, streaming applications, gaming, and other activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of OLEDs in Smartphones

- 5.1.2 Government Support for the Development of OLED Technology in Various Countries

- 5.2 Market Challenges

- 5.2.1 Evolution of Quantum Dot Technology and Micro LED Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Flexible

- 6.1.2 Rigid

- 6.1.3 Transparent

- 6.2 By Display Address Scheme

- 6.2.1 PMOLED Display

- 6.2.2 AMOLED Display

- 6.3 By Size

- 6.3.1 Small-sized OLED Panel

- 6.3.2 Medium-sized OLED Panel

- 6.3.3 Large-sized OLED Panel

- 6.4 By Product

- 6.4.1 Mobile and Tablet

- 6.4.2 Television

- 6.4.3 Automotive

- 6.4.4 Wearable

- 6.4.5 Other Products (Lighting Products, Healthcare, and Home Appliances)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 Italy

- 6.5.2.4 France

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.3.5 Australia and New Zealand

- 6.5.3.6 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Samsung Display Co. Ltd

- 8.1.2 LG Display Co., Ltd

- 8.1.3 Sony Corporation

- 8.1.4 Pioneer Corporation

- 8.1.5 Raystar Optronics Inc.

- 8.1.6 Ritek Corporation

- 8.1.7 OSRAM OLED GmbH

- 8.1.8 WiseChip Semiconductor Inc.

- 8.1.9 Winstar Display Co. Ltd

- 8.1.10 Visionox Co. Ltd