|

市场调查报告书

商品编码

1432485

智慧玻璃市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Smart Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

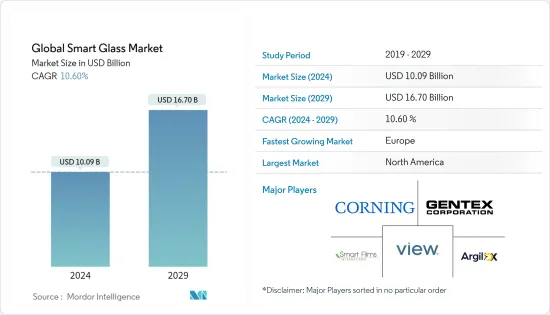

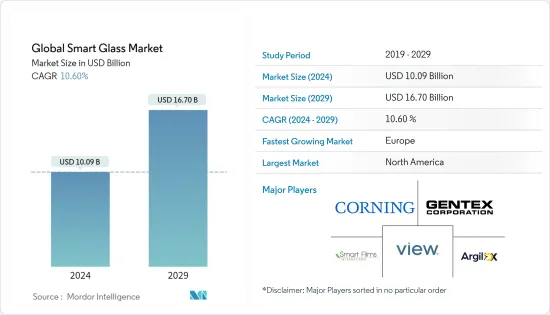

预计2024年全球智慧玻璃市场规模为100.9亿美元,预计2029年将达167亿美元,在预测期间(2024-2029年)复合年增长率为10.60%。

该市场是由高端商业办公室和住宅空间对降低能源成本的需求激增所推动的。随着对永续的日益关注,许多人选择在建筑物中安装用户可控制的窗户。智慧玻璃製造商正在积极投资研发,透过引入新技术和更低成本的原材料来降低生产成本。

主要亮点

- 由于其独特的性能,智慧玻璃在许多最终用户领域都有应用。然而,在目前的市场情况下,智慧玻璃仅在建筑业和运输业的应用中需求量很大。随着国家绿色建筑标准、Green Globes 和 LEEDS 等监管改革的不断加强,商业建筑业主可以投资智慧玻璃等智慧节能解决方案。

- 2021年12月,技术先进的智慧窗户製造商Hario在拉斯维加斯会议中心中央大厅SK CES 2022展位的「绿色大道」部分展示了其电致变色玻璃解决方案。该玻璃解决方案解决了建筑师、开发商和环保人士在製定实现净零建筑策略时需要解决的 10 个关键问题。这种先进的智慧玻璃解决了关键的设计和性能问题,包括清晰度和色调、响应能力和速度、色调均匀性以及用于自主操作的云端基础的人工智慧(AI)。这是我的第一个产品。 Hario 的 AI 即时确定可进入建筑物的最大日光量,从而实现节能,减少高达 20% 的碳排放,有助于阻止全球变暖,同时改善居住者。最大限度地减少领先的眩光管理。

- 航太应用公司波音和空中巴士正在透过整合物联网系统来实施智慧玻璃技术。例如,波音 787 梦幻飞机配备了电致变色窗户,只需单击按钮即可使其完全不透明。这一趋势在世界各地的豪华喷射机和私人喷射机製造商中越来越受欢迎,并开拓了新的市场机会。

- 它不仅越来越多地用于航太,而且还用于船舶和火车。例如,Vision Systems最近展示了多种专为游轮产业设计的SPD智慧玻璃产品,以改善邮轮上的乘客体验。

- 此外,联邦政府的几项重要政策规定、不断上涨的能源成本以及更严格的温室气体排放法规是能源效率措施的主要动力。因此,各国日益优化可再生能源的利用。

- 然而,COVID-19大流行的爆发对智慧玻璃市场造成了干扰。所研究的市场受到建设活动减少和供应链中断的显着影响。 COVID-19大流行的爆发对2020年住宅和商业建设活动产生了重大影响,导致建筑施工计划在短期内推迟或停止。由于景气恶化、营业盈余和收入下降、资金转移到应对新冠肺炎 (COVID-19) 措施以及流动性问题,建筑计划的需求正在下降。

- 欧洲建筑预测集团Euroconstruct预计,今年欧洲建筑市场将萎缩7.8%,直到2023年才能完全恢復,预计2021年将成长4.1%,2022年成长3.4%,2023年成长3.4%。为2.4%。随着建设活动的减少,对智慧玻璃的需求预计也会下降。

智慧玻璃市场趋势

汽车工业显着成长

- 智慧玻璃正在大规模应用,特别是在汽车行业,例如天窗和自动调暗的内部和外部后视镜。宝马和梅赛德斯等顶级汽车製造商都使用智慧玻璃。梅赛德斯-奔驰在 S-Class 变体(包括 S-Class 轿跑车)上提供最新的 Magic Sky Control全景天窗选项,采用 SPD-SmartGlass 技术。 SPD-SmartGlass 的优点包括显着减少车内热量、防紫外线、减少眩光、降低噪音和提高燃油效率。

- 最近的应用包括捷豹路虎推出的 F-Type 和劳斯莱斯推出的 Dawn 所使用的智慧玻璃。将可切换技术与投影应用相结合,使客户能够充分利用可切换玻璃的两个最令人垂涎的功能。

- 火车上也采用了智慧玻璃。例如,韩国单轨列车的车窗在经过附近的公寓大楼时会自动起雾。当电压、热或光施加到窗户表面时,毛玻璃的透光特性会改变。

- 借助智慧玻璃,服务人员只需单击按钮即可调整穿过汽车内部的光量。挡风玻璃和窗户的容量可以根据驾驶因素和乘客进行客製化。此外,还可以阶段性地调整色调。智慧玻璃透过减少眩光使驾驶更安全,透过减少光线进入提高舒适度,使空调工作得更好。

- 交通运输领域的不断扩大的应用正在创造对智慧玻璃的巨大需求。因此,2022年2月,以色列智慧玻璃技术供应商Gauzy收购了一家法国公司,加强了其产品供应,成为全球着名的光控和遮阳系统技术解决方案公司。透过收购 Vision Systems,Gauzy 计划进军 ADAS(高级驾驶辅助系统)行业,收购了法国公司 Vision Systems,该公司提供基于摄像头的图像分析和监控系统以及灯光控制和遮阳元件的定制设计。我们使用安全技术解决方案。

北美预计将占据很大份额

- 根据美国人口普查局的数据,2022 年 6 月美国住宅建设量达到 16 亿套。此外,2021 年商业计划的公共建设支出为 35.4 亿美元,高于 2017 年的 31.5 亿美元。在商业空间中,智慧玻璃应用于窗户、舱室、墙壁、隔间等。在办公室创建一个私人区域是最好的选择。办公室中的智慧玻璃隔间很好地补充了灵活的开放式楼层平面图。充分利用现代办公空间,同时保持隐私。也强烈建议在会议室使用智慧玻璃。智慧玻璃墙不仅可以提供隐私,而且非常适合用作会议投影萤幕。此外,智慧玻璃也为办公环境增添了优雅和现代感。

- 智慧玻璃因其美学价值在商业设计领域越来越受欢迎。例如,北达科他州的一家高檔餐厅 Spirit Lake Casino & Resort 安装了智慧玻璃,儘管存在阳光刺眼的问题,但仍可为客人提供自然环境的美景。这项技术还可以透过减少晴天空调造成的冷负荷来帮助餐厅节省资金。

- 由于人们对建筑物(尤其是商业领域)能源消耗的日益担忧,对智慧玻璃的需求不断增长。根据美国能源部 (DOE) 的数据,建筑占美国总能源消费量的 40%,约占美国用电量的 70%。窗户通常被认为是能源效率最低的建筑组件。冷气、暖气和照明(根据加州能源委员会的数据,因为人造光必须补充帘子阻挡的自然光)约占能源消费量的 40%。上述因素预计将影响该地区对智慧玻璃的需求。

- 2022 年 6 月,通用汽车宣布将对其位于密西根州沃伦的世界技术中心投资超过 8,100 万美元,为该园区配备生产凯迪拉克 Celestic 的设备。凯迪拉克的全电动高阶旗舰计画于 2023 年开始交付。首批采用四象限悬浮颗粒装置 (SPD) 智慧玻璃的全玻璃屋顶之一预计将来自 CELESTIQ。智慧玻璃让每位居住者使用 Research Frontier 的 SPD-Smart 光控制专利技术来客製化屋顶的透明度。

- 2022年6月,智慧建筑科技公司View宣布,凤凰城天港国际机场(PHX)的新航厦「Concourse 8」(俗称T4 S1)采用了其智慧玻璃。新大厅由 SmithGroup 和 Kogan 设计,周围环绕着落地 Outlook 智慧玻璃,最大限度地利用了航站楼的自然采光和令人惊嘆的景观。

智慧玻璃产业概况

由于生产这些产品的众多参与者的存在,全球智慧玻璃市场得到了部分整合。市场上的知名企业包括 View Inc.、Corning Incorporated、Gentex Corporation、Smart Films International 和 Argil Inc.。

- 2021 年7 月,建筑玻璃製造的单一来源Viracon 推出了由Viracon PLUS 智慧玻璃驱动的革命性自着色智慧玻璃解决方案,该解决方案在Halio 的Viracon 中空玻璃单元中采用了Hario 专有的电致变色技术。由 Halio 提供支援的 Viracon PLUS 智慧玻璃可透过自动调整色调等级来降低消费量,同时最大限度地利用自然光,从而优化居住者的舒适度。

- 2021 年 7 月 着名的智慧建筑平台和智慧窗户公司 View, Inc. 宣布收购了安全、云端管理、软体定义的物联网网路供应商 IoTium。 IoTium 易于部署的解决方案使建筑业主能够快速实现企业级安全、降低营运成本并获得整个房地产投资组合的即时可见性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 加强能源效率法规和降低能源成本的必要性

- 提高舒适度、便利性和绿色导向

- 市场限制因素

- 高成本和与软塑胶技术的竞争

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对产业的影响

第五章技术概况

- 透明显示器的演变

- 未来展望 电气控制与发电

第六章市场区隔

- 按类型

- 电致变色

- 悬浮颗粒装置(SPD)

- 液晶

- 被动型(感温变色、光致变色)

- 其他类型(混合、太阳能)

- 按最终用户

- 车

- 建筑(住宅、商业建筑)

- 航空电子设备

- 其他最终用户

- 按地区

- 美国

- 亚太地区

- 欧洲/中东/非洲

第七章 竞争形势

- 公司简介

- Smart Glass Manufacturers

- View Inc.

- Corning Incorporated

- Gentex Corporation

- Halio International SA

- AGC Group(Incl. AIS)

- Guardian Glass LLC

- Polytronix Inc.

- Research Frontiers Inc.

- Compagnie de Saint-Gobain SA(incl. SageGlass)

- Smart Film Manufacturers

- Smart Films International

- UniteGlass(part of China National Building Materials Group)

- Argil Inc.

- Magic Film Factory

- Pro Display(Incl. Intelligent Glass)

- Smart Glass Manufacturers

第八章投资分析

第9章 未来展望

The Global Smart Glass Market size is estimated at USD 10.09 billion in 2024, and is expected to reach USD 16.70 billion by 2029, growing at a CAGR of 10.60% during the forecast period (2024-2029).

The market has been gaining significant traction due to the surging demand for energy cost savings in high-end commercial offices and residential spaces. With a growing focus on sustainable development, many people have been opting for user-controlled windows in buildings. Smart glass manufacturers have been actively investing in research and development to cut production costs by implementing newer technologies and low-cost raw materials.

Key Highlights

- Smart glass has applications in many end-user verticals, owing to its unique properties. However, only the applications encountered in the construction sector and transportation industries stand to be a high source of demand for smart glass in the current market scenario. The increasing regulatory reforms, such as the National Green Building Standard, Green Globes, LEEDS, etc., enable commercial building owners to spend on smart energy-saving solutions, such as smart glass.

- In December 2021, Halio, builder of technologically advanced smart windows, exhibited an electrochromic glass solution in the "Green Avenue" section of the SK CES 2022 booth located in the Las Vegas Convention Center, Central Hall. The glass solution addressed the ten must-haves for architects, developers, and environmentalists as they formulate strategies to achieve net zero buildings. The advanced smart glass is the first to address critical design and performance issues, including clear and tint color, responsiveness and speed, tint uniformity, and cloud-based artificial intelligence (AI) for autonomous operation. Halio's AI determines the maximum amount of daylight that can enter the building in real-time to deliver energy savings that reduce carbon emissions by up to 20%, aiding in staving off global warming while minimizing glare management that leads to occupant wellness.

- Boing and Airbus, aerospace application companies, have been deploying smart glass technology by integrating IoT systems. For instance, Boeing 787 Dreamliner airplane features electrochromic windows, which turn entirely opaque with a button's click. This trend has been obtaining popularity among all the luxury and private jet manufacturers globally, opening new market opportunities.

- Besides aerospace, smart glass is increasingly being adopted in ships and trains. For instance, recently, Vision Systems exhibited a wide variety of SPD-SmartGlass products designed for the cruise industry to improve the cruise ship passenger experience.

- Moreover, several key federal policy directives, rising energy costs, and stringent regulations concerning greenhouse gas emissions are significant factors driving energy-efficient measures. Therefore, the countries have been increasingly optimizing the use of renewable energy sources.

- However, the outbreak of the COVID-19 pandemic has caused disruptions in the smart glass market. The market studied was highly affected due to decreased construction activities and supply chain disruptions. The outbreak of the COVID-19 pandemic has significantly affected the construction activities of residential and commercial buildings in 2020 and has resulted in building construction projects being delayed or halted in the short term. The demand for construction projects has fallen owing to poor business sentiments, lower operating surpluses and incomes, diversion of funds for COVID-19 management, and liquidity problems.

- According to the European construction forecasting body Euroconstruct, the European construction market is expected to shrink by 7.8% this year and will not recover fully until 2023, with forecast growth of 4.1% in 2021, 3.4% in 2022, and 2.4% in 2023. With such a decline in construction activities, the demand for smart glass is anticipated to decrease.

Smart Glass Market Trends

Automotive is Observing a Significant Growth

- Smart glass has found a large-scale application, particularly in the automotive industry, in sunroofs and exterior and interior automatic dimming rear-view mirrors. Smart glass installations are seen in top automotive manufacturers, such as BMW and Mercedes. Mercedes-Benz offers its S-Class Coupe and other variants of the S-Class, with the option of a modern Magic Sky Control panoramic roof using SPD-SmartGlass technology. Some of the benefits of SPD-SmartGlass include remarkable heat reduction inside the vehicle, UV protection, glare control, noise reduction, and fuel consumption.

- Recent applications witnessed in smart glass that is currently being used to merchandise new launches, notably Jaguar Land Rover, which used it to launch the F-Type, and Rolls Royce, which used it to launch the Dawn. By combining switchable technology with a projection application, the customer can use two of the most coveted switchable glass features to maximum effect.

- Smart glass is also increasingly being adopted in trains. For instance, a monorail train in South Korea has windows that automatically fog when passing by the apartments close to the train. Glazing occurs when the window's light transmission properties are altered by applying voltage, heat, or light to the surface.

- With smart glass, drivers can adjust the amount of light penetrating the car just with a click of a button. The capacity of the windshield and the windows can be customized to suit the driver and the passengers. Moreover, incremental adjustments in tint are also being allowed. With smart glass, driving has become safer due to reduced glare, and comfort improves because of the air-conditioning's better functioning as light influx reduces.

- The growing applications in the field of transportation have been generating immense demand for smart glass. To that extent, in February 2022, Israeli smart glass technology provider Gauzy acquired a French company to bolster its offerings and become a prominent global solution firm for light control and shading system technologies. With the acquisition of Vision Systems, Gauzy plans to make inroads into the ADAS (Advanced Driver Assistance System) industry, leveraging the French company's SafetyTech solutions that offer camera-based image analysis and monitoring systems and customized designs for light control and shading elements.

North America is Expected to Hold Significant Share

- According to U.S. Census Bureau, U.S. new home construction in June 2022 amounted to 1.6 billion units. Furthermore, Public construction spending on commercial projects in 2021 is USD 3.54 billion, an increase from USD 3.15 billion in 2017. In business spaces, smart glass is employed in windows, cabins, walls, room dividers, etc. Making private areas in offices is the best option. Smart glass dividers in offices complement flexible open floor plans very well. They maximize space in a contemporary office while maintaining privacy. The use of smart glass in conference rooms is also highly recommended. Smart glass walls not only offer privacy but also make excellent conference projection screens. Additionally, smart glass gives an office setting a dash of elegance and contemporary.

- Smart glass has become an increasingly widespread feature in the commercial design sector because of its aesthetic value. For instance, Spirit Lake Casino and Resort, a fine dining restaurant in North Dakota, installed smart glass to provide (the guests) spectacular views of the natural surroundings, despite solar glare problems. The technology is also helping the restaurant save money by reducing the conditions' cooling load of air conditions on sunny days.

- The demand for smart glass is increasing owing to the growing concerns about energy consumption in buildings, especially in the commercial sector. According to the Department of Energy (DOE), buildings account for 40% of the total energy consumption of the United States and about 70% of the electricity use. Windows are commonly considered the least energy-efficient building components. They are responsible for about 40% of the total energy consumption for cooling and heating, as well as lighting (as natural light blocked by shades has to be replaced by artificial light, according to the California Energy Commission). The factors mentioned above are expected to influence the demand for smart glass in the region.

- In June 2022, General Motors announced that it would invest more than USD 81 million into the company's Global Technical Center in Warren, Michigan, to prepare the campus to build the Cadillac CELESTIQ. Cadillac's all-electric premium flagship is scheduled to begin deliveries in 2023. One of the first full glass roofs to use a four-quadrant, suspended particle device (SPD) smart glass is anticipated to be CELESTIQ's. With this smart glass, each car occupant may customize their own level of roof transparency utilizing Research Frontiers' patented SPD-Smart light-control technology.

- In June 2022, View, Inc., a company involved in smart building technology, declared that Phoenix Sky Harbor International Airport's (PHX) new "Eighth Concourse," also known as T4 S1, had been outfitted with their smart glass. The new concourse is enclosed with floor-to-ceiling Outlook Smart Glass to maximize the terminal's natural lighting and attractive view, according to the design of SmithGroup and Corgan.

Smart Glass Industry Overview

The Global Smart Glass market is partially consolidated with the presence of numerous players manufacturing these products. Some of the prominent players in the market include View Inc., Corning Incorporated, Gentex Corporation, Smart Films International, and Argil Inc., among others.

- July 2021 - Viracon, a single-source architectural glass fabricator, introduced Viracon PLUS Smart Glass powered by Halio, a breakthrough self-tinting smart glass solution that incorporates Halio, Inc.'s proprietary electrochromic technology into Viracon's insulated glass units. Viracon PLUS Smart Glass powered by Halio optimizes occupant comfort by autonomously adjusting tint levels to reduce energy consumption while natural light is maximized.

- July 2021 - View, Inc., one of the prominent players in smart building platforms and smart windows, stated it had acquired IoTium, the provider of secure, cloud-managed, software-defined IoT networks. IoTium's easy-to-deploy solutions allow building owners to quickly achieve enterprise-grade safety, reduce operating costs, and gain real-time visibility into their complete real estate portfolios.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Energy Efficiency Regulations and Need for Energy Cost Savings

- 4.2.2 Increasing Preference for Comfort, Convenience and Green Credentials

- 4.3 Market Restraints

- 4.3.1 High Cost and Competition from Flexible Plastic Technologies

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

- 4.5 Impact of COVID-19 on the Industry

5 TECHNOLOGY SNAPSHOT

- 5.1 Evolution of Transparent Displays

- 5.2 Scope for Future Innovations Electrically Controlled and Electricity Generation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electrochromic

- 6.1.2 Suspended Particle Device (SPD)

- 6.1.3 Liquid Crystal

- 6.1.4 Passive (Thermochromic & Photochromic)

- 6.1.5 Other Types (Hybrid, Photovoltaic)

- 6.2 By End User

- 6.2.1 Automotive

- 6.2.2 Architectural (Residential & Commercial Buildings)

- 6.2.3 Avionics

- 6.2.4 Other End Users

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Asia Pacific

- 6.3.3 Europe, Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smart Glass Manufacturers

- 7.1.1.1 View Inc.

- 7.1.1.2 Corning Incorporated

- 7.1.1.3 Gentex Corporation

- 7.1.1.4 Halio International SA

- 7.1.1.5 AGC Group (Incl. AIS)

- 7.1.1.6 Guardian Glass LLC

- 7.1.1.7 Polytronix Inc.

- 7.1.1.8 Research Frontiers Inc.

- 7.1.1.9 Compagnie de Saint-Gobain S.A (incl. SageGlass)

- 7.1.2 Smart Film Manufacturers

- 7.1.2.1 Smart Films International

- 7.1.2.2 UniteGlass (part of China National Building Materials Group)

- 7.1.2.3 Argil Inc.

- 7.1.2.4 Magic Film Factory

- 7.1.2.5 Pro Display (Incl. Intelligent Glass)

- 7.1.1 Smart Glass Manufacturers