|

市场调查报告书

商品编码

1432535

泡壳包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

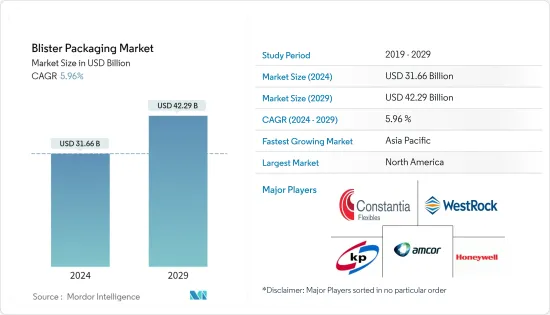

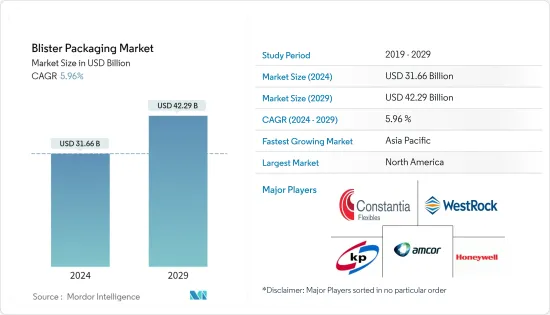

泡壳包装市场规模预计到2024年为316.6亿美元,预计到2029年将达到422.9亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为5.96%。

不断上升的发病率和政府对假药的严格监管迫使製药公司超越维持其生产目的的功效的基本需要,转而生产包装清晰且难以模仿的药品。这样做的压力越来越大是其中之一推动市场的关键因素。泡壳包装为钞票认证系统等防伪系统提供了有效的方法。

主要亮点

- 製造商、消费者和监管机构对产品安全的要求不断提高,使得泡壳包装成为越来越实用的选择。产品完整性和延长保质期等因素对于製药业来说非常必要,因为大多数消费者将药品储存在温度波动较大的环境中,这可能对未受保护的药品有害。

- 在泡壳中使用创新技术,例如在包装外部贴上无线射频识别标籤(RFID),有可能在整个供应链中提供个人安全保障。只有当保护屏障被破坏,甚至分配和服用一颗锭剂或胶囊时,才会发生泡壳中样品的污染。

- 遵守安全法规的需求不断增加,以及对方便易用的包装产品的需求不断增加,预计也将推动市场成长,导致市场供应商与科技公司合作推出这些功能,并扩大产品的差异化优势。买家。

- 此外,北美、欧洲和亚太等已开发地区对药品和个人保健产品的需求不断增加,导致消费者在药品和个人保健产品上的支出增加。胶囊、含片、无菌产品和香水等液体化妆品等产品对泡壳包装、保护、外观和合规性的要求特别高。

- COVID-19 的爆发、不断提高的全球监管标准、人口健康管理、发明、更知情的客户以及成药的兴起正在推动包装的成长。

泡壳包装市场趋势

医药业占有较大份额

- 製药业对泡壳包装解决方案提出了不同的要求,包括维持药品的有效性,以及与外部环境的隔离、高度的防护、成本效益和易于处理。

- 这些包装非常适合满足严格的标准,并因其防护性能、适应性、成本效益以及製药和包装行业的要求而受到高度重视。

- 当药物包装在泡壳中时,消费者可以追踪他们的药物和剂量,从而提高用药依从性。泡壳的单位剂量特征降低了错误剂量的风险。

- 在零售层面配製处方药对药剂师和製药技术人员来说是一项挑战。在超级市场和药局的开放环境中给药可能会对敏感药物在容器之间转移时产生不利影响。泡壳包装可以确保直接配送给客户。

- 虽然保护产品完整性仍然是药品包装的主要目标,但与包装行业的所有领域一样,我们仍在继续努力降低包装过程的成本。

- 根据 Healthcare Informatics 的数据,糖尿病的支出从 2013 年的 420 亿美元增加到 2018 年的 780 亿美元。此外,泡壳包装药物已被证明对于运输可能远距运输的药物(例如糖尿病药物)非常有用。

欧洲占有很大份额

- 製药和医疗保健产业在欧洲泡壳包装市场中占有压倒性的份额。预计消费品产业在预测期内也将占据重要份额。泡壳包装还可以透过标籤处方笺来创建合规性包装或日历包装,患者可以轻鬆遵守。

- 在欧洲,包装系统中多余材料的使用受到严格监管,因此使用泡壳包装有更大的环境奖励。泡壳包装使製造商能够将包装尺寸缩小到最小。在欧洲,英国製药业是创新和研究的主要动力之一。该行业在研发上花费了数十亿美元,并僱用了大量高技能人才担任研发职务。

- 这些巨额投资和高水准的技术纯熟劳工就业展示了英国如何建立药品和未来药品的管道。这种持续的投资为该国泡壳包装的发展带来了巨大的机会。

泡壳包装产业概况

泡壳包装市场较为分散。合作伙伴关係、合併和收购已成为市场上供应商开拓最终用户行业可接受的产品的关键策略,其中包装材料经过严格的品质检查,以确保它们不会影响其内容物的健康。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场驱动因素

- 老年人口增加和疾病传播

- 产品创新,例如相对便宜的小型化

- 市场挑战

- 法规的动态性和缺乏处理重负载的能力

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对泡壳包装市场的影响

第五章市场区隔

- 按流程

- 热成型

- 冷成型

- 按材质

- 塑胶薄膜

- 纸板

- 铝

- 其他材料

- 按最终用户产业

- 消费品

- 药品

- 工业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争讯息

- 公司简介

- Amcor PLC

- Westrock Company

- Constantia Flexibles GmbH

- Sonoco Products Company

- Klockner Pentaplast Group

- EI Du Pont De Nemours and Company

- Honeywell International Inc.

- Pharma Packaging Solutions

- Tekni-Plex Inc.

- The Dow Chemical Company

第七章 投资分析

第八章市场的未来

The Blister Packaging Market size is estimated at USD 31.66 billion in 2024, and is expected to reach USD 42.29 billion by 2029, growing at a CAGR of 5.96% during the forecast period (2024-2029).

Increasing pressure on pharmaceutical companies to manufacture medicines that are distinct in packaging and hard to imitate, beyond the basic need of keeping it effective for the purpose it was produced, for it to be made available for patients, owing to rise in diseases and stringent government regulations against counterfeit drugs, are among the major factors propelling the market. Blister packaging offers an efficient method of anti-counterfeit systems, like banknote authentication systems and others.

Key Highlights

- The rising need for the level of product safety from manufacturers, consumers, and regulatory organizations making blister packaging an increasingly practical option. Factors like product integrity and extended shelf life are highly necessary for the pharmaceutical sector, considering that most consumers store their drugs in a temperature variant atmosphere that can be harmful to unprotected medicines.

- The use of innovative technologies in blisters, such as radio frequency identification tags (RFID), deployed with a seal applied outside the packaging, is growing due to the potential to provide individual security throughout supply chains. Contamination of samples in blisters only occurs when the protective barrier is broken, when a single tablet or capsule is dispensed or administered.

- The growing need for compliance with safety regulations, coupled with increased demand for convenient and easy-to-use packaging products, is also expected to drive the market's growth and results in the market vendors partnering with technology companies to introduce those features and widen their product differentiation advantages for bulk purchasers.

- There is also a growing demand for pharmaceutical and personal care products in industrialized regions, like North America, Europe, Asia-Pacific, and others, where considerable consumer expenditure is increasing for both pharmaceutical and personal care products. Products, such as capsules, lozenges, sterile products, and liquid cosmetics like perfumes, place a particularly high demand for blister packaging, protection, appearance, and compliance.

- The outbreak of COVID-19, growth in regulatory norms across the world, population health management, inventions, more informed customers, and an increase in OTC drugs have augmented the growth of packaging.

Blister Packaging Market Trends

Pharmaceutical Industry Account for a Major Share

- The pharmaceutical sector poses a different set of demands for the blister packaging solutions regarding insulation from external surroundings, high levels of protection, cost-effectiveness, and ease of handling, in addition to retaining the medicine's effectiveness.

- These packs are uniquely suited to meet the stringent standards and highly valued for protective properties, adaptability, cost-effectiveness, and the pharmaceutical and packaging industry requirements.

- When drugs are packaged in blisters, adherence is improved because consumers can keep track of their medications and dosage. The unit dosage feature of blisters reduces the risk of incorrect dosing.

- The retail-level preparation of prescription drugs is troubling pharmacists or pharmaceutical technicians. The administration of medicines in the open atmosphere of the supermarket and drug store can negatively affect sensitive drugs when they are transferred from container to container. Blister packaging can ensure the process of distribution directly to the customer.

- Protecting product integrity remains the primary goal of pharmaceutical packaging, but as in all areas of the packaging industry, there is continued work on cost reduction in the packaging process.

- According to healthcare informatics, diabetes expenditure was USD 42 billion in 2013 and increased to USD 78 billion in 2018. Moreover, blister-packed medicines can prove to be very helpful in the transportation of medicines, such as those used for diabetes, which may be transported over long distances.

Europe to Hold a Significant Share

- The pharmaceutical and healthcare industry holds the dominant share of the blister packaging market in Europe. The consumer goods sector is also expected to contribute a significant market share over the forecast period. Blister packaging also provides the possibility to create a compliance pack or calendar pack by labeling the prescription, to which patients can easily adhere.

- The European community has more substantial environmental incentives to use blister packaging because of the stringent regulations overusing the excess material into the packaging system. The use of blister packaging allows manufacturers to reduce packages to a minimal size. In Europe, the UK pharmaceutical industry is one of the major engines of innovation and research. The industry spends billions on R&D and employs vast numbers of highly skilled personnel for R&D roles.

- These massive investments and the proportion of skilled workers employed show how Britain is building up the pipeline of medicines and future drugs. These ongoing investments can be perceived as an excellent opportunity for the growth of blister packaging in the country.

Blister Packaging Industry Overview

The Blister Packaging Market is fragmented. Partnerships, mergers, and acquisitions have been a critical strategy for the vendors in the market for developing products that are acceptable in the end-user industry, where packaging materials undergo stringent quality tests so that they do not contaminate the content's impact health. Some of the recent developments in the market are:

- In January 2020 - Amcor partnered with Moda to offer innovative packaging solutions. Amcor and Moda offer multiple innovative solutions in flexible packaging and are expected to provide new resources to help gain and further strengthen Amcor's position in the flexible packaging market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing geriatric population and prevalence of diseases

- 4.2.2 Product innovations such as downsizing coupled with relatively low costs

- 4.3 Market Challenges

- 4.3.1 Dynamic nature of regulations and inability to support heavy goods

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the impact of COVID-19 on Blister Packaging Market

5 MARKET SEGMENTATION

- 5.1 By Process (Trends, Forecasts - in USD million & Market Outlook)

- 5.1.1 Thermoforming

- 5.1.2 Coldforming

- 5.2 By Material (Trends, Forecasts - in USD million & KTon & Market Outlook)

- 5.2.1 Plastic Films

- 5.2.2 Paper & Paperboard

- 5.2.3 Aluminum

- 5.2.4 Other Materials

- 5.3 By End-User Industry (Trends, Forecasts - in USD million & Market Outlook)

- 5.3.1 Consumer Goods

- 5.3.2 Pharmaceutical

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries

- 5.4 Geography (Trends, Forecasts - in USD million & Market Outlook)

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE INTELLIGENCE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Westrock Company

- 6.1.3 Constantia Flexibles GmbH

- 6.1.4 Sonoco Products Company

- 6.1.5 Klockner Pentaplast Group

- 6.1.6 E.I. Du Pont De Nemours and Company

- 6.1.7 Honeywell International Inc.

- 6.1.8 Pharma Packaging Solutions

- 6.1.9 Tekni-Plex Inc.

- 6.1.10 The Dow Chemical Company