|

市场调查报告书

商品编码

1432541

BioPET:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Bio-PET - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

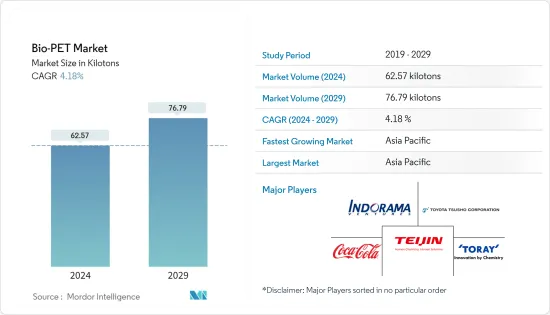

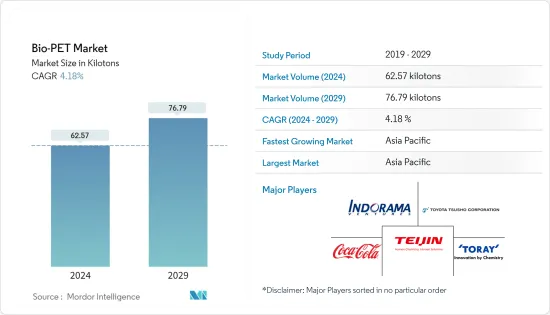

预计2024年生物PET市场规模为62.57千吨,预计2029年将达到76.79千吨,预测期(2024-2029年)复合年增长率为4.18%。

2020 年,由于新冠肺炎 (COVID-19) 疫情的爆发,市场受到了负面影响,导致全球范围内的国家封锁、製造活动和供应链中断以及生产停顿。然而,到了2021年,情况开始好转,市场恢復了成长轨迹。

主要亮点

- 对温室气体(GHG)排放的日益关注是推动市场的主要因素之一。

- 然而,PEF(Polyethylene Furanoate)的发展和生物PET的低熔点可能会抑制市场。

- 推动模式转移的环境因素可能会在预测期内推动对生物 PET 的需求。

- 对可再生资源的关注预计将提供未来的市场成长机会。

- 亚太地区主导全球市场,紧随其后的是北美。预计亚太地区在预测期内将呈现最高成长率。

生物基PET市场趋势

瓶子应用主导市场

- Bio-PET 广泛用于瓶子应用。随着公司寻求减少对石化燃料产品的依赖,他们的需求在全球范围内激增。此外,消费者对生物基产品的需求也增加。

- Bio-PET 是一种包装材料,为数十亿人提供清洁饮用水,为饮料行业的进步做出了贡献。该材料高度安全、轻质、透明、可重新密封、可模压、100%可回收,并具有优异的机械和阻隔性能。

- Bio-PET 已上市多年。这种塑胶由 30%可再生和 70% 石油基原料製成。生物 PET 的机械和热性能与其他石油基 PET 产品相似,使其成为原生 PET 的理想替代品。

- 生物基 PET(聚对苯二甲酸乙二酯)由部分可再生原料製成。好处是显而易见的。透过使用更多的可再生原材料,我们可以使用更少的石油基原材料。消费者日益重视并实现差异化的主题。 Bio-PET 使品牌所有者能够强调他们的地位并吸引人们对其产品的关注。

- 根据国际瓶装水协会(IBWA)的报告,瓶装水是美国消费量最多的饮料产品。亚太地区也出现了类似的趋势,近年来包装饮用水的消费量增加。小型製造商正以庞大的瓶子製造产能涌入市场,积极支持生物PET市场。

- 由于上述原因,瓶子应用可能主导市场。

亚太地区主导市场

- 亚太地区拥有全球一半的人口,消费量的宝特瓶。

- 该地区预计将在生物 PET 使用的成长中发挥关键作用,因为它为生物 PET 在纺织品和包装等多种应用中的广泛接受做出了重大贡献。

- 由于消费者对成本的意识很强,生物 PET 的高价格阻碍了该地区的广泛接受。

- 主要製造商正致力于降低生物PET的价格,降价的成功对市场转向生物PET产生了重大影响。

- 在亚太地区,由于食品的改变、人们可支配收入的增加、工作成年人数量的增加以及对快餐的日益偏好,对包装速食的需求不断增长。消费者更喜欢已调理食品,因为它需要更少的准备时间,新鲜,包装美观且坚固,支持了所研究市场的需求。

- 由于人均收入上升和电商巨头崛起等因素,中国已成为全球最大的包装消费国。随着快速消费品和包装产业的稳定成长,中国在亚太地区占据最高的市场占有率。

- 此外,由于经济的扩张和高购买力的中阶的崛起,中国包装产业近年来持续快速成长。食品包装是包装产业的主要企业,约占中国总市场占有率的60%。 Interpak预计,2023年中国食品包装类别的包装总量将达到4,470亿件,显示包装产业对研究市场的需求不断增加。

- 据印度塑胶工业协会称,印度的包装工业位居世界第五,每年以 22-25% 左右的速度成长。高技能的劳动力和低廉的人事费用使得包装和加工食品的成本比欧洲低 40%。人口的增长和对包装的需求的增加预计将推动市场的发展。

- 根据印度包装工业协会(PIAI)预测,印度包装产业在预测期内预计将成长 22%。此外,印度包装市场预计到2025年将达到2,048.1亿美元,2020年至2025年的复合年增长率为26.7%。因此,预计该地区的生物PET市场将会成长。

- 因此,由于上述原因,亚太地区很可能在预测期内主导生物PET市场。

生物基PET产业概况

BioPET 市场已部分整合。大部分市场占有率被少数参与者瓜分。生物PET市场的主要企业包括可口可乐公司、Indorama Ventures Public Company Limited、丰田通商、TEIJIN LIMITED和TORAY INDUSTRIES INC.(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 促进模式转移的环境因素

- 人们对温室气体排放的担忧日益加剧

- 其他司机

- 抑制因素

- 开发PEF(Polyethylene Furanoate)

- 低熔点阻碍了在某些应用中的使用

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 目的

- 瓶子

- 包裹

- 耐久性消费品

- 家具

- 电影

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Toyota Tsusho Corporation

- Far Eastern New Century Corporation

- Indorama Ventures

- THE COCA-COLA COMPANY

- TORAY INDUSTRIES, INC.

- Plastipak Holdings, Inc.

- Ford Motors

- Gevo Inc.

- TEIJIN LIMITED

第七章 市场机会及未来趋势

- 关注可再生能源

- 其他机会

The Bio-PET Market size is estimated at 62.57 kilotons in 2024, and is expected to reach 76.79 kilotons by 2029, growing at a CAGR of 4.18% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- One of the major factors driving the market studied is the growing GHG (Greenhouse Gases) emission concerns.

- However, the development of PEF (Polyethylene Furanoate) and a low melting point of bio PET is likely to restrain the market.

- Environmental factors encouraging a paradigm shift will likely boost the demand for Bio-PET during the forecast period.

- Focus on renewable sources is likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the market across the world, closely followed by North America. Asia-Pacific is likely to witness the highest growth rate during the forecast period.

Bio-Based PET Market Trends

Bottles Application to Dominate the Market

- Bio-PET is widely used in bottling applications. The demand for these is increasing rapidly worldwide as companies want to reduce their dependency on fossil-fuel-based products. In addition, the demand from consumers for bio-based products is also increasing.

- Bio-PET is a packaging material that helped advance the beverage industry by providing billions of people access to clean drinking water. The material offers safety and is lightweight, transparent, resealable, moldable, and 100% recyclable, with exceptional mechanical and barrier properties.

- Bio-PET is present in the market for many years. The plastic is made from 30% renewable and 70% petroleum-based raw materials. Bio-PET's mechanical and thermal properties are similar to other oil-based PET products, thus making it an ideal replacement for virgin PET.

- Bio-based PET (polyethylene terephthalate) is made from partially renewable raw materials. The benefits are clear. By using more renewable raw materials, fewer petroleum-based raw materials are required. Topics that consumers increasingly value and allow for differentiation. Bio-PET allows brand owners to highlight their position and draw attention to their products.

- As per the International Bottled Water Association (IBWA) reports, bottled water is the most consumed beverage product in the United States in terms of volume. A similar trend is being followed in the Asian-Pacific region, where the consumption of packaged drinking water is triggered in the past few years. Small-scale manufacturers flooded the market with vast production capacities for bottle production, thus positively supporting the bio-PET market.

- The bottle application will likely dominate the market due to the abovementioned reasons.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is home to half of the population in the world, and its consumption of PET bottles is high.

- This region is expected to play a prominent role in the growth of bio-PET usage, as it massively helps the wide-scale acceptance of bio-PET in multiple applications, like textile, packaging, etc.

- The high cost of bio-PET is a deterrent to its wide acceptance in this region due to the cost-conscious nature of the consumer.

- Major manufacturers are focusing on lowering the price of bio-PET, and the success in lowering the prices massively affects the market shift toward bio-PET.

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food. Consumers prefer ready-to-consume foods because they require considerably less time for cooking, are fresh, and include attractive and sturdy packaging, supporting the demand for the market studied.

- China is the world's largest packaging consumer globally owing to factors such as growing per capita income and rising e-commerce giants in the country. Due to the steady growth of its FMCG and packaging industries, China accounts for the highest market share in the Asia-Pacific region.

- Furthermore, the Chinese packaging industry grew rapidly and consistently in recent years, owing to the expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, total packaging in the foodstuff packaging category is expected to reach 447 billion units in 2023, indicating an increased demand for the studied market from the packaging industry.

- India's packaging industry is the fifth-largest in the world, growing at about 22-25% per year, as per the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the Bio-PET market is expected to grow in the region.

- Hence, for the reasons above, Asia-Pacific will likely dominate the bio-PET market during the forecast period.

Bio-Based PET Industry Overview

The bio-PET market is partially consolidated. The majority of the market share is divided among a few players. Some of the key players in the bio-PET market include THE COCA-COLA COMPANY., Indorama Ventures Public Company Limited., Toyota Tsusho Corporation, TEIJIN LIMITED, and TORAY INDUSTRIES INC., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Factors Encouraging a Paradigm Shift

- 4.1.2 Growing GHG (Greenhouse Gases) Emission Concerns

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Development of PEF (Polyethylene Furanoate)

- 4.2.2 Low Melting Point Hinders Usage in Some Applications

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Bottles

- 5.1.2 Packaging

- 5.1.3 Consumer Durables

- 5.1.4 Furniture

- 5.1.5 Films

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 France

- 5.2.3.3 United Kingdom

- 5.2.3.4 Italy

- 5.2.3.5 Rest of the Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Toyota Tsusho Corporation

- 6.4.2 Far Eastern New Century Corporation

- 6.4.3 Indorama Ventures

- 6.4.4 THE COCA-COLA COMPANY

- 6.4.5 TORAY INDUSTRIES, INC.

- 6.4.6 Plastipak Holdings, Inc.

- 6.4.7 Ford Motors

- 6.4.8 Gevo Inc.

- 6.4.9 TEIJIN LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Focus toward Renewable Sources

- 7.2 Other Opportunities