|

市场调查报告书

商品编码

1432668

智慧紧急应变系统基础设施 (IRIS):市场占有率分析、产业趋势和成长预测(2024-2029 年)Intelligent Emergency Response Systems and Infrastructure (IRIS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

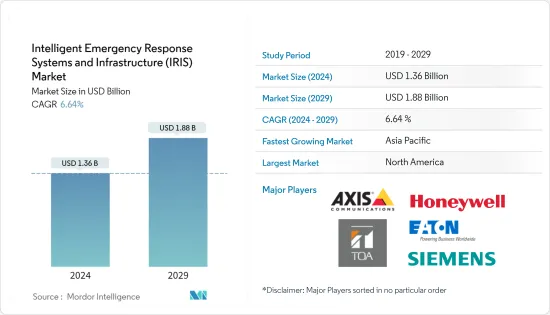

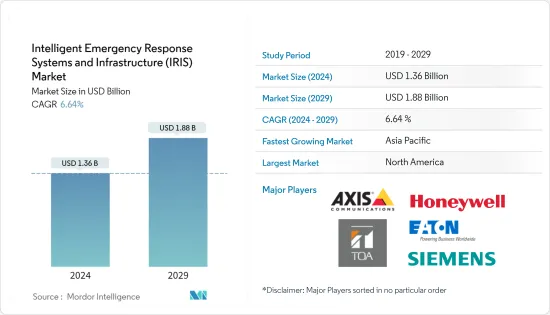

智慧紧急应变系统基础设施市场规模预计到2024年为13.6亿美元,预计到2029年将达到18.8亿美元,预测期内(2024-2029年)复合年增长率为6.64,预计增长% 。

智慧紧急应变系统基础设施(IRIS)在自然灾害和人为紧急情况下发挥作用。在这种情况下,IRIS 用于向卫生机构和政府机构发出警报。 IRIS 直接连接到显着增强的 IT、通讯和卫星生态系统,以实现卓越的资料传输和准确的影像撷取。

主要亮点

- 由于职业事故的增加,世界各国政府正在製定严格的职业安全标准。这就是为什么工业界正在采用智慧紧急应变系统并建造更安全的基础设施。

- 2017年,日本因工业事故发生了约450起死亡事故。一个主要问题是透过安装 IRIS 可以实现快速回应行动。

- 人们对安全重要性的认识不断提高、老化架构的更换、危险工业探勘的增加等预计将在不久的将来推动对 IRIS 的需求。

智慧紧急应变系统基础设施市场趋势

监控系统呈现巨大成长

- 安全和保障是任何行业任何组织最关心的问题。为了监控和克服威胁,已经建立了特定的监控系统以实现快速回应。因此,对这些系统的需求正在迅速增加。

- 儘管有线视讯监控的普及率急剧上升,但它不仅是一项耗时的任务,而且安装成本也很高。因此,在大型基础设施中,需要无线紧急应变系统来克服上述缺点。

- 2018年,美国警方记录的暴力犯罪报告数量比2017年增加了19%。然而,包括谋杀和过失杀人在内的凶杀案数量却增加了 14%。

- 这些系统的结构变得更加紧凑。此外,MEMS技术的进步降低了製造成本。这些是使 IRIS 得以采用的一些因素。这些因素正在推动市场成长。

快速成长的亚太市场

- 亚太地区预计将成为智慧紧急系统基础设施市场成长最快的市场。这是由于该地区的技术进步和采用。

- 全球对 IRIS 优势的认识不断增强,这主要是由于印度等国家智慧城市计划的快速成长。因此,预计该地区的市场成长将非常显着。

- 该地区各国政府也投资 IRIS 以应对自然灾害。印度政府已拨款321亿卢比用于实施全国紧急应变系统。

智慧紧急应变系统和基础设施产业概况

提供不同类型 IRIS 系统的公司几乎没有产品差异化。因此,企业采取市场竞争策略来获得市场占有率。由于存在许多提供系统的参与者,IRIS 市场变得分散。

- 2019 年 4 月 ST Engineering 推出首款基于光纤布拉格光栅 (FBG) 的 AgilFence 埋设入侵侦测系统 (BIDS),用于週边安全。 AgileFence BIDS 结合使用光纤感测器和先进的讯号处理演算法,可以即时、准确地侦测跨越无围栏边界的脚步声。

- 2019 年 1 月 安讯士通讯推出适用于危险环境的防爆摄影机。这些相机配备了 i-CS 镜头,可自动对焦主体。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 技术简介

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 危险行业增加

- 有利的政府法规

- 市场限制因素

- 安装成本高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 生命安全

- 实体安全

- 设施管理安全

- 其他类型

- 按系统

- 监视系统

- 广播系统

- 指示牌

- 週边渗透系统

- 其他系统

- 按最终用户

- 政府机关

- 产业

- 卫生保健

- 防御

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Honeywell International Inc.

- Siemens AG

- Axis Communications AB

- TOA Corporation

- Denyo Co. Ltd

- Eaton Corporation PLC

- Robert Bosch GmbH

- Micron Technologies

- AtHoc Inc.

- Everbridge Inc.

- Visiplex Inc.

- ATI Systems Inc.

第七章 投资分析

第八章 市场机会及未来趋势

The Intelligent Emergency Response Systems and Infrastructure Market size is estimated at USD 1.36 billion in 2024, and is expected to reach USD 1.88 billion by 2029, growing at a CAGR of 6.64% during the forecast period (2024-2029).

Intelligent emergency response system and infrastructure (IRIS) comes into effect during emergencies, either natural catastrophes or human-made. During such situations, the respective health and public administration bodies are alerted using IRSIs. It is directly linked to the telecommunication and satellite ecosystems that have been enhanced immensely for superior data transmission and accurate image capture.

Key Highlights

- The increase in industrial accidents has made the governments make stringent norms for labor safety. Hence, industries are adopting Intelligent Emergency Response Systems and building safer infrastructures.

- In Japan, there were about 450 fatalities due to industrial accidents in 2017. The major concern is the quick response action that can be achieved by the installation of IRIS.

- The increasing awareness about the importance of security, replacement of obsolete architecture, and the rise in hazardous industrial explorations, among other factors, are expected to drive the demand for IRIS in the near future.

Intelligent Emergency Response Systems & Infrastructure Market Trends

Surveillance Systems to Show Significant Growth

- Security and safety are the prime concerns of any organization across the industries. To monitor and overcome the threats, concrete surveillance systems are installed, so that quick responsive actions can be made. Hence, there has been a steep increase in the demand for these systems.

- Though the popularity of wired video surveillance increased dramatically, it is expensive to install as well as a time-consuming task. Hence, for large infrastructures, wireless emergency response systems are needed to overcome the aforementioned disadvantages.

- In 2018, there has been an increase in reported violent crimes by 19%, as recorded by the police in the United Kindom from 2017. However, the number of homicides, including murders and manslaughter, increased by 14%.

- The structure of these systems became compact. Moreover, they are now cheaper to manufacture due to developments in MEMS technology. These are some of the factors enabling the adoption of IRISs. This factor, in turn, adds to the growth of the market.

The Asia-Pacific to be a Fastest Growing Market

- Asia-Pacific is expected to witness the fastest growing market for the intelligent emergency systems and infrastructure market. This is due to the technological advancements and their adoption in the region.

- The awareness about the advantages of IRIS has been increasing globally, mainly because of the rapidly growing smart-city projects in countries like India. Hence, the growth of the market in this region is expected to be substantial.

- the governments in the region are also investing in IRIS to tackle the natural calamities. The Government of India allocated rupees 321 crores for the implementation of emergency response systems across the country.

Intelligent Emergency Response Systems & Infrastructure Industry Overview

The companies that offer various types of IRIS systems have little product differentiation. Hence, the companies are adopting competitive pricing strategies for gaining market shares. The IRIS market is fragmented, owing to the presence of many players offering the systems.

- April 2019 - ST Engineeringintroduced first everFibre Bragg grating (FBG) based AgilFence Buried Intrusion Detection System (BIDS) for perimeter security. AgileFence BIDS is a combination of fiber optic sensors and advanced signal processing algorithms to provide instantaneous and accurate detection of footsteps that cross unfenced boundary lines.

- Jan 2019 - Axis Communications launched explosion-protected cameras for hazardous environment.These cameras are equipped with the i-CS lenses that adjustfocus automatically on the subject.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 Introduction to Market Drivers & Restraints

- 4.4 Market Drivers

- 4.4.1 Increase of Hazardous Industries

- 4.4.2 Favourable Government Regulation

- 4.5 Market Restraints

- 4.5.1 High Installation Cost

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Life Security

- 5.1.2 Physical Security

- 5.1.3 Facility Management Security

- 5.1.4 Other Types

- 5.2 By Systems

- 5.2.1 Surveillance System

- 5.2.2 Broadcasting System

- 5.2.3 Signage

- 5.2.4 Perimeter Intrusion System

- 5.2.5 Other Systems

- 5.3 By End-user

- 5.3.1 Government

- 5.3.2 Industrial

- 5.3.3 Healthcare

- 5.3.4 Defense

- 5.3.5 Other End-users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International Inc.

- 6.1.2 Siemens AG

- 6.1.3 Axis Communications AB

- 6.1.4 TOA Corporation

- 6.1.5 Denyo Co. Ltd

- 6.1.6 Eaton Corporation PLC

- 6.1.7 Robert Bosch GmbH

- 6.1.8 Micron Technologies

- 6.1.9 AtHoc Inc.

- 6.1.10 Everbridge Inc.

- 6.1.11 Visiplex Inc.

- 6.1.12 ATI Systems Inc.