|

市场调查报告书

商品编码

1432669

辐射检测/监测/安全:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Radiation Detection, Monitoring, and Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

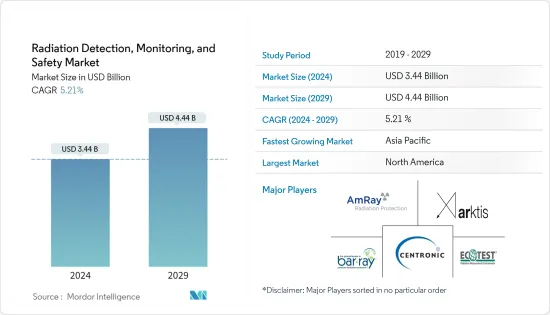

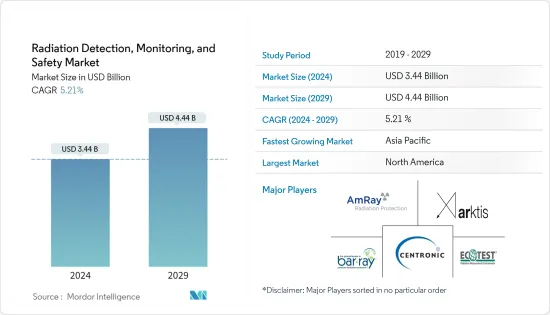

辐射探测、监测和安全市场规模预计到 2024 年为 34.4 亿美元,预计到 2029 年将达到 44.4 亿美元,预测期内(2024-2029 年)复合年增长率为 5.21,增长 %。

辐射监测设备用于透过测量辐射剂量和污染水平来控制辐射和放射性物质的暴露。

主要亮点

- 市场不断受到监管要求和不断变化的客户需求的驱动。放射性材料在电力生产、工业加工、研究加工和安全等领域的使用不断增加,增加了对放射性辐射防护设备的需求。

- 不同地区都面临COVID-19的影响,对放射防护的某些方面的需求很高。其中之一是发电厂,以满足日益增长的电力需求。需要诊断或治疗程序的医院表示需要辐射监测系统。同样,对核子医学製造和安全运输到药房的需求仍然强劲。

- 市场也见证了使用无人机的新监控技术的开拓。例如,2021 年 5 月,比利时核能研究中心 (SCK-CEN) 和比利时航空 Sabca 开发了允许使用无人机进行辐射测量的技术。 SCK-CEN 和 Sabca 已获得 100 万欧元的政府资金,并正在为该计划注入额外资金。

- 此外,各国正在花费大量资金发展核武和核设施,预计将引进更多的辐射探测、监测和安全设备。根据美国科学家联合会统计,截至2019年5月,美国和俄罗斯是拥有持有数量最多的国家之一。随着各种工业流程、电力生产和国防部门等部门越来越多地使用放射性材料,以及全球范围内恐怖分子操作的核武器的威胁日益增加,对放射性辐射防护的需求日益增加。对高功能设备的需求正在增加。

- 福岛第一核能发电厂灾难等事件凸显了安全、环境永续性和监管合规性的必要性。放射检测设备製造商必须遵守监管机构所提及的所有标准。

- 辐射监测和安全市场对熟练的辐射专业人员的需求很大。然而,由于有害辐射的高风险以及缺乏与该行业相关的适当技能,导致人才短缺。

辐射检测、监测和安全市场趋势

医疗保健产业市场占有率最大

- 由于放射学、急诊医学、牙科、核医学和治疗等应用中越来越多地采用剂量计和检测器,医疗和保健行业占据了最大的市场占有率之一。各种型态的辐射用于医疗诊断和治疗。所有辐射都具有潜在危险,必须谨慎管理辐射,以确保对病人的益处大于辐射带来的风险。

- 世界各地核能发电设施数量的不断增加增加了对辐射监测设备的需求。这些发电厂的不同产品可用于医疗保健产业。顺便说一句,医院正在推动安装使用医用同位素对患者进行放射诊断的设备。

- X 光诊断(普通放射线和牙科放射线照相)以及在肿瘤学和其他严重中使用放射性同位素的治疗方法是人类从人为辐射源吸收剂量的主要来源。此外,正在采用使用放射性元素的诊断和治疗方法。

- 放射(放射性同位素)治疗仍然是对抗癌症的主要方法之一。为了减少辐射对医疗机构人员的负面影响,市场供应商提供个人剂量计和用于个人剂量管理的自动化系统。

- 此外,为了保持市场竞争力,市场供应商和研究人员正在将新技术引入他们的产品。 2020年4月,洛斯阿拉莫斯国家实验室和阿贡国家实验室的研究人员宣布,他们开发了一种基于钙钛矿(一种钙钛氧化物矿物)的X射线检测器。有了更灵敏的检测器,基于 X 射线的成像系统也许能够减少辐射剂量并提高影像保真度。

北美地区占比最大

- 北美辐射检测、监测和安全市场的巨大份额是由积极的政府努力、大量运作中的核能发电厂、不断上升的癌症发病率以及该地区辐射安全意识的提高所推动的。事实上,它正在引领市场。此外,美国市场上主要供应商(Thermo Fischer Scientific、Mirion Technologies、LudlumMeasurement、Ametek、Ultra Electronics、Landauer)的存在也预计将推动预测期内的市场成长。

- EIA预计,2020年美国核能发电将增加4.4吉瓦。乔治亚和南卡罗来纳州正在建造多个新核子反应炉(例如,根据 EIA 的核能发电厂,在 Geodia 正在建造两座 1100 MW 反应炉)和南卡罗来纳州,为辐射监测和检测产品的需求带来了机会。核能工业工人安全的严格规定预计将为国内辐射探测、监测和安全设备市场提供动力。

- 最近,已经证实油气管道的辐射监测和检查正在从使用超音波的手动方法转向机械化方法。这一趋势表明,人们越来越重视检查自动化,因为一些检查现场需要技术人员透过使用无人机在极端的现场条件下工作,从而推动市场成长。

- 由于癌症发病率上升,越来越多地采用核医学和放射线治疗可能会推动预测期内的市场成长。例如,根据美国癌症协会估计,2020年美国将有超过181万名新诊断癌症患者,其中约61万人将死于该疾病。据估计,到2020年,美国将新增近91.3万名女性癌症病例。

- 根据国家肿瘤学 PET 登记处的数据,美国1,600 多个 PET 设施中的 85% 拥有 PET/CT 系统,新放射性药物和分子成像新技术的出现可能会导致未来几十年的持续增长。预计这将刺激对辐射探测、监测和安全设备的需求。

辐射检测、监测和安全设备产业概述

辐射探测、监测和安全设备市场适度集中,已进入分散阶段。在这个市场上拥有大量份额的领先公司致力于扩大基本客群。公司正在利用策略联合措施来增加市场占有率和盈利。此外,为了增强我们的产品能力,我们正在收购从事辐射检测、监测和安全技术的新兴企业。

- 2021 年 6 月德克萨斯大学达拉斯分校的研发部门开发出了一种更便宜、更准确和行动科技来检测中子束,该中子束可以表明大规模杀伤性武器(WMD) 所用材料的存在。该技术由德克萨斯大学达拉斯分校的研究人员申请专利,使用基于钙钛矿材料的薄膜。该薄膜的厚度约为8微米。这种新材料的製造成本大约比目前的辐射检测器低100倍到1000倍。

- 2020 年 12 月 Mirion Technologies 的剂量测量服务部门收购了 Dosimetrics GmbH,后者是 OSL个人辐射剂量计和剂量测量解决方案(读取器、橡皮擦、软体、配件、自动化系统等)的开发商和製造商。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

- 技术简介

- 市场驱动因素

- 市场限制因素

第五章市场区隔

- 产品类别

- 发现和监控

- 安全

- 最终用户产业

- 医疗/保健

- 工业的

- 国防安全保障与国防

- 能源和电力

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- AmRay Radiation Protection

- Arktis Radiation Detectors Ltd

- Bar-Ray Products Inc.

- Centronic Ltd

- ECOTEST Group

- Landauer Inc.

- Mirion Technologies Inc.

- Radiation Detection Company Inc.

- RAE Systems Inc.

- Thermo Fisher Scientific Inc.

- Unfors RaySafe AB

- ORTEC(Ametek Inc.)

- Fuji Electric Co. Ltd

- General Electric Company

第七章 投资分析

第八章市场的未来

The Radiation Detection, Monitoring, and Safety Market size is estimated at USD 3.44 billion in 2024, and is expected to reach USD 4.44 billion by 2029, growing at a CAGR of 5.21% during the forecast period (2024-2029).

Radiation monitoring equipment is used to control exposure to radiation or radioactive substances by measuring radiation dose or contamination levels.

Key Highlights

- The market is constantly driven by regulatory requirements and evolving customer needs. The increased use of radioactive materials in areas such as power production, industrial processing, research and processing, and the security sector intensified the need for equipment offering protection against radioactive radiations.

- With multiple regions facing the COVID-19 impact at varying intensities, certain aspects of radiation protection are witnessed to be in demand. One of them is the focus of the power plants to keep up with the increasing electricity demand. The hospitals in need of diagnostic and therapeutic procedures have stated their requirements for radiation monitoring systems. Likewise, the demand for nuclear medicine to be produced and safely transported to pharmacies has remained significant.

- The market is also witnessing the development of new monitoring technology using drones. For instance, in May 2021, a technology that enables drones to be used to carry out radiological measurements was developed by Belgium's Nuclear Research Centre (SCK-CEN) and the Belgian aeronautical firm, Sabca. SCK-CEN and Sabca were awarded EUR 1 million in government funding, and they are investing additional funds into the project by themselves.

- Furthermore, countries spend significantly on the development of nuclear weapons and facilities, which is expected to boost the adoption of radiation detection, monitoring, and safety equipment. According to the Federation of American Scientists, the United States and Russia were among the countries with the maximum number of nuclear weapons as of May 2019. Increased use of radioactive materials across areas, such as diverse industrial processes, power production, and the defense sector, coupled with the heightened global threat of terrorist-operated nuclear weapons, has intensified the need for reliable equipment that offers protection from radioactive radiation.

- The occurrence of incidents, such as the disaster at the Fukushima Dai-Ichi nuclear plant, has emphasized the need for safety, environmental sustainability, and regulatory compliances. Radiation-testing equipment manufacturers need to adhere to all the standards mentioned by the regulatory bodies.

- There is a huge demand for skilled radiation professionals in the radiation monitoring and safety market. However, there has been a lack of personnel due to the high risks associated with the harmful radiation and the lack of proper skills related to the industry.

Radiation Detection Monitoring and Safety Market Trends

Medical and Healthcare Industry has the Largest Market Share

- The medical and healthcare industry accounts for one of the largest market shares, owing to the increasing adoption of dosimeters and detectors in radiology, emergency care, dentistry, nuclear medicine, and therapy applications. Various forms of radiation are used in medical diagnostics and treatment. All forms are potentially dangerous, and exposure must be carefully controlled to ensure that the benefit to patients outweighs the risks from exposure.

- The increasing number of nuclear power facilities across the world is resulting in the increased demand for radiation monitoring equipment. The by-products of these power plants can be used in the healthcare industry. Incidentally, hospitals are promoting the installation of diagnostic radiology equipment, accompanied by using medical isotopes that are administered to patients.

- X-ray diagnostics (general and dental radiography) and therapies, which use radioisotopes in oncology and some other serious diseases, attribute to the primary contribution to the dose absorbed by a person from human-made radiation sources. The upcoming diagnostic and therapeutic methods, based on the use of radioactive elements, are also being adopted.

- Radiation (radioisotope) therapy remains one of the main approaches to fighting cancer. To reduce the negative impact of radiation on the personnel of healthcare facilities, market vendors are offering personal dosimeters and automated systems for personal dosimetry control.

- The market vendors and researchers are also deploying new technologies into their products in order to stay competitive in the market. In April 2020, researchers at Los Alamos and Argonne National Laboratories announced that they had developed an X-ray detector based on perovskite, a calcium titanium oxide mineral. More sensitive detectors may allow X-ray-based imaging systems to reduce the radiation dose that they deliver and improve their image fidelity.

North America to Account for the Most Significant Share

- The massive share of the radiation detection, monitoring, and safety market in North America is attributed to the favorable government initiatives, a higher number of active nuclear power plants, increasing prevalence of cancer, and growing awareness of radiation safety, driving the market in this region. Moreover, the fact wherein major vendors (Thermo Fischer Scientific, Mirion Technologies, Ludlum Measurement, Ametek, Ultra Electronics, and Landauer) of this market are based in the United States is expected to boost market growth during the forecast period.

- The EIA estimated that the United States' nuclear electricity generation capacity increased by 4.4 gigawatts in 2020. Multiple new nuclear power plants are under construction in Georgia (for instance, according to the EIA, two new nuclear reactors are under construction in Geodia with a capacity of 1100 MW) and South Carolina, and they indicate the opportunity for the demand for radiation monitoring and detection products. Strict regulations for workers' safety in the nuclear industry are supposed to give momentum to the market for radiation detection, monitoring, and safety devices in the country.

- Recently, it has been seen that there has been a shift toward mechanized radiation monitoring and inspection of oil and gas pipelines from the manual method of ultrasound application. These trends reflect that more focus is being placed on making the test increasingly automated, as some of the test sites require technicians to work in extreme site conditions, which can be carried out through drone application, consequently fostering the growth of the market.

- The increasing adoption of nuclear medicine and radiation therapy as a consequence of the increasing incidence of cancer may drive the market growth over the forecast period. For instance, according to the American Cancer Society, the number of new cancer cases in 2020 was estimated to be over 1.81 million people in the United States, out of which almost 0.61 million people were estimated to succumb to the disease. By 2020, it was estimated that there would be nearly 913 thousand new cancer cases among women in the United States.

- According to the National Oncology PET Registry, as 85% of more than 1,600 PET facilities in the United States have PET/CT systems, the emergence of molecular imaging with new radiopharmaceuticals and new technologies is expected to result in continued growth in the coming decades, which may give momentum to the demand for radiation detection, monitoring, and safety devices.

Radiation Detection Monitoring and Safety Industry Overview

The radiation detection, monitoring, and safety market is moderately concentrated, moving toward the fragmented stage, and features a significant amount of innovation derived from basic scientific research. Major players with a prominent share in the market are focusing on expanding their customer base across the served end-user industries. The companies leverage strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on radiation detection, monitoring, and safety technologies to strengthen their product capabilities.

- June 2021 - The University of Texas at Dallas researchers developed a cheaper and more accurate portable technology to detect neutron radiation, which can indicate the presence of materials used for weapons of mass destruction (WMD). This UT Dallas researchers' patented technology involves a thin film that is based on perovskite materials. The film measures were as thin as approximately 8 micrometers. Manufacturing costs of new materials are about 100 to 1,000 times less expensive than current radiation detectors.

- December 2020 - The Dosimetry Services Division of Mirion Technologies acquired Dosimetrics GmbH for the development and production of OSL personal radiation dosimeters and dosimetry solutions, including readers, erasers, software, accessories, and automation systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

- 4.5 Technology Snapshot

- 4.6 Market Drivers

- 4.7 Market Restraints

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Detection and Monitoring

- 5.1.2 Safety

- 5.2 End-user Industry

- 5.2.1 Medical and Healthcare

- 5.2.2 Industrial

- 5.2.3 Homeland Security and Defense

- 5.2.4 Energy and Power

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 AmRay Radiation Protection

- 6.1.2 Arktis Radiation Detectors Ltd

- 6.1.3 Bar-Ray Products Inc.

- 6.1.4 Centronic Ltd

- 6.1.5 ECOTEST Group

- 6.1.6 Landauer Inc.

- 6.1.7 Mirion Technologies Inc.

- 6.1.8 Radiation Detection Company Inc.

- 6.1.9 RAE Systems Inc.

- 6.1.10 Thermo Fisher Scientific Inc.

- 6.1.11 Unfors RaySafe AB

- 6.1.12 ORTEC (Ametek Inc.)

- 6.1.13 Fuji Electric Co. Ltd

- 6.1.14 General Electric Company