|

市场调查报告书

商品编码

1432783

金属包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

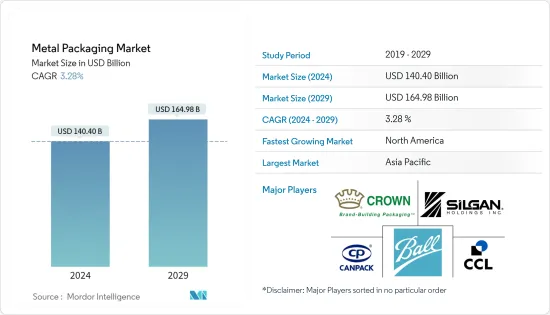

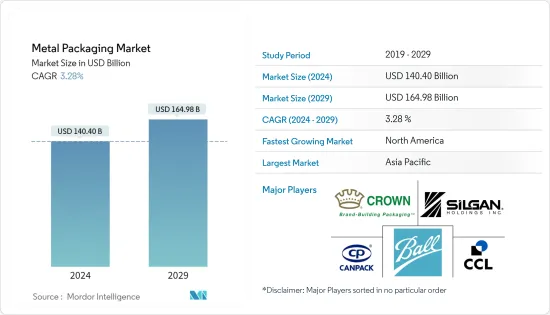

金属包装市场规模预计到2024年为1404亿美元,预计到2029年将达到1649.8亿美元,在预测期内(2024-2029年)复合年增长率为3.28%。

主要亮点

- 金属包装主要由钢、铝、金属製成。金属包装的主要优点包括耐衝击、能够承受严苛的温度、方便远距运输。罐头食品的需求量很大,尤其是在繁忙的都市区,这使得该产品更具吸引力并推动消费。该产品的耐用性和承受高压的能力使其成为香水行业的热门选择。随着饼干、咖啡和茶等偏好在金属包装中越来越普及,金属包装也在成长。

- 消费品、化妆品、医疗保健、食品和食品和饮料以及其他最终用途行业都依赖金属包装。在预期期间,由于这些最终用途行业的显着增长,预计市场将大幅增长。消费者对方便包装的需求不断增长、健康意识的增强、「移动」生活方式的增长趋势以及竞争日益激烈的环境中的品牌提升和差异化,推动了对金属包装的需求。一系列其他因素,包括日益增长的环境保护需求和不断提高的环保意识。因此,公司正在采用新的包装回收法规。对金属包装的需求主要是由于消费者健康意识的增强而推动的。

- 金属包装在食品和饮料行业也被广泛应用,因为它适合保护食品内容物,并保证比大多数其他包装解决方案更长的保质期。相较之下,还有用于运输石油、化学品和液体的坚固金属容器,例如桶子和 IBC(中型散货箱)。据联合国称,世界正在迅速城市化,预计2050年居住在都市区的人口比例将增加至66%。随着都市化的进步和富裕程度的提高,饮食习惯正在发生变化,对包装食品的需求也在增加。此外,食品包装行业正在增加金属包装的使用,因为各种金属产品类型的卓越防腐性能和结构完整性可提供更长的保质期。

- 此外,金属包装的可回收性是预计在此期间推动全球金属包装市场的关键因素之一。由于重复使用碱的普及,铝和钢包装材料是包装中最活跃的两种精製。欧洲和北美的大多数公司更喜欢宣传其产品采用环保材料包装。

- 此外,家常小菜和外带餐也对便利性有稳定的需求,特别是对于生活方式忙碌的消费者来说。结果,大型有组织的零售商开始储存大量罐头食品和食品和饮料。目前,线下和线上零售商在其商店里备有各种品牌的包装食品。金属包装是饮料容器的好选择,因为它很容易冷却,非常有利于保持内容物新鲜,而且材料的强度可以防止在旅途中破裂。

- 金属包装面临替代包装解决方案的激烈竞争。塑胶和玻璃包装解决方案是业内可用的替代包装选择。此外,电子商务在欧洲日益增长的重要性预计将影响整个包装行业。

- 在化妆品和个人护理品产业,消费者俱有很高的议价能力。这是由于竞争的加剧以及来自不同製造商的化妆品的供应。由于这些产品具有高度可替代性,购买竞争对手产品的消费者可以迫使製造商降低产品价格,这是气雾罐市场的主要限制因素。随着能源价格上涨,COVID-19 期间供应链中断影响了铝业的成长。

- 俄罗斯和乌克兰之间的战争导致多个国家受到经济制裁,大宗商品价格飙升,供应链中断,并影响了全球许多市场,导致该行业的贸易中断。战争迫使欧洲铝业公司减产,导致金属短缺。由于乌克兰战争导致依赖俄罗斯供应的欧洲製造商严重供不应求,大宗商品贸易商正在争夺从中国出货铝的微薄利润。欧洲正在经历能源成本上涨。

金属包装市场趋势

罐头预计将占据很大份额

- 金属罐具有许多优点,包括刚性、稳定性和阻隔性,因此用于储存保质期长且可远距运输的产品。在欧洲,锡、钢和铝金属罐是首选。这些材料具有柔软、轻质等重要特性,使製造商能够节省物流成本。

- 自金属包装兴起以来,该国的食品包装见证了许多创新。事实证明,工业化是金属成为食品大规模商业化首选材料的推动力之一。儘管过去 100 年来食品包装行业使用了多种材料,但铝等金属因其可靠的强度和永续性而受到最广泛的支持。金属罐最适合长期储存食品。

- 年轻顾客尤其被大胆、明亮的 360 度设计所吸引,这些设计已成为精酿啤酒的代名词。消费者对酒精饮料罐作为美味饮料的优质产品的看法不断变化,影响了成长。金属罐装酒精饮料越来越受到消费者的欢迎,因为罐装饮料更方便、方便且适合旅行。此外,金属罐比玻璃瓶更便宜且更可回收。

- 近年来,个人护理和製造产品的消费不断增加,实用的包装解决方案使它们得到了更广泛的应用。气雾罐是最有效的包装选择之一,在储存、运输和消费者便利方面提供卓越的性能。随着个人护理和化妆品行业的全球扩张,对环保包装罐的需求迅速增加。个人保健产品和化妆品含有敏感的化学成分,会与阳光和空气发生反应,因此它们被特殊包装在气雾罐中。

- 与竞争的包装类型相比,铝罐具有更高的回收率和更高的回收含量。据铝业协会称,它是市场上回收率最高的材料之一。 2022 年 4 月,Ball 与 Recycle Aerosol LLC 合作,提高美国铝气雾罐的回收率。这项合作不仅提高了气雾罐的回收率,也建立了封闭式系统,将废弃旧气雾罐回收成新的气雾罐。用再生铝生产铝产品具有能源效率和碳效率。由于用于製造铝气雾剂的合金纯度非常高,当主要从回收的铝气雾剂瓶和罐中获取时,还可以提高效率,减少对原始铝的需求。

- 圆柱形铝製饮料罐具有较大的印刷面积以及多种尺寸、样式和装饰选项,非常适合在重要的地方(在货架上和消费者手中)打造强大的品牌形象。包装解决方案。根据澳洲能量饮料品牌红牛预计,2022年全球整体销量将突破115.8亿罐,与前一年同期比较成长18.1%。

亚太地区预计将占据较大份额

- 中国是全球最大的铝生产国,已削减产量,力求 2060 年实现净零碳排放。结果,铝进口激增,以弥补国内产量的下降。随着乌克兰与俄罗斯的战争,这个等式也改变了。随着天然气和其他能源成本上升,欧洲铝生产商减产,导致金属短缺,中欧之间的价差几乎消失。

- 此外,由于中国没有对俄罗斯实施制裁,因此与欧洲相比,中国能够获得更便宜的能源和更低的生产成本。因此,在预测期内,中国在铝基气雾罐的生产方面可能具有成本优势。值得注意的是,中国的竞争对手比世界其他地区少,因此为市场上的製造商提供了巨大的成长机会。

- 个人护理和化妆品行业不断增长的需求迫使製造商提供环保的包装选择。因此,加强对绿色技术的研发(R&D)力度和投资正在推动气雾罐市场的发展。预计中国成长最快的经济产业之一是美容和化妆品产业。根据中国国家统计局的数据,国内批发和零售企业的化妆品零售正在扩大。这一增长预计将增加对洗髮精瓶、乳霜、除臭剂、髮胶喷雾、保湿霜等包装罐的需求。

- 根据环境、森林和气候变迁部的报告,印度政府于 2022 年 7 月实施了一次性塑胶产品禁令,以应对此类产品污染的担忧。随着一次性塑胶使用量的下降,个人护理、医疗保健、製药和汽车等各种行业迫切需要使用基于铝和钢的完全可回收金属包装。

- 乌克兰和俄罗斯之间的战争增强了印度的金属工业,该国增强了对北美、欧洲和MEA主要国家的钢铁出口机会,但基底金属价格正在上涨,产品正在影响价格。

- 食品业是印度使用金属罐和容器的主要产业之一。硬罐主要采用钢罐,薄型轻罐则采用铝罐。罐头所用的钢材几乎都涂有一层薄薄的锡,以防止食品腐蚀,称为马口铁罐。食品业的新趋势在印度市场日益凸显。例如,印度是农产品和加工食品的主要出口国。据工商部称,儘管受到COVID-19的限制,特别是由于第二波疫情,2021-22年(4月至6月)农产品和加工食品出口仍将比2020-21年同期继续增长相比之下,我们实现了44.3% 的稳健成长。

- 自乌俄战争爆发以来,日本经济进入了一个新阶段。战争不仅引发了人们对全球经济未来的担忧,而且日本和其他国家宣布的一系列经济制裁扩大了俄罗斯经济与(几乎)世界其他国家之间的差距。日本经济研究中心的数据显示,2022年2月日本进口物价指数与前一年同期比较增加34%。日本作为铝的主要进口国,面临价格的大幅上涨。因此,生产铝基气雾罐的公司面临原材料短缺和价格上涨影响产品成本的干扰。

金属包装产业概况

金属包装市场较为分散,主要参与者包括 Ball Corporation、Crown Holdings, Inc. 和 Silgan Holdings, Inc.。许多公司透过推出新产品、扩展业务和进行策略併购来扩大市场份额。

2023 年 1 月,永续包装解决方案製造商 Canpac 加入了阿联酋环球铝业公司 (EGA) 在杜拜成立的铝回收联盟。 Canpac 在阿拉伯联合大公国 (UAE) 拥有重要的铝罐製造设施。该联盟汇集了阿联酋饮料、废弃物和铝业的主要企业,教授如何最有效地再利用用过的饮料罐,以提高铝的回收率。

2022年12月,皇冠控股宣布与可口可乐生产的清凉饮料品牌Aquarius及其印刷和影印工作室合作,在西班牙开展一项智慧且引人入胜的促销宣传活动。相比之下,Aquarius 以标准 330 毫升铝罐出售。这种永续包装促进了循环经济,并凭藉其无限的可回收性,最大限度地减少了来自地球的原材料数量。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 金属包装回收率高

- 罐头食品方便且价格低廉

- 市场挑战

- 替代包装解决方案的存在

第六章市场区隔

- 依材料类型

- 铝

- 钢

- 依产品类型

- 能

- 食品

- 饮料罐

- 气雾剂

- 散装货柜

- 运输桶和桶

- 盖子和塞子

- 其他产品类型

- 能

- 按行业分类

- 化妆品/个人护理

- 油漆/清漆

- 其他行业

- 按地区

- 北美洲

- 美国

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Ball Corporation

- Crown Holdings Inc.

- Can-Pack SA

- Silgan Holdings Incorporated

- Tubex GmbH

- Greif Incorporated

- Mauser Packaging Solutions

- Ardagh Group

- DS Containers Inc.

- CCL Container Inc.

- Toyo Seikan Group Holdings Ltd.

第八章投资分析

第9章市场的未来

The Metal Packaging Market size is estimated at USD 140.40 billion in 2024, and is expected to reach USD 164.98 billion by 2029, growing at a CAGR of 3.28% during the forecast period (2024-2029).

Key Highlights

- Metal packaging is made mainly of steel, aluminum, and metal. Key benefits of metal packaging include impact resistance, the capacity to withstand severe temperatures, convenience for long-distance shipping, and others. There is a high demand for canned food, particularly in busy urban areas; therefore, the product's rising appeal for this usage encourages consumption. The product's durability and ability to withstand high pressure make it a popular choice in the fragrance industry. Metal-based packaging is also growing as luxury goods like cookies, coffee, tea, and other commodities become increasingly popular in metal packaging.

- Consumer products, cosmetics, healthcare, food & beverage, and other end-use industries rely on metal packaging. Over the anticipated period, the market is expected to increase significantly due to these end-use industries' phenomenal growth. The demand for metal packaging is also influenced by a wide range of other factors, including rising consumer demand for convenience packaging, rising health consciousness, rising "on-the-go" lifestyle trend, rising need for brand enhancement and differentiation in an environment of greater competition, and increasing environmental awareness. Due to this, businesses have adopted new package recycling regulations. The demand for metal packaging is primarily driven by customers' increasing health consciousness.

- Metal packaging is also finding extensive application in the food and beverage industry, as it is suitable for protecting food content, ensuring a longer shelf life than most other packaging solutions. In contrast, heavy-duty metal containers transport oil, chemicals, and liquids, such as drums and IBCs (Intermediate bulk containers). According to the United Nations, the world is urbanizing rapidly; the proportion of people living in urban areas is expected to increase to 66% by 2050. As urbanization is picking up and rising affluence, diet is changing, characterized by a high demand for packaged food. Additionally, excellent preservative properties and structural integrity of the various metal product types, offering higher shelf life, have increased the usage of metal packaging in the food packaging industry.

- In addition, the recyclability of metal packaging is one of the critical elements expected to drive the worldwide metal packaging market over the figure period. Because of the prevalent reusing foundation, aluminum and steel packaging materials are the two most active unrefined components for packaging. Most businesses in Europe and North America prefer to advertise that their products are packed with environmentally friendly materials.

- Moreover, ready or on-the-go meals have also witnessed a steady demand for convenience, especially among consumers with busy lifestyles. Therefore, large organized retailers have started to stack vast canned food and beverages. Nowadays, offline and online retailers stock a wide range of brands of packaged food items in their stores. Metal packaging is suited as containers for beverages as they are easy to cool, great for keeping the contents fresh, and prevent breakages when on the go due to the material's strength.

- Metal packaging faces high competition from alternative packaging solutions. Plastic and glass packaging solutions are the alternative packaging options available in the industry. Also, the increasing importance of e-commerce in Europe is expected to influence the overall packaging industry.

- Consumers have high bargaining leverage in the cosmetics and personal care industry. This is owing to increased competition and the availability of cosmetics from different manufacturers. Because these products are highly substitutable, consumers buying competitors' products can force manufacturers to lower their product prices which is a significant limitation for the aerosol cans market. With increased energy prices, supply chain disruptions during COVID-19 affected the growth of the aluminum industry.

- The war between Russia and Ukraine has resulted in economic sanctions against several countries, high commodity prices, supply chain disruptions, and impacts on many markets worldwide, and caused trade disruptions in the industry. War pushed European aluminum companies to cut production, leading to metal shortages. Commodity traders are competing for scarce profits from shipping aluminum from China as the war in Ukraine has created severe shortages for European manufacturers who rely on Russian supplies. Europe has experienced a surge in energy costs.

Metal Packaging Market Trends

Cans are Expected to Hold a Significant Share

- Metal cans provide many benefits, such as rigidity, stability, and high barrier properties, due to which they are used to store goods that have a longer shelf life and can be transported for longer distances. In Europe, metal cans of tin, steel, and aluminum are preferred. These materials have significant properties, such as being softer and lightweight, so manufacturers can save logistics costs.

- Food packaging in the country has witnessed many innovations since the rise of metal packages. Industrialization has proved to be one of the driving forces behind metal being the first choice of material for the mass commercialization of food products. The food packaging industry has used various materials over the past century, but metals like aluminum have gained the most widespread favor owing to reliable strength and sustainability. Metal cans make the most sense for long-term food storage.

- Young customers are particularly drawn to the bold, vibrant 360-degree designs that have become synonymous with craft beer. The change in consumer perception around the alcoholic can as a premium product for great tasting drinks has impacted growth; also, its overall experience fits in with today's lifestyle. Metal Can alcoholic beverages expanded in popularity among customers since cans are more convenient, portable, and travel-friendly. Furthermore, as compared to glass bottles, metal cans are less expensive and have a much greater recycling rate.

- Consumption of personal care and manufacturing items has increased in recent years, and it is now more widely available due to its practical packaging solution. Aerosol cans are one of the most effective packaging alternatives, offering excellent performance during storage, transportation, and consumer convenience. With the expansion of the personal care & cosmetics industry globally, the demand for eco-friendly packaging cans has surged. As personal care and cosmetic products have sensitive chemical ingredients that are reactive to sun exposure and air, they are packed in aerosol cans specifically.

- Aluminum cans have a higher recycling rate and more recycled content than competing package types. According to the Aluminum Association, it's one of the most recycled materials on the market. In April 2022, Ball Corporation partnered with Recycle Aerosol LLC to boost the recycling rates of aluminum aerosol cans in the United States; the collaboration not only increases aerosol can recycling but also establishes a closed-loop system in which used cans are recycled into new aerosol cans. The production of aluminum goods from recycled aluminum is energy- and carbon-efficient. Because the alloys used to make aluminum aerosols are of such high purity, there are efficiency improvements that also lessen the demand for virgin aluminum when they are mainly derived from recycled aluminum aerosol bottles and cans.

- With a huge printing surface area and various sizes, styles, and decoration choices, cylindrical aluminum beverage cans are the ideal package solution for creating a strong brand presence where it matters - on the shelf and in the hands of consumers. According to Red Bull, an energy drink brand based out of Australia, it sold more than 11.58 billion cans globally in 2022, 18.1% up from the previous year.

Asia-Pacific is Expected to Hold Major Share

- China, the largest aluminum producer in the world, reduced its output to reach net-zero carbon emissions by 2060. Therefore, the country's aluminum imports sharply increased to compensate for the decline in domestic production. The equation has changed due to the Ukraine-Russia war. European aluminum producers cut back on production as natural gas and other energy costs increased, leading to a shortage of metal and a pricing difference of almost between China and Europe.

- Additionally, China has had access to cheaper energy and reduced production costs compared to Europe because it has not imposed sanctions on Russia. Hence, for the forecast period, the country could have the cost advantage for producing aerosol cans, which use aluminum as the primary raw material. Notable, because there is less rivalry in China than in other parts of the world, there is a huge growth opportunity for the manufacturers in the market.

- The personal care and cosmetics industries' growing demand has compelled producers to provide eco-friendly packaging options. Therefore, rising research and development (R&D) efforts and investments in green technologies propel the aerosol cans market. One of the economic sectors in China that are expected to grow the fastest and most soon is the beauty and cosmetics sector. According to the National Bureau of Statistics of China, there is a growing trend of retail sales of cosmetics by wholesale and retail businesses in the country. This growth would consequently bolster the demand for cans for packaging shampoo bottles, creams, deodorants, hair sprays, hydrating creams, and many others.

- The Indian government, as reported by the Ministry of Environment, Forest, and Climate Change, implemented a ban on single-use plastic items in response to concerns about pollution caused by such products in July 2022. With the decrease in the utilization of single-utilized plastic, the interest in aluminum or steel-based, completely recyclable metal packaging use would increment in the impending time frame across different ventures, including personal care, healthcare, pharmaceutical, and automotive.

- Although Ukraine- Russia war has bolstered India's metal industry, and the country has strengthened its export opportunity of steel and Iron to major North American, Europe, and MEA countries, the prices of base metals are gravitating on the higher side, thereby affecting the price of products.

- The food sector is one of India's major sectors using metal cans and containers. Steel is primarily used to make rigid cans, whereas aluminum makes thin, lightweight cans. Nearly all steel used for cans is coated with a thin layer of tin to inhibit corrosion from the food and is called tin cans. The Indian market is witnessing significant emerging trends catering to the food industry. For instance, India is a major agricultural and processed food product exporter. According to the Ministry of Commerce & Industry, despite COVID-19 restrictions, particularly owing to the second wave of the pandemic, agricultural and processed food product exports achieved a robust increase of 44.3% in 2021-22 (April-June) compared to the corresponding period in 2020-21.

- Japan's economy has entered a new phase since the beginning of the Ukraine-Russia war. Not only did the war heighten concerns about the future of the global economy, but also a series of economic sanctions declared by Japan and others have widened the gap between the Russian economy and (nearly) the rest of the globe. According to the Japan Center for Economic Research, the country's import price index recorded a year-over-year increase of 34% in February 2022. Japan, a major importer of aluminum, faced a sudden price rise. Thereby the companies manufacturing aluminum-based aerosol cans face disruption related to the shortage of raw materials and escalated prices impacting the cost of the product.

Metal Packaging Industry Overview

The metal packaging market is fragmented, consisting of significant individual players such as Ball Corporation, Crown Holdings, Inc., Silgan Holdings, Inc., etc. Many companies are increasing their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions.

In January 2023, CANPACK, a manufacturer of sustainable packaging solutions, joined the Aluminium Recycling Coalition, which was established in Dubai by Emirates Global Aluminium (EGA). CAN PACK has a significant aluminum can manufacturing facility in the United Arab Emirates (UAE). This Alliance, which brought together key players in the UAE's beverage, waste, and aluminum sectors, teaches people how to reuse used beverage jars most effectively to increase aluminum recycling rates.

In December 2022, Crown Holdings, Inc. announced a collaboration with Aquarius, a refreshing beverage brand produced by Coca-Cola and its dedicated print and reprographics studio, on an intelligent and engaging promotional campaign in Spain. In contrast, Aquarius was available in standard 330ml aluminum cans. This sustainable packaging format advanced a Circular Economy and helps minimize the raw materials required to be sourced from the Earth via its infinite recyclability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 Convenience and Lower Price Offered by Canned Food

- 5.2 Market Challenges

- 5.2.1 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.1.1 Food Cans

- 6.2.1.2 Beverage Can

- 6.2.1.3 Aerosols

- 6.2.2 Bulk Containers

- 6.2.3 Shipping Barrels and Drums

- 6.2.4 Caps and Closures

- 6.2.5 Other Product Types

- 6.2.1 Cans

- 6.3 By End-user Vertical

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Industrial

- 6.3.4 Cosmetic and Personal Care

- 6.3.5 Paints and Varnishes

- 6.3.6 Automotive

- 6.3.7 Household

- 6.3.8 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Thailand

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Crown Holdings Inc.

- 7.1.3 Can-Pack SA

- 7.1.4 Silgan Holdings Incorporated

- 7.1.5 Tubex GmbH

- 7.1.6 Greif Incorporated

- 7.1.7 Mauser Packaging Solutions

- 7.1.8 Ardagh Group

- 7.1.9 DS Containers Inc.

- 7.1.10 CCL Container Inc.

- 7.1.11 Toyo Seikan Group Holdings Ltd.