|

市场调查报告书

商品编码

1432789

分散式控制系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Distributed Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

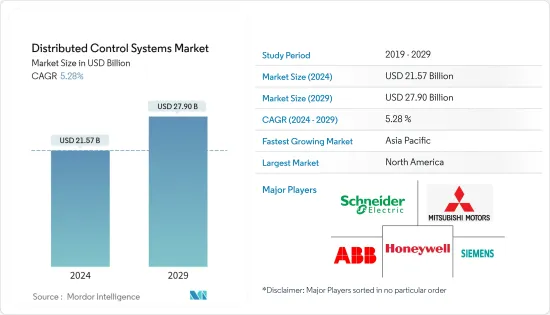

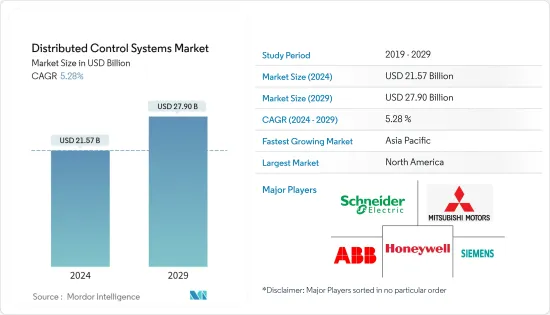

分散式控制系统市场规模预计2024年为215.7亿美元,预计到2029年将达到279亿美元,预测期内(2024-2029年)复合年增长率为5.28%,预计还会增长。

预计未来分散式控制系统市场将受到製程工业製造商实施最佳自动化技术以在当前竞争环境中获得竞争优势的趋势的推动。

智慧应用和物联网技术的日益采用是市场的主要驱动因素。随着智慧型设备的日益普及,对具有减少时间延迟和提高性能的多功能微电子装置的需求不断增加。

现今,製程工业的运作环境高度复杂,对其控制技术的要求也相应更高。控制技术是製程工业竞争力的重要手段,特别是如果它能够应对当今和未来的巨大挑战。最新版本的DCS系统在安全性、与现代技术的兼容性和操作员效率方面比以前的系统带来了显着改进,推动了分散式控制系统市场的发展。

COVID-19 对世界各地的每个行业都产生了重大影响。由于快速成长,世界各国政府对工厂和办公室的运作采取了更强有力的措施,导致封锁增加。由于商业和工业部门的电力需求大幅下降,封锁对电力部门产生了重大影响。对于世界各地的大多数企业来说,从疫情造成的严重损失中恢復的阶段已基本完成。

Wind Europe可再生,许多新的风发电工程预计会出现延误,开发商错过了引入竞标系统的最后期限,并因COVID-19而面临罚款。该机构表示,儘管大流行威胁着全球供应链:在电力产业,向二氧化碳净零排放的转变是不可阻挡的。此次疫情也表明,製造自动化对于现代工业的运作有多么重要。其中一些是由社交距离驱动的,一些是由网路威胁驱动的。随着製造商重组其业务以更多地依赖机器人技术,社交距离措施产生了更大的影响。

然而,最新版本的DCS系统在安全性、与现代技术的兼容性和操作员效率方面比以前的系统显示出显着的改进,这些都是分散式控制系统的市场驱动力。现代 DCS 包括资产诊断、性能监控、车队管理、故障警报处理、讯息优先顺序以及发生故障时的简化操作等新功能。新 DCS 的目的是在发电厂的整个生命週期中发挥作用。 DCS可以在线更新,安装更新和安全补丁,并且可以在不关闭工厂的情况下添加新功能。

此外,DCS 通常用于大量或连续操作,例如石油精製、发电、有机化合物生产、製程、食品和饮料生产、製药生产和水泥。 DCS 可以控制各种类型的设备,例如变速驱动器、品管系统、马达控制中心 (MCC)、窑炉、製造设备和采矿设备。

DCS 系统的主要优势之一是分散式控制、工作站和其他计算元件之间的数位通讯遵循P2P存取原则。为了在石化、核能、石油和天然气工业等製程工业中实现更高的精度和控制,对能够在特定设定点附近提供指定製程公差的控制器的需求不断增长。

这些要求推动了 DCS 的采用。这些系统降低了操作复杂性和计划风险,并提供了诸如在要求苛刻的应用中实现敏捷製造的弹性等功能。 DCS可以整合PLC、涡轮机械控制、安全系统、第三方控制以及热交换器、给水加热器和水质等各种工厂製程控制,进一步促进DCS在能源领域的采用。

集散控制系统市场趋势

服务占重要市场占有率

在研究范围内的其他组成部分中,DCS 产业服务市场是所有收益相关人员中最令人感兴趣的。由于 DCS 在维护、安装、警报管理、升级服务、工厂资产管理、生命週期服务、咨询服务、迁移服务、模拟和培训服务方面的广泛适用性,服务业对 DCS 的需求也在增长。因此,在预测期内,不断增长的能源需求和重大技术进步预计将推动需求,特别是服务业的需求。

此外,市场领先的供应商继续专注于扩大计划以及营运和维护服务能力,以实现市场的持续扩张。市场报告涵盖的服务范围的各个组成部分包括计划管理服务、非合约维护、维修和升级。

由于产业内分散式天线系统服务供应商数量显着增加,目前占据DCS市场重要部分的服务市场预计将在预测期内以最快的速度发展。

随着意识的不断增强,产业相关人员开始专注于部署和执行 IIoT 策略以增强 DCS 网路服务。随着感测器和边缘设备变得更加强大并且具有类似于 PC 的处理和通讯能力,这种关係已经发生了变化。每个设备都可以作为对等方执行更多功能,而不是扮演被动监听和回应的角色。

此外,主要自动化承包商(MAC)的概念在计划服务中变得越来越重要,其中供应商负责计划的所有自动化相关系统。

这种趋势在大多数大型 DCS计划中都在增加。服务市场封装了金字塔的底层实体,即备件和维修,它们有助于系统生产力、降低成本,并透过减少生产单元的运作来延长产品生命週期和系统。它已被证明是有帮助的。高效率地实现营运绩效。

北美占据主要市场占有率

北美快速成长的页岩气产业预计将成为该地区分散式控制系统市场的主要推动力。

根据美国能源局,到 2035 年,页岩气的份额预计将达到近 45%,从而导致紧密整合,这可能会导致 DCS 市场的平行成长。

此外,儘管该市场目前面临全球油价下跌的挑战,但预计未来将成为一个大产业。页岩气开采需要大量的水,为水处理设施中的 DCS 系统创造了市场,从而显着增加了整体市场。

此外,北美化工产业也受惠于可靠性的提高、远端监控的简化以及安装成本的降低。此外,化学产业的一些公司正在从过时的 DCS 系统转向更先进的 DCS 系统,以提高生产、效率、安全性并减少人为错误。

北美石油和天然气产业是流程主导的,具有连续运作和复杂的监控方法。操作员很难监控和调节该领域使用的机器的运作。北美的许多公司已经引入了 HMI 和控制器 (DCS) 的使用,允许操作员管理操作。这些系统会自动执行警报管理系统等安全程序,并执行设备维护和维修任务。

事实证明,分散式控制系统对于核能发电厂的管理至关重要,它可以进一步支援美国核能发电厂市场,并不断增加核能发电厂的容量和数量。

分散式控制系统产业概况

在竞争激烈的分散式控制系统市场上有几个重要的竞争对手。目前,就市场占有率而言,很少有大型竞争对手能够控制大部分市场。拥有重要市场占有率的大公司都致力于扩大其国际消费群。许多公司依靠策略合作计划来增加市场占有率和盈利。

2022 年 12 月,霍尼韦尔宣布印度 Regreen Excel EPC 已在印度 40 家工厂部署霍尼韦尔 PlantCruise by Experion 分散式控制系统 (DCS) 解决方案、模组化系统和现场仪表 (FI)。 Regreen Excel EPC India Pvt. Ltd. 是一家酿酒厂、糖厂、汽电共生、生质燃料、零液体排放系统和可再生能源公司。此技术可协助使用者增加生产运作,提高安全性、可靠性和效率,并降低投资和运作成本。

2022 年 5 月,ABB 对阿联酋的製程控制系统和水泥研磨设备进行了现代化改造,以提高多个站点的运作和一致性。 ABB 正在为阿拉伯联合大公国 Star Super Cement 的水泥研磨作业建造最先进的分散式控制系统 (DCS) 自动化技术。凭藉新的增强型系统和多个线性化和破碎装置的全站点同质性,Star Cement 受益于操作员可视性的提高、维护的简单性和停机时间的减少。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 价值链分析

- 市场驱动因素

- 主要新兴国家能源需求扩大

- 更多采用智慧应用和物联网技术

- 现有 DCS 解决方案的现代化有助于服务业的成长

- 市场限制因素

- 扩大製程自动化领域替代技术的使用

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按成分

- 硬体

- 软体

- 按服务

- 按行业分类

- 发电

- 油和气

- 化学

- 精製

- 矿业/金属

- 纸浆

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- UAE

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- ABB Ltd.

- Honeywell International Corporation

- Siemens AG

- Schneider Electric

- Mitsubishi Motors Corporation

- Rockwell Automation

- Emerson Electric Company

- Metso(Valmet Oyj)

- Omron Corporation

- Novatech Llc(Weir Group)

- Azbil Corporation

- Toshiba International

- Yokogawa Electric Co.

第七章 投资分析

第8章 未来趋势

The Distributed Control Systems Market size is estimated at USD 21.57 billion in 2024, and is expected to reach USD 27.90 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

The distributed control system market will be driven in the future by the tendency for manufacturers in the process industry to implement the best automation technologies to obtain a competitive edge in the current competitive environment.

The growing adoption of smart applications and IoT technologies are the key drivers for the market. With the increased adoption of smart devices, there is an increase in the demand for multifunctional microelectronics with reduced time delays and improved performance.

The process industry currently operates in a very complex environment, and the requirements for its control technology are correspondingly demanding. Control technology is a key lever for gaining a competitive edge in the process industry, all the more so if it can meet the tremendous challenges of both today and tomorrow. The latest iterations of DCS systems provide marked improvements over their predecessors regarding security, compatibility with the latest technology, and operator effectiveness, which drives the distributed control systems market.

COVID-19 had a significant impact on all industries worldwide. Because of the rapid growth, governments worldwide took stronger measures for functioning industrial plants and offices, resulting in stricter lockdowns. The lockdown significantly influenced the power sector as power demand from commercial and industrial sectors reduced significantly. For most businesses worldwide, the recovery phase following large losses during the pandemic was nearly completed.

According to Wind Europe, delays were expected in many new wind farm projects, causing developers to miss the deployment deadlines in the auction systems and face financial penalties due to COVID-19, The International Renewable Energy Agency stated that despite the pandemic threatening global supply chains in the power sector, it would not stop the industry from transitioning to net-zero CO2 emissions. The pandemic also showed how essential manufacturing automation was to modern industry functioning, with some fueled by social distancing and some by cyber threats. Social distancing measures had a greater impact as they led the manufacturers to restructure their operations to rely more on robotics.

However, the latest iterations of DCS systems provide marked improvements over their predecessors regarding security, compatibility with the newest technology, and operator effectiveness, a market driver for distributed control systems. Modern DCSs include new capabilities, such as asset diagnostics, performance monitoring, fleet management, alarm handling during the fault, prioritizing messages, and simplifying actions to be taken in the event of a failure. The purpose of the newer DCSs is to serve the entire lifetime of the power plant. The DCSs can be updated online, where updates and security patches are installed, and new features can be added without shutting down the plant.

Moreover, DCS is often employed in batch-oriented or continuous method operations, such as oil purification, power generation, organic compound manufacturing, craft, food and drink manufacturing, pharmaceutical production, and cement. DCSs can control various instrumentality types, including variable speed drives, quality control systems, motor control centers (MCC), kilns, manufacturing equipment, and mining equipment.

One of the significant benefits of DCS systems is that the digital communication between distributed controllers, workstations, and other computing elements follows the peer-to-peer access principle. To achieve greater precision and control in process industries, like the petrochemical, nuclear, and oil and gas industries, there is an increasing demand for controllers which offer specified process tolerance around an identified set point.

These requirements have driven the adoption of DCS, as these systems provide lower operational complexity, project risk, and functionalities, like flexibility for agile manufacturing in highly demanding applications. The ability of DCS to integrate PLCs, turbomachinery controls, safety systems, third-party controls, and various other plant process controls for heat exchangers, feedwater heaters, and water quality, among others, further drives the adoption of DCS in the energy sector.

Distributed Control Systems Market Trends

Services Constitute a Considerable Market Share

The services market in the DCS industry is the most intriguing of all the revenue stakeholders among the other components included in the report's scope. Due to its widespread applicability in maintenance, installation, alarm management, upgrade services, plant asset management, lifecycle services, consulting services, migration services, simulation, and training services, the service segment is also expanding demand for DCS. As a result, rising energy demand and considerable technological advancements will drive demand for the services segment, among others, during the projection period.

Moreover, the top market suppliers continue to emphasize expanding capabilities for projects and operations and maintenance services for continuous market expansion. The different components in the scope of services covered in the market report include project management services, non-contract maintenance, retrofits, and upgrades.

Due to an enormous increase in the number of distributed antenna systems service providers in the industry, the services market, which currently holds a significant part of the DCS market, is anticipated to develop at the fastest rate over the projection period.

With the rising awareness, industry players are focusing on deploying and executing IIoT strategies to enhance the DCS network services. The relationship has changed because sensors and edge devices are far more capable, with some processing and communications abilities similar to a PC. Instead of acting in a passive listen-and-respond role, each device can perform more as a peer.

In addition, the main automation contractor (MAC) concept is increasingly becoming important in project services, where the supplier is responsible for all automation-related systems of the project.

The trend is growing in the majority of the large DCS projects. The services market encapsulates entities from the bottom of the pyramid, i.e., the spare parts and repairs, which prove to be helpful in system productivity, cost curtailment, and extension of the product life cycle and systems by reducing the uptime of production units, thus, efficiently delivering operational excellence.

North America Holds Significant Market Share

The rapidly growing shale gas industry in North America is expected to be a major driver of the Distributed Control Systems market in the region.

According to the Department of Energy, in the United States, The shale gas percentage is expected to reach nearly 45% by 2035, which is likely to result in a parallel growth of the tightly integrated DCS market, which provides sustainability of the process through redundant controls in high-risk environments.

In addition, this market is currently challenged by reducing oil prices globally but can be relied upon to be a sizeable industry in the future. The requirement for a large amount of water in Shale gas extraction has created a market for DCS systems in water treatment facilities, resulting in a significant rise in the overall market.

Moreover, the chemicals sector in North America is benefiting from improved dependability, simplified remote monitoring, and lower installation costs. Additionally, several businesses in the chemicals sector are switching from outdated DCS systems to more advanced ones to improve production, efficiency, and safety and decrease human error.

The oil and gas industry in North America is process-driven, with ongoing operations and intricate monitoring methods. It is challenging for operators to keep an eye on and regulate the operation of the machinery used in the sector. Many North American businesses are implementing the usage of an HMI and a controller, or DCS, which enables operators to manage operations. These systems automate safety procedures, including alarm management systems, and perform equipment maintenance and repair tasks.

Distributed control systems have proven vital in managing nuclear power plants, further helping their market in the United States and continuously increasing its nuclear power plant capacity and numbers.

Distributed Control Systems Industry Overview

There are several significant competitors in the competitive distributed control system market. Few of the big competitors now control most of the market in terms of market share. Major firms with a sizable market share are concentrating on growing their consumer base internationally. Many businesses rely on strategic collaboration projects to improve their market share and profitability.

In December 2022, Honeywell announced that Regreen Excel EPC, India, has deployed Honeywell's PlantCruise by Experion Distributed Control Systems (DCS) solution, modular systems, and field instruments (FI) across its 40 plants in India. Regreen Excel EPC India Pvt. Ltd. is a distillery, sugar and cogeneration, biofuels, zero liquid discharge systems, and renewable energy company. The technology assists users in increasing production uptime, improving safety, dependability, and efficiency, and lowering investments and running costs.

In May 2022, ABB modernizes process control systems and cement grinding equipment in the UAE to improve uptime and consistency across several sites. ABB builds a cutting-edge distributed control system (DCS) automation technology at Star Super Cement cement grinding operations in the United Arab Emirates. With the new enhanced systems and homogeneity throughout the multiple linearization and grinding unit sites, Star Cement will benefit from greater operator visibility, easier maintenance, and little downtime.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Growing Energy Demand from Major Emerging Economies

- 4.3.2 Growing Adoption for Smart Applications and Iot Technologies

- 4.3.3 Modernization of Existing DCS Solutions will Contribute to the Growth Of Service Sector

- 4.4 Market Restraints

- 4.4.1 Growing Availability of Alternative Technologies in the Field of Process Automation

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End-User Vertical

- 5.2.1 Power Generation

- 5.2.2 Oil & Gas

- 5.2.3 Chemicals

- 5.2.4 Refining

- 5.2.5 Mining & Metals

- 5.2.6 Paper and Pulp

- 5.2.7 Other End-User Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 UAE

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 Honeywell International Corporation

- 6.1.3 Siemens AG

- 6.1.4 Schneider Electric

- 6.1.5 Mitsubishi Motors Corporation

- 6.1.6 Rockwell Automation

- 6.1.7 Emerson Electric Company

- 6.1.8 Metso (Valmet Oyj)

- 6.1.9 Omron Corporation

- 6.1.10 Novatech Llc (Weir Group)

- 6.1.11 Azbil Corporation

- 6.1.12 Toshiba International

- 6.1.13 Yokogawa Electric Co.