|

市场调查报告书

商品编码

1432800

醋酸酐:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Acetic Anhydride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

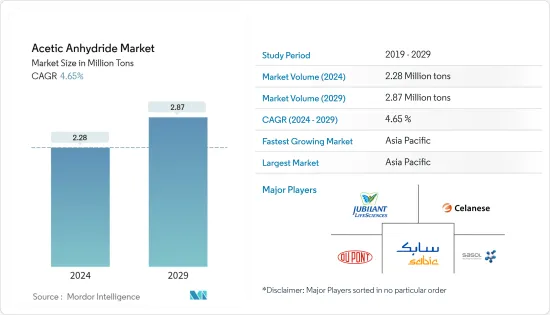

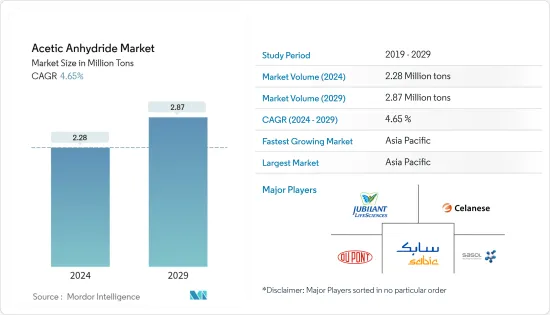

预计2024年醋酐市场规模为228万吨,预计2029年将达到287万吨,预测期内(2024-2029年)复合年增长率为4.65%。

市场的主要驱动力是其在洗衣精中的使用不断增加以及製药业对乙酸酐作为中间体的需求不断增加。

主要亮点

- 清洁剂产业中 TAED 的使用不断增加,推动了醋酸酐市场的发展。

- 电子烟的采用和无水纤维素中乙酸酐的使用减少可能会阻碍市场成长。

- 乙酰化木材的开拓预计将成为未来市场的机会。

醋酐市场走势

製药业需求增加

- 乙酸酐是製造乙酰水杨酸(阿斯匹灵)、磺胺类药物、某些维生素和激素、乙酰对氨基胺基、可的松、乙酰苯胺、茶碱、乙酰胆碱盐酸盐、乙酰芬那西丁、磺胺类药物类药物和乙酰胺酚药品所需的关键成分。 .这是原料。

- 发烧、咳嗽、感冒、身体疼痛和噁心等常见健康问题在全球呈现上升趋势。

- 因此,对阿斯匹灵和乙酰胺酚等药物的需求正在增加。学名药消费量的增加为醋酸酐市场带来了显着的效益。

- 此外,医药产业近年来发展迅速。由于人口健康问题日益严重,预计这种成长趋势将在预测期内持续下去。

- 所有上述因素预计将在预测期内推动全球市场。

亚太地区预计将主导市场

- 亚太地区是全球市场上最大的醋酐消费国。

- 乙酸酐是生产乙酰水杨酸(阿斯匹灵)、磺胺类药物和多种其他医药产品所需的关键原料。

- 由于工业活动的污染水平,该地区的发烧、咳嗽、感冒、身体疼痛和噁心等健康问题增加。

- 由于覆盖范围扩大、服务改善以及公共和私营部门支出增加,医疗保健已成为印度最大的部门之一。

- 政府医疗保健支出从 1.2% 增加至 1.4%。这导致对阿斯匹灵和乙酰胺酚等药品的需求增加。

- 此外,对卫生和清洁的日益关注导致亚太地区洗衣和清洁行业的成长,这可能会在预测期内促进醋酐市场的成长。

醋酐行业概况

醋酐市场部分分散。从市场占有率来看,市场分散在众多全球製造商手中。醋酸酐市场的主要企业包括 Jubilant Life Sciences、Daicel Corporation、Sigma Aldrich 和 Celanese Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 製药业对乙酸酐作为中间体的需求不断增长

- 聚合物/树脂产业需求快速成长

- 扩大四乙酰乙二胺 (TAED) 在清洁剂中的使用

- 抑制因素

- 电子烟的普及

- 减少醋酸纤维素生产中醋酸酐的使用量

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 目的

- 涂层材料

- 火药

- 塑化剂

- 合成剂

- 其他用途

- 最终用户产业

- 烟草

- 药品

- 洗衣/清洁

- 农药

- 纤维

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- BP PLC

- Celanese Corporation

- China National Petroleum Corporation

- Daicel Corporation

- DuPont

- Eastman Chemical Company

- Jiangsu Danhua Group Pvt Ltd

- Jubilant Life Sciences

- Luna Chemical Industries Pvt Ltd

- Shijiazhuang Shengkang Biotech Co. Ltd

- Sigma Aldrich

- Sipchem

- Taj Pharmaceuticals Ltd

- Kunshan Yalong Co. Ltd

第七章 市场机会及未来趋势

- 乙酰化木材的开发

- 其他机会

The Acetic Anhydride Market size is estimated at 2.28 Million tons in 2024, and is expected to reach 2.87 Million tons by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

The market is majorly driven by the growing usage in laundry detergents and increasing demand from the pharmaceutical industry for acetic anhydride, as an intermediate.

Key Highlights

- The growing usage of TAED in the laundry detergent segment has driven the market for acetic anhydride.

- Adoption of E-cigarettes and declining usage of acetic anhydride for cellulose anhydride is likely to hinder the market's growth.

- Development of Acetylated Wood is projected to act as an opportunity for the market in future.

Acetic Anhydride Market Trends

Increasing Demand from the Pharmaceutical Industry

- Acetic anhydride is a key raw material required in the production of medicines, such as acetylsalicylic acid (aspirins), sulfa drugs, certain vitamins and hormones, acetyl-p-aminophenol, cortisone, acetanilide, theophylline, acetylcholine hydrochloride, acetophenacetin, sulfonamides, and paracetamol.

- There has been an enormous growth in the number of general health issues arising globally, such as fever, cough and cold, body pains, nausea, etc.

- This has led to an increase in demand for drugs, like aspirin and paracetamol. The increasing consumption of these generic drugs has significantly benefitted the market for acetic anhydride.

- Additionally, there has been a rapid growth in the pharmaceutical sector in the past few years. The growth trend is expected to continue over the forecast period, due to the increasing health issues among people.

- All the aforementioned factors, is expected to drive the global market during the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is the largest consumer of acetic anhydride in the global market.

- Acetic Anhydride is a key raw material required in the production of medicines, such as acetylsalicylic acid (aspirins), sulfa drugs, and various other medicines.

- The region has witnessed a growth in the number of health issues, which include fever, cough & cold, body pains, nausea, etc. due to the pollution levels from industrial activities.

- Healthcare has become one of the India's largest sectors, due to its strengthening coverage, services and increasing expenditure by public as well as private players.

- The government's expenditure on the healthcare sector increased to 1.4% from 1.2%. This has led to an increase in demand for drugs, like aspirin and paracetamol.

- Additionally, the increasing concerns for hygiene and cleanliness have led to the growth of the laundry and cleaning sector in Asia-Pacific, which in turn shall augment the growth of acetic anhydride market during the forecast period.

Acetic Anhydride Industry Overview

The acetic anhydride market is partially fragmented. In terms of market share, the market is distributed among many global manufacturers. Key players in the acetic anhydride market are Jubilant Life Sciences., Daicel Corporation, Sigma Aldrich, and Celanese Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Pharmaceutical Industry for Acetic Anhydride as an Intermediate

- 4.1.2 Surging Demand from the Polymer/Resin Industry

- 4.1.3 Growing Use of Tetraacetylethylenediamine (TAED) in Laundry Detergents

- 4.2 Restraints

- 4.2.1 Adoption of E-cigarettes

- 4.2.2 Declining Usage of Acetic Anhydride for Cellulose Acetate Production

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Coating Material

- 5.1.2 Explosive

- 5.1.3 Plasticizer

- 5.1.4 Synthesizer

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Tobacco

- 5.2.2 Pharmaceutical

- 5.2.3 Laundry & Cleaning

- 5.2.4 Agrochemical

- 5.2.5 Textile

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Nordic Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BP PLC

- 6.4.3 Celanese Corporation

- 6.4.4 China National Petroleum Corporation

- 6.4.5 Daicel Corporation

- 6.4.6 DuPont

- 6.4.7 Eastman Chemical Company

- 6.4.8 Jiangsu Danhua Group Pvt Ltd

- 6.4.9 Jubilant Life Sciences

- 6.4.10 Luna Chemical Industries Pvt Ltd

- 6.4.11 Shijiazhuang Shengkang Biotech Co. Ltd

- 6.4.12 Sigma Aldrich

- 6.4.13 Sipchem

- 6.4.14 Taj Pharmaceuticals Ltd

- 6.4.15 Kunshan Yalong Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Acetylated Wood

- 7.2 Other Opportunities