|

市场调查报告书

商品编码

1432825

奈米感测器:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Nanosensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

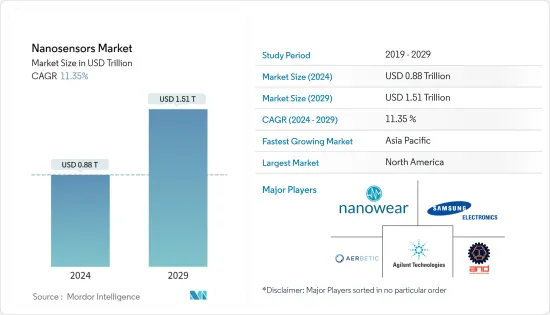

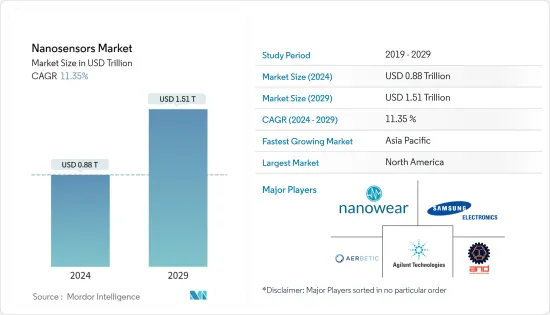

预计2024年奈米感测器市场规模将达到8,800亿美元,预计2029年将达到1.51兆美元,在预测期内(2024-2029年)复合年增长率为11.35%。

半导体和感测器的小型化促进了奈米技术和奈米材料在感测器製造中的应用,从而催生了奈米感测器。预计需求将主要由整体的广泛使用推动,其中诊断和医疗保健领域的应用将发挥关键作用。

奈米感测器广泛应用于各种行业,包括电子、医疗保健、製造、航太和国防,因为它们可以收集较大感测器难以处理的奈米级资料。预计推动需求的主要因素是这种广泛使用以及政府对研究和生产的支持的增加。

感测器应用广泛应用于世界各地的各个领域来检测和监控参数。奈米感测器与传统感测器的唯一区别在于使用奈米材料的製造过程。然而,先进的技术总是鼓励新的视野和不断的发展。奈米技术和奈米材料等最尖端科技的持续研发可以为奈米感测器製造商带来竞争优势。

例如,多年来,奈米感测器市场见证了奈米技术的重大进步和创新,例如奈米碳管和奈米线的生产,对该产业产生了重大影响,并成为许多发展途径的基石。目前,多项研究和开发正在进行中,研究市场可能会在未来几年见证进一步的技术创新,这将影响市场形势。

政府计划支持的奈米技术进步推动了市场扩张。奈米技术标誌性倡议等倡议强调了加速奈米科学技术进步、满足需求并开拓从研究到商业化的机会的关键领域和愿景。同样,MeitY 发起的印度纳米电子用户计划-创意创新 (INUP-i2i) 正在纳米电子研究中心 (CEN) 实施,例如 IISc、IIT Delhi、IIT Bombay、IIT Madras 等。发展社区有大量机会使用最先进的倡议设施来进行技能开发和研究活动。

此外,由于小型化趋势和许多行业使用极小的产品,市场正在扩大。然而,由于奈米感测器的製造困难以及一些消费者对采用新技术持谨慎态度而不愿使用奈米感测器,市场扩张受到阻碍。

由于 COVID-19 爆发,测试、追踪和追踪病毒的需求增加,奈米感测器产业的需求将大幅增加。疫情影响了主要奈米感测器市场的需求,特别是欧洲国家和亚太地区(印度、中国、韩国),世界各地的製造商因封锁期间供应链的变动而陷入困境。然而,随着研究和开发预计将增加,以开发使用奈米感测器的创新医疗设备和治疗方法,市场预计将在后新冠时期获得牵引力。

奈米感测器市场趋势

医疗健康产业显着成长

医疗保健产业在奈米感测器市场中占有主要份额。诊断医学的一个重要方面是提供快速、灵敏和准确的检测。疾病的早期诊断至关重要,因为许多疾病可能直到进展到难以治癒的阶段才会出现症状。即时监测是使用奈米感测器进行诊断的常见方法,可以快速诊断疾病。

预计该市场将受到全球皮肤癌盛行率不断上升的推动。例如,皮肤癌每天影响美国约 9,400 人,每小时夺去超过两人的生命。据美国癌症协会(ACS)称,到2023年,美国皮肤黑色素瘤病例估计将达到58,120名男性和39,490名女性。

皮肤癌是透过奈米医学的应用来治疗的。透过这种方式,可以用药物和其他医学疗法有效治疗目标肿瘤部位和目标细胞,而副作用最小。一种名为 nanoflare 的新技术已被开发出来,可以利用奈米医学来检测血液中的恶性细胞。因此,预计预测期内的市场扩张将受到奈米感测器在治疗皮肤恶性的药物中越来越多使用的推动。

此外,在皮肤癌治疗中使用奈米感测器可以有效地将药物和其他治疗方法输送到特定的肿瘤部位或目标细胞,而几乎没有危险的副作用。此外,智慧药丸是指像锭剂一样建模和设计的奈米级电子设备,但具有更先进的感测、成像和药物传输功能。迄今为止,奈米技术已帮助开发了各种类型的智慧平板锭剂,包括药丸摄影机、带有小型摄影机的胶囊和剂量感应锭剂。

由于奈米感测器能够在不需要外部迹象的情况下早期识别疾病,因此在该地区的诊断医学中应用前景广阔。理想的奈米感测器实施将尝试透过结合诊断和耐受反应能力来模拟人体免疫细胞的反应,提供能够监控感测器输入和反应的资料,等等。我是。此外,可以使用奈米感测器测试植入物的污染情况。当注意到植入周围的细胞受到污染时,植入的奈米感测器会向医生或其他医疗保健提供者发送电信号。奈米感测器可确定细胞是否健康、是否发炎或是否被细菌污染。

此外,许多地区公司正专注于开发使用奈米技术平台分配抗逆转录病毒药物的治疗方案,最终推动奈米感测器市场的发展。奈米技术在药物开发和传输中的应用具有治疗爱滋病毒的潜力,透过开拓奈米尺度上不同于体积、原子或分子尺寸的材料特性,开发具有药理优势的药物,从而具有治疗爱滋病毒的潜力。我们致力于对抗和解决相关问题。

北美占据主要市场占有率

全球奈米感测器市场最大份额最终属于北美市场。该地区现有的基础设施和重要的奈米感测器供应商是主要原因。该地区的奈米感测器製造商正在研究如何将奈米感测器进一步应用于各个产业。这可能会导致先进奈米感测器产品的开发。

推动北美奈米感测器市场的主要因素是军事和国防安全保障领域对奈米感测器的需求不断增加,因为它们用于检测辐射和生物毒素。该地区、尤其是美国国防预算的增加预计将推动对奈米感测器的需求,因为奈米感测器也将透过帮助开发轻型车辆和自癒帐篷等先进战场装备而使军队受益。例如,根据美国国防部的数据,2022财年的预算需求为7,220亿美元,使得国防预算比2021年增加170亿美元。

此外,奈米感测器在飞机上的使用也将推动该地区的需求,因为美国是民航机和军用飞机的主要製造商和消费者。例如,在飞机中,感测器对于感知燃油油位、环境条件和性能更新等各种指标非常重要。在这些感测器系统中添加奈米感测器可以提高灵敏度并减轻整体重量。

此外,奈米感测器小型化带来的成本效益製造预计将带来奈米感测器市场的改善。此外,对更小、更快、可携式诊断感测系统不断增长的需求是推动北美生物医学和医疗保健领域奈米技术发展的主要因素。所有这些因素都导致北美对奈米感测器的需求增加。

此外,该地区的公司专注于创建智慧包装,这是该地区最安全的食品包装选择之一。它属于智慧包装类别,它使用奈米感测器对包装内食品样品的物理或化学变化做出反应,避免污染和劣化。

奈米感测器产业概述

奈米感测器市场竞争激烈,领先公司提供先进的产品来捕捉市场需求和份额。为了进一步扩大在市场上的影响力,主要供应商预计将在技术上进行大量投资,以保持目前的竞争优势。主要市场参与者包括三星电子有限公司、安捷伦科技公司和应用奈米探测器有限公司。

2023 年 2 月,美国化学会 (ACS) Nano 的研究人员报告称,使用一系列汞敏感碲奈米线开发了一种自供电奈米感测器,即摩擦电奈米感测器 (TENS)。研究人员表示,奈米感测器可以检测水和食品中的微量汞离子,并立即报告结果。

2022年8月,Sense-Secure与美国通用电气研究院合作,开发出全球首款一氧化碳奈米感测器密封件「Sense-PRO 1」。根据该公司介绍,新型奈米感测器是一款无需电源即可运作的智慧无线二氧化碳感测器贴纸。厚度为0.1毫米,直径为22毫米,可黏贴在智慧型手机背面,变身为一氧化碳侦测器或分析仪。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 奈米科技产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 小型化趋势和小型化产品的使用日益增加

- 市场挑战

- 奈米感测器的製造流程复杂

- 市场机会

第六章市场区隔

- 按类型

- 生物奈米感测器

- 化学奈米感测器

- 物理奈米感测器

- 按最终用途行业

- 航太/国防

- 汽车和工业

- 消费性电子产品

- 卫生保健

- 发电

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Agilent Technologies, Inc.

- Nanowear, Inc.

- AerBetic

- Applied Nanodetectors Ltd

- BreathDX Ltd

- Inanon Bio Inc.

- LamdaGen Corporation

- Vista Therapeutics, Inc.

- Bruker Corporation

- GBS Inc

- Applied Nanotech, Inc.(PEN Inc.)

- Oxonica Limited

- Beijing ALT Technology Ltd. Co.

- Nanoworld AG

- Samsung Electronics co., Limited

第八章投资分析

第九章 市场机会及未来趋势

The Nanosensors Market size is estimated at USD 0.88 trillion in 2024, and is expected to reach USD 1.51 trillion by 2029, growing at a CAGR of 11.35% during the forecast period (2024-2029).

The miniaturization of semiconductors and sensors has fueled nanotechnology and nanomaterial applications for sensor manufacturing, giving rise to nanosensors. Demand is anticipated to be primarily driven by the extensive use across industries, with applications in diagnostics and healthcare playing a significant role.

Nanosensors are widely employed in various industries, including electronics, healthcare, manufacturing, aerospace, and defense, as they can gather data at the nanoscale that would be difficult to handle with bigger sensors. The main factors driving demand are anticipated to be this widespread use and the expansion in government support for research and production.

A variety of sectors around the world have adopted sensor applications for parameter detection and monitoring. The only difference between nanosensors and conventional sensors is their production process, which uses nanomaterial. However, sophisticated technologies have always fueled new prospects and continued development. Continuous R&D on cutting-edge technologies, such as nanotechnology and nanomaterial, can give nanosensor manufacturers a competitive edge.

For instance, over the years, the market for nanosensors has seen some significant advancements and innovations in nanotechnology, such as the production of carbon nanotubes, nanowires, etc., which had a significant impact on the industry and served as the cornerstone for numerous development paths. With several research and development works currently underway, the studied market will witness further technological innovations in the next few years, which will influence the landscape of the studied market.

Market expansion is being fueled by advances in nanotechnology backed by government programs. Initiatives such as Nanotechnology Signature Initiatives highlight critical areas and the vision for accelerating nanoscale science and technology advancement to address needs and exploit opportunities from research through commercialization. Similarly, the Indian Nanoelectronics Users Programme-Idea to Innovation (INUP-i2i) initiated by MeitY is being implemented at the Centre of Excellence in Nanoelectronics (CEN) at IISc, IIT Delhi, IIT Bombay, IIT Madras, among others has provided significant opportunities for R&D community all over the country for accessing the state of the art nanofabrication facilities for undertaking skill development and research initiatives in Nanoelectronics.

Additionally, the market is expanding due to the trend of shrinking and the use of tiny goods in numerous industries. However, the difficulty of producing nanosensors and certain consumers' resistance to using nanosensors because of a cautious attitude toward embracing new technologies are impeding the market's expansion.

Due to the growing need for testing, tracing, and tracking the virus, the nanosensors industry will experience a considerable increase in demand due to the COVID-19 epidemic, as diagnostic labs require several capabilities to test thousands of samples daily. The pandemic has impacted the principal Nanosensors Market Demand, and manufacturers worldwide have suffered, particularly in European nations and the Asia-Pacific regions (India, China, and South Korea) due to shaky supply chains during the lockdown. However, the market is anticipated to gain traction in the post-covid period owing to an anticipated growth in R&D to develop innovative medical devices and procedures that use nanosensors.

Nanosensors Market Trends

Healthcare Industry to Show Significant Growth

The healthcare industry holds a significant share of the nanosensor market. A crucial aspect of diagnostic medicine is making quick, sensitive, and accurate detections. Since many conditions have symptoms that may not manifest until the condition has advanced to stages that may be challenging to cure, early diagnosis of diseases is crucial. Real-time monitoring is a popular method of using nanosensors in diagnostics to quickly diagnose disorders.

The market is anticipated to be driven by the increasing prevalence of skin cancer worldwide. For instance, skin cancer affects roughly 9,400 individuals in the United States daily, and over two people pass away every hour. According to the American Cancer Society (ACS), in 2023, the estimated number of melanoma of skin cases in the United States is anticipated to reach 58,120 in males and 39,490 in females.

Skin cancer is treated with the application of nanomedicine. In this manner, targeted tumor locations and target cells can be effectively treated with drugs and other medical therapies while minimizing adverse effects. A new technique dubbed Nano Flares for detecting malignant cells in the blood was developed using nanomedicine. Thus, market expansion during the forecast period is anticipated to be driven by the increased use of nanosensors in medications to treat skin malignancies.

Additionally, using nanosensors in skin cancer treatment allows for the effective delivery of medications and other treatments to particular tumor locations and target cells with little in the way of hazardous side effects. Moreover, Smart pills refer to nano-level electronic devices modeled and designed like pharmaceutical pills but perform more sophisticated sensing, imaging, and drug delivery functions. Nanotechnology has previously helped the development of various types of smart pills, such as the PillCam, capsules with mini-video cameras, and dose-sensing pills.

Due to their ability to identify diseases early without the need for external indications, nanosensors have tremendous promise for use in diagnostic medicine in the region. Ideal nanosensor implementations attempt to imitate the response of immune cells in the body by combining diagnostic and resistant response features, providing data to enable monitoring of the sensor input and response, and so on. Additionally, organ implants can be inspected with nanosensors for contamination. When it notices contamination in the cells surrounding the implant, the implanted nanosensor transmits an electric signal to a physician or other healthcare provider. The nanosensor determines whether the cells are healthy, irritated, or contaminated with bacteria.

Furthermore, many regional companies focus on developing therapeutic options using nanotechnology platforms for dispensing antiretroviral drugs, ultimately driving the nanosensor market. Nanotechnological applications in drug development and delivery promise to combat and resolve problems related to HIV treatment by enabling the development of drugs with pharmacological advantages pioneered by different materials properties at the nanoscale compared to the bulk, atomic scale, or molecular dimensions.

North America to Hold a Significant Market Share

The global nanosensor market's largest share ultimately belonged to the North American market. The area's existing infrastructure and significant Nano Sensors providers are among the major reason behind this. Manufacturers of nanosensors in the area are researching how nanosensors may be used further in various industries. This could lead to the development of advanced nanosensor products.

The primary factor driving the nanosensors market in North America is a growing demand for nanosensors in the military and homeland security, as they are used for detecting radiation and biotoxins. As nanosensors have also benefited the military by helping develop advanced Warfield gear, such as lighter vehicles and self-repairing tents, the increased defense budget of the region, specifically the United States, is expected to drive the demand for nanosensors. For instance, according to the United States Department of Defense, the budget for a request for the fiscal year 2022 rose to USD 722 billion, which earns a defense budget increase of USD 17 billion from 2021.

Furthermore, using nanosensors in aircraft also drives their demand in the region, as the United States is among the leading manufacturers and consumers of commercial and military aircraft. For instance, in aircraft, sensors are crucial for sensing a variety of indicators, including fuel levels, environmental conditions, and performance updates. When added to these sensor systems, nanosensors can increase their sensitivity and reduce their overall weight.

Moreover, cost-effective manufacturing due to the compactness of nanosensors is set to bring about a positive transition in the nanosensors market. Moreover, the increasing demand for smaller and faster portable diagnostic sensing systems is the primary factor driving the growth of nanotechnology in North America's biomedical and healthcare segment. All these factors contribute to the increasing demand for nanosensors in North America.

Additionally, businesses in the area are concentrating on creating smart packaging, one of the region's safest food packaging options. It belongs to the smart packaging category, which uses nanosensors to react to physical or chemical changes in food samples held within the packaging to avoid contamination or deterioration.

Nanosensors Industry Overview

The nanosensors market is competitive, with major players occupying the market demand and share with their advanced product offerings. To expand their market presence further, major vendors are expected to invest heavily in technology to maintain the competitive advantage that they are currently witnessing. Some key market players include Samsung Electronics Co., Limited, Agilant Technologies Inc., and Applied Nanodetectors Ltd.

In February 2023, researchers reporting in the American Chemical Society (ACS) Nano developed a self-powered nanosensor triboelectric nanosensor (TENS) using an array of mercury-sensitive tellurium nanowires. According to researchers, these nanosensors can discover small amounts of mercury ions in water or food and report the result immediately.

In August 2022, sense-secure developed the world's first carbon monoxide Nano Sensor Sticker called, Sense-PRO 1 in partnership with General Electric Research, USA. According to the company, the new nanosensor is a smart, wireless CO sensor sticker that can operate without any power source. Its 0.1mm thickness and 22mm in diameter make it smartphone-friendly, allowing the users to attach the sensor to the back of their smartphones and convert them into a Carbon monoxide detector and analyzer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Nanotechnology Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Miniaturization trend and Use of Miniaturized Products

- 5.2 Market Challenges

- 5.2.1 Complex Manufacturing Processes of Nanosensors

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Biological Nanosensors

- 6.1.2 Chemical Nanosensors

- 6.1.3 Physical Nanosensors

- 6.2 By End-use Verticals

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive and Industrial

- 6.2.3 Consumer Electronics

- 6.2.4 Healthcare

- 6.2.5 Power Generation

- 6.2.6 Other End-use Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Agilent Technologies, Inc.

- 7.1.2 Nanowear, Inc.

- 7.1.3 AerBetic

- 7.1.4 Applied Nanodetectors Ltd

- 7.1.5 BreathDX Ltd

- 7.1.6 Inanon Bio Inc.

- 7.1.7 LamdaGen Corporation

- 7.1.8 Vista Therapeutics, Inc.

- 7.1.9 Bruker Corporation

- 7.1.10 GBS Inc

- 7.1.11 Applied Nanotech, Inc. (PEN Inc.)

- 7.1.12 Oxonica Limited

- 7.1.13 Beijing ALT Technology Ltd. Co.

- 7.1.14 Nanoworld AG

- 7.1.15 Samsung Electronics co., Limited