|

市场调查报告书

商品编码

1432853

资料中心结构:市场占有率分析、产业趋势、成长预测(2024-2029)Data Center Fabric - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

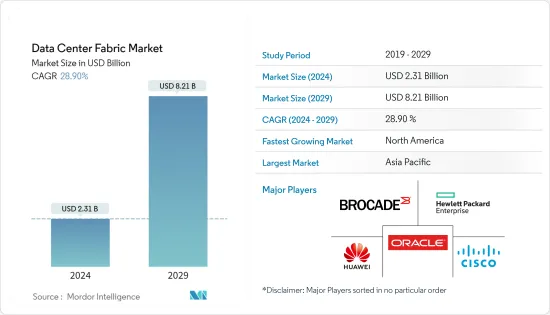

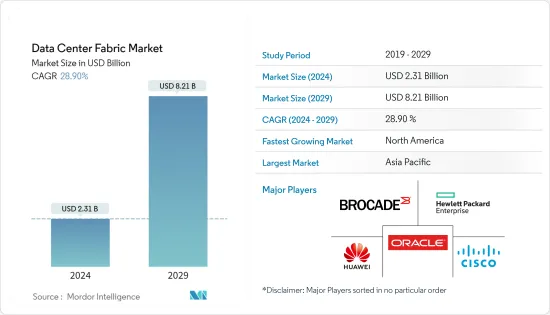

资料中心结构市场规模预计2024年为23.1亿美元,预计到2029年将达到82.1亿美元,在预测期内(2024-2029年)成长28.90%,以复合年增长率成长。

复杂互动式应用程式使用量的增加、互联网服务和活动的扩展以及技术的不断进步,需要更快的资料速率、更多的计算资源和存储来管理生成的资料量,这凸显了对增加容量的需求。此外,自动化智慧资料中心网路必须适应分散式应用的动态处理要求。资料中心结构的概念由网格计算预示并由交换结构提出。

主要亮点

- 虽然最新、效能最高的资料中心硬体和软体对于高速、关键事务处理仍然至关重要,但安全性、软体定义网路 (SDN)、混合云端和巨量资料等趋势正在推动更高水准的资料中心提供基础设施。金融服务。为您的客户提供服务,同时降低风险并节省成本。

- 利用资料中心结构将实体资源虚拟化为逻辑池,让应用程式可以从这些池中取得所需的资源,从而优化 IT 资源利用率。

- 由于基础设施的扩张,特别是在中国和印度等新兴国家,高速资料传输技术的使用增加以及复杂互动应用的研发专业知识的增加,市场价值预计将面临挑战。儘管如此,组织资料量和半导体产业的不断扩大,特别是在新兴国家,将为市场的进一步成长铺平道路。

- 由于人工智慧、机器学习和 AR/VR 等新技术的使用,云端基础的应用程式正在经历显着增长。当今庞大且不断增长的云端建构者社群需要网路元件具有独特程度的客製化和弹性来操作和监控庞大的资料中心。

- COVID-19感染疾病对人们的生活、人口、生存手段和经济产生了意想不到的、不确定的影响。全球经济衰退和失业的可能性增加。随着公司在市场波动的情况下采取优化利润的策略,预测不确定性的程度就变得有必要。封锁措施的经济影响对资料中心光纤产业产生了重大影响,供应链频繁中断阻碍了其发展。

资料中心布料市场趋势

对光纤交换器的需求不断增长推动了市场

- 光纤交换器透过整合资料中心在降低基础设施成本方面发挥关键作用。乙太网路切换器和光纤通道是共用通用基础设施的资料中心中整合伺服器和储存网路的基础。

- Fabric 基础架构具有高度扩充性,可让资料中心随着组织未来需求的增加而成长。与传统网路相比,扁平化网路的网路营运成本显着降低,使得结构产品对于希望降低资料中心整体营运成本同时增加容量的组织来说成为有吸引力的选择。

- 不断上升的电力成本、云端服务的采用以及对巨量资料储存的需求正在促使组织在其资料中心部署结构产品。这样做可以显着降低电力和冷却设备的管理费用。随着公司越来越多地寻求透过向客户提供即时应用程式解决方案来提高效能,扁平网路架构对于分析伺服器上储存的资讯变得非常重要。

- 此外,云端和内容服务供应商的网路支出预计将从核心资料中心到边缘资料资料增加。从本地部署到主机代管设施的转变将减少开发中国家在 1/10GbE 交换器上的支出,从而导致现代资料中心系统中 25/100GbE 交换器的显着增加。

预计北美将占据重要市场占有率

- 由于行动宽频、巨量资料分析和云端运算的成长,资料中心基础设施解决方案在北美经历了令人瞩目的成长。这种成长正在推动该地区对新资料中心基础设施的需求。

- 北美正在大力投资研发,从而创造出技术更先进、资讯管理更有效的下一代设施。此外,该地区是许多资料中心基础设施提供者的所在地,这极大地有助于其快速成长和市场占有率。

- 然而,资料中心基础设施的增加正在增加对资料中心结构市场的需求。由于越来越多地采用基于多核心处理器的伺服器、对有助于在单一伺服器上运行多个应用程式的虚拟伺服器的需求不断增加以及对频宽资料传输系统的需求,对高频宽的需求也在不断增加。网路布料市场。

- 美国目前拥有全球最多的资料中心,超大规模资料中心数量的不断增加使得巨量资料量和流量显着增加。

资料中心架构产业概况

资料中心结构市场是半整合的,由几家中等集中度的大公司组成。这些公司正在相互竞争,以占领不断成长的市场,尤其超级资料中心市场。采取策略合作倡议,提高市场占有率和盈利。市场上一些主要的参与者包括思科系统公司、甲骨文公司和惠普企业公司。

2023 年 8 月,Cyxtera 宣布与 (HPE) 建立合作伙伴关係,协助客户简化 IT 营运、提高敏捷性并大幅节省成本。 Cyxtera Enterprise Bare Metal 上的 HPE ProLiant 伺服器使客户能够受益于云端的营运弹性,以及在 Cyxtera 全球资料中心运作的专用基础设施的效能、控制和成本可预测性,并且具有安全性。

2022 年 7 月,Digital Realty 推出了 ServiceFabric,这是一个互连解决方案和编配平台,旨在支援更广泛的全产业向以资料为中心的混合架构的过渡。此步骤是该公司计划的一部分,旨在帮助客户从其资料中释放锁定的价值。

2022 年 5 月,印度 NTT Ltd. 宣布在新孟买开设一个新的超大规模资料中心设施,首先是 NAV1A资料中心。在此公告之前,Chandivali 设施开设了一个新的资料中心,这是印度第一个营运的超大规模资料中心园区。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 不断增长的资料储存需求和云端运算采用

- 高速资料传输的需求

- 对光纤交换器的需求增加

- 市场限制因素

- 安全问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按解决方案

- 路由器

- 转变

- 储存区域网络

- 其他解决方案

- 按用途

- 资讯科技/通讯

- 银行/金融服务

- 卫生保健

- 零售

- 其他的

- 按最终用户

- 云端服务供应商

- 通讯服务供应商

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Cisco Systems Inc.

- Alcatel-Lucent Holdings Inc.

- Oracle Corporation

- Hewlett-Packard Enterprise Company

- Brocade Communications Systems

- Huawei Technologies Co. Ltd

- Extreme Networks Inc.

- Dell Inc.

- IBM Corporation

- Avaya Inc.

- Unisys Corporation

第七章 投资分析

第八章 市场机会及未来趋势

The Data Center Fabric Market size is estimated at USD 2.31 billion in 2024, and is expected to reach USD 8.21 billion by 2029, growing at a CAGR of 28.90% during the forecast period (2024-2029).

The growing usage of complex interactive applications, the expansion of internet services and activities, and the constant advancement of technology have highlighted the need for faster data rates, more computing resources, and increased storage capacity to manage the volume of data being generated. Additionally, automated smart data center networks are required to adapt to the dynamic processing requirements of distributed applications. The data center fabric concept has been foreshadowed by grid computing and hinted at by switch fabric.

Key Highlights

- While the latest and highest-performing data center hardware and software are still essential for high-speed critical transaction processing, trends such as security, software-defined networks (SDN), hybrid cloud, and big data are crucial to delivering higher levels of financial services to clients while reducing risks and saving costs.

- The virtualization of physical resources into logical pools with the help of data center fabrics optimizes IT resource utilization by enabling applications to fetch required resources from these pools.

- The market value will face challenges due to the expansion of infrastructure, particularly in emerging economies like China and India, the growing use of high-speed data transmission technologies, and increased research and development expertise in relation to complex interactive applications. Nevertheless, the continued expansion of organizational data volumes and the semiconductor sector, especially in emerging nations, will pave the way for further market growth.

- Cloud-based applications are experiencing significant growth, driven by the use of new technologies such as AI, machine learning, and AR/VR. The current large and growing community of cloud builders requires a unique level of customization and flexibility from networking components to operate and monitor sprawling data centers.

- The COVID-19 pandemic had an unanticipated and undetermined impact on people's lives, groups, means of subsistence, and economies. The likelihood of a global economic downturn and employment losses increased. Given that businesses are now employing strategies to optimize profits despite market fluctuations, it has become necessary to forecast the degree of uncertainty. The financial ramifications of lockdown measures have significantly impacted the data center fabric industry, with frequent disruptions in the supply chain hindering its development.

Data Center Fabric Market Trends

Increasing Demand of Fabric Switches is Driving the Market

- Fabric switches play a critical role in reducing infrastructure costs by consolidating data centers. Ethernet switches and fiber channels serve as the foundation for bringing together server and storage networking in data centers that share a common infrastructure.

- The fabric infrastructure is highly scalable, allowing data centers to grow with the organization's increasing demands in the future. Compared to traditional networks, flattened networks' operational costs for networking decrease significantly, making fabric products an attractive option for organizations looking to reduce overall data center operation costs while increasing capacity.

- The rising cost of electricity, the adoption of cloud services, and the need for big data storage are motivating factors for organizations to install fabric products in their data centers. By doing so, they can reduce the overhead cost of power and cooling facilities by a considerable margin. As businesses increasingly seek to improve their performance by providing real-time application solutions to customers, flat network architecture becomes crucial for analyzing information stored in servers.

- Additionally, spending on networks by cloud and content service providers is expected to increase from core to edge data centers. On-premise migration to colocation facilities will decrease spending on 1/10GbE switches in developing nations and result in a significant increase in 25/100GbE switches in modern data center systems.

North America is Expected to Hold a Significant Market Share

- North America has experienced remarkable growth in data center infrastructure solutions due to the expansion of mobile broadband, the growth in big data analytics, and cloud computing. This growth is driving the demand for new data center infrastructures in the region.

- North America makes significant investments in research and development, which will result in the creation of next-generation facilities that are more technologically sophisticated and effective in terms of information management. Furthermore, the area is home to a number of data center infrastructure providers, which has greatly aided its quick growth and market share.

- However, the increase in data center infrastructures has led to high demand for the data center fabric market. The increased deployment of multi-core processor-based servers, the growing demand for virtualized servers that aid in running multiple applications on a single server, and the need for high-speed data transfer systems have led to an increased need for the high-bandwidth networking fabric market.

- The United States currently has the highest number of data centers globally and is witnessing robust growth in terms of the volume of big data and traffic due to the increase in the number of hyperscale data centers.

Data Center Fabric Industry Overview

The market for data center fabric is semi-consolidated and comprises several major players with moderate concentration. These companies are competing against each other to capture the growing market, particularly that of mega data centers. To increase their market share and profitability, they are employing strategic collaborative initiatives. Some of the significant players in the market are Cisco Systems Inc., Oracle Corporation, and Hewlett-Packard Enterprise Company, among others.

In August 2023, Cyxtera has announced its collaboration with (HPE) to help customers simplify their IT operations, improve agility, and realize significant cost savings, With HPE ProLiant servers on Cyxtera Enterprise Bare Metal, customers can benefit from the operational flexibility of the cloud with the performance, control, cost-predictability, and security of dedicated infrastructure running in Cyxtera's global data centers.

In July 2022, Digital Realty launched ServiceFabric, an interconnectivity solution and orchestration platform designed to support the industry's wider shift to a hybrid, data-centric architecture. This step is part of the company's plan to help customers unlock trapped value from their data.

In May 2022, NTT Ltd. in India announced the opening of its new hyperscale data center facility in Navi Mumbai, starting with the NAV1A data center. This announcement follows the opening of a new data center at its Chandivali facility, which is India's first operational hyperscale data center campus.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Data Storage and Adoption of Cloud Computing

- 4.2.2 Need for High Speed Data Transfer

- 4.2.3 Increasing Demand of Fabric Switches

- 4.3 Market Restraints

- 4.3.1 Security issues

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Router

- 5.1.2 Switches

- 5.1.3 Storage Area Networking

- 5.1.4 Other Solutions

- 5.2 By Application

- 5.2.1 IT & Communication

- 5.2.2 Banking & Financial Services

- 5.2.3 Healthcare

- 5.2.4 Retail

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Cloud Service Providers

- 5.3.2 Telecom Service Providers

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Alcatel-Lucent Holdings Inc.

- 6.1.3 Oracle Corporation

- 6.1.4 Hewlett-Packard Enterprise Company

- 6.1.5 Brocade Communications Systems

- 6.1.6 Huawei Technologies Co. Ltd

- 6.1.7 Extreme Networks Inc.

- 6.1.8 Dell Inc.

- 6.1.9 IBM Corporation

- 6.1.10 Avaya Inc.

- 6.1.11 Unisys Corporation