|

市场调查报告书

商品编码

1640479

铝箔包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Aluminum Foil Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

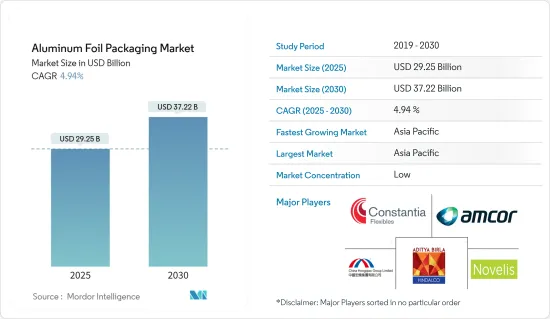

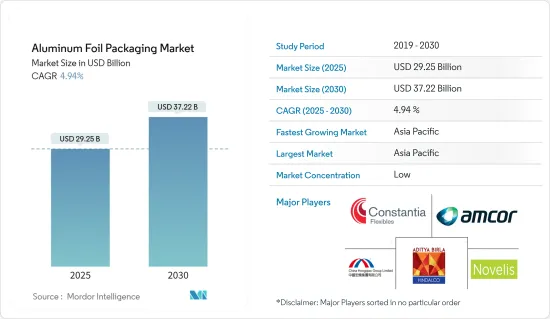

2025年铝箔包装市场规模预估为292.5亿美元,预估至2030年将达372.2亿美元,预测期间(2025-2030年)复合年增长率为4.94%。

关键亮点

- 铝箔可防潮、防光、防氧、防细菌,满足食品、饮料和製药等行业的关键要求。铝箔主要用于食品和饮料行业。由于乳製品产业的庞大需求,用纸製品製成的铝复合材料的需求量很大。此外,铝箔的反射率为88%,可以用作隔热材料。铝片还能起到保护蒸气屏障的作用,非常适合用于食品包装。

- 阳光可以很快损坏许多食品,损害其外观和风味。铝箔是满足这些包装要求最实用的解决方案,这就是为什么这种材料被认为是乳製品、糖果零食和饮料的理想核心包装材料。

关键亮点

- 例如,用层压箔製成的密封包装中的奶粉的保质期为两年。在预测期内,其他软包装解决方案的使用量也可能会激增。国内铝需求的不断增长导致来自中国的铝箔进口量激增,过去十年来中国对美国的铝箔出货量大幅增加。目前,软包装主要用于食品,其中成长最快的领域是咖啡、零嘴零食、生鲜食品、已调理食品和宠物食品。

- 与塑胶和玻璃相比,铝重量轻、耐用、柔韧性和阻隔性,因此铝箔包装的市场需求预计将成长。铝的易用性、便利性、安全性、重量轻和耐用性使其成为各种工业和家庭应用的理想选择。

- 製药业经常使用泡壳包装来包装药品。泡壳包装由一个用铝箔製成的推入式封口(称为泡壳膜或盖膜)和一个带有用于放置单个锭剂的腔体的模製塑料(所谓的推入式泡壳)组成。多种泡壳包装材料用于药品。铝塑包装主要用于药品包装,但也有不少其他药品采用全包装。

- 此外,近年来,药品和网路食品销售对铝箔包装(如铝包装和铝容器)的需求大幅增加。铝业管理倡议(ASI)已经制定了许多有关社会和环境政策的标准。 ASI 预计将恢復因 COVID-19 疫情期间全国实施的停工而中断的铝箔包装材料供应链。

- 铝的永续性创造了竞争性商业优势以及产品开发优势。据铝业协会称,所有生产的铝中近75%仍在使用。此外,铝废弃物的处理更加永续,因为它可以经济地回收,而不会在水或地面上添加有害污染物。

铝箔包装市场趋势

铝箔包装占据了很大的市场份额

- 铝箔包装,包括药品和网购食品的铝包装和容器,需求大幅增加。铝业管理倡议(ASI)为许多社会和环境实践制定了标准。 ASI 预计将恢復因 COVID-19 疫情期间全国实施的停工而中断的铝箔包装材料供应链。

- 铝箔包装保持明亮和反光,在零售空间吸引消费者的注意。此外,铝箔可进行彩色涂漆并印刷品牌识别图案。对永续包装的需求正在增长,特别是在食品和饮料行业,使得铝箔包装成为一种有吸引力的选择。

- 铝箔包装具有其他包装材料所不具备的独特性能,例如可折迭和压花功能。预计预测期内,食品、烟草和化妆品产业将成为铝箔包装成长的主要驱动力。

- 此外,铝箔易于使用和处理,并且由于其导热速度是普通金属的两倍,因此越来越多地用于烹饪各种食物。随着家庭烹饪日益流行的趋势,铝箔被用来包裹和烧烤食物。

- 近年来,铝产量也不断增加,许多国家主动增加冶炼厂数量,并大量生产铝。根据美国地质调查局 2024 年 1 月发布的报告,2023 年中国冶炼厂共生产了约 410 万吨铝。铝作为一种重要的非铁金属,在包装行业中有着广泛的应用。

亚太地区占很大市场份额

- 预计亚太地区将在整个预测期内保持主导地位。中国大量消耗铝箔纸来生产铝包装是该地区对铝箔需求强劲的主要原因,从而带动铝箔市场上涨。该地区越来越多地使用铝箔来保存食物。食品、製药和电动车电池製造商等关键产业预计将推动市场成长。

- 亚太国家生产和使用大部分铝製袋子。这些国家对更健康的生活方式和消费模式的需求正在推动对铝箔的需求。开发中国家的人口成长对铝箔包装的需求日益增长。亚太国家力求鼓励环保消费、确保食品安全、保存食品并坚持环境永续性原则,因此对铝包装的需求正在增加。

- 根据国家统计局的数据,2023年中国原生铝产量将达4,200万吨,高于2022年的4,021万吨。过去十年,中国原生铝年产量稳定成长,2019年达3,504万吨。

- 此外,第 37 届 AAHAR 国际食品与饭店展览会也迎来了 LSKB Aluminum Foils Pvt. Ltd. 推出的印度首款金色压花 HOMEFOIL。 LSKB Aluminium Foils Pvt.Ltd. 推出了 1 公斤和 555 克金银压花箔,厚度为 18 微米,长度为 75 公尺、25 公尺和 9 米,厚度为 12 微米。产品采用创新技术在安全、环保且通风良好的场所生产,以确保卫生。包装中还附带一个铝箔切刀,可以安全地切割铝箔。

- 印度是继中国之后世界第二大烟草消费国,因此对短铝箔包装的需求很高。目前,铝箔是首选的阻隔材料,尤其是用于香烟盒的内衬。这是因为它们结合了独特的“感觉”和外观 - 轻巧、耐用且易于重新密封 - 同时保留了每种混合物和品牌的独特香气。

- ITC 印度有限公司烟草部门的收入预计将从 2019 年的约 2,610 亿印度卢比(27.3 亿美元)飙升至 2023 财年的 3,120 亿印度卢比(37.3 亿美元)以上。值得注意的是,ITC 有限公司已成为印度快速消费品产业的主要企业,烟草是其旗舰产品。因此,烟草收益的成长趋势可能会刺激全国的铝箔需求。

铝箔包装产业概况

由于进入门槛低和需求不断增长,铝箔包装市场呈现细分化。市场的一些主要企业包括 Amcor Limited、Constantia Flexibles、中国宏桥集团有限公司、Hindalco Industries Limited(Aditya Birla Group)和 Novelis。

2024年2月,Constantia Flexibles宣布已签署协议,收购欧洲着名包装製造商Aluflexpack约57%的股份。 Aluflexpack 以其在箔和薄膜包装方面的专业知识而闻名,主要面向消费品和製药行业。此次收购将使 Constantia Flexibles 显着加强其在各个领域的铝箔包装市场的地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 扩充应用

- 铝产品的永续性

- 市场问题

- 出现具有同等阻隔性能和低碳足迹的替代材料

第六章 市场细分

- 按类型

- 轧延箔

- 背衬箔

- 其他类型(泡壳)

- 按应用

- 转换箔

- 容器铝箔

- 其他用途(家庭)

- 按最终用户

- 食物

- 饮料

- 药品

- 化妆品和个人护理

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor PLC

- Constantia Flexibles

- Coppice Alupack Limited

- China Hongqiao Group Limited

- Hindalco Industries Limited(Aditya Birla Group)

- Ess Dee Aluminum Ltd

- Novelis Inc.

- Alcoa Corporation

- Penny Plate LLC

- Eurofoil Luxembourg SA

- Alufoil Products Pvt. Ltd

- United Company RUSAL

- Zhangjiagang Goldshine Aluminium Foil Co. Ltd

第八章投资分析

第九章:市场的未来

The Aluminum Foil Packaging Market size is estimated at USD 29.25 billion in 2025, and is expected to reach USD 37.22 billion by 2030, at a CAGR of 4.94% during the forecast period (2025-2030).

Key Highlights

- Aluminum foil protects against moisture, light, oxygen, and bacteria, thus fulfilling a critical requirement for industries like food, beverage, and pharmaceuticals. Aluminum foil is consumed majorly by the food and beverage industries. Aluminum composites prepared with paper products are in high demand due to the vast dairy industry. Additionally, aluminum foil is 88% reflective, which makes it useful for thermal insulation. The aluminum sheet also provides a protective vapor barrier, making it ideal for use in food packaging.

- Sunlight quickly affects many groceries, damaging their appearance and taste. Foil is the most viable solution to cater to these packaging requirements, which has led to the material being regarded as the ideal core packaging material for dairy products, pastries, and beverages.

- For instance, dry milk in hermetically sealed packages made from laminated foil has a shelf life of two years. A surge in the usage of other flexible packaging solutions might also be observed during the forecast period. The increased domestic demand for aluminum has led to an upsurge in aluminum foil imports from China, whose shipments to the United States increased significantly in the last decade. Currently, flexible packaging is mainly used for food, with the fastest areas of expansion being coffee, snack foods, fresh produce, ready-to-eat meals, and pet food.

- The market demand for aluminum foil packaging is expected to grow, owing to aluminum's lightweight, durability, flexibility, and barrier properties compared to plastic and glass. The ease of use, convenience, safety, lightweight, and durability of aluminum make it ideal for use across various verticals and households.

- The pharmaceutical business frequently uses blister packs for medicinal products. They comprise a push-through closure composed of aluminum foil known as blister film or lid film and the so-called push-through blister, a molded plastic with cavities for individual tablets. Different blister packing materials are employed in medicines for various items. Mainly, aluminum plastic packaging is employed in medicine packaging, while a few other medications use all packaging.

- Furthermore, the demand for aluminum foil packaging, including aluminum wraps and containers for pharmaceuticals and online-ordered food, has significantly increased in recent years. The Aluminum Stewardship Initiative (ASI) sets many standards for social and environmental policies. The organization is expected to restore the disrupted supply chains for aluminum foil packaging materials caused by nationwide lockdowns imposed during the COVID-19 pandemic.

- Aluminum's sustainability creates competitive business advantages while simultaneously providing product development advantages. According to the Aluminum Association, nearly 75% of all aluminum produced is still in use. Moreover, when disposed of, aluminum waste does not add poisonous contaminants to the water or ground but can be economically recycled and more sustainable.

Key Highlights

Aluminum Foil Packaging Market Trends

Rolled Foils Segment Accounts for a Significant Share in the Market

- Aluminum foil packaging, including aluminum wraps and containers for pharmaceuticals and online-ordered food, has registered a significant increase in demand. The Aluminum Stewardship Initiative (ASI) has set many social and environmental policy standards. The organization is expected to restore the disrupted supply chains for aluminum foil packaging materials caused by the nationwide lockdowns imposed during the COVID-19 pandemic.

- Aluminum foil wrappers maintain brightness and reflectivity, attracting consumer attention in retail spaces. Besides, aluminum foil can be color-lacquered or printed with brand-identifying designs. The increasing demand for sustainable packaging, especially in the food and beverage industries, will likely make aluminum foil wrappers an attractive option.

- An aluminum foil wrap provides specific characteristics, such as dead fold and embossability, which other packaging materials cannot obtain. The food, tobacco, and cosmetics industries are expected to be the primary drivers of the growth of aluminum foil wraps over the forecast period.

- Additionally, aluminum rolled foils are increasingly used in the culinary preparation of different foods due to their ease of use and disposal and ability to transfer heat twice as quickly as regular metal. As part of a growing culinary practice in households, aluminum foil is used to wrap and bake food.

- In the past few years, the production of aluminum has also increased, and many countries have taken the initiative to increase the number of smelters for the production of large metric tons of aluminum. According to a US Geological Survey report published in January 2024, China's smelters collectively produced approximately 4.1 million metric tons of aluminum in 2023. Aluminum, the predominant non-ferrous metal, has extensive applications across the packaging industry.

Asia-Pacific Accounts for a Significant Share in the Market

- The Asia-Pacific regional segment is anticipated to maintain its dominance throughout the forecast period. China's massive consumption of aluminum foil for producing aluminum packaging is mainly responsible for the region's strong demand for the material, leading to the rise of the aluminum foil market. Aluminum foil is increasingly used for food goods storage in the region. Key industries, including food, pharmaceutical, and EV battery producers, are anticipated to propel market growth.

- Asia-Pacific countries produce and use the majority of aluminum in pouches and bags. The need for healthier lifestyles and consumption patterns in these countries is increasing the demand for aluminum foil. The need for aluminum foil packaging is rising due to increasing populations in developing countries. The demand for aluminum packaging is increasing across several Asia-Pacific countries as they seek to encourage environmentally friendly consumption, ensure food safety, preserve food, and uphold the principles of environmental sustainability.

- In addition, according to the National Bureau of Statistics, in 2023, the production volume of primary aluminum in China was 42 million tons, an increase from 40.21 million tons in 2022. In the past decade, China's annual primary aluminum production steadily increased, reaching 35.04 million tons in 2019.

- Moreover, at the 37th AAHAR International Food and Hospitality Fair, India's 1st Golden Embossed HOMEFOIL was launched by LSKB Aluminum Foils Pvt. Ltd. The thickness of 1 kg and 555 g golden and silver embossed HOMEFOIL launched by LSKB Aluminium Foils Pvt. Ltd is 18 Micron, and for 75 m, 25 m, and 9 m, it is 12 Micron. The products are manufactured using innovative technologies in safe, environment-friendly, well-ventilated premises to maintain hygiene. The package also has an attached foil cutter to cut the foil safely.

- India is the second-largest country worldwide after China in tobacco consumption, resulting in high demand for short aluminum foil wraps. Nowadays, aluminum foil is the preferred barrier material, particularly for the inner liner of cigarette packets. This is because it combines an exceptional "feel" and appearance that is light, robust, and simple to reseal with the capacity to preserve the distinctive aroma of each blend and brand.

- ITC India Ltd's Cigarette segment's revenue surged to over INR 312 billion (USD 3.73 billion) in the financial year 2023, marking a significant increase from about INR 261 billion (USD 2.73 billion) in 2019. Notably, ITC Ltd stands as a major player in India's FMCG industry, with cigarettes being its flagship product. Therefore, such growth trends in cigarette revenue may have pushed the demand for aluminum foil nationwide.

Aluminum Foil Packaging Industry Overview

The aluminum foil packaging market is fragmented due to low entry barriers and growing demand. Some key players in the market are Amcor Limited, Constantia Flexibles, China Hongqiao Group Limited, Hindalco Industries Limited (Aditya Birla Group), and Novelis.

February 2024: Constantia Flexibles announced that it had inked a deal to purchase about 57% of Aluflexpack's shares, a prominent European packaging producer. Aluflexpack is known for its foil and film packaging expertise, catering primarily to the consumer and pharma industries. This move significantly bolsters Constantia Flexibles' position in the aluminum foil packaging market, spanning various segments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Spectrum of Applications

- 5.1.2 Sustainable Nature of Aluminum Products

- 5.2 Market Challenges

- 5.2.1 Emergence of Alternative Materials with Comparative Barrier Properties and Low Carbon Footprint

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rolled Foil

- 6.1.2 Backed Foil

- 6.1.3 Other Types (Blister)

- 6.2 By Application

- 6.2.1 Converter Foils

- 6.2.2 Container Foils

- 6.2.3 Other Applications (Household)

- 6.3 By End User

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical

- 6.3.4 Cosmetics and Personal Care

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Thailand

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Constantia Flexibles

- 7.1.3 Coppice Alupack Limited

- 7.1.4 China Hongqiao Group Limited

- 7.1.5 Hindalco Industries Limited (Aditya Birla Group)

- 7.1.6 Ess Dee Aluminum Ltd

- 7.1.7 Novelis Inc.

- 7.1.8 Alcoa Corporation

- 7.1.9 Penny Plate LLC

- 7.1.10 Eurofoil Luxembourg SA

- 7.1.11 Alufoil Products Pvt. Ltd

- 7.1.12 United Company RUSAL

- 7.1.13 Zhangjiagang Goldshine Aluminium Foil Co. Ltd