|

市场调查报告书

商品编码

1432876

LTE(长期演进):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Long-term Evolution (LTE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

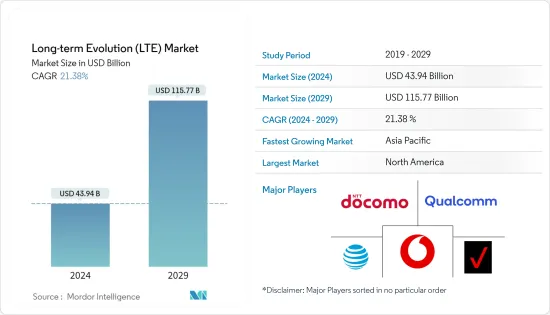

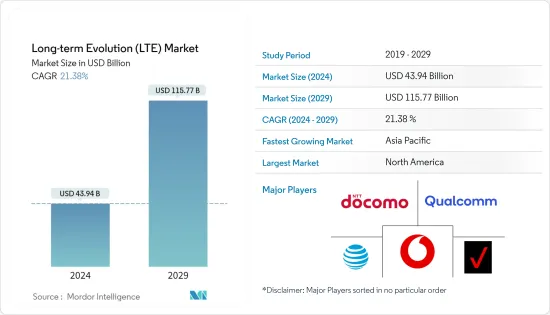

LTE(长期演进)市场规模预计到2024年为439.4亿美元,预计到2029年将达到1157.7亿美元,预测期内(2024-2029年)复合年增长率为21.38%。

全球智慧型手机的持续普及导致普通人的平均资料消费量增加,增加了对 LTE 服务的需求并推动了市场的发展。

主要亮点

- 随着世界各地许多企业的发展,业务的各个方面都在数位化,因此需要资料。电信业者正在对新型先进无线技术进行巨额投资,并寻求更好的应用。

- LTE 网路必须提供更高的资料速率和频谱效率,以满足日益增长的行动资料服务需求。提高的资料速率将允许用户更快地下载和上传资料,而提高的频谱效率将允许通讯业者更有效地使用现有频谱,从而让更多的人能够为用户提供更多的资料服务。

- 公共LTE (PS-LTE) 的日益普及是推动 LTE 市场成长的因素之一。 PS-LTE 是专为警察、消防和紧急医疗服务等公共机构使用而设计的行动通讯标准。为公共人员提供专用无线宽频连接,使他们能够即时存取关键资料和通讯服务。

- 相容性问题可能会限制 LTE 的发展。相容性问题可能会成为采用的障碍,并限制使用者充分利用该技术的能力。相容性问题可能会为 LTE 技术的发展和普及带来重大挑战。

- COVID-19 大流行对 LTE 行业产生了积极和消极的影响。然而,行动资料需求的增加以及远端医疗和电子商务服务的扩展凸显了 LTE 技术在实现远距工作和其他线上活动方面的重要性。

LTE(长期演进)市场趋势

VoLTE 应用领域预计将占据主要市场占有率

- VoLTE(长期演进语音)是一种透过 LTE 网路而非传统电路交换网路实现语音通话的技术。该技术在 LTE 市场中越来越受欢迎,因为它比传统网路提供更好的语音品质和更快的通话建立时间。

- 由于对高速资料服务的需求不断增长,LTE 市场近年来快速成长。 VoLTE是LTE市场的重要应用,让营运商利用LTE网路提供语音服务,而无需依赖传统的电路交换网路。这使得营运商能够释放先前用于语音服务的频宽和网路资源,并利用它们来提供更好的资料服务。

- VoLTE 还透过提供高清 (HD) 语音(提供更好的通话品质)和视讯通话(允许透过 LTE 网路进行视讯通话)等功能来提供更好的用户体验。 VoLTE支援丰富的通讯服务(RCS),让用户在通话过程中共用照片和影片等多媒体内容。

- 最近的许多技术进步促进了此类服务在印度等开发中国家的普及和采用。印度电讯监理局 (TRAI)建议政府竞标3.3-3.6 GHz 频谱中的 5G 服务频谱。政府也允许通讯业者在印度进行5G技术试验。

- 随着5G的普及,全球主要地区的市场预计将进一步成长。根据思科年度网路报告,到 2023 年,中国(20.7%)、日本(20.6%)和英国(19.5%)可能成为设备和连接份额排名前三名的 5G 国家。

亚太地区预计将占据主要市场占有率

- LTE(长期演进)技术最近在亚洲国家经历了显着的成长和普及。这一增长的主要驱动力是这些国家对高速资讯服务的需求不断增长以及行动用户数量的增加。

- 此外,近年来,智慧型手机在该地区不断发展的经济体中的普及迅速提高。预计它将继续成长并引领该地区的市场。

- 中国是亚洲最大的LTE市场,拥有超过12亿用户。中国正大力投资4G和5G基础设施,并将于2023年建成全球最大的5G网络,设备和连接数量将增加20.7%以上。韩国也是亚洲重要的LTE市场,是全球5G普及最高的国家之一。

- 此外,亚太地区消费者偏好的变化和对高速行动宽频需求的不断增长,为亚太地区产业创造了巨大的机会。此外,该地区的通讯业者正计划在这些新兴国家部署更多 LTE。

- 快速的都市化、快速的工业成长和通讯技术的进步是推动该地区先进无线网路和解决方案的关键因素。

LTE(长期演进)产业概况

长期演进 (LTE) 市场高度分散,主要参与者包括 AT&T Inc.、Verizon Communications Inc.、Vodafone Inc.、NTT DoCoMo Inc. 和 Qualcomm Inc.。市场参与者正在采取联盟、创新和收购等策略来增强其产品阵容并获得永续的竞争优势。

2023 年 1 月,沃达丰使用支援连网型设备的新网路成功推出了网路呼叫,为远端紧急监控和快速医疗保健等关键应用铺平了道路。 VoLTE(长期演进语音)呼叫,也称为 4G 呼叫,是在义大利透过沃达丰的商业类别 M (CAT-M) 网路进行的。该网路非常适合在一个行动电话站点上为许多物联网 (IoT) 设备提供服务,而不会降低智慧型手机用户的服务品质。这是欧洲首次在活跃的商业 CAT-M 网路基础设施上进行 VoLTE 通话。

2022 年 7 月,诺基亚与 AT&T 墨西哥建立合作关係,为该国带来 5G 的优势。诺基亚也被选为 AT&T 墨西哥 5G 创新实验室的策略合作伙伴,以创建墨西哥特定的 5G使用案例并探索当地 5G 生态系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 资料使用量的增加需要更高的资料速率和频谱效率

- 公共LTE 的采用率有所提高

- 市场限制因素

- 可用频率有限

第六章市场区隔

- 依技术

- LTE-TDD

- LTE Advanced

- LTT-FDD

- 按用途

- 视讯点播

- VoLTE

- 高速资讯服务

- 国防和安全

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- AT&T Inc.

- Verizon Communication Inc

- Vodafone Inc

- NTT DoCoMo Inc.

- Qualcomm Inc.

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Ericsson Inc.

- Broadcom Corporation

- Microsoft Corporation

第八章投资分析

第九章 市场机会及未来趋势

The Long-term Evolution Market size is estimated at USD 43.94 billion in 2024, and is expected to reach USD 115.77 billion by 2029, growing at a CAGR of 21.38% during the forecast period (2024-2029).

The continuous proliferation of smartphones across the globe has increased the average data consumption by an average man, which has increased the need for LTE services, driving the market.

Key Highlights

- Many businesses across the globe have been growing, and so require data, owing to the digitization of every aspect of the business. Telecommunication companies are making enormous investments in new and advanced wireless technologies and looking for better applications to provide payoffs.

- LTE networks need to provide higher data rates and spectral efficiency to meet this growing demand for mobile data services. Higher data rates enable users to download and upload data more quickly, while greater spectral efficiency enables operators to use their existing spectrum more efficiently, allowing them to provide more data services to more users.

- The increased adoption of Public Safety LTE (PS-LTE) is one of the key drivers of growth in the Long-Term Evolution (LTE) market. PS-LTE is a standard for mobile communications that are designed specifically for use by public safety agencies such as police, fire, and emergency medical services. It provides dedicated wireless broadband connectivity for public safety personnel, enabling them to access critical data and communication services in real time.

- Compatibility issues can restrain LTE's growth, as they can create barriers to adoption and limit the ability of users to utilize the technology entirely. Compatibility issues can pose significant challenges to the growth and adoption of LTE technology.

- The COVID-19 pandemic had a mixed impact on the LTE industry, with both positive and negative effects. However, the increased demand for mobile data and the expansion of telemedicine and e-commerce services highlighted the importance of LTE technology in enabling remote work and other online activities.

Long-term Evolution (LTE) Market Trends

VoLTE Application Segment is Expected to Hold Significant Market Share

- Voice over Long-Term Evolution (VoLTE) is a technology that allows voice calls to be made over LTE networks rather than using traditional circuit-switched networks. This technology has been gaining popularity in the LTE market, offering better voice quality and faster call setup times than conventional networks.

- The LTE market has grown rapidly in recent years due to the increasing demand for high-speed data services. VoLTE is an important application in the LTE market as it allows operators to use their LTE networks to provide voice services rather than relying on legacy circuit-switched networks. This allows operators to free up spectrum and network resources previously used for voice services, which can be used to provide better data services.

- VoLTE also provides a better user experience by offering features such as high-definition (HD) voice, which provides better call quality, and video calling, which allows users to make video calls over LTE networks. VoLTE supports rich communication services (RCS), allowing users to share multimedia content such as photos and videos during calls.

- Many recent technological advancements have contributed to popularizing and adopting such services in developing countries, such as India. The Telecom Regulatory Authority of India (TRAI) has recommended that the government auction spectrum for 5G services in the 3.3-3.6 GHz frequency band. The government has also allowed telecom operators to conduct trials of 5G technology in India.

- With the increasing 5G coverage, the market is expected to witness further growth across major regions of the globe. According to Cisco Annual Internet Report, China (20.7%), Japan (20.6%), and the United Kingdom (19.5%) will likely be the top three 5G countries in terms of device and connection share by 2023.

Asia-Pacific is Expected to Hold Significant Market Share

- Long-Term Evolution (LTE) technology has seen significant growth and adoption in Asian countries recently. The main driving factors behind this growth are the increasing demand for high-speed data services and the growing number of mobile subscribers in these countries.

- Moreover, smartphone penetration in growing economies in this region has grown exponentially in recent years. It is expected to grow in the coming years, which drives the market in this region.

- China is the largest LTE market in Asia, with more than 1.2 billion mobile subscribers. The country has invested heavily in 4G and 5G infrastructure, and by 2023, the country will have the largest global 5G network with over 20.7% of devices and connections. South Korea is also a significant LTE market in Asia, with one of the highest 5G penetration rates globally.

- Furthermore, shifting consumer preferences and increased demand for high-speed mobile broadband in the Asia-Pacific region have created enormous opportunities in the APAC industry. In addition, telecom carriers in this area have more LTE deployments planned in these emerging nations.

- Rapid urbanization, fast industrial growth, and advancement in communication technology are important factors leading the way for advanced wireless networks and solutions in this region.

Long-term Evolution (LTE) Industry Overview

The Long-term Evolution (LTE) Market is highly fragmented, with major players like AT&T Inc., Verizon Communication Inc, Vodafone Inc, NTT DoCoMo Inc., and Qualcomm Inc. The players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, Vodafone successfully performed an internet call using its new network to enable connected devices, opening the path for crucial applications such as emergency monitoring and responsive healthcare in distant locations. The Voice over Long-Term Evolution (VoLTE) call, often known as 4G calling, was made in Italy over Vodafone's commercial Category M (CAT-M) network. The network is perfect for serving many Internet of Things (IoT) devices across a single mobile phone site without reducing service to smartphone users. This is Europe's first VoLTE call on active commercial CAT-M network infrastructure.

In July 2022, Nokia and AT&T Mexico established a partnership to deliver the benefits of 5G to the country. Nokia was also chosen as a strategic partner for AT&T Mexico's 5G Innovation Lab to investigate the creation of 5G use cases specific to Mexico and the local 5G ecosystem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need For Higher Data Rates and Greater Spectral Efficiency Driven By Increased Data Usage

- 5.1.2 Increased Adoption of Public Safety LTE

- 5.2 Market Restraints

- 5.2.1 Availability of Limited Spectrum

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LTE-TDD

- 6.1.2 LTE Advanced

- 6.1.3 LTT-FDD

- 6.2 By Application

- 6.2.1 Video on Demand

- 6.2.2 VoLTE

- 6.2.3 High Speed Data Services

- 6.2.4 Defense and Security

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Verizon Communication Inc

- 7.1.3 Vodafone Inc

- 7.1.4 NTT DoCoMo Inc.

- 7.1.5 Qualcomm Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Samsung Electronics Co. Ltd.

- 7.1.8 Ericsson Inc.

- 7.1.9 Broadcom Corporation

- 7.1.10 Microsoft Corporation

![LTE 物联网市场:趋势、机会与竞争分析 [2023-2028]](/sample/img/cover/42/1342011.png)