|

市场调查报告书

商品编码

1432879

海底生产和加工系统:市场占有率分析、行业趋势和成长预测(2024-2029)Subsea Production and Processing System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

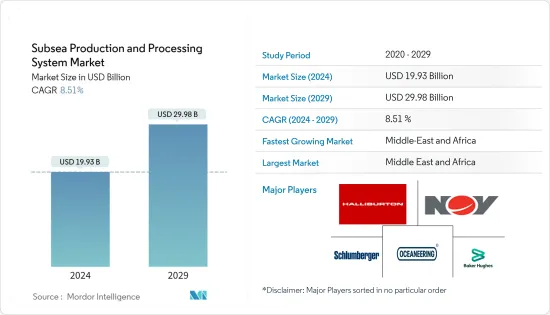

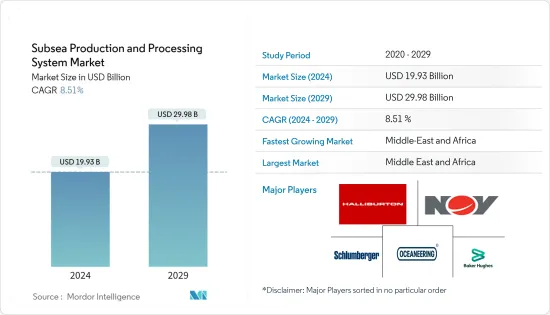

海底生产和加工系统市场规模预计到 2024 年为 199.3 亿美元,到 2029 年达到 299.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 8.51%。

主要亮点

- 从中期来看,全球钻井和完井作业的增加正在推动研究期间对海底生产和加工系统市场的需求。

- 同时,受供需缺口、地缘政治等因素影响,近期油价波动较大,限制了海底生产加工系统的需求成长。

- 儘管如此,石油和天然气发现量的增加以及全球产业的自由化正在为参与者创造新的投资机会。新兴市场为中东、非洲、亚太、南美洲等开发中国家。

海底生产和加工系统市场趋势

深海与超深海主导市场

- 到2030年,全球能源需求预计将增加5%,其中石油和天然气约占一半。技术进步和营运优化显着降低了海上上游计划的成本。预计未来几年新的海上上游计划的引入率将会增加,以满足不断增长的需求。

- 近年来,全球油气上游产业新的海上探勘和生产活动显着增长,特别是在深海和超深海领域。全球石油和燃气公司正在增加新计画的投入,以利用当前油价长期下跌的局面。在预测期内,海上活动中的石油和天然气计划的成长预计将增加。

- 例如,2022 年 4 月,石油和天然气巨头壳牌公司和 TotalEnergies 在巴西海岸附近的桑托斯盆地获得了 6 个区块和 2 个海上探勘区块,作为巴西最新一轮竞标的一部分。此次竞标收购了6个盆地的59个勘探区块。壳牌巴西公司在该国持有30多个油气开发合同,并在第三轮勘探竞标中赢得了勘探区块。同时,Total Energies 获得了 SM-1711 和 SM-1815 勘探区块 100% 的权益。这些发展可能会推动对海底生产和加工系统的需求。

- 2022年3月,作为印尼政府进行的2021年石油和天然气工作区(WK)第二轮竞标的一部分,英国石油天然气公司BP PLC宣布了阿贡L和阿贡II区块的两项投标。近海勘探区块。这些领域相对开拓,预计蕴藏着巨大的资源潜力,从而支持海底生产和加工系统市场。

- 总体而言,由于能源需求迅速增长、陆上蕴藏量枯竭以及各国政府探勘海上资源的努力,对海上石油和天然气活动的投资增加,预计未来几年对深水和超深水海底生产的投资将增加。预计将推动处理系统市场的成长。

中东和非洲主导市场

- 中东和非洲油气上游市场是全球能源产业的主要驱动力。该地区拥有世界上最大的石油和天然气蕴藏量,其持续成长对于满足世界能源需求至关重要。

- 最近,该地区的石油和天然气产业对海底系统的需求显着增加。海底系统从海上油田生产、加工和运输碳氢化合物。事实证明,海底系统是开发深海和超深海蕴藏量的高效且经济高效的解决方案。

- 中东和非洲对海底系统的需求受到多种因素的推动,包括最大限度地提高蕴藏量回收率、提高效率和生产力以及降低成本。随着该地区许多常规陆上蕴藏量的成熟,海底系统正成为开发海上蕴藏量日益重要的工具。

- 2023年3月,部署在中东和非洲的海上钻井平台数量为44座,自2020年10月COVID-19大流行影响达到顶峰以来增加了约57%。中东海上钻井平台的增加将大大影响对海底系统的需求。

- 此外,液化天然气(LNG)作为传统石化燃料的清洁替代品的崛起也推动了该地区海底系统的需求。目前,中东和非洲多个大型液化天然气计划正在进行,各公司正在大力投资海底基础设施,以满足日益增长的天然气需求。

- 总体而言,由于需要提高效率和生产力、降低成本并最大限度地提高蕴藏量采收率,中东和非洲地区对海底系统的需求预计在未来几年将增长。随着公司继续投资海底基础设施,预计该地区在预测期内仍将是市场最大的区域部分之一。

- 因此,在预测期内,该地区石油和天然气活动的增加预计将增加北美地区对海底生产和加工系统市场的需求。

海底生产和加工系统产业概述

海底生产和加工系统市场得到部分整合。该市场的主要企业(排名不分先后)包括斯伦贝谢有限公司、哈里伯顿公司、Aker Solutions ASA、National Oilwell Varc, Inc. 和贝克休斯公司。

2022年8月,斯伦贝谢将与Aaker Solutions和Subsea7组成合资企业,透过帮助客户发现蕴藏量和缩短週期时间来推动海底生产的创新和效率。该计划已公布。该协议汇集了创新技术组合,包括海底天然气压缩、全电动式海底生产系统和其他电气化能力,以帮助客户实现脱碳目标。

同样,Aker Solutions 已签订多项协议和合作伙伴关係来发展其海底生产业务。例如,2022年2月,Aaker Solutions和Drill Quip签署了一项协议,为碳捕获、利用和封存计划提供海底注入系统。根据合约,Drill Quip 将提供用于二氧化碳注入的 Xmas 树和井口,并将其整合到更大的海底注入系统中。该合约具体涵盖英国的 Northern Endurance计划。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 未来规划的主要上游计划

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 提高海上石油和天然气计划的可行性

- 抑制因素

- 禁止多地区海上探勘生产活动

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 生产系统组成

- 海底树

- 海底供应连系管、立管、流线

- 海底井口

- 其他的

- 处理系统类型

- 提升

- 分离

- 注射

- 气体压缩

- 水深

- 浅海

- 深海与超深海

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Aker Solutions ASA

- Baker Hughes Company

- Sri Energy Inc.

- Halliburton Company

- Kerui Group Co. Ltd

- National-Oilwell Varco, Inc.

- Oceaneering International

- Schlumberger Limited

- TechnipFMC PLC

- Subsea 7 SA

第七章 市场机会及未来趋势

- 海底生产和加工系统的技术进步

The Subsea Production and Processing System Market size is estimated at USD 19.93 billion in 2024, and is expected to reach USD 29.98 billion by 2029, growing at a CAGR of 8.51% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing drilling and completion activities, globally, has been driving the demand for the subsea production and processing system market over the study period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics and several other factors has been restraining the growth in the demand for subsea production and processing systems.

- Nevertheless, the increasing oil and gas discoveries coupled with the liberalization in the industry globally, has been leading to creation of new opportunities for the players to invest in. The new emerging markets are several developing nations of Middle East and Africa, Asia-Pacific and South America.

Subsea Production and Processing System Market Trends

Deepwater and Ultra-Deepwater to Dominate the Market

- The global energy demand is expected to increase by 5% by 2030, with oil and natural gas contributing to approximately half the need. With the advancements in technology and optimization in operations, there is a significant reduction in the cost of offshore upstream projects. The uptake rate of new offshore upstream projects is expected to increase in the coming years to meet the rising demand.

- In recent years, the global oil & gas upstream industry is experiencing significant growth in new offshore exploration and production activities, especially in deep and ultra-deep waters. Oil & gas players worldwide are looking to increase the uptake of new projects to capitalize on the current lower-for-longer oil prices scenario. It is expected to increase the growth of oil & gas projects in offshore activities during the forecast period.

- For instance, in April 2022, oil and gas giants Shell PLC and TotalEnergies secured six and two offshore exploration blocks in the Santos Basin offshore Brazil as part of the country's latest bid round. In the auction, 59 exploration blocks were acquired in six basins. With the block acquired in the 3rd Permanent Offer of exploration areas, Shell Brazil holds more than 30 oil & gas contracts in the country. On the other hand, TotalEnergies secured a 100% interest in each exploration block, S-M-1711 and S-M-1815. These developments are likely to aid demand for subsea production and processing systems.

- In March 2022, British oil & gas company BP PLC won two offshore exploration blocks, Agung l, and Agung ll, in Indonesia, as part of the government's second round of the 2021 Oil & Gas Working Area (WK) Bid Round. These blocks are relatively unexplored and are expected to include significant resource potential, thus supporting the subsea production and processing system market.

- Overall, the rising investments in offshore oil & gas activities, owing to the surging energy demand, depleting onshore reserves, and efforts from governments across nations to explore their offshore resources are expected to drive the growth of the deepwater and ultra-deepwater subsea production and processing system market in the coming years.

Middle East and Africa to Dominate the Market

- The upstream oil and gas market in the Middle East & Africa is a key driver of the global energy industry. The region is home to some of the world's largest oil and gas reserves, and its continued growth is critical to meeting global energy demand.

- Recently, there is a significant increase in the demand for subsea systems in the region's oil and gas industry. Subsea systems produce, process, and transport hydrocarbons from offshore fields. They proved a highly efficient and cost-effective solution for developing deepwater and ultra-deepwater reserves.

- The demand for subsea systems in the Middle East & Africa is driven by several factors, including maximizing the reserves recovery, improving efficiency and productivity, and reducing costs. With many of the region's conventional onshore reserves maturing, subsea systems are becoming an increasingly important tool for developing offshore reserves.

- In March 2023, the offshore rig count deployed in the Middle East & Africa stood at 44, up by nearly 57% since October 2020, when the impact of the COVID-19 pandemic peaked. The rising offshore rig deployment in the Middle East significantly impacts the demand for subsea systems.

- Moreover, the rise of liquefied natural gas (LNG) as a cleaner alternative to traditional fossil fuels is also driving the demand for subsea systems in the region. With several major LNG projects currently underway in the Middle East & Africa, companies are investing heavily in subsea infrastructure to help meet the growing demand for natural gas.

- Overall, the demand for subsea systems in the Middle East & Africa is expected to grow in the coming years, driven by the need to increase efficiency and productivity, reduce costs, and maximize the recovery of reserves. As companies continue to invest in subsea infrastructure, the region will likely remain one of the largest geographical segments in the market during the forecast period.

- Therefore, increasing oil and gas activities in the region are expected to increase the demand for subsea production and processing system markets over the forecast period in the North American region.

Subsea Production and Processing System Industry Overview

The subsea production and processing system market is partially consolidated. Some key players in this market (in no particular order) include Schlumberger Limited, Halliburton Company, Aker Solutions ASA, National Oilwell Varc, Inc., and Baker Hughes Company., among others.

In August 2022, Schlumberger, has announced its plan to enter a joint venture with Aker Solutions and Subsea 7 to drive innovation and efficiency in subsea production by helping customers unlock reserves and reduce cycle time. The agreement will bring together a portfolio of innovative technologies such as subsea gas compression, all-electric subsea production systems, and other electrification capabilities that help customers meet their decarbonization goals.

Similarly, Aker Solutions has made several agreements and collaborations to develop its subsea production business. For example, in February 2022, Aker Solutions and Drill-Quip have entered into an agreement to provide subsea injection systems for carbon capture, utilization, and storage projects. As per the agreement, Drill Quip would provide CO2 injection Xmas trees and wellheads which will be integrated into a larger subsea injection system. The agreement is specifically made for the Northern Endurance Project in the United Kingdom..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Major Upcoming Upstream Projects

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Improved Viability Of Offshore Oil And Gas Projects

- 4.6.2 Restraints

- 4.6.2.1 Ban On Offshore Exploration And Production Activities In Multiple Regions

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Production System Component

- 5.1.1 Subsea Trees

- 5.1.2 Subsea Umbilicals, Risers, & Flowlines

- 5.1.3 Subsea Wellhead

- 5.1.4 Other

- 5.2 Processing System Type

- 5.2.1 Boosting

- 5.2.2 Separation

- 5.2.3 Injection

- 5.2.4 Gas Compression

- 5.3 Water Depth

- 5.3.1 Shallow Water

- 5.3.2 Deepwater and Ultra-Deepwater

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Aker Solutions ASA

- 6.3.2 Baker Hughes Company

- 6.3.3 Sri Energy Inc.

- 6.3.4 Halliburton Company

- 6.3.5 Kerui Group Co. Ltd

- 6.3.6 National-Oilwell Varco, Inc.

- 6.3.7 Oceaneering International

- 6.3.8 Schlumberger Limited

- 6.3.9 TechnipFMC PLC

- 6.3.10 Subsea 7 SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancements in Subsea Production and Processing Systems