|

市场调查报告书

商品编码

1640522

无线网状网路:市场占有率分析、产业趋势和成长预测(2025-2030 年)Wireless Mesh Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

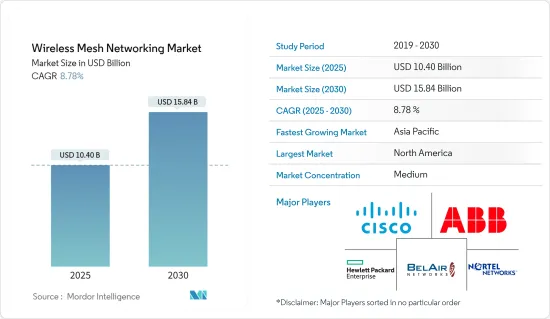

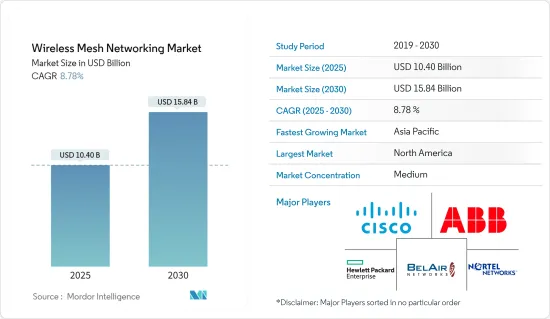

无线网状网路市场规模预计在 2025 年为 104 亿美元,预计到 2030 年将达到 158.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.78%。

由于无线通讯领域的进步,全球无线网状网路 (WMN) 市场预计将在预测期内大幅扩张。采用此技术的主要优势包括弹性通讯、低财务成本和灵活规模。

关键亮点

- 这些网路的另一个优点是其自动配置和自组织功能,这使得可以部署更多 WAP 来增加覆盖范围、容量和可用性,而不会中断其他节点。这使得它易于扩展并适用于各种应用程式。

- 2023 年 7 月 总部位于宾州马尔文的动能网状无线网路全球先驱 Rajant Corporation 去年与 Crossover Distribution 签署了策略性分销协议。 Crossover 是领先的无线解决方案供应商之一,拥有支援北美的设计和工程专业知识。两家公司的协议标誌着 Rajant 进一步进行全球投资,将其世界领先的 Kinetic Mesh 解决方案带给采矿、室内自动化、智慧城市、公共和农村宽频等行业的跨行业客户。

- 由于物联网和工业自动化在各个领域的应用日益广泛,无线网状网路市场正经历显着成长。这项技术创新正在推动包括固定无线市场在内的各类市场的新应用。

- 此外,无线网状网路 (WMN) 的连接优势和低成本使其成为透过可靠的无线连接网路追踪托盘和监控大型实体物件的理想选择。这项技术可以轻鬆追踪工厂车间或多个位置的关键资料并在问题发生之前发现问题,因此现在许多供应商都提供工业级产品。

- 随着农业领域自动化程度的提高,WMN 技术在追踪太阳辐射和农作物水位方面也表现出色。透过在您的土地上安装支援网状结构的节点,您可以以低成本扩展并开发蜂窝连接的物联网农场。

无线网状网路市场趋势

无线网状网路户外应用的增加预计将推动市场成长

- 经济实惠的 Wi-Fi 用户端的广泛普及正在创造新的服务机会和应用,透过户外无线存取来提高使用者的工作效率和回应能力。这一趋势在工业 4.0 中尤其重要,需要像 WMN 这样的解决方案来解决跨设施的延迟问题。

- ABB 对全球 WMN 市场的广泛覆盖以及针对主要终端用户不断扩展的产品组合证明了对 WMN 路由器和客户端节点的需求。例如,该公司为纽约Hudson谷中部的公共设施提供无线网状场域网路。该网路具有高容量、低延迟和支援多种公共产业程式的能力。该公司的解决方案和服务包括TropOS 6420户外网状路由器、TropOS 1410网状边缘节点、SuprOS通讯网路管理系统以及TropOS网路的设计、安装、客户服务和维护。

- 该公司也为德克萨斯州的一个石油储存槽场提供了类似的解决方案。该农场需要在具有反射金属罐的环境中实现可靠的通讯、支援即时 SCADA 应用的低延迟无线通讯以及支援行动现场工作期间的网路存取。

- 据爱立信称,到 2028 年,全球 5G 固定无线存取 (FWA) 连线预计将达到 2.36 亿。 2022年全球5G FWA连线数将达到1923万。

- 随着对室外无线存取的需求不断增长,预算紧张、资源受限的客户需要最大限度地利用现有工具和网路资源,以经济高效的方式解决部署难易度、知识和WLAN 安全问题。可能会采用无线区域网路(WLAN) 解决方案可以然而,户外解决方案面临着环境、覆盖范围、总拥有成本 (TCO) 和实体设备安全等挑战,这些挑战使得它们不如室内无线解决方案有吸引力。

预计北美将占据较大的市场占有率

- 美国无线网状网路市场仍然是世界上最大的市场。安全监控的高采用率和对关键任务应用程式的不断增长的需求对北美市场的成长做出了重大贡献。这种成长引发了该地区一系列新产品的发布和併购活动。

- 预计未来五年家庭网路、视讯监控和连结医疗设备应用将在北美经历显着增长。同时,英国各工业领域(包括石油和天然气、化学品和采矿业)对无线网状网路的应用日益增加。这种采用是由远端位置之间的无缝通讯的需求以及行动和手持设备的快速普及所驱动,这推动了对 WMN 解决方案的需求。

- 2022年,英国付费电视和网路连线服务供应商TalkTalk推出了新的Future Fibre 900和Total Home Wi-Fi方案。该套餐结合了速度和覆盖范围,为客户提供整个家庭的无缝连接。 TalkTalk 的 Future Fiber 900 套餐包括两个 Amazon eero Pro 6 网状 Wi-Fi 设备。

- 英国无线网状网路市场的扩张也受到政府旨在公共场所创建免费市政无线网路的倡议的推动。市政无线网路覆盖整个城市,通常透过安装无线网状网路来实现,透过 Wi-Fi 为整个市政区域的很大一部分提供市政宽频。典型的部署场景涉及安装在室外(通常在电线杆)的数百个无线网路基地台。

无线网状网路产业概况

由于企业需要较高的前期投资和基础设施,无线网状网路市场是半静态的。市场的主要企业包括 ABB、思科和 HP。近期市场发展趋势如下:

- 2023 年 1 月 - 摩托罗拉品牌宣布将透过在 HomeDepot.com 上推出摩托罗拉家庭网路设备来扩大其电子商务足迹。该电子商务伙伴关係将把摩托罗拉品牌的网路解决方案直接带给北美各地的家居装饰购物者。支援 WiFi 6 的设备数量持续增加,Minim 的电子商务子公司与 Home Depot 合作,从摩托罗拉家庭网路产品组合中列出了八款高效能设备,其中包括摩托罗拉 MH7603 WiFi 6 网状系统。

- 2022 年 6 月-华为推出 HUAWEI WiFi Mesh 7,扩展其网状路由器产品线。新款华为智慧网状路由器有两种包装,可为 6,000 平方英尺范围内最多 250 台装置提供超快速的 Wi-Fi 6 Plus 连线速率。非常适合需要快速、可靠和安全的网路连线的大型住宅。

- 2022 年 5 月-Inksys 宣布推出两款全新 Wi-Fi 6 网状系统,旨在为家庭用户(尤其是远端工作者、多媒体串流媒体和多用户游戏用户)提供最佳 Wi-Fi 效能。 Linksys Hydra 6 和 Linksys Atlas 6 是最新的入门级双频设备,也是迄今为止最实惠的版本。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 经济高效且可扩展性灵活

- 多跳可靠性

- 无线网状网路拓展户外应用

- 市场限制

- 易受安全攻击

- 冗余和缺乏互通性

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按建筑分类

- 基于基础设施的无线网状网络

- 混合无线网状网路

- 基于客户端的无线网状网络

- 按应用

- 室内的

- 户外的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 其他的

- 北美洲

第六章 竞争格局

- 公司简介

- Motorola Solutions Inc.

- ABB(Tropos Networks Inc.)

- Belair Networks(NAS Wireless LLC)

- Cisco Systems

- Strix Systems

- Synapse Wireless Inc.

- Brocade(Ruckus Wireless Inc.)

- Firetide

- HP(Aruba Networks Inc.)

- Unicom Systems

第七章 投资机会

第八章 市场机会与未来趋势

The Wireless Mesh Networking Market size is estimated at USD 10.40 billion in 2025, and is expected to reach USD 15.84 billion by 2030, at a CAGR of 8.78% during the forecast period (2025-2030).

The global wireless mesh networking (WMN) market is expected to experience significant expansion during the forecast period, owing to advancements in the wireless communication sector. The deployment of this technology is being driven by major advantages such as resilient communications, low financial cost, and flexible scale.

Key Highlights

- Another advantage of these networks is their auto-configuration and self-organization capability, which allows them to enhance coverage, capacity, and availability by deploying more WAPs without disturbing other nodes. This makes them easy to expand and suitable for various applications.

- In July 2023, Rajant Corporation, one of the leading global pioneers of Kinetic Mesh wireless networks headquartered in Malvern, Pennsylvania, entered a strategic distribution agreement with Crossover Distribution last year. Crossover is one of the leading wireless solutions providers skilled in design and engineering expertise to support North America. Their agreement represents Rajant's further global investment to introduce its global-leading Kinetic Mesh solution to Crossover's customers within industries such as mining, indoor automation, smart cities, public safety, and rural broadband.

- The wireless mesh networking market is experiencing significant growth due to increasing adoption of IoT and industrial automation across all sectors. Innovations in this technology are creating new applications in various markets, including the fixed wireless market.

- Wireless mesh networking (WMN) is also ideal for tracking pallets and monitoring large physical objects with a highly reliable wireless connectivity network due to its connectivity advantage and low cost. This technology can easily track key data across the factory floor and multiple locations to identify issues before they occur, attracting many vendors to offer industry-oriented products.

- With growing automation in the agriculture sector, WMN technology is also excellent for tracking sun exposure and water levels in crops. It can be scaled at a low cost with mesh-enabled nodes across an entire land, to develop a cellular connected IoT farm.

Wireless Mesh Networking Market Trends

Increasing Outdoor use of Wireless Mesh Networking is Expected to Drive the Market Growth

- The popularity of inexpensive Wi-Fi clients has led to new service opportunities and applications that improve user productivity and responsiveness through outdoor wireless access. This trend is particularly important in Industry 4.0, where solutions like WMN are needed to solve latency issues across facilities.

- ABB's extensive coverage in the global WMN market, and the extension of its portfolio for major end-users, demonstrate the demand for WMN routers and client nodes. For example, the company provided a wireless mesh field area network to a utility facility in New York's Mid-Hudson River Valley. This network encompassed high capacity, low latency, and an ability to support multiple utility applications. The company's solutions and services included TropOS 6420 outdoor mesh routers, TropOS 1410 mesh edge nodes, SuprOS communication network management system, as well as design, installation, customer service, and maintenance of the TropOS network.

- The company also provided similar solutions to an oil storage tank farm in Texas, which required reliable communication in an environment with metal tanks that reflected radio signals, low latency wireless communications to support real-time SCADA applications, and support for Internet access during mobile fieldwork.

- According to Ericsson, 5G fixed wireless access (FWA) connections are expected to reach 236 million globally by 2028. In 2022, 5G FWA connections globally reached 19.23 million.

- As the demand for outdoor wireless access increases, customers with tight budgets and reduced resources are likely to adopt wireless LAN (WLAN) solutions that take full advantage of existing tools and network resources to address ease of deployment, knowledge, and WLAN security issues in a cost-effective way. However, outdoor solutions face challenges such as environment, coverage, the total cost of ownership (TCO), and physical device security, which may make them less attractive compared to indoor wireless solutions.

North America is Expected to Hold Significant Market Share

- The wireless mesh network market in the United States remains the largest in the world. The high adoption rates for security surveillance and increased demand for mission-critical applications have been significant contributors to the market's growth in North America. This growth has led to a series of new product launches and mergers and acquisitions in the region.

- In North America, home networking, video surveillance, and medical device connectivity applications are expected to experience significant growth over the next five years. Meanwhile, the United Kingdom has seen a rise in the adoption of wireless mesh networks in various industrial sectors, such as oil and gas, chemicals, and mining. This adoption is driven by the need for seamless communication in remote locations, as well as the rapid uptake in mobile and handheld devices, which has led to an increase in demand for WMN solutions.

- In 2022, TalkTalk, a company that provides pay television and internet access services in the United Kingdom, launched its new Future Fiber 900 and Total Home Wi-Fi package. This package combines high speed and coverage to provide customers with seamless connectivity throughout their homes. TalkTalk's Future Fiber 900 package includes two Amazon eero Pro 6 mesh Wi-Fi devices.

- The expansion of the wire mesh networking market in the United Kingdom is also fueled by government initiatives aimed at building free municipal wireless networks in public locations. A municipal wireless network spans the entire city and is commonly accomplished by installing a wireless mesh network to provide municipal broadband through Wi-Fi to significant portions of the entire municipal territory. Typically, hundreds of wireless access points are installed outdoors, often on poles, in a typical deployment plan.

Wireless Mesh Networking Industry Overview

The wireless mesh networking market is semi-consolidated due to the high initial investments and infrastructure required by firms. Some key companies in the market include ABB, Cisco, and HP. Recent developments in the market include:

- January 2023 - Motorola brand, announced the expansion of its e-commerce footprint with the launch of Motorola home network devices on HomeDepot.com. The organization's e-commerce partnership brings Motorola-branded networking solutions directly to Home Improvement shoppers across North America. The adoption of WiFi 6-enabled devices continues; working with Home Depot, Minim's e-commerce relationship would offer eight high-performance devices from the Motorola home network portfolio, including the Motorola MH7603 WiFi 6 Mesh System.

- June 2022 - Huawei unveiled the HUAWEI WiFi Mesh 7, which extends its mesh router product line. The new Huawei smart mesh routers come in two packs and enable blazing-fast Wi-Fi 6 Plus connection rates for up to 250 devices within 6,000 square feet. They are ideal for large homes that require high-speed, dependable, and secure internet connections for everyone at home.

- May 2022 - Linksys introduced two new Wi-Fi 6 mesh systems designed to provide peak wifi performance to home users, particularly distant workers, multimedia streams, and multi-user gaming. The Linksys Hydra 6 and Linksys Atlas 6 are the company's latest entry-level dual-band devices and the brand's most affordable versions to date.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Cost-Effectiveness And The Flexibility To Expand Effortlessly

- 4.3.2 Reliability Owing To Multi-Hopping Nature

- 4.3.3 Increasing Outdoor use of Wireless Mesh Networking

- 4.4 Market Restraints

- 4.4.1 Vulnerable To Security Attacks

- 4.4.2 Redundancy And Lack Of Interoperability

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Architecture

- 5.1.1 Infrastructure Wireless Mesh Networks

- 5.1.2 Hybrid Wireless Mesh Networks

- 5.1.3 Client Wireless Mesh Networks

- 5.2 By Application

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of The World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Motorola Solutions Inc.

- 6.1.2 ABB (Tropos Networks Inc.)

- 6.1.3 Belair Networks (NAS Wireless LLC)

- 6.1.4 Cisco Systems

- 6.1.5 Strix Systems

- 6.1.6 Synapse Wireless Inc.

- 6.1.7 Brocade (Ruckus Wireless Inc.)

- 6.1.8 Firetide

- 6.1.9 HP (Aruba Networks Inc.)

- 6.1.10 Unicom Systems