|

市场调查报告书

商品编码

1432893

复杂事件处理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Complex Event Processing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

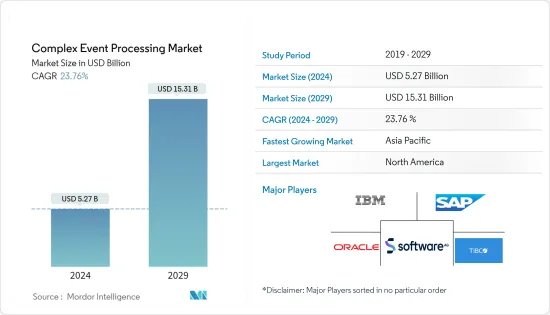

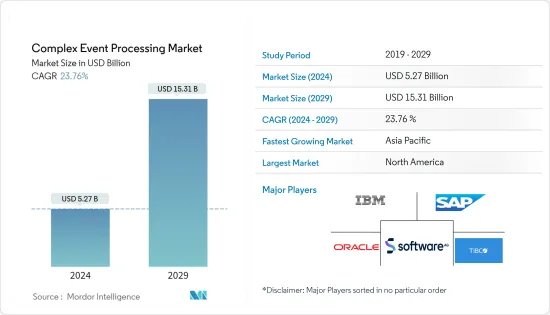

复杂事件处理市场规模预计到2024年为52.7亿美元,预计到2029年将达到153.1亿美元,在预测期内(2024-2029年)复合年增长率预计为23.76%。

随着感测器和连接设备的普及,储存的资料量呈指数级增长。传统的 DBMS 技术面临即时分析这些资料的挑战。复杂事件处理(CEP)可以解决这个问题,因为它对累积的查询而不是累积的资料进行操作。

主要亮点

- 巨量资料) 的兴起正在推动对 CEP 解决方案的需求。巨量资料和物联网产生大量资料,很难使用传统方法进行分析。因此,分析这些资料并识别模式和趋势正在推动复杂事件处理市场的采用。

- 近年来,随着网路革命,对即时资料分析的需求增加了一倍。公司正在大力投资工业自动化并不断进步机器学习。此外,各种行业和巨量资料正在使网路变得更加复杂,最终推动复杂事件处理市场的发展。

- 随着即时资料分析的需求,储存的资料量经常达到高水准。因此,对高效 CEP 系统进行有效即时资料处理的需求日益增长。根据 AI、Data & Analytics Network 于 2022 年 11 月发布的一项全球调查,高阶分析投资的首要领域是复杂事件处理,52% 的公司已经对此进行了投资。

- 然而,为各种应用程式实施复杂的事件处理解决方案的成本很高,阻碍了中小型企业的采用。此外,资料流的复杂性使得 CEP 难以识别模式。

- 随着企业和组织转向数位管道与客户和员工互动,新冠病毒大流行导致资料生成激增,以及获取资料洞察和即时采取行动的复杂性,对事件处理解决方案的需求增加。此外,疫情也催生了人工智慧 (AI) 和机器学习 (ML) 等新技术的使用,以提高 CEP 解决方案的效率。

复杂事件处理 (CEP) 市场趋势

BFSI 最终用户群显着成长

- BFSI 行业越来越依赖即时资料分析、风险管理、诈欺检测、合规性和以客户为中心的方法,这极大地推动了全球对复杂事件处理的需求。 CEP 是金融机构的重要技术,因为它能够即时处理和分析大量资料、发现模式并采取行动。

- 信用卡公司越来越多地使用复杂的事件处理解决方案和巨量资料分析来有效管理诈欺。当诈欺活动模式出现时,该公司会处理动态资料流,从而在造成重大损失之前快速冻结信用卡。底层系统预计将关联传入的事务、追踪事件资料流和触发流程。

- 银行业和其他金融组织越来越多地使用复杂的事件处理来检测诈欺,这可能会在未来几年对该行业的发展做出重大贡献。因此,复杂事件处理业务的份额和规模可望扩大。

- 银行和公司正在投资区块链技术,创建 CEP 系统的使用。 CEP 系统有助于整合各种营业单位、客户、系统和技术之间的数位交易的生命週期。 CEP 需要配置事件处理程序来侦听区块链或连接端点中的变更、关联并呼叫适当的 CEP 规则来衍生操作或警报。

- 该统计数据显示了 2022 年按行业分類的 IT 支出在全球企业收益中所占的份额。 Flexera Software 表示,软体和技术託管/云端和金融服务公司在 IT 上的支出远高于其他产业。金融服务业将约 10% 的收入投资于 IT。

北美预计将占据主要市场占有率

- 北美各最终用户产业对物联网 (IoT) 和巨量资料技术的采用显着增加。许多组织从多个来源产生和收集大量资料,以深入了解客户业务效率、行为和诈欺侦测。在此类应用中,CEP 越来越多地用于分析这些即时资料。

- 该地区是复杂事件处理技术的早期采用者。该地区的几家领先供应商已经开发了复杂的事件处理解决方案,并在各种应用中展示了它们的优势。这种早期采用创造了有利的市场环境,促进了进一步的成长和采用。

- 例如,2022 年 7 月,IBM 宣布其业务自动化产品组合包括 IBM Decision Manager Open Edition,这是其决策管理功能的最新补充,由企业级营运决策管理器和低程式码的下一代自动化决策服务组成。已扩大。 IBM Decision Manager Open Edition 提供基于 Kogito 的云端原生架构、符合 DMN1.4 的执行时间以及复杂的事件处理。

- 美国在各行业的技术发展上也一直走在前面。这种环境正在推动复杂事件处理技术的发展和采用。

复杂事件处理 (CEP) 产业概述

复杂事件处理市场处于半固体,IBM、 Oracle、SAP、Software AG 和 Tibco Software 等主要企业占据了重要的市场占有率。为了在竞争中生存,在这个市场上运营的参与者正在投资产品推出、併购和市场竞争。

2022 年 7 月,IBM 将扩展其业务自动化产品组合,包括 IBM Decision Manager Open Edition,这是其决策管理功能的最新补充,由企业级营运决策管理器和低程式码的下一代自动化决策服务组成。扩大了。 IBM Decision Manager Open Edition 提供基于 Kogito 的云端架构、符合 DMN1.4 的执行时间以及复杂的事件处理。

2022 年 2 月,复杂事件流处理软体领域的领先公司之一 thatDot, Inc. 发布了 Quine。这种独特的方法将图形资料和串流技术整合到一个现代的、开发人员友好的开放原始码软体中。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 技术简介

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 机器学习和资料分析领域的发展

- 即时分析的需求不断增长

- 市场限制因素

- 结果缺乏一致性

第六章市场区隔

- 按类型

- 软体

- 服务

- 按公司类型

- 中小企业

- 大公司

- 按行业分类

- BFSI

- 管理流动性

- 政府/国防

- 零售

- 卫生保健

- 通讯/IT产业

- 媒体娱乐

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- SAP SE

- Oracle Corporation

- Tibco Software Inc.

- Software AG

- SAS Institute Inc.

- Informatica Corporation

- Nastel Technologies Inc.

- Espertech Inc.

- Cisco Systems Inc.

- Red Lambda Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Complex Event Processing Market size is estimated at USD 5.27 billion in 2024, and is expected to reach USD 15.31 billion by 2029, growing at a CAGR of 23.76% during the forecast period (2024-2029).

With the growing use of sensors and connecting devices, the amount of data getting stored is increasing exponentially. In the traditional DBMS method, the problem of analyzing this data on a real-time basis is a challenge. Complex Event Processing (CEP) addresses this problem in response, as it works on the stored query rather than stored data.

Key Highlights

- The rise of big data and the Internet of Things (IoT) drives the demand for CEP solutions. Big data and IoT generate massive amounts of data that are difficult to analyze using traditional methods. Thus, analyzing this data and identifying patterns and trends have propelled the adoption of the Complex Event Processing Market.

- With the internet revolution, the need for real-time data analytics has multiplied over the past few years. Companies are investing highly in industrial automation, raising the developments in machine learning. Additionally, varied industries, along with Big Data, are making the web more complicated, ultimately driving the complex event processing market.

- Along with the need for real-time data analytics, the amount of data getting stored is reaching high regularly. Hence, the demand for efficient CEP systems for effective real-time data processing is growing. According to a global survey released in November 2022 by the AI, Data & Analytics Network, the top area of investment in advanced analytics is complex event processing, as 52% of companies are already investing in it.

- However, the high implementation cost of complex event processing solutions for different applications is high, preventing small and medium-sized businesses from adopting them. Also, the complexities involved in the data streams make it challenging for the CEP to recognize patterns.

- The COVID pandemic resulted in a surge in data generation, as businesses and organizations turned to digital channels to interact with customers and employees, which led increased need for complex event processing solutions to get insights into data and take action in real-time. Further, the pandemic led to the use of new technologies, such as artificial intelligence (AI) and machine learning (ML) to improve the efficiency of CEP solutions.

Complex Event Processing (CEP) Market Trends

BFSI End-user Segment to Grow Significantly

- The BFSI sector's growing reliance on real-time data analysis, risk management, fraud detection, compliance, and customer-centric approaches have significantly fueled global demand for complex event processing. CEP is an essential technology for financial institutions because of its capacity to process and analyze enormous amounts of data in real time, find patterns, and initiate actions.

- Credit card companies increasingly use complex event processing solutions with Big Data analytics to manage fraudulent activities efficiently. When a pattern of fraud incidence emerges, the company can block the credit card quickly before it can experience significant losses, as it deals with the moving flow of data. The underlying system is expected to correlate the incoming transactions, track the event data stream, and trigger a process.

- Factors for the increased use of complex event processing for fraud detection in the banking sector and other financial organizations will significantly contribute to this industry segment's development in the coming years. This, in turn, will increase the share and size of the complex event-processing business.

- Banks and trading companies are investing in blockchain technology, which is giving rise to using CEP systems. CEP systems help integrate the digital transaction lifecycle among various business entities, customers, systems, and technologies. With CEP, event handlers must be configured to listen for changes in the blockchain or the connected endpoints and then correlate and invoke appropriate CEP rules to derive an action or alert.

- This statistic shows IT spending as a share of companies' revenue by industry worldwide in 2022. According to Flexera Software, software and tech hosting/cloud, and financial services companies spend much more on IT than other industries. The financial services industry invests around 10% of its revenue in IT.

North America Expected to Hold Major Market Share

- The adoption of the Internet of Things (IoT) and big data technology in various end-user verticals in North America is increasing significantly. Many organizations are generating and collecting large amounts of data from multiple sources to gain insights into customer operational efficiency, behavior, and fraud detection. In such applications, CEP is increasingly used to analyze this real-time data.

- The region has witnessed the early adoption of complex event-processing technologies. Several prominent regional vendors have developed complex event-processing solutions and demonstrated their benefits in various applications. This early adoption has created a favorable market environment, driving further growth and adoption.

- For instance, in July 2022, IBM expanded its business automation portfolio, including IBM Decision Manager Open Edition, the latest addition to its decision management capabilities consisting of the enterprise-grade Operational Decision Manager and low-code, next-generation Automation Decision Services. It offers Kogito-based cloud-native architecture, DMN1.4-compliant runtime, and complex event processing.

- In addition, the United States has been at the forefront of technological advancements in various industries for technology development. This environment fosters the growth and adoption of complex event-processing technologies.

Complex Event Processing (CEP) Industry Overview

The complex event processing market is semi-consolidated, with significant players such as IBM, Oracle, SAP, Software AG, and Tibco Software collectively accounting for a substantial market share. The players operating in the market have been investing in product launches, mergers and acquisitions, and collaboration activities to stay ahead of the competition.

In July 2022, IBM expanded its business automation portfolio, including IBM Decision Manager Open Edition, the latest addition to its decision management capabilities consisting of the enterprise-grade Operational Decision Manager and low-code, next-generation Automation Decision Services. It offers Kogito-based cloud-native architecture, DMN1.4-compliant runtime, and complex event processing.

In February 2022, thatDot, Inc., one of the leading companies in complex event stream processing software, released Quine. This unique approach combines graph data and streaming technologies into a modern, developer-friendly, open-source software package.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development in the Field of Machine Learning and Data Analytics

- 5.1.2 Growing Need for Real-time Analytics

- 5.2 Market Restraints

- 5.2.1 Lack of Consistency in Results

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Enterprise Type

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Managed Mobility

- 6.3.3 Government and Defense

- 6.3.4 Retail

- 6.3.5 Healthcare

- 6.3.6 Telecom and IT Industry

- 6.3.7 Media and Entertainment

- 6.3.8 Manufacturing

- 6.3.9 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 SAP SE

- 7.1.3 Oracle Corporation

- 7.1.4 Tibco Software Inc.

- 7.1.5 Software AG

- 7.1.6 SAS Institute Inc.

- 7.1.7 Informatica Corporation

- 7.1.8 Nastel Technologies Inc.

- 7.1.9 Espertech Inc.

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Red Lambda Inc.