|

市场调查报告书

商品编码

1432897

电缆固定头:市场占有率分析、产业趋势/统计、成长预测 (2024-2029)Cable Glands - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

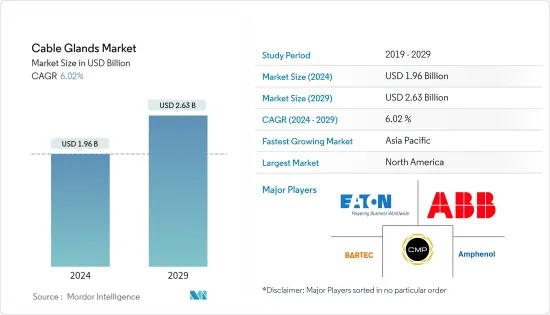

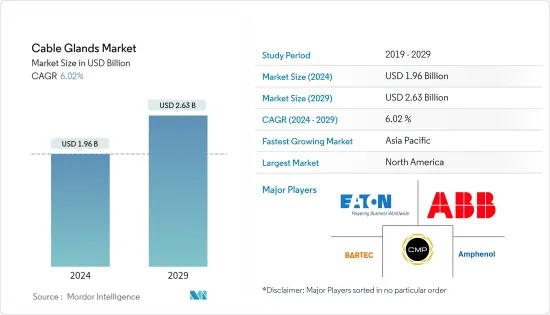

电缆固定头市场规模预计到 2024 年为 19.6 亿美元,预计到 2029 年将达到 26.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.02%。

COVID-19 的疫情为世界各地的製造商带来了各种供应链挑战,并对电缆固定头市场产生了类似的影响。

市场上经营的供应商面临原材料供应短缺、价格波动以及缺乏终端用户和创业投资的投资。例如,联合国贸易和发展会议(UNCTAD)估计,由于製造业下滑以及工厂关闭,新冠疫情已导致全球 FDI 萎缩 5-15%。

主要亮点

- 在过去的几十年里,电缆固定头已成为电缆管理系统的关键组件之一,并广泛应用于多个行业和危险环境。

- 电缆管理系统市场的成长是推动电缆固定头需求的关键驱动力。随着实体基础设施的成长,对合适的电缆管理解决方案的需求也在增长。另外,随着通讯领域的进步,电缆固定头也成为连接传输资料的电缆的必备组件。

- 全球建设活动的活性化也推动了市场的成长。为了改善经济状况,许多新兴国家正在大力投资基础建设。因此,公共和私人设施的建设和维修也推动了对安全电缆连接的需求,并带动了对电缆固定头的需求。

- 在汽车领域,电动车产量的增加和成长预计将提振市场。这些因素也推动了製造业和加工业对电缆固定头的需求。智慧电网的不断发展和石油和天然气行业的扩大探勘也为所研究的市场提供了巨大的成长机会。

电缆固定头市场趋势

航太领域占据主要市场占有率

- 电缆固定头在飞机和太空船中有着重要的应用,包括军事应用,因为它们被用于国防服务的飞机上的整个电气设备。电缆固定头可防止火灾蔓延、爆炸,并防止油、水和所有其他类型的液体进入面板室。

- 在航太设备中,它们用于密封地面支援应用和通讯系统中的阀门,与电气感测设备相比具有显着的优势。机械电缆组件、电线连接器和附件以及电缆固定头在飞行控制系统、机舱性能和安全性中发挥着至关重要的作用,并全面支持航太工业,无论是民用、商业还是军用设计。

- 例如,STEGO Elektrotechnik GmbH 的通风电缆固定头DAK 284 用于将电缆和电线引导到机柜和外壳。由于可以在外壳内进行压力补偿,因此可以最大限度地减少安装压力补偿装置的单独工作。

- 对有效利用资源和材料、最大限度地降低维护成本、防止太空船中存在灰尘和湿气、提高性能和安全系统的需求日益增长,是该领域采用电缆固定头的主要推动力。电缆固定头为那些配置为使用特定尺寸或电缆参数范围的设备提供更好的密封保护。

北美市场占据主导地位

- 对技术先进设备的需求创造了北美对电缆固定头的大量需求。北美是一个以技术为基础的地区,主要依赖建筑业、製造业以及石油和天然气产业。美国是电缆固定头(和其他电缆管理工具)的主要市场之一,预计将继续占据主导地位。

- 不断增长的消费者需求和技术创新,以及具有竞争力的劳动力和能够建造、安装和服务所有能源技术的供应链,使美国成为最具吸引力的市场之一。根据国际能源总署(IEA)预测,2019年全球对美国能源效率的投资总额将达2,500亿美元。

- 随着公众对环境的日益关注,许多人开始投资环保资源消耗。近年来,太阳能发电的引进呈现出较高的成长速度。美国政府也制定了财政奖励,使太阳能更容易获得。由于太阳能电缆固定头密封套的需求预计将增加。

- 人口成长将导致能源和基础设施需求增加,从而在预测期内推动该地区的建筑业发展。商业和住宅领域的强劲投资正在增加流入经济的现金流,并刺激该地区对电缆固定头的需求。加拿大资源丰富,电缆固定头市场蓬勃发展。

电缆固定头产业概述

由于全球各地存在许多供应商,电缆固定头市场的竞争形势呈现零碎化。供应商正在实现业务多元化,一些大型供应商在美国和欧洲国家运营,而较小的供应商则分散在世界各地。随着竞争的加剧,该公司正在努力推出新产品,以满足电缆固定头市场不断增长的需求。也进行策略併购以获得竞争优势。

- 2021 年 2 月 - CMP Products Ltd 已获得危险区域电缆固定头和配件的南非国家标准 (SANS) 60079 认证。该认证将使我们能够直接从约翰尼斯堡购买产品,预计将在南非和整个非洲大陆成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 升级并更新新兴经济体的现有网络

- 全球建筑业快速成长

- 市场限制因素

- 区域市场碎片化

- 原物料价格波动

- COVID-19 对市场的影响

第五章市场区隔

- 类型

- 适用于非危险区域的电缆固定头

- 适用于危险区域的电缆固定头

- 电缆类型

- 电缆固定头接头

- 非铠装电缆固定头

- 使用材料

- 黄铜

- 铝

- 塑胶

- 不銹钢

- 其他的

- 最终用户产业

- 航太

- 建造

- 製造/加工

- 油和气

- 电力/公共产业

- 其他(海洋、采矿、化工)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Amphenol Corporation

- Bartec Group

- CMP Products Limited

- Eaton Group(Cooper Crouse-Hinds Electric Company)

- ABB Ltd

- Cortem SPA

- Emerson Industrial Automation

- Elsewedy Electric

- Hubbell Incorporated

- Jacob Gmbh

- R.Stahl Ag

- Quanguan Electric

- Warom Technology Incorporated

- TE Connectivity Ltd

第七章 投资分析

第八章市场的未来

The Cable Glands Market size is estimated at USD 1.96 billion in 2024, and is expected to reach USD 2.63 billion by 2029, growing at a CAGR of 6.02% during the forecast period (2024-2029).

The outbreak of COVID-19 resulted in various supply chain challenges for manufacturers across the world, which had a similar impact on the cable glands market as well.

Vendors operating in the market were faced with shortages and price fluctuations in raw material supply and a shortage of investments from end-users and venture capitalists. For instance, according to the United Nations Conference on Trade and Development (UNCTAD) estimations, the pandemic caused a global FDI shrinking by 5-15% owing to the downfall in manufacturing coupled with factory shutdown.

Key Highlights

- Over the last few decades, cable glands have emerged as one of the primary components of cable management systems and are widely being used in several industrial and hazardous environments.

- The growth in the cable management systems market is a significant driver stimulating the need for cable glands. With the expansion of physical infrastructure, the demand for suitable cable management solutions is also rising. Also, with the advancement in the telecom sector, cable glands are also becoming a necessary component to connect the cables transferring data.

- The market growth is also fueled by growing construction activities, globally. To boost economic conditions, most of the emerging countries are investing hugely in infrastructure development. Hence, the construction and refurbishment of public and private installations have also propelled the need for secure cable connections, thus, driving the demand for cable glands.

- In the automotive sector, the growing number of vehicles that are being manufactured and the growth of electric vehicles are estimated to boost the market. These factors are also fueling the demand for cable glands in the manufacturing and process industries. The increasing development of smart grids and growing exploration in the oil and gas sector also offers a massive opportunity for the studied market to grow.

Cable Glands Market Trends

Aerospace Sector to Hold a Significant Market Share

- Cable glands find significant applications among aircraft and space vehicles, including military applications, as they are used across the electrical equipment in aircraft for defense services. Cable glands withstand fire propagation, explosion and protect against the entry of oil, water, or any other kind of liquids into the panel compartment.

- In aerospace equipment, these are substantially used for ground support applications and communication systems to seal the valves, thus providing a more significant advantage over electrical sensing devices. Mechanical cable assemblies, wire connectors, and fittings, along with cable glands, play a crucial role in flight control systems, cabin performance, and safety, supporting aerospace industries across the board regardless of civilian, commercial, or military design.

- For instance, the Ventilation Cable Gland DAK 284, by STEGO Elektrotechnik GmbH, is used to lead cables and wires into cabinets and enclosures. It allows for pressure compensation within the enclosure, thereby minimizing a separate work step to install pressure compensation devices.

- Factors such as the increasing need for better utilization of resources and materials, minimization of maintenance costs, protection from dust and moisture present in space vehicles, enhancing the performance, and safety systems are significantly driving the growth in the adoption of cable glands in this sector. Cable glands provide better sealing protection for those configured to operate with any specific size and range of cable parameters.

North America to Dominate the Market

- The demand for technologically advanced equipment is creating significant demand for cable glands in North America. North American is a technology-based region mainly relying on construction, manufacturing, and oil & natural gas industries. The United States is one of the significant markets for cable glands (and other cable management tools), and it is expected to continue its dominance.

- Increasing consumer demand and innovation, combined with a competing workforce and supply chain capable of building, installing, and servicing all energy technologies, make the United States one of the most attractive markets. According to the International Energy Agency, the United States has experienced a total Global investment in energy efficiency of USD 250 Billion in 2019.

- With the rising environmental concerns among the population, many individuals are investing in eco-friendly resource consumption. The adoption of solar power has seen a high growth rate over the last few years. The US government has also set financial incentives to make solar more accessible. As solar applications demand cables with maximum reliability to prevent costly downtime and disruption to the energy grid, the demand for cable glands is expected to rise over the forecast period.

- The rise in population has led to an increase in the demand for energy and infrastructure, thus propelling the region's construction industry during the forecasted years. Heavy investments in the commercial & residential sector have increased the cash flow into the economy, boosting the demand for the cable glands in the region. The Canadian market for cable glands is proliferating, owing to the abundant resources in the country.

Cable Glands Industry Overview

The competitive landscape of cable glands market is fragmented due to the presence of many vendors across the globe. The vendors have well-diversified businesses and several major vendors operate in the United States and European countries, whereas, the small vendors are scattered across the globe. With the increasing competition, companies are involved in introducing new products to leverage the increasing demand for the cable glands market. Companies are also involved in strategic mergers and acquisitions, to gain a competitive edge.

- February 2021 - CMP Products Ltd has achieved approval to South African National Standard (SANS) 60079 for its range of hazardous area cable glands and accessories. The accreditation will boost company's growth across South Africa and the wider African continent, providing choice and access to products directly from Johannesburg.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Upgrading and Renewal of Existing Networks in Developed Economies

- 4.3.2 Surge in Construction Industry Globally

- 4.4 Market Restraints

- 4.4.1 Fragmentation in the Regional Markets

- 4.4.2 Volatility in Raw Material Prices

- 4.5 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Non-Hazardous Area Cable Glands

- 5.1.2 Hazardous Area Cable Glands

- 5.2 Cable Type

- 5.2.1 Armored Cable Glands

- 5.2.2 Unarmored Cable Glands

- 5.3 Materials Used

- 5.3.1 Brass

- 5.3.2 Aluminium

- 5.3.3 Plastic

- 5.3.4 Stainless Steel

- 5.3.5 Other Material Types

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Construction

- 5.4.3 Manufacturing And Processing

- 5.4.4 Oil and Gas

- 5.4.5 Power and Utilities

- 5.4.6 Other End-user Industries (Marine, Mining, Chemicals)

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Amphenol Corporation

- 6.1.2 Bartec Group

- 6.1.3 CMP Products Limited

- 6.1.4 Eaton Group (Cooper Crouse-Hinds Electric Company)

- 6.1.5 ABB Ltd

- 6.1.6 Cortem SPA

- 6.1.7 Emerson Industrial Automation

- 6.1.8 Elsewedy Electric

- 6.1.9 Hubbell Incorporated

- 6.1.10 Jacob Gmbh

- 6.1.11 R.Stahl Ag

- 6.1.12 Quanguan Electric

- 6.1.13 Warom Technology Incorporated

- 6.1.14 TE Connectivity Ltd