|

市场调查报告书

商品编码

1640592

毫微微基地台:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Femtocells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

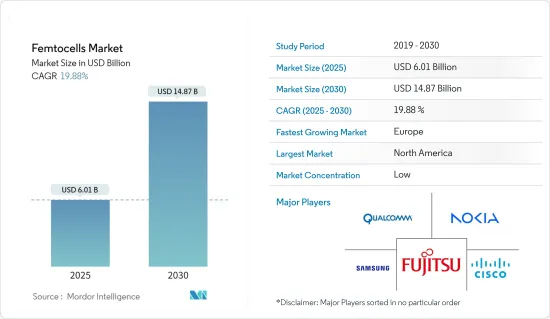

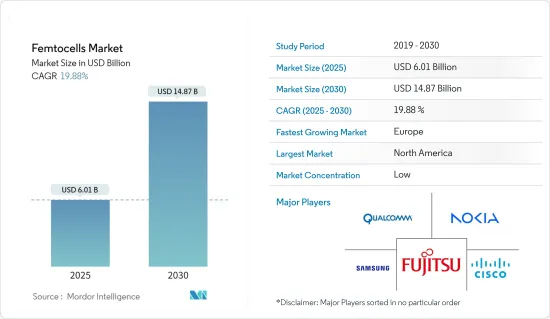

预计 2025 年毫微微基地台市场规模为 60.1 亿美元,到 2030 年将达到 148.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 19.88%。

毫微微基地台是一种为行动装置提供无线连接的蜂巢式基地台。在行动讯号较弱的地区可使用毫微微基地台。网路基地台可以更轻鬆地存取语音和资讯服务、可扩展部署、与大型基地台技术相容、降低传输功率、提高设备便携性和扩大覆盖范围,从而延长行动装置的电池寿命。

主要亮点

- 由于毫微微基地台技术的进步和毫微微基地台设备价格的下降,毫微微基地台市场正在不断增长。住宅领域对毫微微基地台的采用日益增多以及企业领域的需求不断增长正在推动市场的发展。

- 毫微微基地台市场的主要驱动力是功耗限制。与大型基地台网路相比,毫微微基地台的传输功率相对较小,因此毫微微基地台消耗的电量较少。毫微微基地台的功耗不到 7W,并且在每个范围内支援多个连接。

- 用于提供附加价值服务的智慧型手机应用程式的成长正在推动毫微微基地台市场的成长。行动电话、笔记型电脑和其他设备成本的下降正在推动市场需求。

- 由于毫微微基地台可协助企业满足大量网路流量需求,因此 COVID-19 疫情对毫微微基地台市场扩张产生了正面影响。过去一年,大多数网路和资料服务供应商都发现全球网路流量增加,这得益于新冠疫情以及製造业、电子商务、运输和物流等各行各业采用工业自动化。增加对物联网连接毫微微基地台的需求。

毫微微基地台市场趋势

商业领域可望大幅成长

- 不断增长的行动流量以及多租户建筑、酒店和办公大楼的网路增强需求正在推动商业领域毫微微基地台的成长。毫微微基地台具有低成本、灵活性等优势,进一步推动了市场成长。

- 物联网的出现正在重塑经营模式、价值链和产业结构,从而改变各行各业。根据今年 6 月的爱立信行动报告,宽频物联网(4G/5G)是去年连接所有蜂巢式物联网设备最大份额的技术。

- 工业 4.0 的日益普及以及企业拥抱 BYOD 等各种因素正在推动市场成长。市场驱动因素包括创新城市计划,鼓励供应商开发专注于智慧城市等应用的产品。

- 例如,恩智浦半导体公司最近宣布推出一款针对高频宽、低功耗基频应用的毫微微基地台解决方案。该解决方案针对LTE和WCDMA(HSPA+)进行了最佳化,并为创新城市发展提供了成本和功率最佳化。

- 毫微微基地台技术使通讯业者能够实现固定行动替代等优势,并有助于推动ARPU成长。毫微微基地台技术将提高室内环境和郊区等偏远地区的覆盖范围。

欧洲:预计成长显着

- 在欧洲,英国在科技和服务领域处于领先地位,GDP成长率达到1.6%。由于消费支出疲软以及英国脱欧谈判结果带来政治和经济不确定性,预计经济成长仍将保持温和。

- 英国市场以强大的技术和基础设施为基础,拥有像 Verizon 这样的市场领导。此外,该地区的行动和宽频领域竞争激烈。这是该国行动电话普及率高于欧洲平均的原因之一,且消费价格相对较低。

- 由于智慧型手机普及率不断提高(约 80%)、行动装置功能的不断进步以及 4G 技术在全部区域的推广,资料使用量依然强劲。预计未来几年英国近50%的家庭将实现智慧家庭。这一趋势表明,毫微微基地台的普及潜力巨大。

- 英国市场的成长预计将受到住宅和商业领域对无线网路的强劲需求、行动装置上强劲的资料使用以及智慧家居的日益普及的推动。

毫微微基地台行业概况

毫微微基地台市场十分分散。市场参与者引入了大量技术创新,并发生了各种併购事件。在这个市场中运营的市场参与者可以透过提供具有成本效益、一致性和扩充性的设备来获得竞争优势。

- 2023 年 6 月 - 一系列行业主要企业与台湾工业局 (IDB) 和台湾资讯产业策进会 (III) 合作,在 COMNEXT Tokyo 2023 上展示了创新的工业和企业 5G 连接解决方案。展会上,也就光宝科技等台湾、日本新一代通讯业动向进行了探讨。 LITEON RAN Solutions 提供全面的符合 5G/O-RAN SA 的产品系列。 LITEON FlexFi AIO 和 Femtocell 支援 n78/n79 sub-6G 频段,具有灵活、高效且经济高效的架构。

- 2022 年 11 月-思科透露在西班牙开设新一代半导体设备设计中心的计画。作为实现可靠、可扩展和永续的全球半导体供应链的全球策略的一部分,思科计划建立一个工程设计中心来创建和製作下一代半导体设备的原型。该计画将在西班牙微电子和半导体復苏和经济转型策略计划框架内进行。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 毫微微基地台站在 4G 和 5G 延续中发挥越来越重要的作用

- 对异质网路的需求

- 市场限制

- 各行业专业工程师短缺

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 技术简介

第六章 市场细分

- 按应用

- 商业的

- 住宅

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Nokia Corporation

- Samsung Electronics

- Cisco

- Qualcomm

- Airvana Inc.

- CommScope Inc.

- Fujitsu Ltd.

- ZTE Corporation

- Netgear Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Femtocells Market size is estimated at USD 6.01 billion in 2025, and is expected to reach USD 14.87 billion by 2030, at a CAGR of 19.88% during the forecast period (2025-2030).

Femtocells are cellular base stations providing wireless connectivity for mobile devices. Femtocells are used in areas with weak mobile signal. The access points facilitate feasible access to voice and data services, enabling a scalable deployment, compatibility with the macrocellular technology, reduced transmission power, device portability, and improved coverage that results in prolonged mobile battery life.

Key Highlights

- Femtocells market is growing due to advancements in femtocell technology and the low cost of femtocell devices. Increased adoption of femtocells in the residential segment and increasing demand from the enterprise segment augment the market.

- The primary driving factor for the femtocells market is limited power consumption. Femtocells consume less power as the transmission power of femtocells is comparatively less than macrocell networks. A femtocell consumes less than 7 W and support several connections in each range.

- Growth in the applications of smartphones for availing value-added services is propelling the growth of the femtocell market. Reductions in the cost of mobile phones, laptops, and other devices have increased the demand for the market.

- The COVID-19 pandemic has had a positive impact on the femtocell market's expansion as femtocell technologies assist businesses in meeting the high-capacity internet traffic demand. Most internet and data service providers noticed increased worldwide internet traffic over the past year related to the COVID-19 pandemic and the adoption of industrial automation across various industry verticals, including manufacturing, e-commerce, and transit and logistics, which is expected to increase demand for femtocells for Internet of Things connectivity.

Femtocell Market Trends

Commercial Segment Expected to Witness Significant Growth

- The increased mobile traffic and the need for more networks in multitenant buildings, hotels, or office towers are drivers of the growth of femtocell in the commercial segment. Benefits such as it can be cheaper and more flexible are further bolstering the market growth.

- The advent of IoT is transforming industries by reshaping business models, value chains, and industry configurations. Femtocells offers indoor coverage and satisfies the needs of smart devices, ensuring affordable connectivity throughout enterprises. according to Ericsson Mobility Report in June this year, broadband IoT (4G/5G) was the technology that connected the largest share of all cellular IoT devices last year.

- Rising Industry 4.0 adoption as well as business organizations promoting BYOD, various factors have been augmenting the market's growth. Significant market drivers include innovative city initiatives, encouraging vendors to develop products specific to applications such as smart cities.

- For instance, NXP Semiconductor recently introduced a femtocell solution that targets high-bandwidth, low-power baseband applications. The solution is optimized for LTE and WCDMA (HSPA+), offering optimized cost and power for innovative city development.

- Femtocell technology enables carriers to enjoy benefits, such as fixed mobile substitution, driving incremental ARPU. Femtocell technology raises the bar in indoor environments and remote areas, such as the suburbs.

Europe Expected to Witness Significant Growth

- In Europe, the United Kingdom is a front-runner in technology and services and recorded GDP growth of 1.6%. The economy is expected to be modest, owing to the subdued consumer expenditure and the political and economic uncertainty of the outcomes of Brexit negotiations.

- The UK segment is buoyed by the presence of robust technologies and infrastructure, owing to the presence of market leaders like Verizon. It is characterized by intense competition in the mobile and broadband sectors. This is one of the reasons why mobile penetration in the country is higher than the European average, supported by relatively low consumer prices.

- With the increasing smartphone penetration (which is around 80%), advancements in the capabilities of these mobile devices and the penetration of the 4G technology across the region have led to robust data usage. In the next few yaers, nearly 50% of UK households are expected to be smart homes. This trend indicates that there exists a significant potential for the adoption of femtocells.

- The growth of the UK segment is anticipated to be driven by the robust demand for wireless networks in the residential and commercial sectors, robust data usage on mobile devices, and the increasing adoption of smart homes.

Femtocell Industry Overview

The femtocells market is fragmented. The players in the market are bringing many innovations, and there are various mergers and acquisitions. The market players operating in this market can achieve a competitive advantage by providing cost-efficient, consistent, and scalable equipment.

- June 2023 - A series of industry-leading companies in partnership with the Industry Development Bureau (IDB) and the Institute for Information Industry (III), Taiwan, showcased their innovative industrial and enterprise 5G connectivity solutions at COMNEXT Tokyo 2023. The exhibition included LITE-ON Technology Corp., among others and a discussing regarding the next generation communication industry trends in Taiwan and Japan. LITEON RAN solution provides a comprehensive 5G/O-RAN SA compliant product portfolio. LITEON FlexFi AIO & Femtocell support sub-6G bands across n78/n79, using a flexible, high performance, and cost-effective architecture.

- November 2022 - Cisco revealed plans to open a next-generation semiconductor device design center in Spain. Cisco plans to establish an engineering design center to create and prototype next-generation semiconductor devices as part of its global strategy to enable a dependable, scalable, and sustainable global semiconductor supply chain. This will be done within the framework of the Spanish strategic project for the Recovery and Economic Transformation of Microelectronics and Semiconductors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Role of Femtocells in the Continuity of 4G and 5G

- 4.3.2 Demand for Heterogeneous Networks

- 4.4 Market Restraints

- 4.4.1 Lack of Skilled Professional Across Industries

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Commercial

- 6.1.2 Residential

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Samsung Electronics

- 7.1.3 Cisco

- 7.1.4 Qualcomm

- 7.1.5 Airvana Inc.

- 7.1.6 CommScope Inc.

- 7.1.7 Fujitsu Ltd.

- 7.1.8 ZTE Corporation

- 7.1.9 Netgear Inc.