|

市场调查报告书

商品编码

1850200

绿色资料中心:市场占有率分析、产业趋势、统计资料和成长预测(2025-2030 年)Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

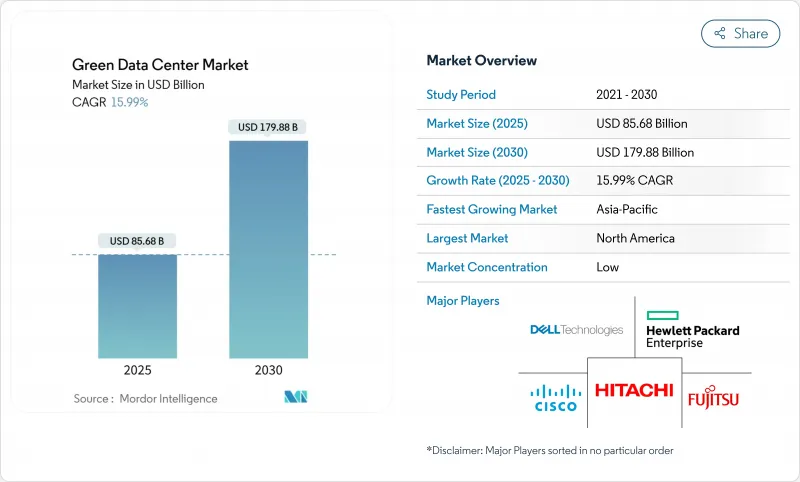

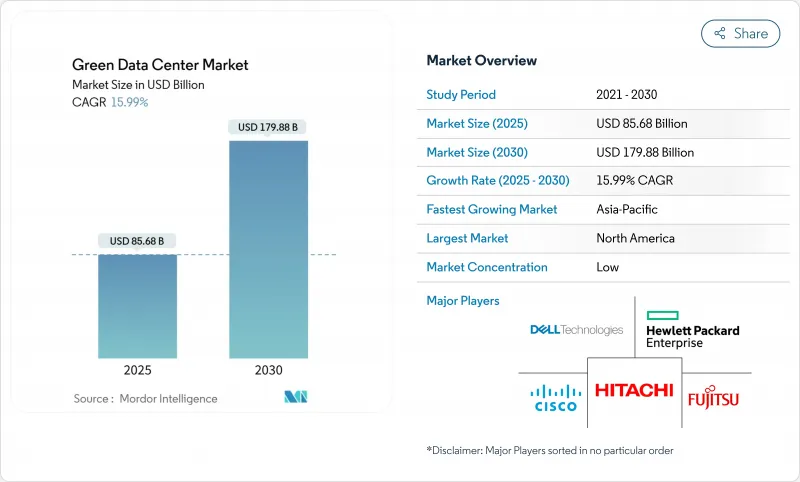

绿色资料中心市场预计到 2025 年将达到 856.8 亿美元,到 2030 年将达到 1,798.8 亿美元,复合年增长率为 15.99%。

为了应对不断上涨的电费并满足日益严格的ESG(环境、社会和治理)要求,营运商正在加快对再生能源购电协议、液冷晶片冷却和人工智慧能源管理软体的资本投入。超大规模云端服务供应商透过预先预留数吉瓦级可再生能源组合,并发布开放原始码液冷参考设计供託管服务供应商后续采用,从而影响技术标准。经合组织成员国的监管机构目前正将PUE(电源使用效率)≤1.3作为设施的基准,鼓励快速维修和新建项目采用整合余热回收和氢能发电系统的设计。基于位置的可再生能源信用额度溢价也提振了投资意愿,部分抵消了绿色建筑的前期投资溢价,而不断增长的人工智慧工作负载则支撑了对采用低全球暖化潜值(GWP)冷媒的高密度园区的需求。

全球绿色资料中心市场趋势与洞察

超大规模云端建设转向100%再生能源

绿色资料中心市场正受惠于超大规模营运商纷纷签约风能、太阳能和电池混合计划。亚马逊计画在2024年实现其营运100%使用可再生能源,微软承诺到2030年实现碳负排放,谷歌则将多余的再生能源投入市政区域供热计划,进一步实现余热货币化。这些策略有助于营运商确保稳定的电价,透过出售可再生能源证书来获得对冲收益,并为託管机房业主建立采购范本。

推动所有经合组织经济体制定要求PUE≤1.3的法规

欧盟新指令和美国更新的能源法规要求透明地报告电源使用效率 (PUE)、用水效率和碳排放强度。德国的《能源效率法》强制要求揭露冷却效率。同时,AWS 报告称,其 2024 年全球 PUE 为 1.15,证明透过将基于人工智慧的工作负载调度与液冷相结合,可以实现合规。儘早维修的营运商可以透过降低风扇能耗和增加机械冗余来节省成本,从而在续约託管合约时更具竞争力。违规的处罚逐年增加,促使人们采用节能设备。

与棕地维修相比,初始投资溢价为 30-40%。

高性能隔热材料、与浸没式冷却机架相容的结构化布线以及现场太阳能发电和储能係统,与传统机房相比,会使建造成本增加高达 40%。即使到了 2025 年,低碳混凝土和相变保温墙等建筑材料的供应仍然有限,这为绿色资料中心市场的发展带来了进度风险。小型业者通常更注重逐步提高效率的维修,而不是全面采用绿色建筑,这导致整体容量成长放缓,直到组件价格恢復正常。

细分市场分析

2024年,解决方案将占总营收的63.2%,巩固绿色资料中心市场在资本密集度的主导。随着营运商优先考虑电源调节器、热回收冷却器和人工智慧驱动的资料中心基础设施管理(DCIM)软体以满足能源效率要求,液冷产品线实现了两位数的销售成长。服务业务虽然绝对值较小,但预计将以15.7%的复合年增长率成长,因为设施业主需要聘请专家进行生命週期永续性审核、人工智慧主导的工作负载编配、ESG报告等服务。

电力系统升级,包括采用效率高达98%的UPS模组和智慧电网接口,提高了系统的韧性并降低了营运成本。冷却解决方案也从高位空气处理机组转向后门式热交换器结合热水循环系统。在服务方面,整合合作伙伴现在提供碳计量会计仪錶板和可再生能源证书交易平台等服务。这种永续性管理的专业化标誌着绿色资料中心产业的结构性改进。

随着企业持续推动外包策略,託管公司在2024年将占到总支出的37.2%,但超大规模资料中心将以16.5%的复合年增长率超越此领域,从而扩大自有容量绿色资料中心的整体市场规模。数十亿美元的可再生能源购电协议(PPA)和客製化的浸没式系统推动了技术普及,并正逐步渗透到零售託管套件中。

企业营运商表现强劲,透过货柜式模组和模组化电池储能係统对棕地设施进行改造,以满足董事会层面的排放目标。边缘微型设施虽然仍处于起步阶段,但已采用被动式冷却和太阳能UPS来支援5G行动通信基地台的处理。云端服务巨头的采购能力正在拉低组件供应商的成本,间接降低了二线供应商的进入门槛。

绿色资料中心市场按组件(服务、解决方案)、资料中心类型(託管服务提供者、超大规模资料中心业者/云端服务供应商、企业级资料中心、边缘资料中心)、层级(一级和二级、三级、四级)、垂直行业(医疗保健、银行、金融服务和保险、政府等)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区凭藉可靠的可再生能源、强有力的税收优惠以及集中在维吉尼亚、奥勒冈州和德克萨斯州的超大规模数据中心活动,将在 2024 年占全球收入的 26.5%。各州监管机构正在实施细緻的 ESG 资讯揭露,鼓励儘早采用基于人工智慧的能源管理,使该地区的绿色资料中心市场在技术成熟度方面处于领先。

在亚太地区,日本的碳中和资料中心计画、印度的资料主权政策以及澳洲的可再生能源区将刺激新建资料中心,到 2030 年的复合年增长率将达到 23.4%。东南亚的电网瓶颈正在推动透过专用线路进行太阳能和电池交易,互联升级将显着提高该地区的效率。

欧洲凭藉《气候中和资料中心营运商协议》等统一政策,在绿色资料中心领域保持核心地位。北欧资料中心利用近乎免费的冷却技术和丰富的水力资源,将余热输送至市政电网,从而将有效PUE值降低至1.1。太阳能混合计划在南欧加速发展,而德国法兰克福的企业购电协议(PPA)正在推动多重云端架构的普及。区域政策的一致性将维持绿色资料中心市场的投资动能。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 超大规模云端建设转向100%再生能源

- 推动制定法规,使经合组织国家的PUE值达到1.3或更低。

- 10兆瓦以上校园现场氢燃料电池试点计画(2025-2028年)

- 人工智慧工作负载在区域供热网路中的余热再利用

- 将基于位置的可再生能源信用额度货币化

- 液冷承包生态系与伺服器OEM联盟

- 市场限制

- 初始资本支出溢价(30-40%)和棕地维修

- 新兴经济体绿色电网容量短缺

- 城市中心附近缺乏再生水权益

- 低全球暖化潜势冷媒(R-718、R-1234yf)供应链不稳定

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 评估市场中的宏观经济因素

第五章 市场规模与成长预测

- 按组件

- 透过服务

- 系统整合

- 监控服务

- 专业服务

- 其他服务

- 透过解决方案

- 电力

- 冷却

- 伺服器

- 网路装置

- 管理软体

- 其他解决方案

- 透过服务

- 依资料中心类型

- 託管服务提供者

- 超大规模资料中心业者/云端服务供应商

- 企业和边缘运算

- 依层级类型

- 一级和二级

- 三级

- 第四级

- 按行业

- 卫生保健

- BFSI

- 政府

- 通讯/IT

- 製造业

- 媒体与娱乐

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Fujitsu Ltd

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- Dell Technologies Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Communications Corp.

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Huawei Technologies Co. Ltd

- Rittal GmbH and Co. KG

- Siemens AG

- Vapor IO Inc.

- Iron Mountain Inc.

- QTS Realty Trust Inc.

- Keppel Data Centres

第七章 市场机会与未来展望

The green data center market stood at USD 85.68 billion in 2025 and is on track to reach USD 179.88 billion by 2030, reflecting a 15.99% CAGR.

Operators are accelerating capital deployment into renewable power purchase agreements, liquid-to-chip cooling, and AI-enabled energy-management software to curb escalating electricity costs while meeting tightening ESG mandates. Hyperscale cloud providers influence technology standards by pre-booking multi-gigawatt renewable portfolios and publishing open-source liquid-cooling reference designs that colocation players later adopt. Regulatory bodies in OECD economies now benchmark facilities to a <=1.3 PUE, prompting rapid retrofits and new-build designs that integrate waste-heat reuse and hydrogen-ready power systems. Investment appetite also benefits from premium pricing of location-based renewable-energy credits, which offsets a portion of up-front capital premiums for green builds, while AI workload growth sustains demand for high-density campuses equipped with low-GWP refrigerants.

Global Green Data Center Market Trends and Insights

Hyperscale Cloud Build-outs Shifting to 100% Renewable Power

The green data center market is benefiting from hyperscale operators that now contract for wind, solar, and battery-hybrid projects sized well beyond their direct consumption. Amazon achieved company-wide 100% renewable energy in 2024, Microsoft has pledged carbon-negative operations by 2030, and Google channels surplus renewable power into municipal district-heating projects that further monetise waste heat. These strategies help operators lock in price-stable electricity, create hedging income through renewable-energy credit sales, and establish procurement templates that colocation landlords subsequently follow

Regulatory Push for PUE <= 1.3 Across OECD Economies

New directives in the EU and updated U.S. energy codes require transparent reporting of PUE, water-usage effectiveness, and carbon intensity. Germany's Energy Efficiency Act mandates cooling-efficiency disclosures, while AWS reported a global PUE of 1.15 in 2024, proving compliance is feasible when AI-based workload scheduling and liquid cooling are combined. Operators that retrofit early capture cost savings from lower fan energy and reduced mechanical redundancy, improving competitiveness during colocation contract renewals. Penalties for non-compliance increase each fiscal year, creating a near-term rush to commission energy-efficient equipment.

Up-front CAPEX Premium (30-40%) Versus Brownfield Retrofits

High-performance insulation, structured cabling rated for immersion-cooled racks, and on-site solar plus storage systems inflate build costs by as much as 40% relative to conventional shells. Construction inputs such as low-carbon concrete and phase-change thermal walls remain supply-constrained in 2025, adding schedule risk to green data center market deployments. Smaller operators often pivot to incremental efficiency retrofits instead of full green builds, slowing overall capacity additions until component prices normalise.

Other drivers and restraints analyzed in the detailed report include:

- On-site Hydrogen Fuel-Cell Pilots in Greater than 10 MW Campuses (2025-2028)

- AI-workload Waste-Heat Reuse for District Heating Networks

- Limited Green-Power Grid Capacity in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 63.2% of 2024 revenue, underpinning the green data center market size leadership in capital intensity. Operators prioritised power-conditioning gear, heat-recovery chillers, and artificial-intelligence DCIM software to satisfy efficiency mandates, while liquid-to-chip cooling lines experienced double-digit unit shipment growth. Services, though smaller in absolute value, are forecast for 15.7% CAGR as facility owners engage specialists for lifecycle sustainability audits, AI-driven workload orchestration, and ESG reporting.

Power-train upgrades, including 98%-efficient UPS modules and smart grid interfaces, strengthened resilience and trimmed operating costs. Cooling solutions shifted from raised-floor air handlers to rear-door heat exchangers coupled with warm-water loops. On the services side, integration partners now bundle carbon accounting dashboards and renewable-certificate trading platforms. This professionalisation of sustainability management marks a structural uplift in the green data center industry.

Colocation firms held 37.2% of 2024 spending as enterprises continued outsourcing strategies, yet hyperscalers outpaced the field with a 16.5% CAGR, enlarging the overall green data center market size for self-owned capacity. Their billion-dollar renewable PPAs and custom-designed immersion systems set technology adoption curves that trickle down into retail colocation suites.

Enterprise operators remained steady, refreshing brownfield assets with containment pods and modular battery storage to meet board-level emissions targets. Edge micro-facilities, though nascent, adopted passive cooling and solar-powered UPS to support 5G cell-site processing. The procurement heft of cloud majors keeps component suppliers' cost curves descending, indirectly lowering barriers for second-tier providers.

Green Data Center Market is Segmented by Component (Service, Solution), Data Center Type (Colocation Providers, Hyperscalers/Cloud Service Providers, Enterprise, and Edge), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Industry Vertical (Healthcare, BFSI, Government and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 26.5% revenue in 2024, buttressed by reliable renewable generation, robust tax incentives, and hyperscale activity clustering around Virginia, Oregon, and Texas. State regulators impose granular ESG disclosures, prompting early adoption of AI-based energy management that pushes the regional green data center market ahead in technology maturity.

Asia Pacific is forecast for a 23.4% CAGR through 2030 as Japan's carbon-neutral data center initiative, India's data-sovereignty policy, and Australia's renewable energy zones catalyse new builds. Grid bottlenecks in Southeast Asia have spurred private-wire solar plus battery deals, positioning the region for leap-frog efficiency gains once interconnect upgrades materialise.

Europe maintains a central role through unified policy such as the Climate Neutral Data Centre Operator Pact. Nordic campuses leverage near-free cooling and ample hydropower, exporting heat into municipal networks and thereby lowering effective PUE to 1.1. Southern Europe accelerates solar-hybrid projects, and Germany's corporate PPAs fuel multicloud adoption in Frankfurt. Collectively, regional policy coherence sustains investment momentum within the green data center market

- Fujitsu Ltd

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- Dell Technologies Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Holdings Co

- Equinix Inc.

- Digital Realty Trust Inc.

- NTT Communications Corp.

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Huawei Technologies Co. Ltd

- Rittal GmbH and Co. KG

- Siemens AG

- Vapor IO Inc.

- Iron Mountain Inc.

- QTS Realty Trust Inc.

- Keppel Data Centres

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hyperscale cloud build-outs shifting to 100 % renewable power

- 4.2.2 Regulatory push for PUE Less than or Equal to 1.3 across OECD economies

- 4.2.3 On-site hydrogen fuel-cell pilots in Greater Than 10 MW campuses (2025-2028)

- 4.2.4 AI-workload waste-heat reuse for district heating networks

- 4.2.5 Location-based renewable-energy credits monetization

- 4.2.6 Liquid-cooling turnkey ecosystems from server-OEM alliances

- 4.3 Market Restraints

- 4.3.1 Up-front CAPEX premium (30-40 %) versus brownfield retrofits

- 4.3.2 Limited green-power grid capacity in emerging economies

- 4.3.3 Scarcity of recycled-water rights near urban cores

- 4.3.4 Supply-chain volatility for low-GWP refrigerants (R-718, R-1234yf)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 By Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 By Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 By Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 BFSI

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia_Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Fujitsu Ltd

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Hewlett Packard Enterprise Co.

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Hitachi Ltd

- 6.4.6 Schneider Electric SE

- 6.4.7 IBM Corporation

- 6.4.8 Eaton Corporation

- 6.4.9 Vertiv Holdings Co

- 6.4.10 Equinix Inc.

- 6.4.11 Digital Realty Trust Inc.

- 6.4.12 NTT Communications Corp.

- 6.4.13 Amazon Web Services Inc.

- 6.4.14 Microsoft Corp.

- 6.4.15 Google LLC

- 6.4.16 Huawei Technologies Co. Ltd

- 6.4.17 Rittal GmbH and Co. KG

- 6.4.18 Siemens AG

- 6.4.19 Vapor IO Inc.

- 6.4.20 Iron Mountain Inc.

- 6.4.21 QTS Realty Trust Inc.

- 6.4.22 Keppel Data Centres

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment