|

市场调查报告书

商品编码

1432916

云端加密 -市场占有率分析、产业趋势/统计、成长预测(2024-2029)Cloud Encryption - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

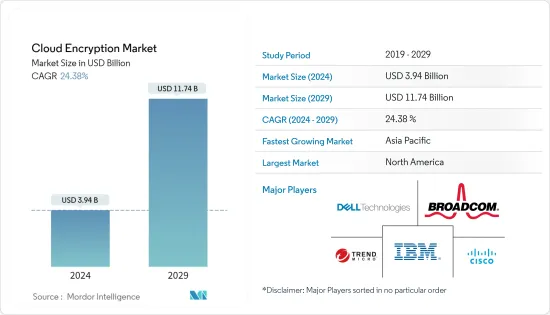

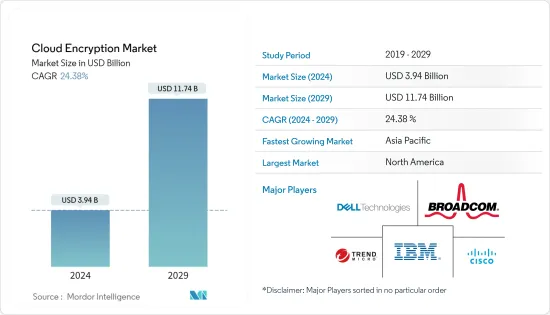

预计到 2024 年,云端加密市场规模将达到 39.4 亿美元,预计到 2029 年将达到 117.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 24.38%。

主要亮点

- 云端运算可以透过对大量资料进行整理、分离、处理和分析来提高公司的运算和分析能力。

- 云端普及和虚拟的激增,以及为提高云端加密解决方案采用率而引入的严格法规,正在推动全球市场的成长。

- 在过去的十年中,资料外洩急剧增加,产生了对云端加密的需求。网路攻击和恶意软体等其他动态进一步推动了云端加密市场的成长。

- 有几个因素可能会阻碍云端加密的采用,包括高级云端服务的成本。然而,值得注意的是,云端加密还可以提供显着的好处,例如提高安全性和遵守法规要求。

- 由于远距工作和业务数位化程度的提高,COVID-19 大流行显着增加了云端服务的采用。因此,随着企业希望保护储存在云端的敏感资料的安全,对云端加密的需求也随之增加。即使在大流行之后,随着组织继续采用云端,市场仍在快速成长。

云端加密市场趋势

云端采用率的提高和物联网的成长预计将推动市场成长

- 所有主要行业日益加强的技术整合正在对云端加密市场产生积极影响。云端服务呈现高普及,物联网系统的需求也不断增加。这种成长正在推动对云端加密系统的需求。

- 物联网连接设备的增加预计将推动市场成长。正如思科年度网际网路报告预测,到 2023 年,连网装置和连线的数量将从 2018 年的 184 亿增加到约 300 亿。到 2023 年,物联网设备预计将占所有连网装置的 50%(147 亿),高于 2018 年的 33%(61 亿)。

- 随着购买、管理和维护内部储存设备的成本显着下降,云端储存的使用不断增长。由于对技术的高度依赖,网路攻击呈指数级增长,企业开始投资加密技术。

- 各领域采用连网型设备的不断成长趋势也对所研究的市场产生了正面影响。爱立信表示,大规模物联网连接数量预计将翻一番,达到近2亿人。据爱立信称,到年终,40% 的蜂巢式物联网连接将是宽频物联网,其中大部分由 4G 连接。

- 此外,用户越来越意识到威胁并要求更好、更安全的服务。所有这些因素都在推动云端加密软体市场的成长。已开发国家国防和医疗保健等产业越来越多地采用SaaS也是推动云端加密市场成长的关键因素。

- 此外,IT系统复杂性的增加以及通讯、银行和IT产业对云端加密安全的认识和使用的增加也是预期推动云端加密市场成长的因素。

预计北美将占据较大市场占有率

- 美国和加拿大是新兴经济体,在研发方面投入大量资金。各行业重点领域的数位化程度不断提高、技术不断进步以及智慧连网型设备的日益普及,都促进了北美云端加密市场的成长。连网型设备和相关网路基础设施的使用不断增加,以及网路、硬体和软体供应商之间的协作不断加强,是推动北美物联网市场扩张的关键因素。

- 快速的 5G 连接将促进该国的敏捷运作。该技术预计将促进网路化物流、自动化仓储、自动化组装、包装、产品处理,并实现自动购物车的使用。

- 该地区各国政府也发起了公共宣传宣传活动,教育个人和组织了解加密的重要性以及不使用加密所带来的风险。这可能会增加对加密解决方案的需求并加速其采用。

- 《联邦资讯安全现代化法案》(FISMA) 是影响美国云端加密的重要立法。 FISMA 要求联邦机构实施安全控制来保护资讯和资讯系统,包括对云端中的敏感资料进行加密。

- 总体而言,云端加密是美国云端安全的重要组成部分,并受到各种法律、法规和行业标准的约束。在云端中储存敏感资料的组织正在推动市场成长。

云端加密产业概况

云端加密市场高度分散,主要参与者包括 IBM Corporation、Trend Micro Inc.、Dell Technologies Inc.、Broadcom Inc.(Symantec Corporation)和 Google LLC。市场参与者正在采取联盟、创新、併购和收购等策略来增强产品供应并获得永续的竞争优势。

2022 年 10 月,Vaultree 宣布推出 Google AlloyDB 的使用中资料加密预览版。作为 Google AlloyDB 的启动合作伙伴,该服务将 Vaultree 世界一流的使用中加密解决方案与 Google AlloyDB for PostgreSQL 结合。用户可在云端测试Vaultree的同态搜寻云端搜寻技术,并推进加密标准以实现下一代加密和资料安全。

2022 年 6 月,思科推出了新的 Talos Intel On-Demand 服务。它提供针对每个组织特定威胁情势的客製化研究。为了帮助事件侦测和回应,思科对思科安全云端分析进行了更改,包括立即将警报升级到 SecureX 并将这些警报映射到 MITRE ATT&CK。在此之前,SecureX 设备洞察已全面上市,可收集、关联和标准化有关环境中设备的资料,并整合 Kenna 和 Secure Endpoint 以改善漏洞优先顺序。思科也发布了专为混合使用而设计的安全防火墙 3100 系列。该系列采用新的加密视觉化引擎,使用人工智慧和机器学习来侦测隐藏的威胁。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 云端采用率的提高和物联网的成长

- 云端环境面临的威胁日益增加

- 法规增加云端加密解决方案的采用

- 市场限制因素

- 采用优质云端服务需要巨额投资

第六章市场区隔

- 按最终用户产业

- 零售

- 政府机关

- 能源/电力

- 按服务模式

- Infrastructure-as-a-Service

- Platform-as-a-Service

- Software-as-a-Service

- 按公司规模

- 大公司

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 澳洲

- 新加坡

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Trend Micro Inc.

- Dell Technologies Inc.

- Broadcom Inc.(Symantec Corporation)

- Google LLC

- Cisco Systems Inc.

- Sophos Group PLC

- Hewlett Packard Enterprise Company

- Skyhigh Networks Inc.(McAfee Inc.)

- CipherCloud

第八章投资分析

第九章 市场机会及未来趋势

The Cloud Encryption Market size is estimated at USD 3.94 billion in 2024, and is expected to reach USD 11.74 billion by 2029, growing at a CAGR of 24.38% during the forecast period (2024-2029).

Key Highlights

- Cloud computing can improve an enterprise's computing and analytics capabilities by enabling it to collate, segregate, process, and analyze significant volumes of data.

- The proliferation of cloud adoption and virtualization and the introduction of stringent regulations to increase the adoption rate of cloud encryption solutions fuel global market growth.

- In the last decade, data breaches increased dramatically, resulting in the need for cloud encryption. Other dynamics, like cyberattacks and malicious software, further drive the growth of the cloud encryption market.

- Several factors can restrain the adoption of cloud encryption, including the cost of premium cloud services. However, it is important to note that cloud encryption can also provide significant benefits, such as increased security and compliance with regulatory requirements.

- The COVID-19 pandemic led to a significant increase in the adoption of cloud services due to remote work and increased digitization of businesses. As a result, the demand for cloud encryption also increased as companies looked to secure their sensitive data stored in the cloud. Post-pandemic also, the market is growing rapidly with the increased cloud adoption in various organizations.

Cloud Encryption Market Trends

Increase in Cloud Adoption and Growth of IoT is Expected to Drive the Market Growth

- The increased integration of technology across all major industries has positively impacted the cloud encryption market. Cloud services are experiencing high adoption, and the demand for IoT systems is rising. This rise is driving the demand for cloud encryption systems.

- The increase in IoT-connected devices is expected to drive market growth. By 2023, there will be approximately 30 billion network-connected devices and connections, up from 18.4 billion in 2018, as Cisco's Annual Internet Report predicted. By 2023, IoT devices are projected to make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018.

- The usage of cloud storage has grown as the cost of purchasing, administering, and maintaining in-house storage equipment has decreased significantly. Because of the reliance on technology, cyber-attacks have increased exponentially, and businesses have begun to invest in encryption technologies.

- The growing trend of adopting connected devices in various sectors positively influences the market studied. According to Ericsson, the number of massive IoT connections is expected to have doubled, reaching nearly 200 million. According to Ericsson, by the end of 2027, 40% of cellular IoT connections will likely be broadband IoT, with 4G connecting most of them.

- Additionally, users are becoming aware of the threats and looking for better, more secure services. All these factors are driving the cloud encryption software market growth. The increasing adoption of SaaS in developed countries by industries such as defense and healthcare is a crucial factor driving the growth of the cloud encryption market.

- Moreover, the increasing complexity of IT systems and the rising awareness and use of cloud encryption security by the telecom, banking, and IT industries, are other factors expected to boost the growth of the cloud encryption market.

North America is Expected to Hold Significant Market Share

- The United States and Canada have developed economies that enable them to invest heavily in R&D. Rising digitization throughout the industrial emphasis areas, steady technological advancements, and rising penetration of smart connected devices have all contributed to the growth of the North American cloud encryption market. The increased usage of connected devices and associated network infrastructure, as well as the increased collaboration of network, hardware, and software providers, are the primary drivers that assist in expanding the IoT market in the North American region.

- Rapid 5G connectivity facilitates the country's agile operations. The technology is anticipated to render networked logistics, automated warehouses, automated assembly, packing, and product handling easier and make the usage of autonomous carts possible.

- The government in this region is also launching public awareness campaigns to educate individuals and organizations about the importance of encryption and the risks associated with not using encryption. This can increase demand for encryption solutions and encourage their adoption.

- The Federal Information Security Modernization Act (FISMA) is an important law affecting cloud encryption in the United States. FISMA requires federal agencies to implement security controls to protect their information and information systems, including encrypting sensitive data in the cloud.

- Overall, cloud encryption is an important component of cloud security in the United States and is subjected to various laws, regulations, and industrial standards. Organizations that store sensitive data in the cloud drive market growth.

Cloud Encryption Industry Overview

The Cloud Encryption Market is highly fragmented, with the presence of major players like IBM Corporation, Trend Micro Inc., Dell Technologies Inc., Broadcom Inc. (Symantec Corporation), and Google LLC. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In October 2022, Vaultree announced the availability of its Data-in-Use Encryption for Google's AlloyDB, which is available for a preview trial. The service, a launch partner for Google's AlloyDB, combines the global functioning Encryption-in-Use solution powered by Vaultree with Google's AlloyDB for PostgreSQL. Users may now test Vaultree's homomorphic and searchable cloud encryption technology homomorphic and searchable encryption technology on the cloud, indicating an advancement in encryption standards that will allow next-generation encryption and data security.

In June 2022, Cisco launched a new Talos Intel On-Demand service, which provides tailored research on the threat landscape specific to each organization. Cisco introduced Cisco Secure Cloud Analytics changes to assist incident detection and response, including instantly elevating alarms into SecureX and mapping those warnings to MITRE ATT&CK. This came on the heels of the public release of SecureX device insights to collect, correlate, and normalize data about the devices in their environment and the Kenna and Secure Endpoint integrations to prioritize vulnerabilities better. Cisco also announced the Secure Firewall 3100 Series, intended for hybrid usage, and features a new encrypted visibility engine that detects hidden threats using artificial intelligence and machine learning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Cloud Adoption and Growth of IoT

- 5.1.2 Increasing Threats to Cloud Environments

- 5.1.3 Regulations to Increase the Adoption of Cloud Encryption Solutions

- 5.2 Market Restraints

- 5.2.1 Huge Investment Required for the Adoption of the Premium Cloud Service

6 MARKET SEGMENTATION

- 6.1 By End User Industry

- 6.1.1 Retail

- 6.1.2 Government

- 6.1.3 Energy and Power

- 6.2 By Service Model

- 6.2.1 Infrastructure-as-a-Service

- 6.2.2 Platform-as-a-Service

- 6.2.3 Software-as-a-Service

- 6.3 By Size of Enterprise

- 6.3.1 Large Enterprise

- 6.3.2 Small and Medium Size Enterprises

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Australia

- 6.4.3.3 Singapore

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Trend Micro Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Broadcom Inc. (Symantec Corporation)

- 7.1.5 Google LLC

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Sophos Group PLC

- 7.1.8 Hewlett Packard Enterprise Company

- 7.1.9 Skyhigh Networks Inc. (McAfee Inc.)

- 7.1.10 CipherCloud