|

市场调查报告书

商品编码

1432927

油田服务 (OFS) -市场占有率分析、行业趋势和统计数据、成长预测(2024-2029)Oilfield Services (OFS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

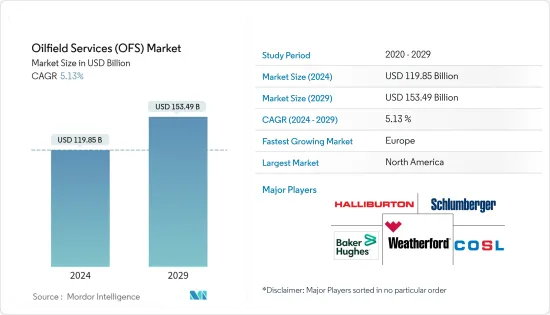

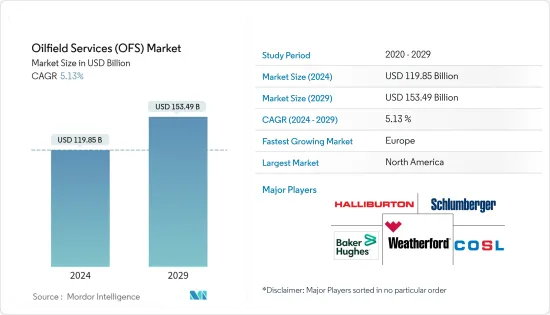

油田服务市场规模预计到2024年为1,198.5亿美元,预计到2029年将达到1,534.9亿美元,在预测期内(2024-2029年)复合年增长率为5.13%。

主要亮点

- 从中期来看,天然气蕴藏量的开拓以及先进技术、工具和设备等因素预计将在预测期内推动油田服务市场的发展。

- 另一方面,近期受供需缺口、地缘政治等因素影响,油价大幅波动,限製油田服务市场需求成长。

- 也就是说,对优化碳氢化合物生产成本的新技术和製程的关注预计将在预测期内为油田服务(OFS)市场创造一些机会。

- 由于页岩油田的大量钻探和生产活动,预计北美将成为预测期内最大的市场。预计北美将在预测期内主导市场。

油田服务 (OFS) 市场趋势

钻井服务预计将主导市场

- 预计全球经济将支持石油需求的大幅成长。强劲的经济体预计将消耗更多的石油,并且需求预计将在未来几年显着增长。预计到 2023 年,印度和中国将占全球石油需求的 50% 左右。

- 根据石油输出国组织(OPEC)统计,2022年全球原油需求约9,957万桶/日,高于2021年的9,708万桶/日。原油需求的成长将增加全球钻井服务的需求。

- 因此,石油和天然气公司面临越来越大的压力,需要增加产量以满足不断增长的能源需求。因此,随着传统型油田开始显示出成熟的迹象,一些营运公司正在将重点转向开发传统型蕴藏量。

- 例如,2022年2月,阿布达比国家石油公司(ADNOC)与四家油田服务供应商签署了价值19.4亿美元的框架协议,以扩大钻探规模。该协议建立在ADNOC最近对钻井相关设备和服务的投资基础上,旨在2030年将原油产能提高到500万桶/日(mmbpd)。

- 此外,新的海上钻井承包服务预计将推动油田服务市场。例如,2022年5月,Equinor与三大油田服务公司(Baker Hughes Norge、Halliburton和Schlumberger)签署了挪威大陆棚(NCS)综合钻井和油井服务合约。合约期限自2022年6月1日起两年。合约总价值约18亿美元。

- 钻井和测井工具的技术进步预计也将促进预测期内的钻井服务。例如,2022年11月,国家能源服务联合公司(NESR)宣布,该公司获得了科威特定向钻井服务的长期合约。合约范围包括五年的定向钻井、随钻测量、性能钻井、油井工程和随钻测井(LWD)服务,并可选择额外延长一年。

- 因此,鑑于上述几点,预计钻井服务将在预测期内主导油田服务(OFS)市场。

预计北美将主导市场

- 由于美国、加拿大和墨西哥等国家的存在,北美在世界原油产量中所占的份额很高。美国平均原油产量约为每天1,190万桶,该地区原油产量大幅增加。与2021年相比,该国原油产量增加5.6%。

- 在北美,由于效率的提高和供应链的加强,石油和天然气计划变得更具竞争力,从而降低了钻井成本并提高了计划的可行性。

- 美国是该地区最大的油田服务市场之一,这主要是由于页岩蕴藏量中钻探和水力碾碎的油井数量不断增加以及储量紧张。这主要是由于页岩地层和蕴藏量紧张的钻井和水力碾碎井数量不断增加。页岩地层、水平钻井和水力压裂的最新发展显着增加了该地区油田服务的需求。

- 同样,加拿大拥有仅次于委内瑞拉和沙乌地阿拉伯的世界第三大石油蕴藏量,其中96%是油砂蕴藏量。加拿大可开采的原油密度大,含有许多沙粒。因此,将石油从井底输送到地面需要高压和油井干预,从而增加了该国对油田服务的需求。

- 因此,鑑于上述几点,预计北美在预测期内将主导油田服务(OFS)市场。

油田服务 (OFS) 产业概览

油田服务市场分散。该市场的主要企业包括(排名不分先后)斯伦贝谢有限公司、贝克休斯公司、哈里伯顿公司、威德福国际公司和中海油田服务有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 2028 年石油和天然气产量及预测

- 到 2022 年运作的陆上和海上钻井平台数量

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 增加天然气蕴藏量和开发先进技术、工具和设备

- 全球油田服务投资增加

- 抑制因素

- 近期原油价格因供需缺口而波动

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 服务类型

- 钻井服务

- 竣工服务

- 生产/干预服务

- 其他服务

- 地点

- 陆上

- 离岸

- 区域市场分析:2028年之前的市场规模与需求预测(按区域)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schlumberger Limited

- Weatherford International plc

- Baker Hughes Company

- Halliburton Company

- Transocean Ltd.

- Valaris PLC

- China Oilfield Services Limited

- Nabors Industries, Inc.

- Basic Energy Services Inc.

- OiLSERV

- Expro Group

第七章 市场机会及未来趋势

- 越来越关注优化碳氢化合物生产成本的新技术和方法

简介目录

Product Code: 55022

The Oilfield Services Market size is estimated at USD 119.85 billion in 2024, and is expected to reach USD 153.49 billion by 2029, growing at a CAGR of 5.13% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increasing development of gas reserves and advanced technology, tools, and equipment are expected to drive the oilfield services market during the forecast period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics, and several other factors, have been restraining the growth in the demand for the oilfield services market.

- Nevertheless, the focus on new technologies and methods to optimize the production cost of hydrocarbons is expected to create several opportunities for the oilfield services (OFS) market during the forecast period.

- North America is expected to be the largest market during the forecast period, owing to high drilling and production activity in shale fields. It is expected to dominate the market during the forecast period.

Oilfield Services (OFS) Market Trends

Drilling Services Expected to Dominate the Market

- The global economy is expected to underpin a substantial increase in oil demand. Strong economies are anticipated to consume more oil, and the demand is expected to grow significantly over the years. India and China are expected to contribute around 50% of the global oil demand by 2023.

- According to Organization of the Petroleum Exporting Countries (OPEC) statistics, in 2022, the worldwide crude oil demand was around 99.57 million barrels per day, increasing from 97.08 million barrels in 2021. The rising demand for crude oil increases the demand for drilling services worldwide.

- Hence, there is increasing pressure among the top oil and gas operating companies to increase their production and meet the increasing energy demand. As a result, several operating companies have shifted their focus toward exploiting unconventional reserves, as the conventional fields have started showing signs of maturity.

- For instance, in February 2022, Abu Dhabi National Oil Company (ADNOC) awarded framework agreements to four oilfield services providers valued at USD 1.94 billion to enable drilling growth. The awards aim at ADNOC's recent investments in drilling-related equipment and services to boost crude oil production capacity to 5 million barrels per day (mmbpd) by 2030.

- Further, new offshore contract drilling services are expected to drive the oilfield services market. For instance, in May 2022, Equinor had contracts with three oilfield services giants - Baker Hughes Norge, Halliburton, and Schlumberger for integrated drilling and well services on the Norwegian continental shelf (NCS). The contract is for two years, starting from 1st June 2022. The total value of the contract is about USD 1.8 billion.

- Technological advancements in drilling and logging tools are also expected to drive drilling services during the forecast period. For instance, In November 2022, National Energy Services Reunited Corporation (NESR) announced that the company had been awarded a long-term contract for directional drilling services in Kuwait. The contract scope includes directional drilling, measurements while drilling, performance drilling, well engineering, and logging while drilling (LWD) services for five years with an option to extend an additional year.

- Therefore, owing to the above points, drilling services are expected to dominate the oilfield services (OFS) market during the forecast period.

North America Expected to Dominate the Market

- The share of North America in global crude oil production is high owing to the presence of countries such as the United States, Canada, and Mexico. The crude oil production in the region is increasing significantly, as United States's average crude oil production was around 11.9 million barrels per day. The crude oil production for the country grew from 5.6% compared to the year 2021.

- In North America, oil and gas projects are becoming more competitive, owing to improving efficiencies and tightening of the supply chain, which has led to declining drilling costs and has, in turn, made many projects viable.

- The United States in the region is to be one of the largest markets for oilfield services, mainly due to the increasing number of wells being drilled and fracked in the shale and tight reserves. The low breakeven price of the basins supports this. The recent development of shale plays, horizontal drilling, and fracking has resulted in a massive increase in demand for oilfield services in the region.

- Similarly, Canada has the world's third-largest crude oil reserves, after Venezuela and Saudi Arabia, of which 96% are oil sand reserves. The oil available in the country is of high density and has high sand particle content. Due to this, oil transport from the bottom hole of the oil well to the surface requires high pressure and wellbore intervention, thus increasing the demand for oilfield services in the country.

- Therefore, owing to the above points, North America is expected to dominate the oilfield services (OFS) market during the forecast period.

Oilfield Services (OFS) Industry Overview

The oilfield services market is fragmented. Some of the major players in the market (in no particular order) include Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International Plc, and China Oilfield Services Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Crude Oil and Natural Gas Production and Forecast, till 2028

- 4.4 Onshore and Offshore Active Rig Count, till 2022

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Development of Gas Reserves and Advanced Technology, Tools, and Equipment

- 4.7.1.2 Increasing Investment in the Oilfield Services across World

- 4.7.2 Restraints

- 4.7.2.1 The Volatile Oil Prices Over the Recent Period, Owing to the Supply-Demand Gap

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production and Intervention Services

- 5.1.4 Other Services

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Weatherford International plc

- 6.3.3 Baker Hughes Company

- 6.3.4 Halliburton Company

- 6.3.5 Transocean Ltd.

- 6.3.6 Valaris PLC

- 6.3.7 China Oilfield Services Limited

- 6.3.8 Nabors Industries, Inc.

- 6.3.9 Basic Energy Services Inc.

- 6.3.10 OiLSERV

- 6.3.11 Expro Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on New Technologies and Methods to Optimize its Production Cost of Hydrocarbons

02-2729-4219

+886-2-2729-4219