|

市场调查报告书

商品编码

1432969

环境智慧:市场占有率分析、产业趋势、成长预测(2024-2029)Ambient Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

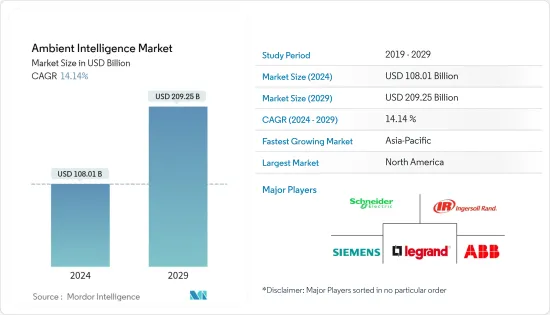

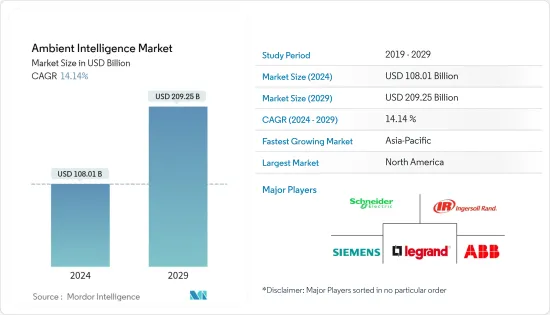

环境智慧市场规模预计到 2024 年为 1,080.1 亿美元,预计到 2029 年将达到 2092.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 14.14%。

环境智慧是一个新兴领域,它将智慧带入日常环境并使其对使用者做出回应。环境智慧解决方案基于先进的感测器、感测器网路、普适运算和人工智慧。

主要亮点

- 智慧家庭和智慧建筑的普及是市场成长的关键驱动力之一。智慧家庭和建筑利用环境智慧技术来优化能源消耗,从而显着节省能源并减少碳排放。

- 此外,先进感测器的开拓预计将推动市场成长,因为这些感测器能够即时监控环境。政府和企业增加对物联网和智慧城市基础设施的投资也推动了市场成长。

- 然而,由于这些系统收集和分析敏感资料,实施成本很高,而且隐私和安全问题限制了市场的成长。对这项技术及其优势的认识有限也限制了市场的成长。

- COVID-19 大流行的出现对市场产生了复杂的影响,加速了某些领域环境智慧技术的采用,同时减缓了其他领域的市场成长。医疗保健、製造和物流等行业对远端监控和自动化的需求不断增加,对市场成长产生了积极影响。

- 此外,这种需求主要是由在家工作文化的转变所推动的。随着公司扩大在家工作安排,人们继续在家工作并寻求先进的数位解决方案以获得无缝的工作体验,这种趋势仍在继续。

环境智慧市场趋势

医疗保健领域预计将推动市场成长

- 医疗保健产业预计将成长环境智慧市场,因为环境环境智慧技术有潜力透过改善患者治疗结果、降低成本和提高整体护理品质来改变医疗保健产业,是重要的推动因素之一。

- 在老年人口较多的国家,环境智慧透过环境智慧生活辅助(AAL)技术,可以远端监控老年人的健康状况,使他们能够独立生活。采用这项技术将改善患者体验、医生满意度和护理品质。因此,环境智慧解决方案的采用预计在明年将会成长。

- 嵌入环境中的被动、非接触式感测器可以创建环境智慧,识别人们的活动并适应他们持续的健康需求。这种环境智慧可以帮助临床医生和家庭看护者完善构成现代医疗保健最后阶段的身体运动。

- 由于环境技术的潜力,市场上的参与者正在为医疗保健产业推出技术增强的功能。例如,2022年3月,Nuance Communications宣布扩展下一代环境AI影像诊断能力。 Nuance PowerScribe 平台中改进的人工智慧报告使放射科医生能够在更短的时间内使用更具临床价值的结构化资料创建更准确的报告。

- 预计不断增加的医疗保健支出也将推动市场成长。根据医疗保险和医疗补助服务中心 (CMS) 的数据,2022 年美国全国医疗保健支出总额为 44,965 亿美元,预计 2028 年将达到 61,209 亿美元。

预计北美将占据最大份额

- 由于北美地区拥有大量环境智慧主要企业、较早采用先进技术以及该地区各个行业的数位化水平较高等因素,因此在市场研究中占据很大份额。预期的。

- 该地区对智慧建筑的需求不断增长,推动了市场的成长。越来越多地关注安全和保障、更加关注能源效率和排放预计将推动智慧建筑需求的成长,创造对先进环境辅助技术的需求,并推动该地区的市场成长。

- 2021年3月,Nuance Communications Inc.宣布一家独立门诊诊所将在伯灵顿加速采用Nuance Dragon 环境 Experience (DAX)环境临床智能(ACI)解决方案,以提高医生和患者的满意度,并宣布水平有所提高显着地。借助 Nuance DAX,独立门诊的医生可以花更少的时间记录治疗,而将更多的时间花在患者身上。

- COVID-19 大流行加速了美国最终用户对环境智慧和普适运算的认识。环境智慧的实施是为了简化日常业务,支援医疗保健产业的患者照护,并使用人工智慧来减少体力劳动。

- 此外,智慧家庭的主要应用正在推动该地区对环境智慧的需求。例如,The Ambient 发布的信息显示,美国拥有最多的智慧家庭(估计总数为 4130 万个),而且美国公民比任何其他国家都更喜欢家庭自动化设备,使该地区成为最受欢迎的地区之一预计AmI市场将变得更加普及。

环境智慧产业概况

全球环境智慧市场较为分散,有许多公司参与其中。施耐德电机、英格索兰、罗格朗、西门子、ABB 集团和霍尼韦尔国际公司等领先公司采用新产品开拓、全球扩张、收购和投资等开拓市场策略。

- 2022 年 3 月 - Nuance Communications 宣布扩展下一代环境AI 影像诊断功能。 Nuance PowerScribe 平台中经过改进的人工智慧彙报使放射科医生能够在更短的时间内使用更具临床价值的结构化资料来建立更准确的报告。

- 2022 年 3 月 - 微软收购语音辨识公司和会话人工智慧领先供应商 Nuance Communications,以增强其医疗保健人工智慧能力。透过此次收购,微软将利用人工智慧技术来改善患者治疗效果并使医疗保健更实惠。

- 2022 年 3 月 - Cerner 和 Nuance 扩大合作,进一步将 Nuance 的 Dragon Ambient eXperience 技术整合到 Cerner 的千年电子健康记录中。两家公司希望扩大 DAX 整合将帮助医院和卫生系统更好地管理导致临床医生倦怠的日益增加的业务负担。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 产品生命週期分析

- 客户接受度/适应性

- 比较分析

- 投资场景

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 人工智慧和物联网设备的普遍使用

- 不断发展的位置资讯移动应用程式

- 智慧城市和智慧家庭计划在全球扩展

- 市场挑战

- 资料安全、隐私和身分问题

- 中小企业缺乏意识

- 市场趋势

- 最近的创新和产品开发

第六章市场区隔

- 按成分

- 硬体

- 软体和解决方案

- 依技术

- Bluetooth Low Energy

- RFID

- 感测器 环境光感测器

- 软体代理

- 情感计算

- 奈米科技

- 生物辨识技术

- 其他技术

- 按最终用户产业

- 住宅

- 零售

- 卫生保健

- 产业

- 办公大楼

- 车

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Schneider Electric SE

- Ingersoll-Rand PLC

- Legrand SA

- Siemens AG

- ABB Group

- Honeywell International Inc.

- Tunstall Healthcare Ltd

- Koninklijke Philips NV

- Chubb Community Care

- Caretech Ab

- Assisted Living Technologies Inc

- Getemed Medizin-Und Informationstechnik AG

- Medic4all Group

- Telbios

- Televic NV

- Vitaphone GmbH.

第八章投资分析

第9章市场的未来

The Ambient Intelligence Market size is estimated at USD 108.01 billion in 2024, and is expected to reach USD 209.25 billion by 2029, growing at a CAGR of 14.14% during the forecast period (2024-2029).

Ambient intelligence is an emerging discipline that brings intelligence to everyday environments and makes such environments sensitive to users. Ambient Intelligence solutions build upon advanced sensors, sensor networks, pervasive computing, and artificial intelligence.

Key Highlights

- The increased adoption of smart homes and buildings is one of the main drivers of the market's growth, as smart homes and buildings use ambient intelligence technology to optimize energy consumption, which results in significant energy savings and reduces the carbon footprint.

- In addition, the development of advanced sensors is expected to fuel the growth of the market, as these sensors enable real-time monitoring of the environment. Also, the increase in investment in IoT and smart city infrastructure by the government and businesses are driving market growth.

- However, the higher implementation cost and the concern about privacy and security, as these systems collect and analyze sensitive data, restrain the market growth. Also, the limited awareness of the technology and its benefits is limiting the market growth.

- The emergence of the COVID-19 pandemic had a mixed impact on the market as some sectors accelerated the adoption of ambient intelligence technology while others slowed down the growth of the market. The increased demand for remote monitoring and automation in the industries like healthcare, manufacturing, and logistics positively impacted market growth.

- Furthermore, the demand is mainly attributed to the shift to working from home culture. The trend is still prevailing, as companies have extended the work-from-home policy, and people are continuing to work from home and seeking advanced digital solutions to make the work experience seamless.

Ambient Intelligence Market Trends

Healthcare Segment is Expected to Drive Market Growth

- The healthcare industry becomes one of the key drivers of the ambient intelligence market growth, as ambient intelligence technology has the potential to transform the healthcare sector by improving patient outcomes, reducing costs, and enhancing the overall quality of care.

- In countries with a larger population of senior citizens, through Ambient Assisted Living (AAL) technology, ambient intelligence helps the elderly by remotely monitoring their health, enabling them to have independent living. Employing this technology will enrich patient experience, physician satisfaction, and quality of care. Thus, the adoption of ambience intelligence solutions is expected to grow in the coming year.

- Passive, contactless sensors embedded in the environment can create an ambient intelligence aware of people's movements and adapt to their continuing health needs. This type of ambient intelligence can assist clinicians and in-home caregivers in perfecting the physical motions that comprise modern healthcare's final steps.

- The players operating in the market are coming up with technologically extended capabilities for the healthcare sector due to the potential of ambient technology. For instance, in March 2022, Nuance Communications, Inc. announced the expansion of its next-generation ambient AI diagnostic imaging capabilities. Improved AI-powered reporting features in the Nuance PowerScribe platform would enable radiologists to create highly accurate reports in less time and with more clinically valuable structured data.

- The continuously increasing healthcare expenditure is also anticipated to fuel the market growth. According to the Centers for Medicare & Medicaid Services (CMS), the U.S. total national health expenditure in 2022 was USD 4,496.5 billion and is expected to reach USD 6,120.9 billion by 2028.

North America is Expected to Hold the Largest Share

- The North American region is expected to hold a significant share of the market studied, owing to factors such as the presence large number of key players of ambient intelligence vendors in the country, early adoption of advanced technologies, and considerable digitalization across various sectors in the region.

- The increasing demand for smart buildings in the region is driving the market growth. Rising emphasis on safety and security and growing concerns about energy efficiency and emission reduction are expected to drive growth in smart building demand, creating a need for advanced ambient-assisted technology and boosting the market growth in the region.

- In March 2021, Nuance Communications, Inc. announced that independent ambulatory clinics accelerated their adoption of the Nuance Dragon Ambient eXperience (DAX) ambient clinical intelligence (ACI) solution in Burlington and reported a significant increase in physician and patient satisfaction. Nuance DAX allows physicians at independent ambulatory clinics to spend less time documenting care, allowing them to spend more time with patients.

- The COVID-19 pandemic has accelerated the awareness of ambient intelligence and ubiquitous computing among end users in the United States. It has started adopting ambient intelligence to improve efficiency in daily tasks, assist the healthcare industry with patient care, and reduce manual efforts using AI.

- In addition, its primary application in smart homes mainly drives the demand for ambient intelligence in this region. For instance, as per the information stated by The Ambient, The United States has the greatest number of smart homes (an estimated total of 41.3 million), and citizens of the United States favor home automation devices more than other nations, which in turn is expected to boost the AmI market adoption in the region.

Ambient Intelligence Industry Overview

The Global Ambient Intelligence Market is fragmented with large number of players present in the market. Some major players, including Schneider Electric S.E., Ingersoll-Rand PLC, Legrand SA, Siemens AG, ABB Group, and Honeywell International Inc., are adopting strategies for developing the market, like new product development, global expansion, acquisitions, and investments.

- March 2022 - Nuance Communications, Inc. announced the expansion of its next-generation ambient AI diagnostic imaging capabilities. Improved AI-powered reporting features in the Nuance PowerScribe platform would enable radiologists to create highly accurate reports in less time and with more clinically valuable structured data.

- March 2022 - Microsoft acquired Nuance Communication, a speech recognition company and a leading provider of conversational artificial intelligence to enhance healthcare artificial intelligence. The acquisition would allow Microsoft to leverage artificial intelligence technology for better patient outcomes and more affordable healthcare.

- March 2022 - Cerner and Nuance expanded their collaboration to further integrate Nuance's Dragon Ambient eXperience technology into Cerner's Millennium electronic health record. The companies expect that expanded DAX integration will assist hospitals and health systems in better managing the increasing administrative workloads that contribute to clinician burnout.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Product Life Cycle Analysis

- 4.5 Customer Acceptance / Adaptability

- 4.6 Comparative Analysis

- 4.7 Investment Scenario

- 4.8 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ubiquity of AI and IoT devices

- 5.1.2 Evolving Location-based Mobile Applications

- 5.1.3 Growing Smart Cities and Smart Home Projects Across the World

- 5.2 Market Challenges

- 5.2.1 Data Security, Privacy and Identity Issues

- 5.2.2 Lack of Awareness Among Smaller Enterprises

- 5.3 Market Trends

- 5.4 Recent Innovations and Product Developments

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software and Solutions

- 6.2 By Technology

- 6.2.1 Bluetooth Low Energy

- 6.2.2 RFID

- 6.2.3 Sensors Ambient Light Sensor

- 6.2.4 Software agents

- 6.2.5 Affective computing

- 6.2.6 Nanotechnology

- 6.2.7 Biometrics

- 6.2.8 Other Technologies

- 6.3 By End-User Industry

- 6.3.1 Residential

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 Industrial

- 6.3.5 Office Building

- 6.3.6 Automotive

- 6.3.7 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric S.E.

- 7.1.2 Ingersoll-Rand PLC

- 7.1.3 Legrand SA

- 7.1.4 Siemens AG

- 7.1.5 ABB Group

- 7.1.6 Honeywell International Inc.

- 7.1.7 Tunstall Healthcare Ltd

- 7.1.8 Koninklijke Philips N.V.

- 7.1.9 Chubb Community Care

- 7.1.10 Caretech Ab

- 7.1.11 Assisted Living Technologies Inc

- 7.1.12 Getemed Medizin-Und Informationstechnik AG

- 7.1.13 Medic4all Group

- 7.1.14 Telbios

- 7.1.15 Televic N.V.

- 7.1.16 Vitaphone GmbH.