|

市场调查报告书

商品编码

1432977

日本电动车充电设备:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Japan Electric Vehicle Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

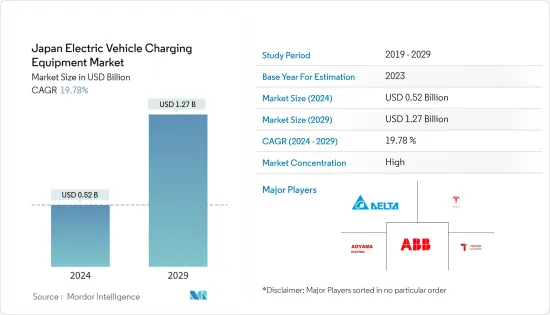

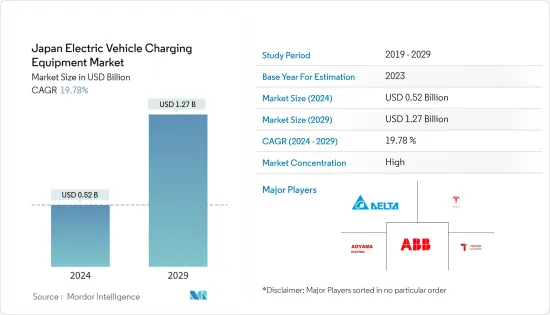

日本电动车充电设备市场规模预计到 2024 年为 5.2 亿美元,预计到 2029 年将达到 12.7 亿美元,预测期内(2024-2029 年)复合年增长率为 19.78%。

COVID-19 的爆发对市场产生了负面影响。该国电动车的销售受到阻碍,而电动车的市场占有率很低。今年销售疲软的主要原因是经济活动长期暂停和实施严格的封锁措施。 2020年3月,日本充电站数量减少约1,087个,至29,233个。充电站数量减少的原因是电动车仅占日本销售新车的1%,因此充电站的使用不多。有些看台很旧,有些已经拆除。

在日本,插电式混合动力汽车的大量使用以及纯电动车及其使用需求的不断增长,使得电动车充电站的需求大幅增加,扩大了该行业的市场机会。此外,自2010年以来,日本的车站数量一直在稳步增加。 2010年充电站数量约310个,到2021年将增加到3万多个。

日本政府的目标是到 2050 年实现碳中和,为充电站提供补贴,以促进电动车的普及。日本政府正在促进绿色燃料汽车的销售,雄心勃勃的计划是到 2035 年所有销售的新车都将采用电力动力来源,包括电动车和混合。这可能会在预测期内推动电动车充电设备的需求。

日本电动车充电站市场趋势

政府促进电动车销售的措施将对市场产生正面影响

日本政府透过鼓励电动车(HEV、PHEV、BEV)的普及提高人们对环境问题的认识。同时,道路上的电动车数量不断增加,这可能会推动对相关充电基础设施的需求。

五个最大的小客车市场包括中国、美国、德国、印度和日本。 2020年12月,日本政府推出绿色成长策略,透过推广电动车、燃料电池电动车、插电式混合和混合,到2050年实现日本碳中和。

透过这些实施,日本寻求减少运输部门排放的影响,以实现《巴黎协定》下的温室气体减排目标。日本充电站的集中度远低于其他已开发国家,显示未来几年的成长潜力巨大。例如,2021年,日本每100公里道路只有1.7个充电站,而韩国则约为75.2个。 2020年,日本总合29,855个充电站(21,916个普通充电器和7,939个快速充电器)。然而,与充电技术相关的专利申请数量超过1,310件,位居世界第二。

日本为其汽车产业制定了克服气候变迁和尽量减少碳排放的长期目标和策略。在接下来的半个世纪里,各国政府制定了三项主要行动来推广电动车,包括创新、政策和基础设施投资。促进创新,开发锂离子电池,创造经济的采购路线,并开发下一代技术。

政策重点是加强全球供应链、纳入国际电动政策、最大限度地提高燃料标准。在基础设施发展方面,第一次调查将包括透过稳定电池零件的采购来建立电池网路、制定废弃电池再利用和回收指南以及投资无线充电基础设施的研发。 2021年11月,日本政府宣布将对电动车的奖励加倍至每辆车80万日元,并提供充电基础设施补贴,以赶上北美、欧洲等成熟经济体。

高安装和维护成本预计将阻碍市场成长

安装电动车充电站的成本相当高,并且根据安装的充电器类型而有所不同。为了安装电动车充电基础设施,必须满足最低基础设施要求,找到合适的供应商和位置非常重要。充电基础设施成本包括固定成本(安装、公用事业服务、变压器、设备)和变动成本(电费)。

对于公用电费充电器来说,按需收费可占营业成本的大部分。因此,快速充电站的总电力成本高于住宅充电器,除非前者达到足够高的运转率。

在目前的利用水准下,商业充电器通常在经济上不可行。为了使商业充电基础设施实现经济盈利并与 IC 引擎竞争,需要显着且持续的需求成长。

在高峰时段集中对电动车进行家庭充电可能会使当地变压器过载。公用事业公司可能必须购买额外的高峰容量,除非它们能够将需求转移到非尖峰时段时段。

电动车充电器分为三种。电器产品常用的标准 120V 插头充电速度较慢,但约 8 至 12 小时即可将电池充满。 240V 2 级充电器通常可在一小时内充电 20-25 英里,将充电时间缩短至不到八小时。在典型的家庭中,2 级充电器可以使用服装类机或电烤箱所需的相同类型的插座。 3 级直流 (DC) 快速充电器可在 30 分钟内将电池充电至 80%。

汽车製造商使用三种类型的直流快速充电器。大多数製造商使用SAE组合充电系统(CCS),CHAdeMO由日产和三菱使用,而Tesla Supercharger仅由特斯拉汽车使用。车辆相容性的缺乏可能会限制车辆普遍使用充电站并阻碍市场成长。

必须谨慎部署高功率充电桩,以确保电站的高使用率。在目前的情况下,充电站的盈利相当低。只有当电动车足够普及并且基础设施能够保持高运转率时,盈利才可能增加。例如,2020年纯电动车销量为14,604辆,而同期混合动力汽车销量超过1,324,800辆。

日本电动车充电站产业概况

电动车充电站市场较为集中,主要市场占有率由少数企业占据。主要参与企业包括ABB、Delta电子和丰田。该国的主要企业已与其他参与者成立合资企业,以开发尖端技术。此外,各种汽车製造商正在向其客户提供家庭充电解决方案以及电动车。例如,

- 2021 年 11 月,Subaru宣布推出首款电动车 (EV) Solterra。使用住宅充电器将 Solterra 从零充满到 100% 需要近 13 小时。不过,使用 Level 3 直流快速充电器,Solterra 可以在不到一小时的时间内充电至 80%,续航里程预计超过 320 公里。

- 2021年10月,丰田汽车公司公布了新型BEV(电池电动车)「bZ4X」的详细资料。 bZ4X是中型SUV,也是丰田bZ系列的首款车型。采用与Subaru公司共同开发的BEV专用平台。随附的家用壁式充电器可在 10 小时内充满电。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 最终用途

- 家庭充电

- 公共充电

- 充电站

- 交流充电站

- 直流充电站

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- ABB Ltd

- Delta Electronics Inc.

- e-Mobility Power Inc.

- Toyota Connected Corporation

- Tesla Inc.

- Aoyama Elevator Global Ltd

- Tritium Charging

- NEC Telecommunication and Information Technology Ltd

第七章 市场机会及未来趋势

The Japan Electric Vehicle Charging Equipment Market size is estimated at USD 0.52 billion in 2024, and is expected to reach USD 1.27 billion by 2029, growing at a CAGR of 19.78% during the forecast period (2024-2029).

The outbreak of COVID-19 has negatively impacted the market. The sales of electric vehicles in the country were hampered, and the market share of electric vehicles is very low. The major reason for the low sales during the year was the strict lockdown measures as economic activities were stopped for a long time. In March 2020, it was recorded that the number of charging stations in the country reduced by around 1,087 to 29,233 charging stations. The reason for the reduction in charging stations is that electric vehicles account for only one percent of the new cars sold in Japan because the charging stands are not being used very much. Some of them are outdated, and others have been removed.

The high number of plug-in hybrids and the growing demand for battery electric vehicles and their usage in the country significantly boosted the demand for electric vehicle charging stations and increased market opportunities for the industry. Further, number of stations has been growing steadily in Japan since fiscal 2010. In 2010, there were around 310 charging stations in the country, which increased to more than 30,000 stations in 2021.

Major subsidies offered by the country's government to promote the use of electric vehicles, as an effort to become carbon neutral by 2050, led to subsidizing the charging stations in the country. This is likely to drive the market's growth during the forecast period.The Japanese government is boosting the sales of green fuel vehicles and has an ambitious plan that all the new vehicles sold by 2035 will be powered by electricity, both electric and hybrid electric vehicles. This will enhance electric vehicle charging equipment demand during the forecast period.

Japan EV Charging Stations Market Trends

Government Initiatives to Boost Electric Vehicle Sales to Have Positive Impact on the Market

Surging carbon emission by the transportation sector has propelled the environmental concern across Japan, which is scrutinized by Japan government by encouraging the adoption of electric vehicles, i.e., HEVs, PHEVs, and BEVs. With this, the number of electric vehicles on the road is constantly increasing, which is likely to drive the demand for associated charging infrastructure.

The five largest passenger car market includes China, the United States, Germany, India, and Japan. Along with several other countries across the world, Japan has committed to net zero-emission passenger car sales.In December 2020, Japan government introduced a green growth strategy to make Japan carbon neutral by 2050 by promoting electric vehicles, fuel cell electric vehicles, plug-in hybrid vehicles, and hybrid vehicles.

With these implementations, Japan seeks to reduce the emission impact from the transportation sector to achieve the GHG (Green House Gas) reduction goals under the Paris agreement.The concentration of charging stations in Japan is quite less compared to other developed countries, indicating massive growth potential in the coming years. For instance, in 2021, Japan had only 1.7 charging stations per 100 km of roadways, whereas South Korea had around 75.2. In 2020, Japan had a total of 29,855 charging stations (21,916 sallow chargers and 7,939 fast chargers). Although, Japan accounts for the second position in charging technology patents across the world, with more than 1,310 patent filings.

Japan has long-term goals and strategies for the automotive industry to beat climate change and minimize carbon emissions. For the next half-decade, the government has set three key actions to promote the electric vehicle, including innovations, Policies, and investment in infrastructure.Promotion for innovation, developing lithium-ion batteries, building economic procurement channels, and developing next-generation technologies.

Through policies, the country is focusing on robust the global supply chain, incorporating international electrification policies, and maximizing the fuel standards. In Infrastructural development, the primary focus would be building a battery network by stabilizing the battery components procurement, establishing a guideline for used batteries to reuse/recycle, and investing in research and development of wireless charging infrastructures. In November 2021, Japan government announced to double their incentives for electric vehicles to 800,000 Yen per vehicle and subsidizes charging infrastructure to catch up with matured economies, including North America and Europe.

High Cost of Installation and Maintenance Expected to Hinder Market growth

The cost of setting up an EV charging station is quite high and varies according to the type of chargers being installed. In order to set up the EV charging infrastructure, minimum infrastructure requirements need to be fulfilled, and finding the right vendor and location is important. The charging infrastructure costs include fixed (installation, utility service, transformers, and equipment) and variable (electricity charges) components.

For chargers on commercial electricity tariffs, demand charges can dominate operating costs. As a result, the total cost of power from fast-charging stations is higher than slower residential chargers unless the former can achieve sufficiently high utilization rates.

At current levels of utilization, commercial chargers are almost universally not economically profitable. A significant, sustained increase in demand will be needed for commercial charging infrastructure to deliver financial returns and compete with IC engines.

The high concentration of EV home charging during peak periods can overload local transformers. Utilities may have to procure additional peak capacities unless they are able to shift demand to off-peak periods.

There are three types of chargers available for EVs. The standard 120V plug, often used for home appliances, charges slowly but can fill a battery to near-full capacity in about 8 to 12 hours. The 240V level-2 chargers generally provide 20 to 25 miles of charge in an hour, which shortens charging time to eight hours or less. In homes, level-2 chargers can use the same outlet type required for clothes dryers or electric ovens. Level-3 direct current (DC) fast chargers can charge a battery up to 80% in 30 minutes.

Different auto manufacturers use three different varieties of DC fast chargers. Most manufacturers use the SAE Combined Charging System (CCS), the CHAdeMO variant is used by Nissan and Mitsubishi, and the Tesla Supercharger is used by only Tesla cars. This lack of vehicle compatibility restricts universal vehicle access to charging stations and could hinder market growth.

Deploying high-powered energy chargers must be done carefully to ensure stations have high utilization. The profit potential of charging stations is quite low in the current scenario. The profitability may only increase when there are enough electric cars on the road, so the infrastructure could have a high utilization rate. Consumer preference is more leaned toward hybrid vehicles, which significantly restraints the sales of BEVs; for instance, the sales of BEVs in 2020 was 14,604 units, whereas hybrid vehicles have surpassed the sales volume of 1,324,800 units during the same tenure.

Japan EV Charging Stations Industry Overview

The Electric vehicle charging station market is relatively consolidated, with a major market share being covered by a few companies. Some major players in the market are ABB, Delta Electronics Inc., Toyota, and others. The major players in the country are entering into joint ventures with other players to develop the latest technology. Various automakers are also providing home charging solutions to their customers along with electric vehicles. For instance,

- In November 2021, Subaru Corp unveiled its first all-electric vehicle (EV), the Solterra which takes almost 13 hours to fully charge from zero to 100 percent with the residential charger. However, Solterra also get an 80% charge in under an hour from a Level 3 DC fast charger giving out an estimated range to be greater than 320 km.

- In October 2021, Toyota Motor Corporation announced the details of bZ4X, its all-new model BEV (Battery Electric Vehicle). The bZ4X, a medium-segment SUV-type BEV, is the first model in the Toyota bZ series. The model adopts a BEV-dedicated platform jointly developed with Subaru Corporation. With provided home wall mount charger, car can reach full recharge in 10 hours.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End Use

- 5.1.1 Home Charging

- 5.1.2 Public Charging

- 5.2 Charging Station

- 5.2.1 AC Charging Station

- 5.2.2 DC Charging Station

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 ABB Ltd

- 6.2.2 Delta Electronics Inc.

- 6.2.3 e-Mobility Power Inc.

- 6.2.4 Toyota Connected Corporation

- 6.2.5 Tesla Inc.

- 6.2.6 Aoyama Elevator Global Ltd

- 6.2.7 Tritium Charging

- 6.2.8 NEC Telecommunication and Information Technology Ltd