|

市场调查报告书

商品编码

1432997

VoWiFi:市场占有率分析、产业趋势与统计、成长预测(2024-2029)VoWiFi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

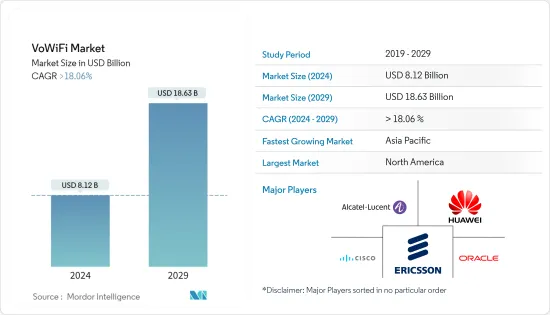

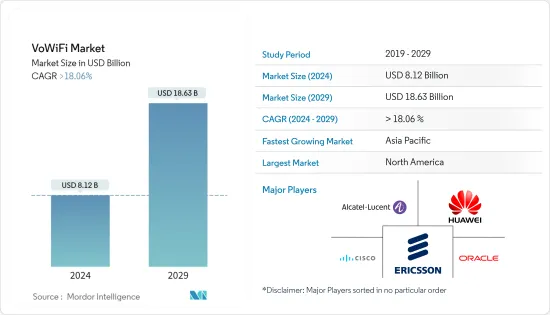

VoWiFi市场规模预计2024年为81.2亿美元,预计到2029年将达到186.3亿美元,在预测期内(2024-2029年)增长超过18.06%,预计将以复合年增长率增长。

作为迈向基于 IP 的通讯的自然步骤,大多数通讯业者预计将提供 VoWiFi 和 VoLTE 服务,这可以改善室内网路覆盖范围。

主要亮点

- 使用 WiFi 网路提供语音服务称为「WiFi 语音」(VoWiFi)。支援 WiFi 网路和音讯系统的音讯组件通常是最终用户的个人财产。随着越来越多的人习惯 WiFi 技术,行动电话业者(通讯业者)正在寻求透过向住宅和企业提供 VoWiFi 来利用这些潜在的商机。Masu。我们还希望透过引入更快的宽频连线来在更多地点提供我们的服务。

- 市场是由解决室内覆盖问题所驱动的。对于用户来说,在家中、职场和商店中行动电话接收不良是一个严重的问题。没有足够室内覆盖的人可能会采取极端措施,例如探出窗外接收讯号。 VoWiFi 让客户即使在室内也能可靠地拨打和接听电话,而无需升级手机或安装新硬体。

- 高速网路的普及和宽频服务的日益普及正在对市场产生重大影响。与2022年12月相比,2023年6月中国网民增加了1,100万人。根据 Speedtest 的数据,截至 2023 年 4 月,卡达拥有世界上最快的平均行动互联网连接,约为 190Mbps。其次是阿拉伯联合大公国 (UAE) 和澳门,这两个国家的中位数平均速度均超过 170Mbps。

- 然而,维护成为一个挑战,因为通讯业者不负责诊断和修復 WiFi 网路。住宅WiFi 用户和企业 IT 团队需要承担责任。此外,VoWiFi尚不支援E-911,这限制了市场。

- 由于大规模封锁和社会隔离的需要,冠状病毒(COVID-19)大流行增加了我们对网路的依赖。它使家人和朋友能够沟通、企业和政府能够运作、学生能够学习、病人能够获得医疗服务。对网路依赖的增加使得建立网路和弥合数位鸿沟变得更加重要。

- 在 COVID-19感染疾病期间,由于家庭中更多地使用 WiFi 来改善通话连线, VoWiFi 市场的收入激增。该行业的快速成长是由于企业需要改善员工沟通,并利用人工智慧(AI)和物联网(IoT)等尖端技术来实现业务顺利运营,预计这也将得到促进经过

VoWiFi市场趋势

公共 WiFi 热点获得显着的市场占有率

- 即使附近没有行动电话塔,用户也可以继续透过通用接取网路拨打电话。除了覆盖行动电话接收不良的区域之外,公共 WiFi 热点的可用性增加了对额外 VoWiFi 的需求。农村地区的行动电话覆盖率远低于都市区,因此越来越多的消费者转向公共 WiFi。

- 作为数位连接国家的巨大努力的一部分,印度政府已强制要求在每 250,000 克 panchayat(村庄街区)中安装 5 个 WiFi 热点,用于公共事业服务。为了支援公共资料办公室,政府希望在 2022 年安装 1,000 万个 WiFi 热点。

- 透过使用 WiFi 热点而不是营运商网路进行呼叫,客户可以利用 WiFi 热点的激增,从而使通讯业者能够释放频谱。因此,营运商可以减少资本支出。

- 为了减少客户流失,通讯业者预计将使用 VoWiFi 来扩大通讯,特别是在室内和行动电话通讯较弱的地方。这一策略可能会推动未来市场的成长。

- 根据电信咨询服务的数据,2018年免费Wi-Fi流量总量约为34.37亿GB。预计到 2023 年,交通量将增加约三倍。

预计北美将占据重要市场占有率

- 由于对高品质和无缝语音通讯服务的需求不断增长,北美 WiFi 语音 (VoWiFi) 市场预计在未来几年将成长。远距工作和自带设备 (BYOD) 趋势的兴起也推动了该地区 VoWiFi 的成长。

- 许多公司现在鼓励员工使用行动装置远端执行与工作相关的任务。 BYOD(自带设备)越来越受欢迎,为员工提供了更多自由来远程办公和存取公司资讯资源。保护员工隐私并确保从个人装置存取组织资料时的安全既是一个问题,也是一个威胁。

- 北美地区的漫游资费非常高,漫游时间也是其他地区中最长的。因此,使用VoWiFi可以降低漫游费用,并可以鼓励更多人在该地区使用资料漫游。

- 北美通讯业者和服务供应商正在投资 VoWiFi 技术的开发和部署,以满足对先进通讯服务不断增长的需求。该市场的特点是存在多个大型和成熟企业以及众多新兴企业和小型企业。

- 例如,2023 年 2 月,Virgin Media O2 和 Mavenir 宣布将把 O2 行动客户全面迁移到提供 LTE 语音 (VoLTE) 和 WiFi 语音的虚拟IP 多媒体子系统 (IMS) 解决方案。 Mavenir 是一家网路软体供应商,利用可在任何云端上运行的云端原生应用程式 (VoWiFi) 来建立未来网路。 Virgin Media O2 透过虚拟网路打破了硬体和软体之间的连结。虚拟允许用户在同一平台上存取各种应用程序,使 Virgin Media O2 的网路更加灵活和有效。它还降低了成本,并为改进和新服务的可能性打开了大门。

VoWiFi产业概述

随着竞争公司之间的敌对关係加剧,WiFi 语音 (VoWiFi) 市场正在走向分散。全球市场参与者正在创新新技术,以使消费者更加方便和有效率。该市场的主要企业是阿尔卡特朗讯、思科系统公司和甲骨文公司。市场的最新发展包括:

- Vodafone Idea (Vi) 计划在全国 12 个州提供 VoWi-Fi 通话服务。这是一项重要的服务,特别是对于改善消费者的赔偿体验。由于室内行动网路没有得到很好的覆盖,许多人在家里依赖这种方式。 Vodafone Idea 仅在 12 个邦提供服务,包括马哈拉斯特拉邦拉邦和果阿邦、UP West、加尔各答、拉贾斯坦邦、古吉拉突邦、旁遮普邦、UP 酵母、德里以及孟加拉邦、孟买和哈里亚纳邦的其余地区。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 提高网路普及

- 减少室内覆盖问题

- 市场限制因素

- 营运商造成的维护问题

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 音讯客户端

- 整合 VoWiFi 用户端

- 独立的 VoWiFi 用户端

- 浏览器 VoWiFi 用户端

- 设备类型

- 智慧型手机

- 平板电脑/笔记型电脑

- 其他设备类型

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Alcatel-Lucent

- Oracle Corporation

- Cisco Systems Inc.

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Aptilo Networks

- KT Corporation

- Mitel Networks Corporation

- Nokia Corporation

- Ribbon Communications

第七章 投资分析

第八章 市场机会及未来趋势

The VoWiFi Market size is estimated at USD 8.12 billion in 2024, and is expected to reach USD 18.63 billion by 2029, growing at a CAGR of greater than 18.06% during the forecast period (2024-2029).

As a natural step toward IP-based communication, most operators are expected to offer both VoWiFi and VoLTE services, which could improve indoor network coverage.

Key Highlights

- The use of a WiFi network for voice services is known as "voice over WiFi" (VoWiFi). The WiFi network and the voice components that support the voice system are typically the end user's personal property. Mobile operators (Telcos) are attempting to take advantage of these potential business opportunities as more and more people become accustomed to WiFi technology by providing VoWiFi to homeowners and businesses. They also want to make their service available in more places by putting in faster broadband connections.

- The market is being driven by the elimination of the indoor coverage issue. For users, poor cellular reception in homes, workplaces, and stores is a serious problem. People with inadequate interior coverage may take extreme measures to receive a signal, such as leaning out of windows. VoWiFi enables customers to reliably place and receive calls, even while they are indoors, without having to upgrade their handsets or install new hardware.

- The proliferation of high-speed internet and increased accessability to broadband services have significantly impacted the market. China's internet population increased by 11 million in June 2023 compared to December 2022. According to Speedtest, as of April 2023, Qatar had the fastest average mobile internet connections globally, nearly 190 Mbps. The United Arab Emirates (UAE) and Macau followed, with each of these countries registering average median speeds above 170 Mbps.

- Maintenance, however, presents a challenge because carriers are not accountable for diagnosing and fixing WiFi networks. Residential WiFi users and corporate IT teams should be held accountable. Additionally, VoWiFi does not yet support E-911, which is restricting the market.

- Because of extensive lockdowns and the need to socially isolate oneself, the coronavirus (COVID-19) pandemic increased dependency on the Internet. It enabled family and friends to communicate, businesses and governments to operate, students to study, and patients to get healthcare services. This increased reliance on the Internet made it more important to both build out the Internet and close the digital divide.

- Due to the rising use of WiFi in homes for better call connectivity during the coronavirus disease (COVID-19) epidemic, the VoWiFi market experienced a surge in income creation. The rapid growth of the industry was also expected to be driven by the need for businesses to improve employee communication for smooth operations and the need to use cutting-edge technology like artificial intelligence (AI) and the Internet of Things (IoT).

VoWiFi Market Trends

Public WiFi Hotspot to Gain Significant Market Share

- Users can continue to place calls over a general access network without the need for a nearby cell tower. The availability of public WiFi hotspots is driving the need for additional VoWiFi in addition to providing coverage for areas with poor cell reception. Because cell tower coverage is substantially weaker in rural regions than it is in cities, this encourages more consumers to use public WiFi.

- In India, the government has mandated five WiFi hotspots in each of the 250,000 gram panchayats, or village blocks, for public utility services as part of the mega initiative to digitally connect the nation. To help public data offices, the government wants to set up 10 million WiFi hotspots by 2022.

- By using WiFi hotspots rather than the carrier network to make calls, customers may exploit the increase in WiFi hotspots to assist operators in freeing up their spectrum. Operators might reduce their capital expenditures as a result.

- In order to reduce churn, operators are expected to use VoWiFi to extend coverage, especially indoors and in places with weak cellular coverage. This strategy could boost market growth in the future.

- According to Telecom Advisory Service, in 2018, there were roughly 3,437 million gigabytes of total free Wi-Fi traffic. By 2023, the volume of traffic is anticipated to increase by roughly threefold.

North America is Expected to Hold Significant Market Share

- The Voice over WiFi (VoWiFi) market in North America is expected to grow in the coming years due to increasing demand for high-quality, seamless voice communication services. The rise of remote work and bring-your-own-device (BYOD) trends have also driven the growth of VoWiFi in the region.

- Nowadays, a lot of companies encourage their staff to conduct work-related tasks remotely using their own mobile devices. BYOD (bring your own device), an increasingly popular trend, gives employees more freedom to telework and access company information resources. Protecting the privacy of employees and making sure that an organization's data is safe when it is accessed through personal devices are both problems and threats.

- In North America, roaming rates are very high, with the time spent on roaming trips being the highest among all other regions. So, with VoWiFi, roaming charges are likely to go down, and the area may see more people using data roaming.

- North American telecom operators and service providers are investing in the development and deployment of VoWiFi technology to meet the growing demand for advanced communication services. The market is characterized by the presence of several large and established players, as well as a number of start-ups and small players.

- For instance, in February 2023, Virgin Media O2 and Mavenir announced the full migration of O2 mobile customers to its virtualized IP Multimedia Subsystem (IMS) solution, which offers voice over LTE (VoLTE) and voice over WiFi. Mavenir is a network software provider building the networks of the future with cloud-native applications that work on any cloud (VoWiFi). Virgin Media O2 is cutting the link between hardware and software by virtualizing its network. By letting users access a variety of apps that are all on the same platform, virtualization makes Virgin Media O2's network more flexible and effective. It also cuts costs and opens the door for possible improvements and new services.

VoWiFi Industry Overview

The voice-over WiFi (VoWiFi) market is moving toward fragmentation as the competitive rivalry increases. Global players in the market are innovating new technologies to make them more helpful and efficient for consumers. Key players in the market are Alcatel-Lucent, Cisco Systems, Inc., and Oracle Corporation. Recent developments in the market are:

- In 12 states nationwide, Vodafone Idea (Vi) were to provide VoWi-Fi calling service. It is a crucial service, especially for improving consumers' coverage experiences. Many individuals utilize it inside their homes because they don't have adequate indoor mobile network coverage. Only 12 states, including Maharashtra and Goa, UP West, Kolkata, Rajasthan, Gujarat, Punjab, UP East, Delhi, the rest of Bengal, Mumbai, and Haryana, provide Vodafone Idea.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Internet Penetration

- 4.3.2 Reduction of Indoor Coverage Problems

- 4.4 Market Restraints

- 4.4.1 Maintenance Problems Due to Carriers

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Voice Client

- 5.1.1 Integrated VoWiFi Client

- 5.1.2 Separate VoWiFi Client

- 5.1.3 Browser VoWiFi Client

- 5.2 Device Type

- 5.2.1 Smartphones

- 5.2.2 Tablets and Laptops

- 5.2.3 Other Device Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alcatel-Lucent

- 6.1.2 Oracle Corporation

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Ericsson AB

- 6.1.5 Huawei Technologies Co. Ltd.

- 6.1.6 Aptilo Networks

- 6.1.7 KT Corporation

- 6.1.8 Mitel Networks Corporation

- 6.1.9 Nokia Corporation

- 6.1.10 Ribbon Communications